Best Credit Cards For Shopping At Target – Save 5% With Target RedCard

When you talk about big box department store chains, the name of Target appears at the top of the list. It has a decent customer base of loyal customers who often end up spending more than they planned after a visit.

This phenomenon even has a name- “The Target Effect.”

If it also impacts you, and you love shopping at Target, you need to know about the best Target credit cards, as it can help you maximize your savings and minimize your spending. It can also help you get some decent rewards and perks.

To help you out, we have created a list of the best credit cards for Target that you must take a look at before your next visit to Target or the next online order at Target.

Remember, there isn’t a single best credit card for Target, you need to find a card that suits your needs best.

What To Look for in a Credit Card for Target?

Whenever you buy something from Target, your purchase will get categorized according to the merchant category code or MCC. It can vary depending on the merchant’s location.

Usually, there are two merchant categories. The first is 5310 — Discount stores/warehouse/wholesale, and the second is 5411 — Grocery stores/supermarkets/bakeries.

It is important because if the location you shop at belongs to the 5411 category, you can get bonus points like you do at other supermarkets or grocery stores.

In contrast, if the location of the Target store you shop at is 5310, you need to use a different credit card.

How do you figure out which Target location gets you more benefits? You must shop at different Target locations and make test purchases with a Target credit card or any other credit card.

It will help you locate the Target that codes as a supermarket. A little effort in locating the right store near you might help you get bonuses and maximize your savings.

How the Target Credit Card Works?

Using a credit card for Target is simple. Let’s say that you have the Target credit card, the RedCard. You can simply use it in all of Target’s retail stores and on the store’s website when you make any purchases.

The Target RedCard will help you to get a 5% discount on purchases at Target.

You should also know that the Target REDcard Debit Card and the Target REDcard™ Credit Card are “closed-loop” cards. So, you can only use them at Target or Target.com.

However, if you have the Target REDcard Mastercard, you can use it anywhere that accepts Mastercard.

There are four ways of making a payment to your Target RedCard. You need to visit Target.com/RedCard/About and then click on “Manage My RedCard.” After that, you must enter your username and password on the Target RedCard login page.

Once you do that, the Manage My RedCard screen will appear. Then, you need to click on “Schedule a Payment” under the Payment Information tab that is located on the left side of your screen.

After that, you can pick a method among these- By phone (800-659-2396), In-store and by mail. There is no charge levied when you pay the balance with these methods as long as you pay on time.

Can a Target Credit Card Help Build Credit?

Yes. Most credit cards, including Target Credit cards, report the payments to the major credit bureaus. So, it can be used to build credit. The only thing is that you need to make the payments promptly.

You also need a decent credit score of at least 640 or more to be eligible for a Target card. So, you must check that requirement before you apply for one.

Is a Target Credit Card Worth It?

A Target credit card is usually worth it for people who shop at a Target store or Target.com often and want to maximize savings or earn benefits every time they shop. You must pay your bills in full to get the best value from a Target credit card.

List of the Best Credit Cards for Target

| Card Name | Best For | Key Benefit | Welcome Offer | Annual Fee |

|---|---|---|---|---|

Target RedCard™ |

Discounts |

5% discount at checkout on most purchases in-store and at Target.com |

$50 |

$0 |

Earns a Simple Flat-Rate |

Unlimited 1.5% cash back on every purchase |

$200 |

$0 |

|

Good Mile Rewards |

2x miles on all non-bonus purchases |

75,000 Miles |

$95 |

|

Target Cashback |

3% cash back at U.S. online retailers |

$200 |

$0 |

|

Unlimited Matched Cashback |

1.5% cash back on purchases |

0% Intro APR for 15 months |

$0 |

|

Wells Fargo Active Cash® Card |

Cashback |

Unlimited 2% cash rewards on purchases |

$200 |

$0 |

Final Thoughts

Some people consider Target as a grocery store, while others think that it’s a wholesale club. No matter how you think of it, it would help if you considered getting a credit card for Target use from the options listed above.

Remember, different credit cards appear to be the best department store credit cards, but you need to find a card that’s perfect for your Target shopping needs.

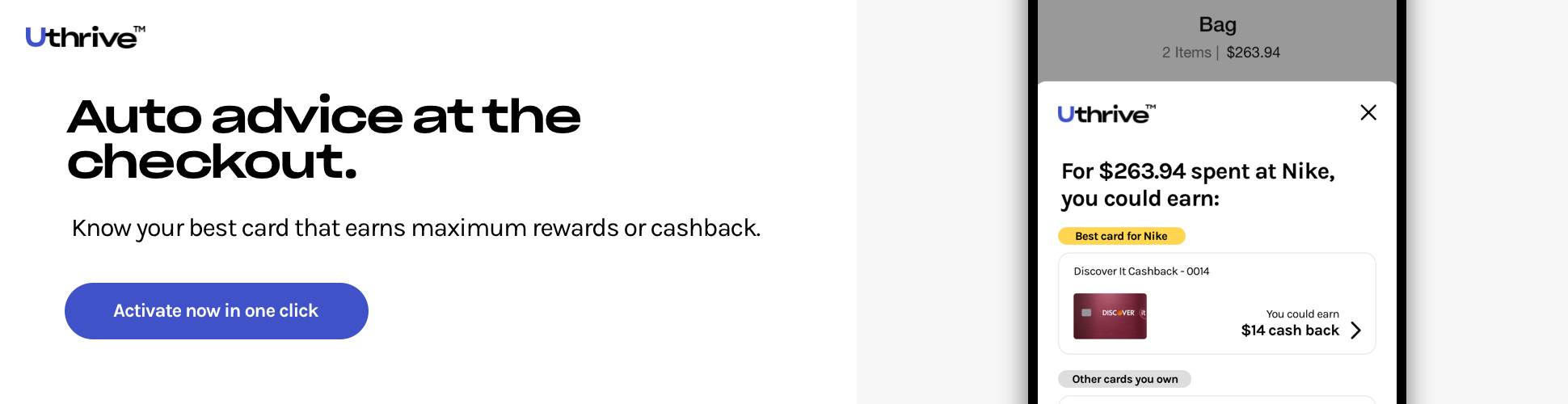

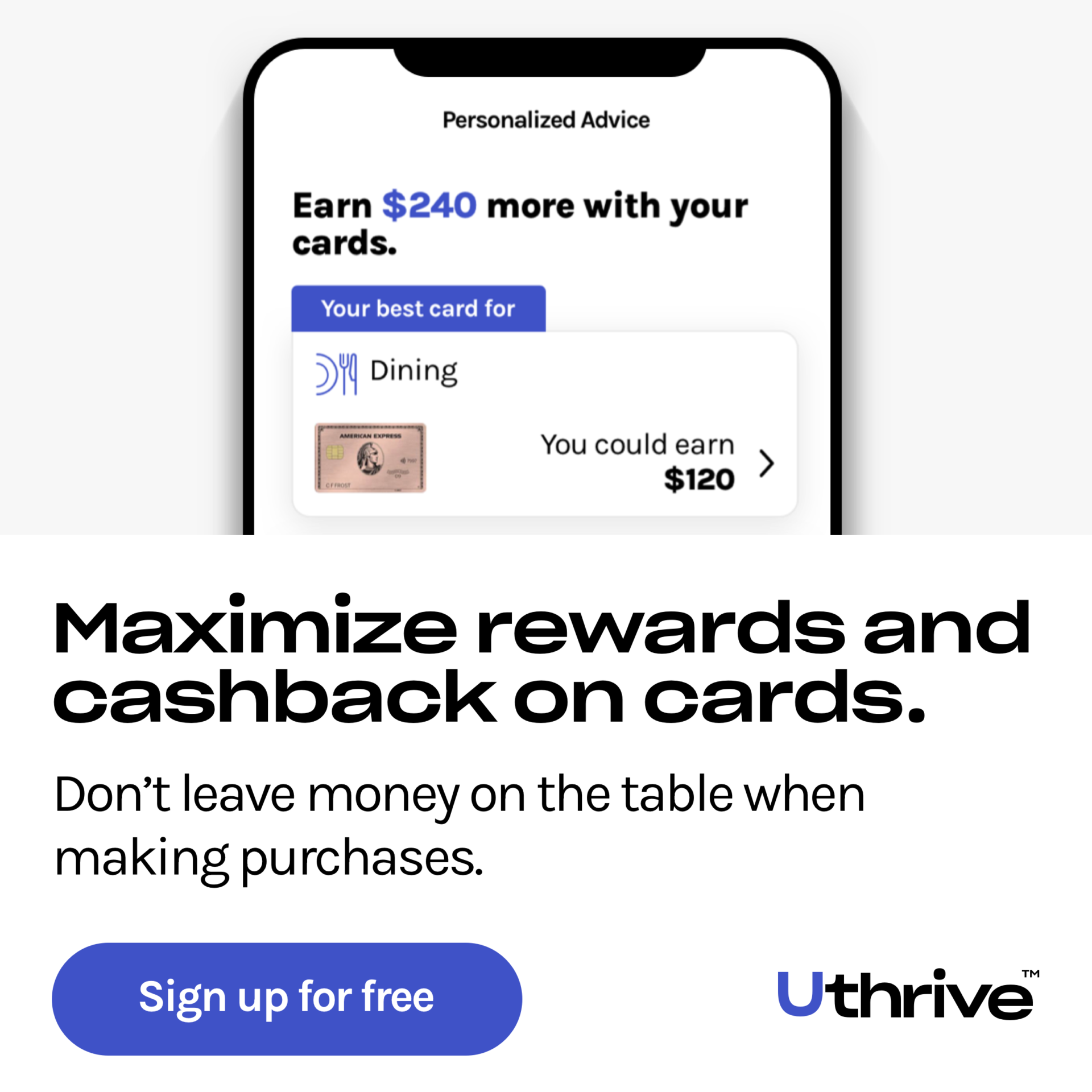

If you need more help figuring out which credit cards to use at which store or online, you can get help from the Uthrive website or app. It specifically tells you which credit card to use and where to get maximum benefits.

Try it and see for yourself. The more you regularly use Uthrive, the higher your rewards, cashback, or points.

Frequently Asked Questions

List of the Best Credit Cards for Target

Yes. You can use AmEx, Visa, Mastercard, JCB, Discover, and many other credit cards.

It also accepts debit/ATM cards, contactless pay, EBT cards, gift cards & certificates, personal checks, rebate checks, merchandise vouchers, multiple payment methods sales, WIC program, mobile payments, etc.

It also accepts Alipay and Campus Cash in select locations.

What are the perks of a Target Credit Card?

The key benefits of the Target RedCard are zero annual fees, a 5% discount at checkout on most purchases in-store and at Target.com, and a $50 welcome offer.

Other perks include free two-day shipping on many items, an additional 30 days for returns and exchanges, and exclusive offers for special items, gifts, and many more.

Can you have 2 Target credit cards?

Yes. Target allows you to apply for two different versions of RedCard.

Does Target do cashback?

Yes, at most Target locations, shoppers can get up to $40 cash back if they use a debit card at a register or choose self-checkout.

You can also earn credit card cashback rewards on Target purchases.

The amount of that cashback will depend on the type of credit card you use and the reward policies of the card.

Will a Target credit application lead to a Hard Inquiry?

When you choose to apply for a target credit card, your credit history will be reviewed. There is no option for pre-qualifying with only a soft pull as of now.

Can I use a Target Credit Card anywhere?

If you opt for the REDcard Debit Card and the Target REDcard™ Credit Card, you will only be able to use them at a Target store or Target.com website.

However, the Target REDcard Mastercard can be used anywhere that takes Mastercard. Please note that you can’t apply for this card directly.

What are the best credit cards for shopping at Target?

The best personal credit cards for shopping at Target are Target RedCard™, Capital One Quicksilver, Wells Fargo Active Cash® Card, Capital One Venture Rewards Credit Card, Blue Cash Everyday® Card from American Express, and Chase Freedom Unlimited®.

Can I split the payment on Target?

On Target.com, you can only choose one credit card payment per order. Though a Target Credit Card® or Target® Mastercard® can’t be combined with the Target Debit Card™ while making payments, a credit card or the Target Debit Card™ can be combined with up to 10 Target GiftCard payments.

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)