As featured in

Never Miss Rewards

Know exactly how to optimize your credit card rewards.

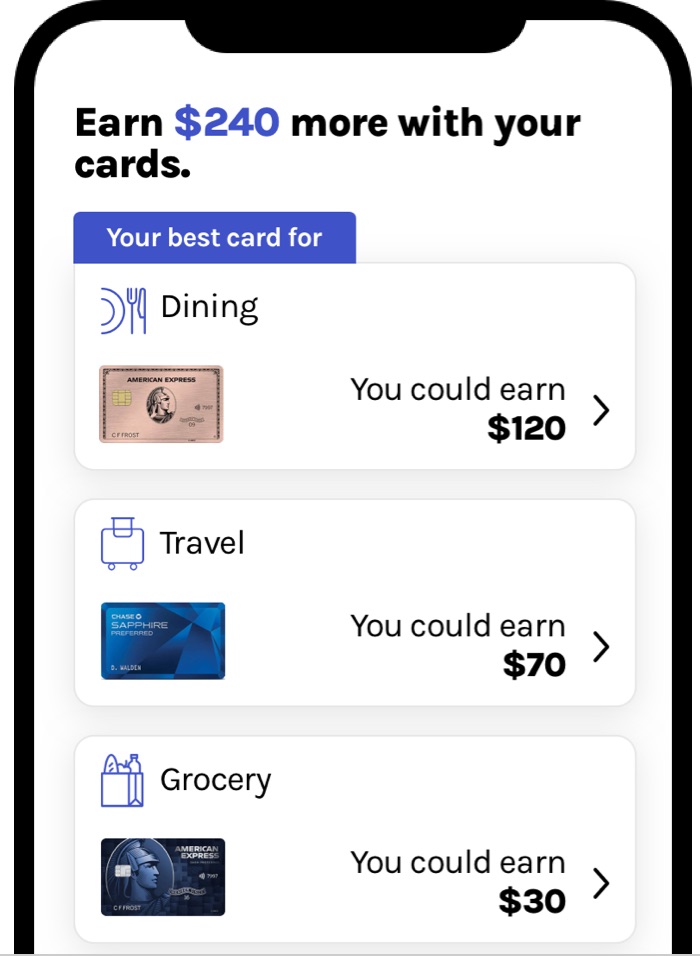

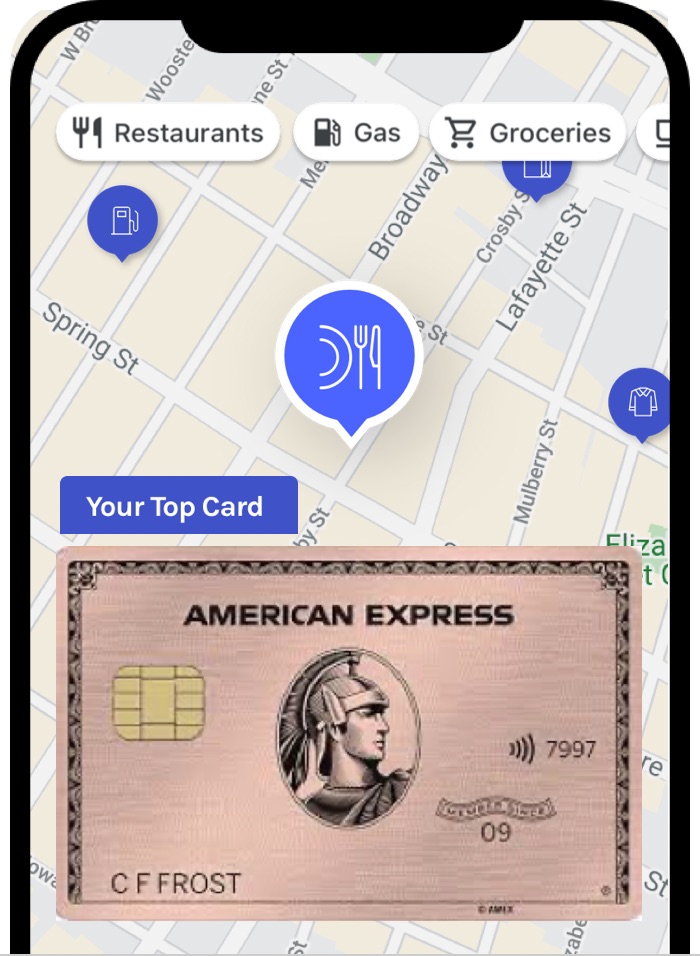

Guess No More

Wonder which card to use where? Know in just two taps.

Just the Right Cards

Discover the best card to use at nearby places.

Uthrive works with cards from top issuers including:

We Got Your Back.

We use bank level encryption.

With 256-bit SSL encryption and security practices that match with your bank’s, your account is well protected.

And we don’t store sensitive data.

We do not store sensitive information including credit card numbers or login credentials.

What people say about Uthrive?

Great app to get money back

Optimized Rewards

Great App

Huge value add

So helpful and insightful

Great app to get money back

Optimized Rewards

How Uthrive Works

Frequently Asked Questions

What is the best credit card for rewards?

The best credit card for rewards will depend on your preferences and spending habits.

But a few popular options include the Chase Sapphire Preferred® Card, Blue Cash Preferred® Card From American Express, and Capital One Venture Rewards Credit Card.

How many credit cards should I have?

There is no one-size-fits-all solution for the number of credit cards you must have.

Generally, having two to three credit cards at a time for different purposes can be beneficial, offering flexibility and maximum rewards – one with flat-rate rewards and the other with bonus categories.

Ultimately, the number of cards you can own would depend on your financial situation, credit score, and ability to manage multiple accounts.

How to maximize credit card rewards?

To maximize your credit card rewards, make sure the card’s rewards structure complements your spending habits, aim to achieve the welcome bonus, and leverage the bonus categories and other perks like travel insurance & airport lounge access.

Also, make sure to redeem your earned rewards strategically for maximum value and always pay off your credit card bill in full each month.

How do credit cards work?

Credit cards work by offering you a line of credit from the card issuer, which is used by cardholders to make purchases, balance transfers, etc.

You can only borrow this money with an agreement to repay the loan amount in the future and interest if not paid in full by the due date.

Are credit card rewards taxable?

Generally, your credit card rewards are not taxable.

The IRS considers these rewards as a form of discounts or rebates on purchases made with credit cards instead of your income.