Today, credit cards have become an essential tool for managing finances. They provide convenience, security, flexibility, and an opportunity to earn various rewards.

However, picking the best credit card can be overwhelming with so many options available.

In this guide, we’ll break down the different types of credit cards, how they work, their perks, how to maximize the rewards, and tips on finding the perfect card for your needs.

Choosing the right credit card is crucial for your financial well-being! Ink Business Cash® Credit Card

What are the best credit cards?

No perfect credit card exists for everything; different cards work better for different needs.

There is a unique card tailored to suit your diverse spending habits and financial goals.

Some excel in providing cashback on everyday purchases, while others offer travel rewards, no annual fees, or attractive introductory APRs.

Each card offers various benefits and rewards, whether you’re a beginner, an avid traveler, or an entrepreneur.

We have put together a list of the best credit cards for 2023, so you can pick the one that best aligns with your needs.

Best Credit Cards

| Credit Card | Best for | Rewards and Benefits | Annual fee | Uthrive rating |

|---|---|---|---|---|

| Chase Freedom Unlimited Card® | Best Cash Back Credit Card |

It offers a versatile rewards structure with 5% cash back on travel booked via Chase Ultimate Rewards, |

annual_fees | 4.8 / 5 |

| Chase Sapphire Preferred® | Best Travel Credit Card |

This is fantastic for travelers to maximize their rewards with benefits like 5x points on travel purchased via Chase Ultimate Rewards, |

annual_fees | 4.8 / 5 |

| The Business Platinum(R) Card from American Express | Best Business Credit Card |

The benefits of this card are tailored to the needs of business owners. |

annual_fees | 4.8 / 5 |

| The Platinum Card(R) from American Express | Best Airline Credit Card |

Frequent flyers can revel in Amex Global Lounge Collection with access to 1,400+ lounges, $200 airline fee credit, |

annual_fees | 4.8 / 5 |

| card_name | Best Credit Card for Balance Transfer |

This card stands out with an extended 0% introductory APR on balance transfers, providing a smart solution for consolidating high-interest debt. |

annual_fees | 4.4 / 5 |

| Capital One(R) Quicksilver(R) Cash Rewards Credit Card | Best Credit Card for Beginners |

With no annual fee and straightforward rewards, it’s an excellent start for those new to credit cards. |

annual_fees | 4.6 / 5 |

| Capital One Platinum Secured Credit Card | Best Credit Card to Build Credit |

It offers a secured credit line and cashback rewards, ideal for establishing or rebuilding credit. |

annual_fees | 4.2 / 5 |

| Chase Freedom Rise Card | Best Credit Card for Students |

The card has $0 annual fees and offers 1,5% cash back rewards on all everyday purchases. |

$0 | 4.5 / 5 |

| Blue Cash Everyday(R) Card from American Express | Best Gas Credit Card |

The Amex Blue Cash Everyday Card is the best credit card for gas due to its unbeatable cashback rewards on fuel purchases. |

annual_fees | 4.6 / 5 |

| Marriott Bonvoy Boundless Credit Card | Best Hotel Credit Card |

It has earned the reputation as the best hotel credit card thanks to its exceptional benefits for Marriott enthusiasts. |

$95 | 4.3 / 5 |

| Blue Cash Preferred(R) Card from American Express | Best Credit Card for Groceries |

With remarkable 6% cash back rewards at U.S. supermarkets, it’s a must-have for grocery shoppers with just $95 annual fee. |

annual_fees | 4.8 / 5 |

| Ink Business Cash(SM) Credit Card | Best Credit Card for Small Businesses |

With this versatile card, small business owners can maximize their credit card rewards, especially for their business expenses. |

annual_fees | 4.7 / 5 |

How do credit cards work?

Credit cards allow you to make purchases on credit up to a certain limit, essentially borrowing money from the card issuer to be paid back later.

They are a form of unsecured debt, which means they don’t require collateral.

Here’s a breakdown of how they work:

Every credit card has a credit limit i,e. the maximum amount you can spend on the card. The card issuer determines this limit based on factors like your income and credit history. Exceeding your credit limit may result in penalties and fees. Credit card statements include a minimum payment amount you must pay by a specific due date. One can go by paying only the minimum, but that’s unwise as it can lead to high-interest charges and long-term debt. If you don’t pay your credit card balance in full by the due date, you’ll be charged interest on the remaining balance. Credit card interest rates (APRs) vary from card to card. Paying your full statement balance each month is best to minimize interest charges. Missing a credit card payment or paying late can result in late fees and penalty interest rates. It can also negatively impact your credit score.

![]()

![]()

![]()

![]()

Types of Credit Cards

Credit card companies provide a range of card options tailored to diverse consumer needs.

Some individuals regularly use their cards for significant monthly spending, while others might use them primarily for specific purchases.

Understanding the various types of credit cards helps you choose the one that best aligns with your financial needs and goals.

Cash back Credit Cards

The Cash back Credit Cards is a popular choice among consumers seeking to earn rewards for their everyday spending.

Cashback credit cards typically offer cashback on various categories like dining, groceries, or gas.

These cards offer a percentage of the money spent as cashback, which can add up to substantial savings over time.

Best Cash Back Credit Cards: Chase Freedom Unlimited Card, Blue Cash Everyday Card from American Express, Capital One SavorOne Cash Rewards Credit Card, Blue Cash Preferred Card from American Express.

Travel Credit Cards

The Travel Credit Cards are perfect for individuals who frequently travel.

They often provide benefits, such as airline miles, hotel stays, or travel insurance.

Travel cards come with various perks like travel credits, airport lounge access, and flexible redemption options, making them an ideal choice for travel enthusiasts looking to enhance their journey experiences and earn travel rewards along the way.

Best Travel Credit Cards: Chase Sapphire Preferred Card, American Express Platinum Card, Capital One Venture Credit Card.

Student Credit Cards

The Student Credit Cards are specially designed for college students and young adults with limited credit histories.

Student credit cards often offer cashback rewards based on student spending habits, such as dining and groceries, with no annual fees.

It serves as a stepping stone for students into the world of credit and provides educational resources to help them learn responsible credit management.

Best Student Credit Cards: Discover It Student Cash Back, Capital One Journey Student Rewards, Discover It Student Chrome.

Secured Credit Cards

The Secured Credit Cards also known as credit cards for bad credit, require a security deposit that serves as collateral & sets the card’s credit limit.

They can help build or improve credit, opening doors to unsecured credit cards with higher limits and more benefits.

Secured cards work similarly to traditional credit cards, allowing users to make purchases, build credit, and establish a positive payment history.

Best Secured Credit Cards: Discover it Secured Credit Card, Capital One Secured Mastercard, Citi Secured Mastercard.

Balance Transfer Credit Cards

The Balance transfer credit cards are a financial tool designed to help individuals manage and reduce high-interest credit card debt.

These cards allow you to transfer existing credit card balances to a new card, typically at a lower or even 0% introductory APR.

Doing so can save on interest charges and make it easier to pay off your debt more quickly.

Best Balance Transfer Credit Cards: Citi Simplicity Card, Wells Fargo Reflect Card, U.S. Bank Visa Platinum Card.

Small Business Credit Cards

The Small Business Credit Cards is a financial tool designed specifically for businesses- sole proprietorships, partnerships & small companies.

Small Business cards offer a range of benefits to cater to the needs of business owners, such as expense tracking and rewards on business-related purchases.

Some may offer perks like cashback, travel rewards, and introductory 0% APR periods.

Best Small Business Credit Cards: Chase Ink Business Preferred Credit Card by Chase, American Express Blue Business Cash Card, Capital One Spark Cash

How do credit card rewards work?

Credit card rewards programs offer incentives to cardholders who make purchases using their credit cards. Here’s how they work:

When you make purchases with a rewards credit card, you earn points, miles, or cashback based on the amount you spend. Different cards have different earning structures. For example, you earn 1 point for every dollar spent or 2% cashback on specific categories like dining or travel. Over time, you add to these rewards as you continue to use your best credit card for eligible purchases. The more you spend, the more rewards you earn. (TIP- Research well on what is the best credit card for rewards.) Once you’ve earned sufficient points or miles, you can redeem them for various benefits, which include Travel (booking flights, hotel, rental cars, etc.), Statement Credits, Gift Cards, Merchandise, and more. Many rewards cards offer extra benefits like travel insurance, airport lounge access, extended warranties, and purchase protection. Some may come with annual fees, while others do not. Consider whether the benefits and rewards outweigh the cost of the annual fee.

![]()

![]()

![]()

![]()

![]()

Also, be aware of any specific terms and conditions associated with your rewards program, as they can vary between credit cards.

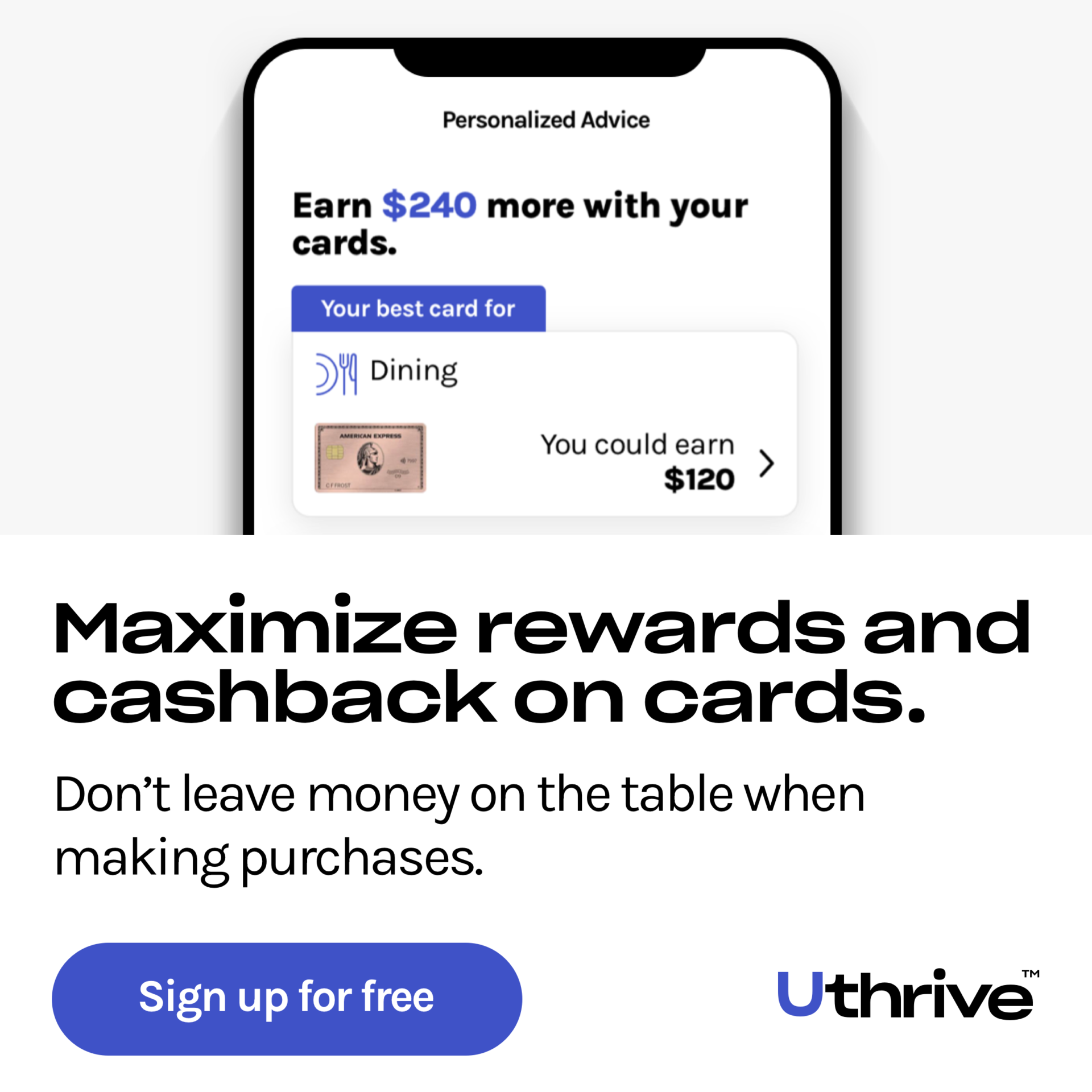

How to maximize credit card rewards?

The way you utilize your credit card can significantly impact your financial well-being. It is essential to assess your financial situation annually to ensure you get the most from your credit card.

Take a moment to evaluate whether your current credit cards align with your needs. You can follow these strategies to maximize the benefits of your best card:

You must pay your full credit card bills on time every month. Late payments can severely harm your credit score. Consistently making on-time payments is crucial for building and maintaining good credit. Paying off your entire balance each month is crucial to avoid interest charges and maintain a low credit utilization ratio to boost your credit score. Know your credit card’s rewards program to understand bonus categories & valuable redemption options. (Also, learn what are the best credit cards for you!) This way, you can prioritize shopping that aligns with your bonus categories and maximize your rewards by uncovering additional value in unexpected places. The best credit cards offer generous sign-up bonuses when you meet a minimum spending requirement within the first few months. Capitalize on these bonuses to kickstart your rewards earnings. Take advantage of the benefits offered by your credit card, especially if it comes with an annual fee. These perks, such as travel insurance or airport lounge access, can add substantial value to your card. Be aware of any drawbacks associated with your card, such as foreign transaction fees or restrictions on earning and redeeming rewards. Understanding these limitations enables you to adjust your spending habits.

How many credit cards should I have?

The number of credit cards you should have depends on your financial goals and ability to manage multiple accounts.

Some individuals may benefit from having multiple cards- each for specific types of purchases to maximize rewards, while others may prefer simplicity with just one best credit card to handle all their transactions.

The ideal number of credit cards varies from person to person, depending on individual needs. It’s crucial to consider the following points when determining the right number of credit cards for you:

When building or improving your credit, starting with one or two credit cards is typically a good approach. Timely payments and responsible card use are essential for rebuilding your credit score. Combining cards with different bonus categories can be advantageous if you want to maximize rewards. This allows you to earn more in various spending areas. Maintaining a low credit utilization ratio is essential for a healthy credit score. With multiple cards, it may be easier to keep this ratio down. Consider the yearly fees associated with each card. If you have several cards with annual fees, ensure the rewards and benefits justify the costs.

![]()

![]()

![]()

![]()

There is no one-size-fits-all answer to how many credit cards you should have. It is a personal choice that should align with your financial preferences and credit management capabilities.

How to choose a credit card?

Choosing the right credit card is an important financial decision that should adhere to your spending needs and budget. Below are some key factors that can help you in choosing a credit card:

Determine your primary reason for getting a credit card. Are you looking for traveling rewards, building credit, or consolidating debt? Your goal will guide your choice. Check your credit score to understand your creditworthiness to know the best credit cards you qualify for. Different credit cards cater to different credit profiles, so knowing where you stand is essential. Evaluate the card’s welcome offer, as some cards offer more substantial bonuses than others. Typically, higher bonuses may come with higher annual fees or spending requirements to unlock them. Ensure the card’s annual fee fits comfortably within your monthly budget before applying. Also, calculate if the rewards offset the cost of the fee. Some cards offer higher rewards for spending in specific categories like groceries, dining, or gas. Analyze your monthly expenditure to determine where you spend the most. Consider cards with rotating bonus categories or a straightforward rewards structure if your spending varies. Consider your spending habits and preferences. If you spend significantly on certain categories like travel, groceries, or entertainment, select a card with relevant rewards or cashback.

How to apply for a credit card?

Applying for a credit card is a straightforward process but requires careful consideration and preparation to ensure a successful application. Here’s a step-by-step guide on how to apply for a credit card:

Before applying, check your credit score. Your credit score plays a pivotal role in the approval process and determines the type of cards you’re eligible for. Explore various cards to find the best credit card that suits your needs. Consider factors like interest rates, annual fees, rewards, and credit limits. Ensure you have all the necessary documents, including proof of income, personal identification, and other financial information. You can apply online through the issuer’s website or by calling their customer service. Fill out the application form accurately, providing all required information. Carefully read the card’s terms and conditions, including the annual percentage rate (APR), fees, and rewards program details. Submit your application online or via mail, following the issuer’s instructions. Be prepared to provide any additional information if requested. Once your application is submitted, the card issuer will review your credit history and financial information. You can then get your credit card in a few minutes to several weeks. If approved, the card issuer will send your credit card by mail. Follow the activation instructions provided with the card. Generally, you’ll need to call a designated number or activate it online.

Step 1: Assess Your Credit Score

Step 2: Research and Compare Cards

Step 3: Gather Required Documents

Step 4: Complete the Application

Step 5: Review Terms and Conditions

Step 6: Submit Your Application

Step 7: Wait for Approval

Step 8: Receive and Activate Your Card

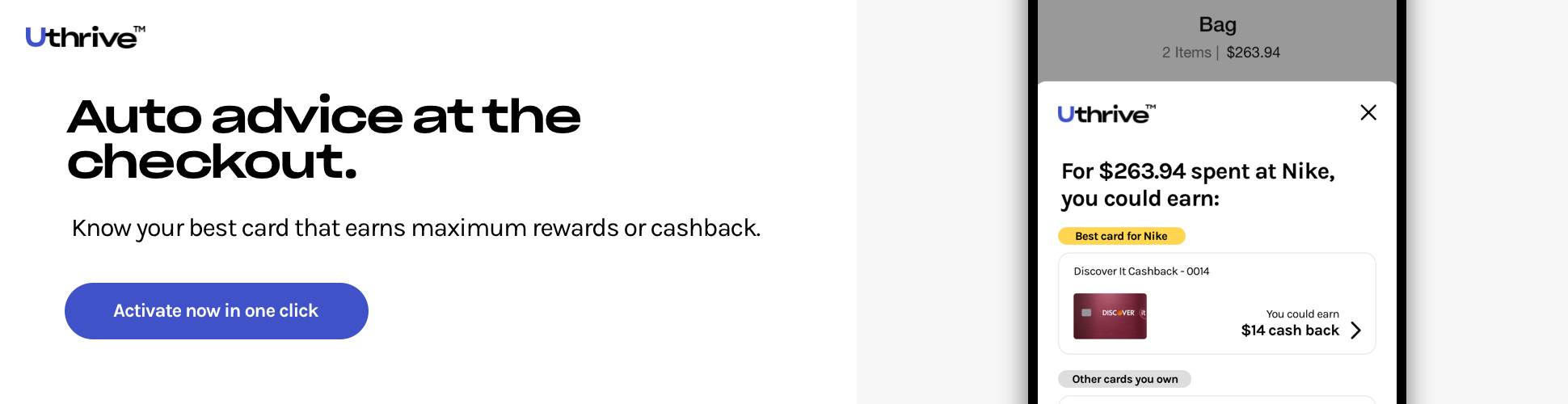

Why choose the best credit cards on Uthrive?

Choosing the best credit cards on Uthrive is a wise decision for anyone looking to maximize savings and rewards.

Uthrive simplifies the process by recommending the right credit card for each purchase, ensuring you get the most out of your everyday spending.

With its user-friendly interface, you can effortlessly track rewards and cash back without the hassle of monitoring individual credit card benefits.

Whether you shop in-store or online, Uthrive helps you pick the best card to use, offering benefits like miles, hotel points, lounge access, and more.

It even alerts you when you’re missing out on rewards, ensuring you never leave potential savings on the table.

The Uthrive App supports all major credit cards, ensuring wide coverage for all major airlines and hotels.

Credit Cards FAQ’s

It’s challenging to pinpoint a single “best” credit card, as the ideal card depends on your financial goals, spending habits, and credit history. However, one popular and versatile option is the Chase Sapphire Preferred Card. Credit cards allow you to make purchases on credit up to a certain limit, essentially borrowing money from the card issuer to be paid back later. They are a form of unsecured debt, which means they don’t require collateral. There is no one-size-fits-all answer to how many credit cards you should have. It is a personal choice that should align with your financial preferences and credit management capabilities. You must pay your bills on time, avoid carrying a balance, and only charge what you can afford to pay off each month to use a credit card wisely. This will help you build credit, avoid interest charges, and enjoy the benefits of your card. Once your application is submitted, the card issuer will review your credit history and financial information. You can then get your credit card in a few minutes to several weeks. Discover it Secured Credit Card is the easiest to get as it is even accessible to those with limited or poor credit. It is a popular choice for credit building and offers cashback rewards. If you don’t pay your credit card balance in full by the due date, you’ll be charged interest on the remaining balance. Credit card interest rates (APRs) vary from card to card. A credit report is a detailed record of your credit history & financial behavior often used by Lenders and creditors. It includes information about your credit accounts, payment history, outstanding debts, and any public records related to your finances. Getting a credit card for a big purchase can be smart if you can pay off the balance quickly and avoid high-interest charges. It can offer benefits like purchase protection and rewards. Once your application is submitted, the card issuer will review your credit history and financial information. You can then get your credit card in a few minutes to several weeks. A credit score is a three-digit number that reflects an individual’s creditworthiness, helping lenders assess their ability to manage and repay credit. It ranges from 300 to 850- higher scores indicating lower credit risk.

What is the best credit card?

How does a credit card work?

How many credit cards should I have?

How should I use a credit card?

How to apply for a credit card online?

What is the easiest credit card to get?

How does credit card interest work?

What is a credit report?

Should you get a credit card for a big purchase?

How long does it take to get a credit card?

What is a credit score?

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)