Key Takeaways:

-

Cash back credit cards are like your money-saving buddy, rewarding you with a portion of your purchases.

-

From how to maximize your cashback rewards to finding the right fit for your spending habits, we’ve got you covered.

-

The top cash back contenders boast superb rates and versatile reward categories, spanning from travel to groceries. Let’s explore the best cards for cashback 2024.

Want to get rewarded for your everyday spending? Using cash back credit cards might be the answer! They offer a simple and effective way to earn money back on your purchases.

With a plethora of options available, finding the best cash back credit card can be overwhelming.

From flat-rate cash back to tiered and rotating category cards, each offers unique benefits tailored to different spending habits.

In this guide, we’ll walk you through everything you need to know about choosing the credit card with the best cash back.

Get ready to maximize your rewards and make the most of your expenses!

What are cash-back credit cards?

Cash back credit cards are a type of rewards card that give you a percentage of your purchases back as cash rewards.

You can redeem these rewards in various ways, such as statement credits, direct deposits to your bank account, a check, etc.

For example, if your card earns 5% cash back on eligible purchases, a $100 expense would give you $5 back.

Their flexibility, ease of use, and ongoing benefits make cash back cards a top choice for many consumers.

Depending on the cash back on credit card, you may earn a flat-rate cash back on all purchases or higher rates in specific categories.

Whether you often spend on groceries, gas, or other essentials, there’s likely a cash back card perfectly suited to your needs.

What are the common types of cash back cards?

Cards with cashback rewards offer various ways to earn, broadly divided into three main categories: flat-rate, tiered, and rotating.

Understanding these categories helps you choose the best cash back card that aligns with your spending habits and preferences.

-

Flat-rate cash back Cards

It has a straightforward way to earn rewards, providing a consistent cash back rate on all purchases.

Flat-rate cards are ideal for individuals seeking simplicity in their rewards program without the hassle of tracking rotating categories or tiered rewards.

While they may not offer the highest cash back rates, they are easy to understand and use.

Examples include the Wells Fargo Active Cash® Card, Citi Double Cash® Card, and Capital One Quicksilver Cash Rewards Credit Card, each offering a flat cashback rate on all eligible purchases, making them suitable for everyday spending without the need for strategic planning.

-

Tiered Cash Back Card

These cards offer different levels of cash back rewards based on specific spending categories.

Tiered credit cards typically provide higher cashback rates in select categories, such as dining, groceries, gas stations, or travel, while offering a standard rate on other purchases.

For instance, the Blue Cash Everyday® Card from American Express offers elevated cashback rates on groceries and gas, and the Chase Freedom Unlimited® provides increased rewards on travel and dining.

They may have earning caps on higher-rate categories but can still maximize cash back rewards on everyday spending.

-

Rotating Bonus Category Cash Back Cards

They come with high cash back rates in specific spending categories that change periodically, usually each quarter.

The rotating cash back cards require activation of the new bonus categories each quarter.

Examples include Discover it Cash Back, Chase Freedom Flex℠, and Bank of America Customized Cash Rewards. Additionally, these cards often impose earning caps on bonus category purchases, limiting the amount of cash back you can earn.

How does cash-back credit card work?

Cash back credit cards work by rewarding cardholders with a percentage of their spending back in cash.

So, if your credit card offers 3% cashback on groceries and you spend $100 at the grocery store, you’ll earn $3 in cashback rewards.

These rewards accumulate over time and can be redeemed through various options like statement credits, checks, charitable donations, direct deposits into your bank account, travel rewards, or even gift cards.

Essentially, the more you spend using your cash back rewards card, the more cash back you’ll earn, providing a simple and substantial benefit for your everyday purchases.

Best Cash Back Credit Cards

Looking to earn rewards effortlessly on your day-to-day purchases? Utilizing cash back credit cards is a flexible way to accumulate easy rewards.

From groceries to gas, dining to travel, these cards provide opportunities to earn cash back on a variety of purchases.

But with numerous options available, finding the best cash back credit card can be overwhelming.

Join us as we unveil the features of top contenders in the world of cash back credit cards, each adding value to your wallet and promising to turn your everyday spending into rewarding experiences.

| Best Cashback Credit Cards | Cashback Rewards Rates |

|---|---|

5% cash back on travel purchased through Chase Travel 3% back on dining and drugstore purchases 1.5% on all purchases |

|

6% cash back at U.S. supermarkets (on Up to $6,000 per year) and select U.S. streaming subscriptions 3% cash back at U.S. gas stations and on transit 1% on other qualifying purchases |

|

5% cash back on hotels and rental cars booked through Capital One Travel 3% cashback on dining, entertainment, popular streaming services, and grocery stores (excluding Walmart and Target) 1% on all other eligible purchases |

|

3% cash back at U.S. supermarkets. U.S. gas stations, and U.S online retail purchases (each with a cap of $6,000 per year, then 1%) 1% on other eligible purchases |

|

5% cash back on hotels and rental car booked through Capital One Travel 1.5% unlimited cash back on every purchase |

|

2% cash back on all purchases |

|

5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate 5% on travel purchased through Chase Travel 3% on dining and drugstore purchases 1% on all other qualifying purchases |

|

5% cash back on your top eligible category (up to $500 spent each billing cycle) 4% cash back on hotels and car rentals booked on Citi Travel portal (through 6/30/2025) Unlimited 1% back on other eligible purchases |

-

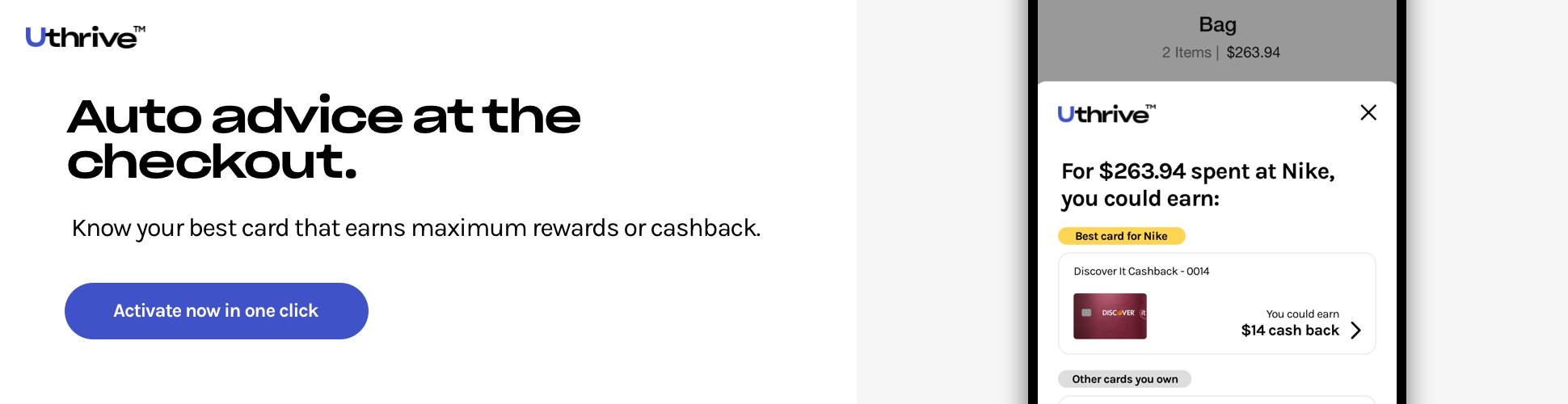

Chase Freedom Unlimited® - Ideal for Daily Spending Rewards

The Chase Freedom Unlimited® is considered one of the best cashback credit cards due to its appealing rewards structure and perks. With its attractive welcome bonus, new cardholders can bonus_miles_full

It offers unlimited 1.5% cash back on all purchases, 5% back on travel purchased through Chase, and 3% on dining and drugstore purchases, making it a simple and rewarding choice for everyday spending.

Additionally, you can benefit from no annual fee and various perks such as flexible redemption options and comprehensive travel and shopping benefits.

-

Blue Cash Preferred® Card from American Express - Perfect for High Cash Back on Grocery and Streaming

The Blue Cash Preferred® Card from American Express stands out as one of the top cashback cards thanks to its lucrative rewards program and valuable perks. You can bonus_miles_full as a welcome bonus.

With a annual_fees Cardholders get 6% cash back at U.S. supermarkets (on Up to $6,000 per year) and select U.S. streaming subscriptions, 3% back at U.S. gas stations and local transit, and 1% on all other eligible purchases.

Apart from being ideal for various regular expenses, it provides useful statement credits like $84 for Disney Bundle, travel benefits, and exclusive access to Amex offers.

-

Capital One SavorOne Cash Rewards Credit Card - Top Pick for Dining and Entertainment

The Capital One SavorOne Cash Rewards Credit Card is an excellent choice for cashback rewards, especially for its competitive reward system and generous welcome bonus where you can bonus_miles_full.

Cardholders can earn 3% cashback on dining, entertainment, grocery stores (excluding Walmart and Target), and popular streaming services, 5% back on hotels and rental cars booked through Capital One Travel, and 1% on other eligible purchases, catering to various lifestyle needs.

With no annual fee, it comes with various perks like no foreign transaction fees, multiple redemption options, and valuable travel and shopping benefits for peace of mind.

-

Citi Double Cash Card - Best Balance Transfer Cashback Card

The Citi Double Cash® Card is among the best cashback credit cards due to its unique rewards structure and no annual fee. New cardholders get to receive a decent welcome bonus, where they bonus_miles_full

This cashback rewards card offers 2% cash back on all purchases – 1% when you make a purchase and an additional 1% when you pay it off – providing simplicity and value for cardholders.

With no limit on earnings potential and no category restrictions, it appeals to those seeking straightforward rewards without the hassle of tracking rotating categories. You also enjoy $0 liability on unauthorized charges and Citi Entertainment perks.

-

Chase Freedom Flex℠ - Ideal for Rotating Bonus Categories

The Chase Freedom Flex℠ is a fantastic Chase cash back credit card, particularly for its versatile rewards program and a significant welcome bonus that allows you to <welcome offer>.

It features rotating quarterly bonus categories where users can earn 5% cash back on different categories throughout the year, including grocery stores, hotels, and restaurants. Plus, cardholders get 5% cash back on travel purchased through Chase and 3% back on drugstore purchases and dining.

With no annual fee, this is a credit card with best cashback opportunities. You also enjoy flexibility in redemption and comprehensive shopping and travel benefits for added comfort and convenience.

-

Blue Cash Everyday® Card from American Express - Best Card for Everyday Purchases

The Blue Cash Everyday® Card from American Express is the best cash back credit card with no annual fee! It has a solid welcome bonus that lets you bonus_miles_full

The card comes with a practical rewards program focused on everyday spending categories. You can earn 3% cash back at U.S. supermarkets, U.S. online retail purchases, and U.S. gas stations (with a cap of up to $6,000 per year on each category) and 1% back on other eligible purchases.

It allows you to maximize your earnings on essential purchases while enjoying perks such as no annual fee, worthwhile statement credits, shopping benefits, and exclusive Amex Offers.

-

Capital One Quicksilver Cash Rewards Credit Card - Top Pick for Simple Cashback

The Capital One Quicksilver Cash Rewards Credit Card stands out for its straightforward approach to earning cash back on credit cards with an amazing welcome bonus to bonus_miles_full.

It provides unlimited 1.5% cash back on all your purchases without any category restrictions or earning caps and 5% back on hotel and car rentals booked via Capital One Travel, appealing to individuals seeking simplicity in their rewards program.

With no annual fees, you can enjoy flexible redemption options, no foreign transaction fees for seamless international shopping, Capital One Entertainment perks, and valuable travel and shopping benefits at no extra cost.

-

Citi Custom Cash® Card - Tailored for Personalized Cashback Rewards

The Citi Custom Cash® Card is considered one of the best cash back rewards credit cards due to its innovative rewards structure tailored to individual spending habits. It has a decent welcome bonus, where you can bonus_miles_full

This unique card automatically adjusts to your highest earning category each billing cycle (including restaurants, gas stations, travel, grocery, etc.) based on where you spend the most money – allowing you to earn 5% cash back in that category on up to $500 each billing cycle.

It also offers unlimited 1% back on other eligible purchases. With no annual fee, cardholders enjoy free access to your FICO Score and flexibility and simplicity in maximizing rewards based on personalized spending habits.

Pros and cons of using cash back credit cards

Credit cards with best cash back offer enticing rewards, potentially saving you hundreds annually, but they may not suit everyone’s needs and goals.

Here’s a breakdown of the benefits and drawbacks of owning a cashback card.

Pros

-

Earn Rewards: With the right card that aligns with your spending habits, you can effortlessly accumulate excellent cashback through everyday shopping.

-

Build Credit: Responsible usage of a cashback credit card can positively impact your credit score, enhancing your overall creditworthiness over time.

-

No Annual Fee: The best cards with cash back rewards come with no annual fees, ensuring that your earnings aren't offset by annual costs, provided you pay your balance in full each month.

-

Sign-up Bonuses: The welcome offers can be lucrative, often adding up to hundreds of dollars, when you meet the minimum spending requirement within the specified timeframe.

-

Flexibility of Rewards: Cash rewards offer unparalleled flexibility, allowing you to use them however you want. Unlike travel rewards, cash back on credit cards has no redemption restrictions and can be spent anywhere.

-

Simplicity: Cashback cards are straightforward and easy to understand, making them a hassle-free option for those who prefer a simple rewards structure without the complexity of points or miles systems.

Cons

-

Higher APRs: Cashback cards often come with higher interest rates, making them less suitable for carrying balances, as the accrued interest can offset any rewards earned.

-

Limited Perks: Most cards with cashback rewards generally lack the travel benefits found in travel rewards cards, such as airport lounge access, free checked bags, or TSA Precheck credits, making them less attractive for frequent travelers.

-

Lower value compared to travel rewards: They typically offer less redemption value compared to travel cards with high-value deals, such as free flights or hotel stays.

Common cash-back bonus categories

Cashback cards offer rewards in varying categories. From everyday expenses like groceries and gas to specific purchases like dining and travel, cash back bonus categories have exciting rewards for savvy cardholders.

Explore how these categories work and which cards offer the best rewards. Understanding these cash back bonus categories is key to unlocking the full potential of your rewards.

-

Supermarkets & Groceries

Supermarkets & GroceriesSupermarkets, also known as grocery stores, are a common bonus category on many credit cards. It includes a wide range of items purchased at supermarkets, including groceries, cleaning supplies, toiletries, and even prepared meals.

Plus, buying gift cards for restaurants or retailers from supermarkets often qualifies for bonus rewards. However, some card issuers exclude certain superstores like Target and Walmart from this category.

For households with significant grocery expenses, this bonus category can offer valuable cash back rewards. Popular cash back cards for groceries are the Blue Cash Preferred® Card from American Express and Discover it Cash Back Credit Card.

-

Restaurants

RestaurantsRestaurants, often referred to as ‘dining’ in credit card terms, consist of several eating establishments, from fast-food joints to fine-dining restaurants and happening bars to serene cafes.

This bonus category allows you to earn accelerated rewards on your entire restaurant bill.

Additionally, some credit cards extend the dining category to include takeout and delivery services, providing opportunities to earn cash back even when dining at home.

This versatility makes the dining category particularly appealing for those who frequently enjoy meals outside or order food for delivery.

Best cash back cards for restaurants include Chase Freedom Unlimited® and Capital One Savor Cash Rewards Credit Card.

-

Gas stations

Gas stationsTraditional gasoline service stations like Mobil, Shell, and BP fall under the bonus category of gas.

While this category typically doesn’t cover gas stations affiliated with supermarkets or warehouse clubs, it may cover purchases made at associated convenience stores.

However, certain cards may limit rewards to gas purchases made at the pump only. Individuals who commute daily for work or those who like to travel can benefit from the rewards.

So, if you spend significantly on fuel, you can earn cash back at gas stations for excellent rewards with cards like the Costco Anywhere Visa® Card by Citi or the Discover it Chrome Gas & Restaurant Credit Card.

-

Travel

TravelTravel, often encompassing airline tickets and hotel stays, is a versatile bonus category offered by many cash back credit cards. Beyond flights and accommodations, it may extend to other travel-related expenses such as rental cars, cruises, and vacation packages.

Note that some credit cards may require you to book travel through their designated portals to qualify for elevated cash back. For instance, Capital One and Chase cash back credit cards offer rewards when booked via the Capital One Travel portal and Chase Travel portal.

Cards under the travel category cater to frequent travelers, offering lucrative rewards and perks tailored to their needs. Best travel cashback card options include Chase Sapphire Preferred® Card and Citi Custom Cash® Card.

What is the Best Cash-Back Credit Card?

Determining the best cash back credit card is subjective, as it depends on your spending habits and preferences. Factors such as reward structure, redemption options, annual fees, and desired perks also play a crucial role.

An outstanding option for the best cash back rewards card is the Chase Freedom Unlimited Credit Card for unlimited 1.5% cash back on all purchases with 3%-5% cash back rewards on other categories, no annual fees, and valuable perks for travel and shopping.

The Citi Double Cash Card is another attractive choice, offering 2% cash back on all purchases with no categories to track.

With no burden of annual fees, you also enjoy flexible redemption options with a handful of transfer partners and the ability to transfer your high-interest balance, thanks to the zero-interest promotional period.

To make the right choice, be sure to assess your financial goals and lifestyle. Ultimately, the best cash back credit card is the one that aligns closely with your unique needs and maximizes your overall value and satisfaction.

How many Cash-Back Credit Cards should I have?

Deciding how many cash back credit cards to have depends on your spending habits, ability to manage multiple accounts, and the time you’re willing to invest. If you’re new to cashback cards, we recommend starting with one to understand its benefits and structure.

Generally, it is best to have one or two cash back credit cards to maximize your rewards. Having multiple cards allows you to tailor your earnings to different bonus categories, helping you boost your cash back rewards with higher rates.

For example, having one card that offers higher cashback on groceries and another that offers better rewards on gas purchases can help you optimize your spending.

However, managing too many cards can be overwhelming as juggling several statements and monthly payments may be challenging – resulting in missed payments or increased debt.

Ultimately, the ideal number of cash back credit cards you should have depends on your needs, capability to pay monthly bills, and financial goals.

How to pair Cash-Back Credit Cards?

Pairing cash back credit cards can maximize your rewards potential effortlessly. This strategy involves combining a card offering high rewards in certain bonus categories with a flat-rate credit card for everything else.

With multiple cash back credit cards available in the market, each offering different reward categories, it’s essential to understand how to pair them effectively to maximize your earnings.

The first strategy is to identify the categories where you spend the most – groceries, gas, dining, or other purchases.

By using a credit card with elevated cashback on specific bonus categories and another card with fixed-rate rewards, you can effectively double your cashback earnings.

For instance, pairing the Citi Premier℠ Card, which earns triple rewards on dining, groceries, gas, and travel, with the Citi Double Cash® Card, providing a flat 2% cash back on all purchases, covering almost all your expenses.

Another way to combine two cards is to consider using a rotating category card offering higher cash-back rates that change quarterly – if you have consistent spending patterns in various categories throughout the year.

Pairing one of these cards with a credit card that provides consistent cashback for other purchases can optimize your annual rewards.

Similarly, using the no annual fee best cash back credit cards like the Chase Freedom Flex℠ with 5% cashback on quarterly rotating bonus categories and the Wells Fargo Active Cash® Card offering an unlimited 2% cash back on all purchases can optimize rewards across different spending habits.

Cash back credit cards offer an attractive incentive to consumers who use their cards for everyday purchases. This optimal pairing ensures your cashback rewards are tailored to your preferences and spending patterns while simplifying your earning strategy.

How to compare cash-back credit cards?

When comparing cashback credit cards, it’s essential to consider several factors to determine which card best suits your needs and financial situation. Knowing what makes each card different can help you make an informed decision.

Ultimately, the best cash back credit card for you is one that aligns with your spending patterns, financial goals, and lifestyle preferences.

By carefully comparing these factors, you can select a card that maximizes your reward potential while minimizing costs.

-

Cash Back Categories

Cash Back CategoriesThe reward structures offered by cash back credit cards vary, where some cards offer higher cash back rewards in specific categories like groceries, dining, travel, or gas.

It is essential to consider your spending habits, compare credit cards, and choose the one that provides higher rewards in categories where you spend the most!

-

Annual Fees

Annual FeesSome cash back cards come with annual fees, while others have no annual fees. Always weigh the benefits of a credit card against its annual fee to determine if the rewards and perks justify the cost.

-

Sign-Up Bonuses

Sign-Up BonusesLook for welcome bonuses the card issuer offers, as they can significantly boost your rewards. When comparing cards, look at the sign-up bonus amount, the requirements to earn it, and whether it aligns with your spending patterns.

-

Flexible Redemption Options

Flexible Redemption OptionsCheck how easy it is to redeem your cash back rewards – whether it’s through statement credits, direct deposits, gift cards, or other methods. Select a card with redemption options that suit your preferences.

-

Interest Rates and Fees

Interest Rates and FeesWhile earning cashback is appealing, it’s also important to consider the interest rates and fees associated with a credit card.

Review the APR for purchases and balance transfers, any foreign transaction fees, or late payment penalties that may apply.

-

Additional Benefits

Additional BenefitsThe best cash back credit cards offer additional perks such as travel insurance, extended warranties, purchase protection, or other travel benefits, enhancing your overall experience.

When’s the best time to redeem your cash back?

The best time to redeem your cash back is when you have accumulated ample rewards and can maximize its value!

Waiting until you have earned a substantial amount allows you to make more significant purchases or receive a large sum of money.

Additionally, some credit card companies provide bonus or promotion offers for redeeming cash back rewards during specific periods, such as holidays or special events.

For example, if a card issuer offers a 10% bonus on cash back redemptions during the holiday season, it would be profitable to wait until then to redeem your rewards.

Sometimes, even when you might consider saving up for a larger redemption, and they are about to expire soon, there are benefits to redeeming sooner rather than later.

Then, it’s best to redeem your cash back before it expires, ensuring you don’t lose out on your rewards.

How to choose a cash back credit card?

You can easily boost the value of your cash back credit card by choosing the right one, as it can make a big difference in your savings!

Whether you’re just starting out or aiming to optimize your rewards, understanding your spending habits is crucial.

From flat-rate cards to those with category-specific rewards, finding the perfect fit can result in substantial cash back on your everyday purchases.

Below are some key factors to consider while selecting the best cash back credit card for your needs.

-

Check your credit score

Check your credit scoreStart by checking your credit score because most cash back cards require at least a good credit score. Your credit score plays a crucial role in determining your eligibility for the best cash back credit card.

-

Review your spending habits

Review your spending habitsReview your spending habits to identify which categories earn you the most rewards. Opt for a card whose bonus categories align with your frequent shopping to maximize your cashback potential.

-

Compare welcome offers

Compare welcome offersCompare the welcome bonuses of different credit cards and pick the one where you can easily meet the spending requirements to significantly boost your rewards balance.

-

Think about your cash back strategy

Think about your cash back strategyFlat-rate cards offer consistent rewards for all purchases, while bonus category cards provide higher rewards on certain spending. Develop a cash-back strategy by choosing between flat-rate and bonus-category credit cards.

-

Weigh the costs

Weigh the costsWeigh the costs associated with each card, including annual fees, interest rates, and other credit card fees. Determine if the benefits and rewards offered by the card justify its costs to ensure you’re getting the most value out of your cash back credit card.

-

Review the perks

Review the perksAssess the perks the cash back cards offer, such as statement credits, purchase protection, and travel insurance. These additional benefits can enhance the overall value of the card.

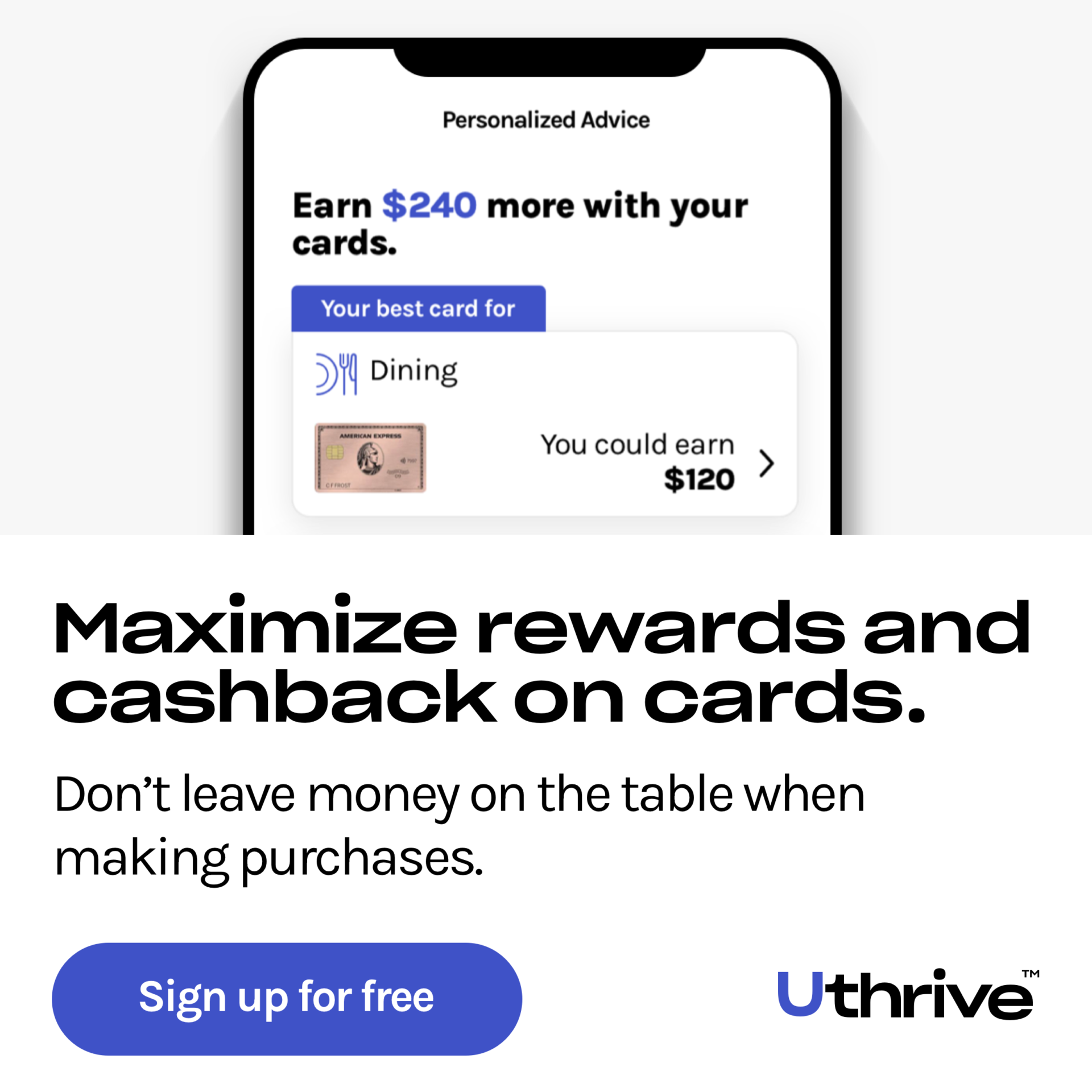

How can you Maximize the Value from Cash-Back Credit Cards?

Wondering how to get the most out of your cashback credit cards? From strategic pairing of cards to leveraging welcome bonuses, you can utilize various tactics to maximize their value.

You can keep track of your bonus categories aligning with your highest spending areas or opt for a card with a higher flat-rate reward on all purchases.

Here are some valuable tips and tricks to ensure you get the maximum cash back on your credit card.

-

Don’t SPEND just to earn!

While it might be appealing to increase your spending to earn cashback rewards, you must not fall into that allure of overspending. It will only result in a balance you can’t pay off in full.

Carrying a balance means losing the cash back you’ve earned to interest charges. So, to maximize your rewards without incurring extra costs, pay your monthly balances on time and in full.

-

Combine cards for optimum rewards

Combining two or more cards is the key to maximizing cash back rewards. Opt for top credit cards that align with your spending habits and needs.

For optimal rewards, choose cards with complimentary reward structures. For instance, one card may offer extra cash back for dining, another for Amazon purchases, and another for gas and groceries.

Including at least one cash back credit card with a high flat-rate reward on all purchases helps to earn consistent rewards and make sure your cash back categories don’t overlap.

-

Earn back the annual fee

To justify the annual fee, ensure your cashback earnings exceed this cost. The rewards and perks offered by the card must outweigh the fee.

Evaluate whether the rewards accumulated over the year exceed the annual fee’s cost. Most cash back cards track rewards earned annually, allowing you to assess their value.

-

Aim to achieve your welcome bonus

Ensure you meet the minimum spending requirement to claim the welcome bonus, offering significant value. Some cards are worthwhile solely for their attractive sign-up bonuses.

Do not miss out on these potential rewards, often worth hundreds of dollars. Consider shifting your expenses to the new card to reach this target without overspending, maximizing the benefits of the welcome offer.

-

Take advantage of rotating bonus categories

To boost your cashback rewards, you must enroll or activate your card’s rotating bonus categories every quarter. It is essential for earning the higher bonus rate offered during that period.

By doing so, you can capitalize on accumulating 5% cash back on select categories like restaurants, wholesale clubs, gas stations, groceries, and more.

Failing to enroll would mean missing out on the additional cashback value and only earning at a standard rate. Be proactive to make the most of these opportunities to increase rewards earnings.

-

Use the card's shopping portal for extra rewards!

Utilize your card’s online shopping portal to unlock additional cashback rewards. The best cash back credit cards provide access to these portals, offering exclusive cash back deals on your purchases.

You can easily activate these offers through your card issuer’s portal to significantly boost your cashback earnings, providing valuable rewards for your online shopping.

FAQs

What is cashback in credit card?

Cash back on credit cards refers to a rewards program where cardholders get back a percentage of the amount spent on purchases in the form of cash or statement credits – incentivizing spending and helping offset the costs of the card.

What is the Best Cash-Back Credit Card?

The best cash back credit card varies based on an individual’s preferences, spending habits, and financial goals. Popular options include the Blue Cash Preferred® Card from American Express and the Chase Freedom Unlimited®.

Do cash back cards actually give you cash?

YES! Cash-back cards typically provide cardholders with actual cash rewards. The earned cash back can usually be redeemed as a statement credit, deposited into a bank account, or received as a physical check.

Is cash back from a credit card taxable?

In most cases, cash back rewards from credit cards are not considered taxable income by the IRS as they are treated as rebates or discounts rather than income.

However, if you earn significant rewards through business spending, consult with a tax professional for guidance.

Does cash back expire?

The expiration of cash back rewards depends on the credit card issuer’s policies. Generally, the cash back does not expire as long as the account remains open and in good standing.

Is it better to earn cash back or rewards?

The choice between earning cash back or rewards depends on your preferences and financial goals.

Cash back provides immediate value and enhanced flexibility for various expenses, while rewards points may offer higher redemption value for travel or specific purchases.

What is a Good Cash-Back Rate on a Credit Card?

A good cash-back rate on a credit card typically ranges from 1% to 2% on general purchases, and some cards offer higher rates, such as 3% to 6%, on specific categories like groceries, dining, or gas, providing even more value depending on your spending habits.

How do you get 5% Cashback on everything?

To get 5% cash back on everything, consider applying for rotating category credit cards, which offer 5% cash back rewards in different spending categories each quarter.

Consider options like- the Chase Freedom Flex℠, Discover It Cash Back Card, and Citi Custom Cash® Card.

Should I save up cash back rewards?

Yes, because saving up cash back rewards can be beneficial for making large redemptions or unexpected expenses. However, regularly redeeming your rewards can prevent devaluation due to changes in reward programs or account closure.

Are cash back credit cards worth it?

Whether cash back credit cards are worth it depends on your spending habits and financial goals. They offer a simple way to earn rewards on everyday spending, allowing you to save money on your purchases.

If used responsibly and strategically to maximize rewards while avoiding interest charges, these cards can provide valuable benefits and significant savings over time.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What is cashback in credit card?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Cash back on credit cards refers to a rewards program where cardholders get back a percentage of the amount spent on purchases in the form of cash or statement credits – incentivizing spending and helping offset the costs of the card.”

}

},{

“@type”: “Question”,

“name”: “What is the Best Cash-Back Credit Card?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The best cash back credit card varies based on an individual’s preferences, spending habits, and financial goals. Popular options include the Blue Cash Preferred Card from American Express and the Chase Freedom Unlimited Card.”

}

},{

“@type”: “Question”,

“name”: “Do cash back cards actually give you cash?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “YES! Cash-back cards typically provide cardholders with actual cash rewards. The earned cash back can usually be redeemed as a statement credit, deposited into a bank account, or received as a physical check.”

}

},{

“@type”: “Question”,

“name”: “Is cash back from a credit card taxable?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “In most cases, cash back rewards from credit cards are not considered taxable income by the IRS as they are treated as rebates or discounts rather than income.

However, if you earn significant rewards through business spending, consult with a tax professional for guidance.”

}

},{

“@type”: “Question”,

“name”: “Does cash back expire?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The expiration of cash back rewards depends on the credit card issuer’s policies. Generally, the cash back does not expire as long as the account remains open and in good standing.”

}

},{

“@type”: “Question”,

“name”: “Is it better to earn cash back or rewards?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The choice between earning cash back or rewards depends on your preferences and financial goals.

Cash back provides immediate value and enhanced flexibility for various expenses, while rewards points may offer higher redemption value for travel or specific purchases.”

}

},{

“@type”: “Question”,

“name”: “What is a Good Cash-Back Rate on a Credit Card?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “A good cash-back rate on a credit card typically ranges from 1% to 2% on general purchases, and some cards offer higher rates, such as 3% to 6%, on specific categories like groceries, dining, or gas, providing even more value depending on your spending habits.”

}

},{

“@type”: “Question”,

“name”: “How do you get 5% Cashback on everything?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “To get 5% cash back on everything, consider applying for rotating category credit cards, which offer 5% cash back rewards in different spending categories each quarter.

Consider options like- the Chase Freedom Flex Credit Card, Discover It Cash Back Card, and Citi Custom Cash Card.”

}

},{

“@type”: “Question”,

“name”: “Should I save up cash back rewards?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, because saving up cash back rewards can be beneficial for making large redemptions or unexpected expenses. However, regularly redeeming your rewards can prevent devaluation due to changes in reward programs or account closure.”

}

},{

“@type”: “Question”,

“name”: “Are cash back credit cards worth it?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Whether cash back credit cards are worth it depends on your spending habits and financial goals. They offer a simple way to earn rewards on everyday spending, allowing you to save money on your purchases.

If used responsibly and strategically to maximize rewards while avoiding interest charges, these cards can provide valuable benefits and significant savings over time.”

}

}]

}

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)