Life is unpredictable, and when unforeseen events unfold during your travels, having a safety net becomes paramount.

Enter travel insurance – the guardian angel for your journeys!

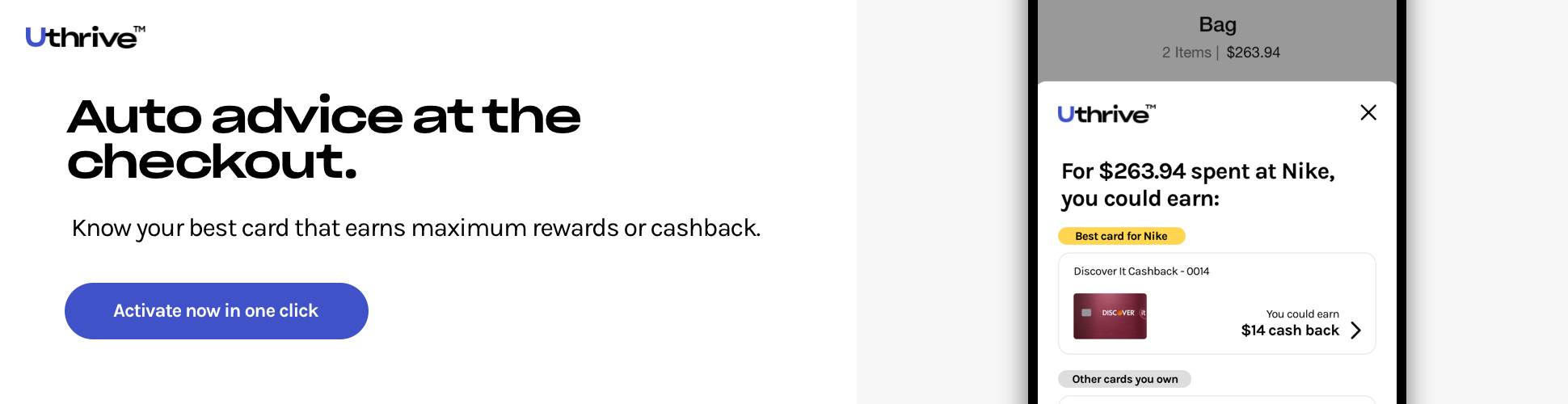

While purchasing a standalone travel insurance policy is a common practice, credit card travel insurance emerges as a potential game-changer, offering a layer of protection that might suit your specific trips without paying separately for it.

Travel is filled with unforeseen challenges. In modern-day travel, safeguarding against unexpected trip cancellations and delays is not merely an option but a vital necessity.

These credit cards equipped with travel insurance are a powerful ally in shielding you from financial setbacks caused by lost luggage, theft, trip cancellations beyond your control, or even unexpected damages to your rental car.

What’s truly remarkable is that these credit cards extend the umbrella of protection at no additional cost.

However, not all credit cards have equal travel insurance perks. Premium travel credit cards emerge as champions in offering the most extensive coverage.

The spectrum of protection spans a variety of areas, including trip cancellation and interruption insurance, auto rental coverage, baggage delay insurance, lost luggage reimbursement, roadside assistance, and a myriad of other invaluable safeguards.

We’ll explore the best credit cards for travel insurance, decoding what you need to consider when contemplating your upcoming trip.

This comprehensive guide will help you navigate through the unpredictable by unveiling the power of credit card travel insurance.

What does Credit Card Travel Insurance cover?

Credit card travel insurance typically covers the following aspects. But they may vary by card, so reviewing the terms is crucial.

-

Trip Cancellation/Interruption

Reimburses non-refundable trip expenses if canceled or interrupted.

-

Travel Accident Insurance

Provides coverage for accidental death or dismemberment during travel.

-

Baggage Delay/Loss

Offers reimbursement for essential items due to delayed or lost baggage.

-

Rental Car Insurance

Covers damage or theft of rental cars when paid with a credit card.

-

Emergency Medical Assistance

Assists with medical emergencies during travel.

-

Trip Delay Reimbursement

Compensates for necessary expenses during a covered trip delay.

-

Emergency Evacuation

Covers transportation costs for emergency evacuations.

6 Best Credit Cards for Travel Insurance

Embark on worry-free journeys with the perfect blend of convenience and protection offered by the top 6 travel insurance credit cards. They cover everything, from trip cancellations to emergency medical assistance.

So, if you are wondering which credit cards offer travel insurance, our meticulously selected cards ensure you enjoy the perks of travel and navigate unexpected challenges with confidence.

-

Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card stands out for its robust travel insurance offerings, including trip cancellation/interruption, baggage delay, and travel accident insurance.

Additionally, it features no foreign transaction fees, making it an excellent companion for international adventures.

Travel Insurance Perks Details Trip Cancellation/Interruption Insurance

Up to $10,000 per person and $20,000 per trip

Auto Rental Collision Damage Waiver

Primary coverage for theft or collision damage

Baggage Delay Insurance

Reimburses essential purchases for baggage delays over 6 hours, up to $100 per day for 5 days

Trip Delay Reimbursement

Reimburses up to $500 per ticket for delays over 12 hours or requiring an overnight stay

Travel Accident Insurance

Up to $500,000 for death or dismemberment while traveling

Beyond insurance, it rewards users with 5x points on travel and 3x on dining expenses, online grocery shopping, and select streaming services.

With a $95 annual fee, cardholders get a generous welcome bonus of 60,000 bonus points and the flexibility to transfer points to 15+ loyalty programs.

It is a favorite among travelers seeking both coverage and rewards.

-

United Explorer Card

The Chase United Explorer excels in travel insurance, such as trip cancellation insurance, baggage delay coverage, and lost luggage reimbursement.

With other benefits like TSA PreCheck/Global Entry credit and no foreign transaction fees, it caters to frequent United travelers with great coverage and airline-specific rewards.

Travel Insurance Perks Details Trip Cancellation/Interruption Insurance

Up to $1,500 per person and $6,000 per trip

Auto Rental Collision Damage Waiver

Secondary coverage for theft or collision damage

Baggage Delay Insurance

Reimburses up to $100 per day for 3 days for essential purchases due to baggage delays over 6 hours

Trip Delay Reimbursement

Reimburses up to $500 per ticket for delays over 12 hours or requiring an overnight stay

Lost Luggage Reimbursement

Up to $3,000 per passenger for lost or damaged luggage

It brings more perks for United Airlines loyalists, with priority boarding, free checked bags, and two one-time United Club passes annually.

Cardholders earn a generous sign-up bonus and 2x miles on United purchases, dining, and hotels, providing flexibility in booking flights.

-

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards appeals to travelers with its uncomplicated rewards structure and essential travel insurance benefits, ensuring coverage during journeys.

It further distinguishes itself with a Global Entry/TSA PreCheck application fee credit and no foreign transaction fees, making it a versatile and cost-effective choice for those valuing simplicity.

Travel Insurance Perks Details Travel Accident Insurance

Up to $250,000 for death or dismemberment while traveling

Auto Rental Collision Damage Waiver

Secondary coverage for theft or collision damage

24-Hour Travel Assistance Services

Access to travel assistance services, including medical and legal referrals

Lost Luggage Reimbursement

Up to $3,000 per trip for lost or damaged luggage

With just a $95 annual fee, the straightforward rewards system provides unlimited 2x miles on every purchase, 5x on rental cars & hotels, 75,000 bonus miles of welcome bonus, and flexible redemption for travel expenses.

-

American Express Gold Card

The Amex Gold Card combines travel insurance perks with elevated rewards on dining and groceries, making it a compelling choice.

With trip cancellation/interruption insurance, baggage insurance, and access to the Premium Global Assist Hotline, it provides a safety net for travelers.

Travel Insurance Perks Details Trip Cancellation/Interruption Insurance

Up to $10,000 per person and $20,000 per trip

Baggage Insurance Plan

Up to $1,250 for carry-on baggage and $500 for checked baggage

Premium Global Assist Hotline

Access to medical, legal, financial, and other emergency assistance services while traveling

The card shines in its rewards program, offering 4x Membership Rewards points on dining and groceries, 3x on flights, and a substantial sign-up bonus of 60,000 Membership Rewards points.

With an annual fee of $250, no foreign transaction fees, and valuable credits, it creates a package catering to many with comprehensive insurance coverage and high rewards on everyday expenses.

-

Chase Sapphire Reserve Credit Card

The Chase Sapphire Reserve Card earns its reputation as a premium travel card with extensive travel insurance coverage and exceptional rewards.

Boasting trip cancellation/interruption insurance, primary rental car coverage, and travel accident insurance, it prioritizes the safety and security of travelers.

Travel Insurance Perks Details Trip Cancellation/Interruption Insurance

Up to $10,000 per person and $20,000 per trip

Auto Rental Collision Damage Waiver

Primary reimbursement up to $75,000 for theft or collision damage

Baggage Delay Insurance

Reimburses essential purchases for baggage delays over 6 hours, up to $100 per day for 5 days

Trip Delay Reimbursement

Reimburses up to $500 per ticket for delays over 6 hours or requiring an overnight stay

Travel Accident Insurance

Up to $1,000,000 for death or dismemberment while traveling

With a $550 annual fee, the rewards program offers 10x points on hotels, 5x on flights, and 3x on dining.

Cardholders can also transfer their points to various loyalty programs and earn a generous welcome bonus.

Additional benefits like access to 1,300+ Priority Pass lounges, Global Entry or TSA PreCheck credit, and a $300 annual travel credit contribute to its status as a preferred choice for frequent travelers.

-

Platinum Card from American Express

The Platinum Card from American Express caters to luxury travelers seeking unparalleled benefits and travel protections.

Its travel insurance includes trip cancellation/interruption insurance, baggage insurance, and access to the Premium Global Assist Hotline.

Travel Insurance Perks Details Trip Cancellation/Interruption Insurance

Up to $10,000 per person and $20,000 per trip

Auto Rental Collision Damage Waiver

Secondary coverage for theft or collision damage

Trip Delay Insurance

Reimburses up to $500 per ticket for delays over 6 hours or requiring an overnight stay

Baggage Insurance Plan

Up to $3,000 for carry-on baggage and $2,000 for checked baggage

Premium Global Assist Hotline

Access to medical, legal, financial, and other emergency assistance services while traveling

Beyond insurance, the card offers extensive perks like airport lounge access, a $200 hotel and airline fee credit, Uber credits, and Marriott Bonvoy and Hilton Honors Gold Elite Status.

With a high annual fee of $695, it has a robust rewards program, including 5x Membership Rewards points on flights and prepaid hotels and an excellent sign-up offer.

| Credit card |

Uthrive rating

|

Intro offer | Rewards rate | Annual fee | Learn more |

|---|---|---|---|---|---|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles |

Reward Rates 3x - 5x total points |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.2/5

|

Intro Offer bonus_miles |

Reward Rates 1X - 2X miles per $1 |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates 2- 5 Miles per dollar |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates 3x - 4x Membership Rewards® Points |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.2/5

|

Intro Offer bonus_miles |

Reward Rates 2x - 10x total points |

Annual Fees $550 |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles |

Reward Rates Earn 5X Membership Rewards® Points |

Annual Fees annual_fees |

Benefits of Travel Insurance Credit Cards

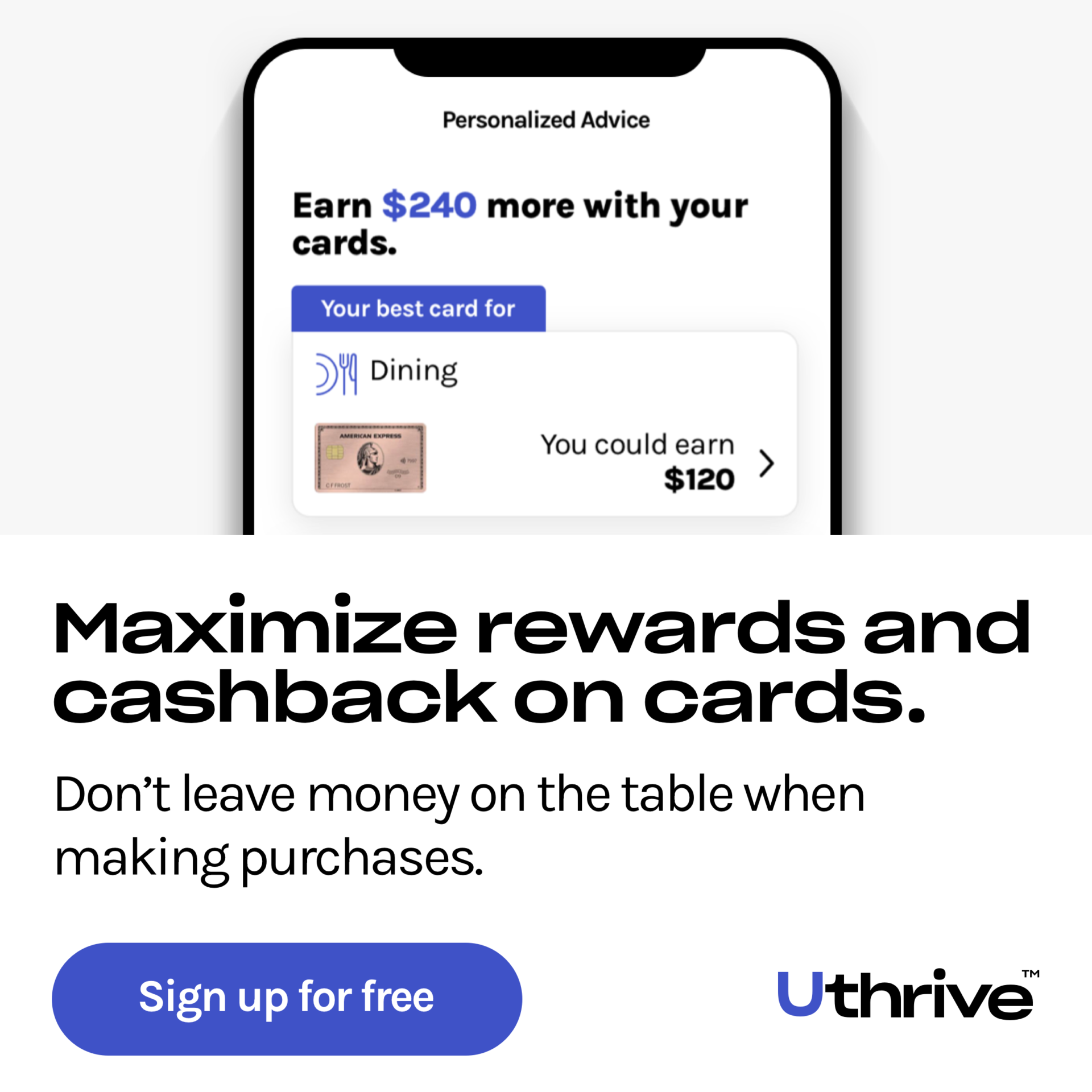

Credit card travel insurance emerges as an innovative breakthrough, simplifying the travel experience in multiple ways.

It is not just a payment tool but a reliable companion, saving and reassuring you throughout your travel adventures.

Here are the benefits of travel insurance credit cards:

-

Simplicity in Coverage

Simplicity in CoverageThe primary benefit lies in simplicity. There is no need to delve into the complexities of independent travel insurance policies and pay separately for them unless your credit card doesn’t meet your coverage preferences for a specific trip.

-

Cost Savings

Cost SavingsA tangible advantage is cost savings. For instance, you can save over $100 by acquiring theft and collision coverage through the Chase Sapphire Preferred card instead of purchasing it separately from a car rental company.

-

Reassurance in Unexpected Events

Reassurance in Unexpected EventsTravel uncertainties are part of the journey.

Whether it’s a flight cancellation due to bad weather or a temporarily misplaced checked bag, having a credit card with travel insurance provides reassurance.

The Chase Sapphire Reserve travel insurance benefits will cover trip delay protection and baggage delay insurance, ensuring you can navigate such situations with ease and minimal financial impact.

-

Various Travel Protections Included

Various Travel Protections IncludedCredit card insurance benefits provide a comprehensive safety net for several uncertainties, including trip cancellation/interruption protection, emergency medical assistance, baggage loss/delay reimbursement, and rental car insurance.

Additionally, travel assistance services extend 24/7 support for a range of travel-related concerns, including lost passports and emergency translations, enhancing your overall travel experience.

These benefits collectively redefine the travel experience, making travel insurance credit cards an indispensable companion for the modern explorer.

Is Credit Card Travel Insurance Worth It?

While travel credit cards with travel insurance dazzle with enticing perks and substantial savings, their worth depends on how frequently you use them for traveling. For infrequent travelers, the struggle to offset the hefty annual fee is real.

Yet, avid travelers relish travel protections and benefits like airline lounge access, complimentary baggage, and upgrades.

The true game-changer surfaces in the form of provided travel insurance, helpful when your luggage vanishes or plans abruptly derail.

Even if you’re an occasional traveler checking just a bag or two annually, the card’s annual fee seamlessly justifies itself.

Notably, the age factor comes into play, as travel insurance tends to become pricier with time. Premium cards with fixed annual fees, such as the Platinum Card from American Express and the Chase Sapphire Reserve, gain more value as you age.

Assess your travel needs to decide whether your credit card coverage suffices or if additional travel insurance is imperative, especially for ambitious, nonrefundable international ventures.

Sure, the allure of free miles and other travel perks is enticing. You must factor in the annual fees of the credit card, its rewards & other perks, and your travel habits before choosing the best credit card for travel insurance.

The Bottom Line

Travel insurance often falls into the category of credit card benefits you’d prefer not to utilize, yet its value becomes apparent in saving you from considerable out-of-pocket expenses when needed.

However, the suitability of credit card travel insurance depends on your circumstances and the nature of your upcoming trip.

Many travel credit cards can provide you with enough travel insurance benefits to protect you in an emergency or if your plans change, so purchasing extra travel coverage likely won’t be necessary.

It’s crucial to delve into the fine print, comprehensively understanding the coverage provided, before deciding between relying on credit card travel insurance or opting for a standalone policy.

Careful consideration ensures that your choice aligns perfectly with your specific needs and ensures a worry-free travel experience.

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)