Walmart is undoubtedly one of the most popular superstores in the US. So, it’s not astonishing to see how popular Walmart credit cards are becoming now.

As Walmart offers everything from household goods to electronics, having the best credit cards for Walmart handy or a Walmart credit card is very beneficial. Read on for more.

What are Walmart Reward Cards?

Well, the name is quite self-explanatory. Walmart credit cards are credit cards that offer you cashback and rewards when you buy from one of the superstores. You also get access to additional perks like price protection and extended warranties.

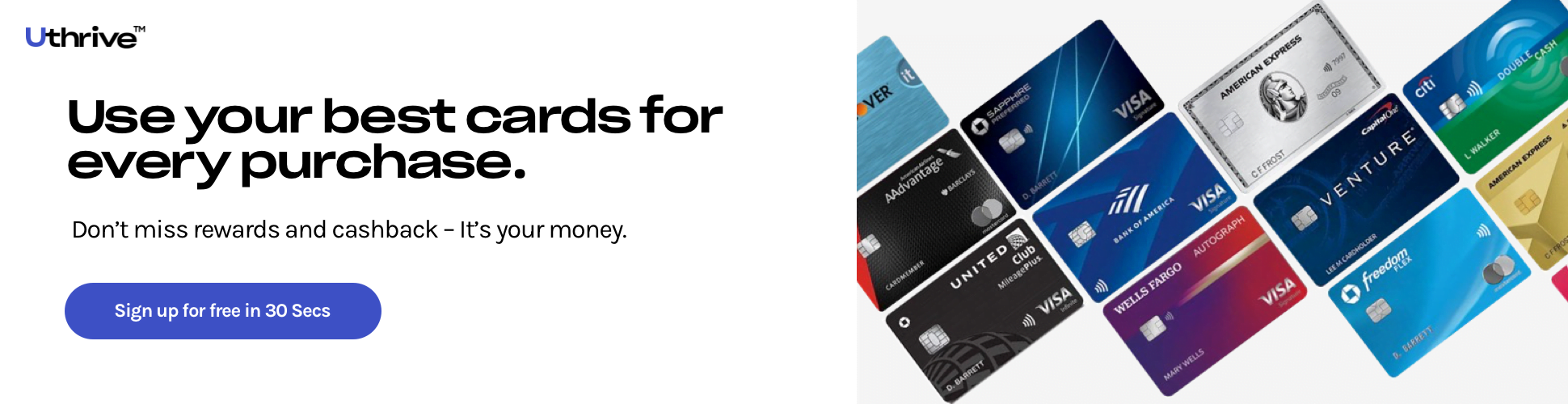

What Credit Cards are Accepted at Walmart?

There are many credit cards accepted and preferred at Walmart. It would help if you kept in mind their reward rates, annual fees, credit requirements, and perks before deciding. The top ones are mentioned below.

Best Credit Cards for Walmart

-

Capital One Walmart Rewards Mastercard

The Capital One® Walmart Rewards™ Mastercard® with an annual fee of $0, is a great choice. You get to earn 5% back on purchases in Walmart stores every time you use this card in Walmart Pay.

It is a great welcome offer that’s valid for the first 12 months after approval.

In addition to that, you get 2% back for in-store purchases. It includes the purchases made at Murphy USA and Walmart gas stations. You also get the same percentage of cashback at restaurants and on travel. The cardholders also get 1% back on all other purchases.

When redeeming, you get to choose from travel, cashback, or gift cards. It’s a great choice for those who shop mostly online and want a higher cashback.

-

Chase Freedom Flex

The Chase Freedom Flex card also has a $0 annual fee and offers $200 when you spend $500 within the first three months. It also offers a 5% cashback, but you get it on quarterly bonus categories only, and there is a cap of $1500 per quarter.

The card also offers a 5% back on travel booked through Chase Ultimate Rewards and 3% on dining, including takeout and delivery services, and the same on drugstore purchases.

It also offers 5% back on specific Lyft services bought through the Lyft app for all cardholders. It is valid till March 31, 2025.

You also get 1% on all other purchases, including non-qualifying Walmart purchases. This card is good for people seeking an option in everyday spending, not just at Walmart but at drug stores and dining as well.

-

Capital One Venture Rewards Credit Card

With The Capital One Venture Rewards Credit Card, you can earn unlimited 2 miles per dollar on all purchases. The list includes shopping at Walmart. It has an annual fee of $95, which you can offset easily.

The card also has a welcome bonus of 75,000 bonus miles that you can earn by spending $4,000 within the first three months.

The USP of this card is that you can earn unlimited 5 miles per dollar on hotels and rental cars booked through Capital One Travel. It also has no foreign transaction fees, and you get amazing perks like up to $100 credit for Global Entry or TSA Precheck, two free lounge access annually, etc.

-

Chase Freedom Unlimited

The Chase Freedom Unlimited is a great choice for Walmart shoppers as it allows you to get a flat-rate cashback reward of 1.5% on all purchases. As the card has no annual fee, having it doesn’t cost you anything.

It is a good choice for budget-conscious shoppers who want a straightforward rewards system.

It also allows you to maximize your savings every time you shop at Walmart or many other places without paying any additional charges.

-

Capital One Quicksilver Credit Card

If you are looking for a decent flat rate on every spending (including Walmart), a good welcome offer, and a decent interest-free window, Capital One Quicksilver Credit Card is worth it for you. It has no annual fee, a 15% intro APR of 0%, and a high rewards rate.

The card also doesn’t have any foreign transaction fees, which is good news for travelers. When you get it, you also earn a $200 cash bonus on spending $500 within the first 3 months.

You also get unlimited 1.5% cash back on every purchase daily. Additional perks include up to 6 months of complimentary Uber One membership statement credits through 11/14/2024. It also lets you earn unlimited 5% cash back on hotels and rental cars booked through Capital One travel.

-

American Express Blue Business Cash Everyday

The AMEX Blue Business Cash Everyday card is a good choice as it has no annual fee and an appealing welcome offer of $200 statement credit on spending $2,000 within the first six months.

The attractive rewards include 3% cashback on online retail purchases, supermarkets, and US gas stations. All have a cap of $6,000 a year, which is quite generous. You also get 1% back on other purchases.

As the online retail purchases include shopping at Walmart.com, it’s a great card for frequent Walmart shoppers.

| Credit card |

Uthrive rating

|

Intro offer | Rewards rate | Annual fee | Learn more |

|---|---|---|---|---|---|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer Earn a $200 Bonus |

Reward Rates 1% - 5% cash back |

Annual Fees $0 |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates 2 - 5 miles per dollar |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles |

Reward Rates 1.5% cash back |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles |

Reward Rates 1.5% Cash Back |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.6/5

|

Intro Offer bonus_miles |

Reward Rates 3% Cash Back |

Annual Fees annual_fees |

What are the Benefits of Using Walmart Reward Cards?

There are many benefits of using Walmart reward cards. Some of them are:

-

You get decent cashback on every purchase

-

You get additional perks like payment protection

-

Decent welcome offers are also available on some cards

-

You save more when you spend more

-

Some cards even have no annual fee

-

You can build credit and enhance your credit score

How to Apply for a Walmart Credit Card?

There are two methods of applying for a Walmart credit card. You can apply online, at any store register, or even at a jewelry kiosk. If you are approved, you get a Temporary Shopping Pass. You can use it at your preferred Walmart store.

What Credit Score is Needed for a Walmart Credit Card?

If you are wondering how to get approved for a Walmart credit card, you should know that you require a decent credit score for a Walmart card. You need to have a credit score between 650-850. If you don’t get a Walmart credit card, you can apply for a store card that’s only meant for Walmart stores.

Factors to Consider While Choosing a Credit Card for Shopping at Walmart

When choosing the best credit card for Walmart, you need to remember these important factors:

-

Annual fee

Annual feeThe lower the annual fee, the better it is. Seek cards with a $0 annual fee if possible.

-

Welcome bonus

Welcome bonusThe higher the welcome bonus, the better would be the worth of the card.

-

Rewards rate

Rewards rateAim for higher reward rates to maximize your savings.

-

Additional perks

Additional perksLook for additional perks like extended warranties to get more value for money.

-

Credit score

Credit scoreBefore you apply for a Walmart credit card, make sure you meet the eligibility criteria and have a credit score in at least the mid-600s.

Should You Choose the Walmart Credit Card?

If you do a lot of shopping at Walmart stores or online, a credit card for this superstore will help you increase your savings, along with some attractive benefits. Choose the card that you are eligible for and make the most of the benefits. Be a smart shopper by trusting the credit cards mentioned above.

Wamart FAQ’s

Where can I use my Walmart credit card?

Most Walmart credit cards can only be used at Walmart stores, Walmart.com, Sam’s Club, and Murphy USA Gas stations only.

Can I pay my Walmart credit card bill in-store?

Yes. You can pay it at any Sam’s Club or Walmart store.

How do I apply for a Walmart credit card?

The answer to how to apply for a Walmart credit card is simple- you can apply online or offline. Pick a method you like and follow the given instructions.

How much does the Walmart credit card cost?

Some Walmart credit cards have an annual fee, while others don’t. Those with no annual fee will cost you nothing!

What is the Walmart Credit Card credit score requirement?

The answer to what credit score is needed for a Walmart credit card is between 650-850.

What credit limit can I get approved for with a Walmart credit card?

The credit limit depends on many factors, like your current debt, your credit score, your credit history, etc.

Can you get cashback on a Walmart credit card?

Yes, you can get up to 5% cash back on Walmart credit cards.

Does Walmart take American Express?

Yes, Walmart accepts AMEX credit cards.

What credit cards does Walmart accept?

Walmart accepts a wide array of credit cards. A few popular ones are mentioned above.

What is the difference between a Walmart Credit Card and a Walmart Mastercard?

A Walmart Mastercard can be used anywhere a Mastercard is accepted, while the Walmart credit cards are meant for Walmart stores and/or Walmart.com only.