American Express, often referred to as Amex, boasts an extensive lineup of credit cards encompassing various categories, including co-branded partnerships with hotels and airlines.

Amex Membership Rewards program is one of the most versatile and rewarding loyalty programs in credit cards.

It offers cardholders a gateway to several benefits, from travel perks to cashback opportunities, making it a favorite among those who want to boost the value of their earnings.

Join us as we delve into Amex Membership Rewards, exploring some of the premier Amex cards for accumulating points, their perks, redemption strategies, and tips for optimizing the abundant rewards and benefits.

What are American Express Membership Rewards Points?

These points are highly versatile and valuable loyalty currency offered by American Express.

American Express Membership Rewards points are earned through select American Express credit cards, covering a broad spectrum of spending categories.

Typically, you’ll earn 1 point per dollar on eligible purchases, but various Cards provide higher rewards on specific categories.

For instance, the American Express Gold Card rewards you 4 points per dollar spent on dining.

Apart from regular credit card usage, Membership Rewards points can be acquired by referring friends to American Express cards or through online shopping on the Rakuten shopping portal.

They are redeemable for a variety of rewards, including travel reservations, statement credits, merchandise, gift cards, and even transfers to airline and hotel loyalty programs.

The ability to transfer these points to a diverse range of partners makes the Amex program appealing to travelers and consumers who seek to maximize the benefits of their spending.

How to Earn Amex Membership Rewards Points?

Accumulating Amex Membership points is a rewarding journey that allows you to make the most of your everyday spending!

With various Amex credit cards in the lineup, you can collect these valuable points through regular purchases and even more by leveraging bonus categories and card-specific perks.

American Express offers a selection of cards, each with its unique set of benefits and features. These cards grant you access to the Membership Rewards program, allowing you to earn points and explore a world of possibilities for redemption. Personal Credit Cards Top five personal credit cards offered by AMEX are: Business Credit Cards The top business credit cards from AMEX are: You can earn membership rewards points by making the most of the welcome offers. Many AMEX cards come with decent offers, and availing them is usually tied to spending a specific amount of money in a specific timeframe. For instance, the Amex Business Platinum card offers 120,000 Membership Rewards Points when you spend $15,000 on purchases within the first three months. Similarly, with an American Express Green Card, you can earn 40,000 bonus points on spending $2,000 in the first six months. It is a fantastic avenue for American Express cardholders to boost their Amex Membership Rewards points. These personalized offers are accessible directly through your account and designed to enhance your rewards potential by earning additional points while spending with select merchants. Usually, these AMEX offers must be added to the card before the purchase, so you need to read the terms and conditions carefully. Also, the AMEX offers usually can only be added to one card at a time, even if you have multiple AMEX cards. You can also earn bonus points by referring other customers to apply for a card. You will receive the bonus points only if they get approved. An individual can receive a maximum of 100,000 points in a year through referrals. The offer applies to both personal and business cards, but the points you can earn vary from one card to another. So, check the Refer a Friend section on the AMEX website to get the information on the latest Refer a Friend offers. Formerly known as Ebates, Rakuten is an online shopping portal that can help boost your AMEX membership rewards points. You get cashback on purchases at more than 3,500 stores and on the Rakuten website as well. You can also earn via the mobile app or by using the browser extension. As the cashback is usually paid via PayPal or as a Big Fat Check, you need to sign up to earn membership rewards points and specify it. These points are offered in addition to the regular points you earn with purchases. The earning rate for membership rewards points at Rakuten is offered at the same rate as earning cashback. So, if a store is offering a 5% cashback, you would get 5 Membership Rewards points on each dollar you spend.

![]()

![]()

![]()

![]()

![]()

Earn Amex Membership Rewards points from American Express Credit Cards

The American Express Platinum Card can be a good option due to its exceptional benefits and perks with an annual fee of $695. You get 80,000 Membership Rewards Points when you spend $8,000 within the first six months. You can also earn 5 Membership Rewards Points for each dollar for flights booked with airlines or American Express Travel. You also get 5 points for each dollar on prepaid hotels booked with American Express Travel. You get 1 point per dollar on all other eligible purchases. The perks include up to $200 airline incidental statement credit, up to $200 in annual Uber Cash for US services, and Global Lounge Collection access. The American Express Green Card comes with a nominal fee of $150 and lets you earn 40,000 points on spending $3,000 within the first six months. It also lets you earn 3 points per dollar on travel and transit. It includes not only flights and hotels but also taxis, rideshare services, trains, parking, and more. The card also allows you to earn 3 points for each dollar at restaurants worldwide, including takeout and delivery services in the US. It offers 1 point per dollar on other purchases. The perks include up to $100 CLEAR Plus membership statement credit and up to $100 LoungeBuddy statement credit. The American Express Gold Card is a card with a fee of $250 and a generous bonus of 60,000 Membership Rewards points on spending $4,000 within the first six months, a good addition to your credit card portfolio. You also get 4 Membership Rewards points for each dollar spent at restaurants, including takeout and delivery in the US. You also get 4 Membership Rewards points for each dollar at US supermarkets (with a cap of $25,000 annually) and 3 Membership Rewards points for each dollar on flights booked directly with airlines or through American Express travel. The card offers 1 point per dollar on all other eligible purchases. You also get up to $120 in annual dining statement credits at eligible restaurants if you complete the enrollment process. The American Express Business Gold Card has an annual fee of $295 and offers a whopping welcome offer. You get 70,000 Membership Rewards points on spending $10,000 within the first three months. You can also earn 4 Membership Rewards points for each dollar you spend on the two select categories with a cap of $150,000. You can also earn 1 point per for other purchases. It also has additional perks like a no foreign transaction fee and travel protections for eligible losses. The American Express Blue Business Plus Credit Card allows you to earn 2 Membership Rewards points for each dollar spent on everyday business purchases like office supplies or client dinners, with no annual fee The cap is at $50,000 in purchases per year. Also, there is no category spending, which saves hassle for businesses!

American Express Platinum Card

American Express Green Card

American Express Gold Card

American Express Business Gold Card

American Express Blue Business Plus Credit Card

| Credit card |

Uthrive rating

|

Intro offer | Rewards rate | Annual fee | Learn more |

|---|---|---|---|---|---|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles |

Reward Rates Earn 5X Membership Rewards® Points |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates 3x - 4x Membership Rewards® Points |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles |

Reward Rates 1x-5x Membership Rewards® points |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles |

Reward Rates 1x - 3x Membership Rewards® |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles |

Reward Rates 1x - 2x Membership Rewards® points |

Annual Fees annual_fees |

How Much Are Amex Reward Points Worth?

Usually, the value of the membership rewards depends on how a person uses them. When doing redemption with AMEX, you can expect the following:

Fine Hotels & Resorts stays 1 cent Flights and upgrades 1 cent Prepaid hotels and rental cars, cruises, and vacation packages 0.7 cents Retail and restaurant gift cards 0.7 – 1 cent American Express gift cards 0.5 cents Statement credits 0.6 cents Merchandise 0.5 cents Shopping with select merchants 0.7 – 1 cent

Redemption type

Redemption value

When you transfer the rewards to AMEX hotel or airline partners, their value might vary based on the details of your redemption.

With hotel partners, you get less than a cent per point in value, while with airlines, you can get more than 1 cent per point.

Also, there is an excise tax offset fee of $0.0006 per point on transferring the rewards.

Remember it when you want to know about Amex membership rewards value. You are free to use points to cover that at a rate of 0.5 cents apiece.

How To Redeem American Express Membership Rewards Points?

There are many ways to redeem the AMEX membership rewards. Some of them are briefly explained here:

As membership rewards points are transferable, you can transfer them to over 15 airline partners and three hotel partners. Though there are exceptions, the membership rewards transfers to airlines can usually be done at a 1:1 ratio. You can book your travel via the AMEX travel portal, an online travel agency that allows you to use the rewards as a payment method for booking hotels, flights, rental cars, cruises, and a lot more. The points would usually be 1 cent each and 0.7 cents each for prepaid hotels, cruises, rental cars, or vacation packages. When you have an Amex membership rewards card, you can explore Go Shopping. It’s an online shopping center by American Express. You can buy retail goods with the reward points. The usual redemption rates are 0.5 cents for each point. So, if you want to buy a product worth $10, you need to spend 2,000 membership rewards points. You can also explore special offers that allow you to buy goods by spending 30% to 50% fewer points. The maximum you can expect is 1 cent per point in value. You can redeem the membership rewards points as payment for gift cards. The value of the points will vary depending on the brand. For example, if you want a Gap gift card worth $100, you need to spend 10,000 points, while for an Apple gift card worth $85, you also need to spend 10,000 points. You can also transfer your membership rewards points to other reward programs that offer anywhere from 10 to 50% transfer bonuses. It’s a great way to get extra value without any additional effort. Some of the programs we recommend are:

![]()

![]()

![]()

![]()

This travel partner has a network of European and American flights and offers lucrative monthly rewards.

You can get transatlantic premium cabin travel by using Membership Rewards here. You can also use Virgin Points for travel within the US on Delta.

It opens the door to a wide range of luxury hotels and resorts worldwide, allowing you to enjoy premium stays and earn additional benefits through its loyalty program.

You gain access to a robust airline loyalty program, which can be particularly valuable for domestic and international travel within the Delta network.

How To Maximize Amex Reward Points?

There are many ways of maximizing the AMEX Reward Points. A few of them are listed here:

Look for cards that earn bonus points for categories you spend a lot on. Transfer membership rewards to gift cards or travel partners to get more benefits Transfer your points to Amex membership rewards transfer partners that offer up to a 50% transfer bonus.

Are American Express Membership Rewards Worth It?

If you travel frequently, the AMEX membership rewards are worth it for you.

The reward program offers a lot of benefits to travelers. You can easily earn thousands of points annually and convert them to money via some awesome loyalty programs.

So, if you travel frequently, you can’t miss out!

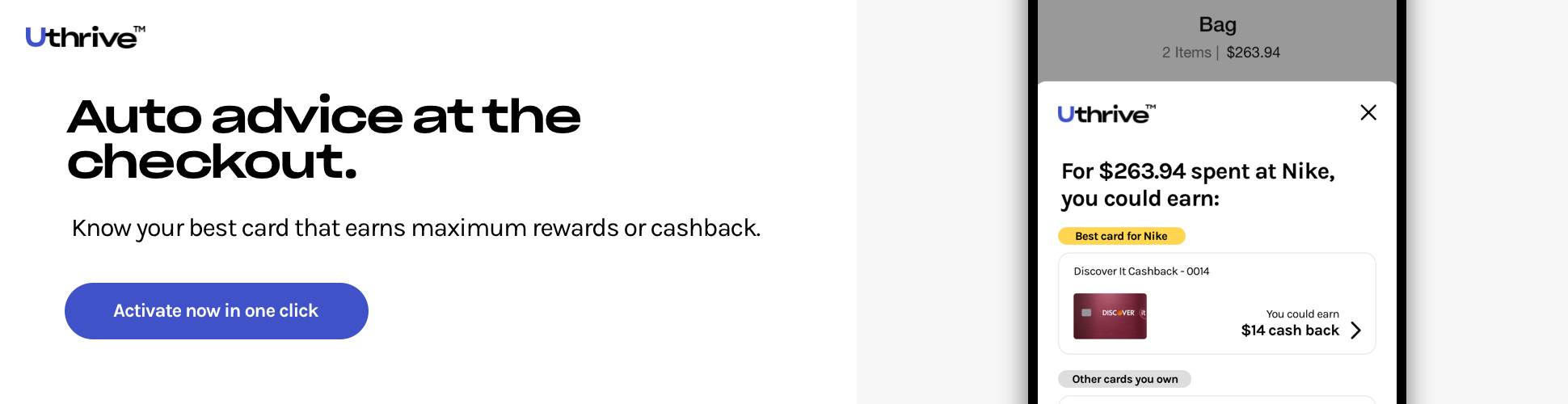

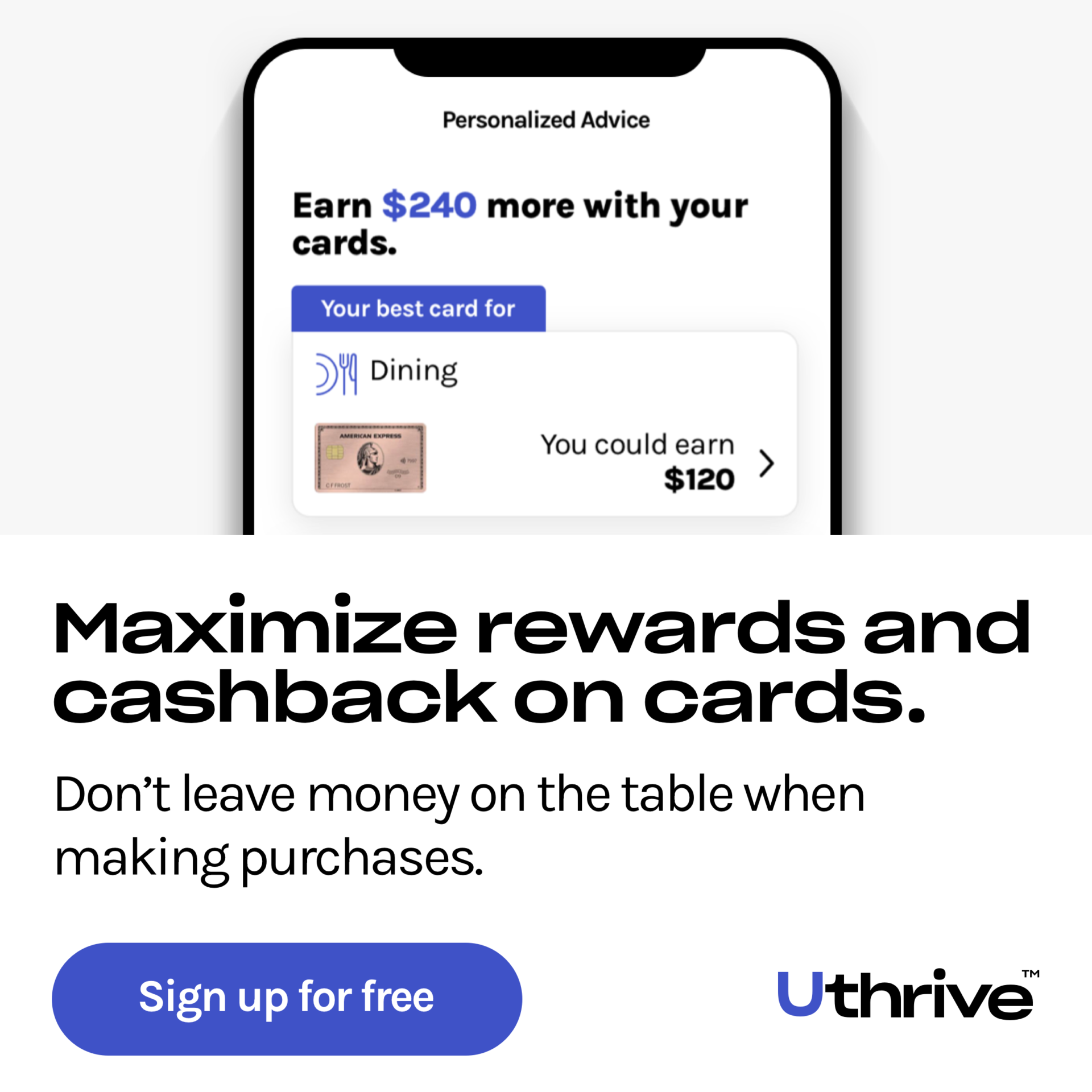

Why track your Amex Membership Rewards with Uthrive?

Tracking your Amex Membership Rewards with Uthrive Premium ensures you never miss out on valuable savings and rewards! Uthrive’s user-friendly interface simplifies the process, which allows you to monitor your rewards and cash back effortlessly.

It eliminates the need to keep track of individual credit card benefits. You can easily identify the best card to use to maximize your benefits for various purchases, whether you’re shopping, dining out, or booking travel.

The alert system prevents missed opportunities for rewards, ensuring you always make the right choice.

With vast coverage for major credit cards and top airlines and hotels, Uthrive Premium is your key to unlocking the full potential of your Amex Membership Rewards.

Download the Uthrive App today and optimize your Amex rewards and savings.

Amex Membership Rewards FAQs

The American Express Membership Rewards program enables cardholders to earn points with eligible Amex cards, offering at least 1 point per dollar spent and often extra points for category-specific purchases. For example, the Amex Platinum card offers 5x points on flights and hotels. These points are redeemable for many rewards, including travel, gift cards, and more. Amex Membership Reward Points can be redeemed for a range of rewards, including statement credit, travel, gift cards, shopping, transfer to airline and hotel partners, donation to charity, etc. You can use Amex Rewards whenever you like as long as you have enough points in your account to cover the redemption you want to make. There are no strict time limitations or expiry dates for Amex Rewards points as long as your account remains open and in good standing. Your American Express credit card may not be eligible for Membership Rewards for several reasons, including the specific card type or an issue with your account. Some American Express cards are not enrolled in the Membership Rewards program automatically, and you may need to request enrollment or choose a different card. It’s best to contact American Express customer service for specific details regarding your card’s eligibility. There are many ways to redeem AMEX membership rewards. They vary from online shopping to gift cards and transferring to travel partners or other rewards programs. To qualify for Amex Membership Rewards, you need an eligible American Express credit card participating in the Membership Rewards program. They usually require a good or excellent credit, which starts at a FICO score of 670. No, Membership Rewards points do not expire as long as your account remains active and in good standing. Your points will be available for redemption whenever you choose to use them. The value of 50,000 American Express Membership Rewards points can vary depending on how you redeem them. On average, the value is approximately $500 when used for travel, merchandise, or gift cards, but it can be higher or lower based on specific redemption options and promotions. Amex also allows you to use your points directly for purchases on Amazon. For instance, transferring Amex points to Airlines like Delta SkyMiles can get you a round-trip domestic flight or even an international flight, depending on the destination and available deals, or Hotels like Marriott Bonvoy, where you might get several nights at a mid-tier hotel or a luxury property, depending on the category. No! Not all American Express cards earn Membership Rewards points, as only cards with AmEx’s signature Green, Gold, and Platinum are eligible. To earn Membership Rewards points (at least 1 point per dollar spent), you should have an eligible AmExcard enrolled in the program.

How does the American Express Membership Rewards program work?

What Can You Do with Amex Membership Rewards?

When Can You Use Amex Rewards?

Why is my American Express card not eligible for Membership Rewards?

How do I redeem American Express Membership Rewards points?

What Qualifications Do You Have to Meet to Get Amex Membership Rewards?

Do American Express Membership Rewards points expire?

How much are 50,000 Amex points worth?

Do all American Express cards earn Membership Rewards points?

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)