Key Takeaways

-

The United Club℠ Infinite Card provides unlimited United Club access, priority boarding, free checked bags, and earns 4x miles on United purchases.

-

The United℠ Explorer Card and United℠ Business Card offer two annual United Club passes and other travel perks at a lower annual fee.

-

The Chase Sapphire Reserve® and The Platinum Card® from American Express provide Priority Pass Select membership for access to over 1,300 lounges worldwide, catering to those who want flexibility beyond United Clubs.

Ever found yourself sitting in an airport terminal, surrounded by tired travelers and overpriced snacks, wishing you could slip away to one of those mysterious lounges you’ve heard so much about?

If you’re flying with United Airlines, that secret oasis is called the United Club, a place where Wi-Fi flows freely, drinks are on the house, and comfort is the order of the day.

But how exactly does one get inside? Today, we’re diving deep into the world of United Club access credit cards to answer that question and explore the best ways to use them for lounge access.

What is United Club Access?

Before we get into the details of how to get United Club access, let’s clarify what it is.

The United Club lounges, available at major airports worldwide, provide a peaceful escape from the usual airport chaos.

With complimentary snacks, beverages (yes, alcoholic ones too!), high-speed Wi-Fi, comfortable seating, and workspaces, these lounges are highly sought after by frequent travelers.

And for good reason! But this luxury comes at a cost, and not everyone has free access.

How to Get United Club Access

There are several ways to gain access to United Club lounges:

-

United Club Membership

You can buy an annual membership. However, this could cost you anywhere from $650 to $700 per year, depending on your MileagePlus status. Not cheap, but if you’re a frequent traveler, it might be worth the investment.

-

Flying in Certain Premium Cabins

International passengers flying in United Polaris business class or Star Alliance first or business class can enjoy complimentary access. Domestic first-class passengers, however, aren’t so lucky.

-

Day Pass

You can purchase a one-time United Club Lounge access pass for around $59 at select locations, but this is only useful for occasional travelers.

-

Credit Cards

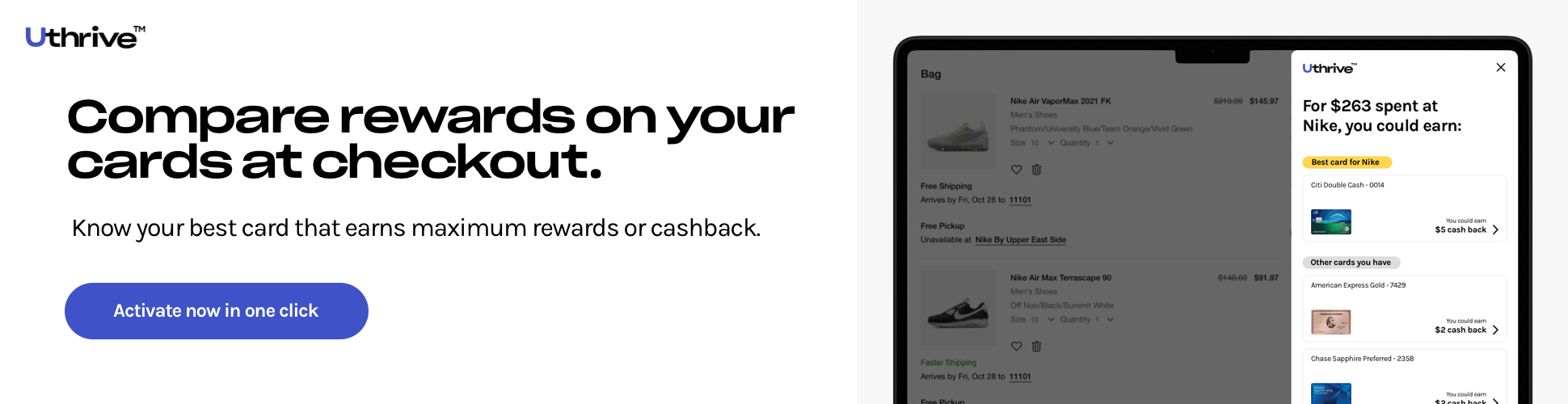

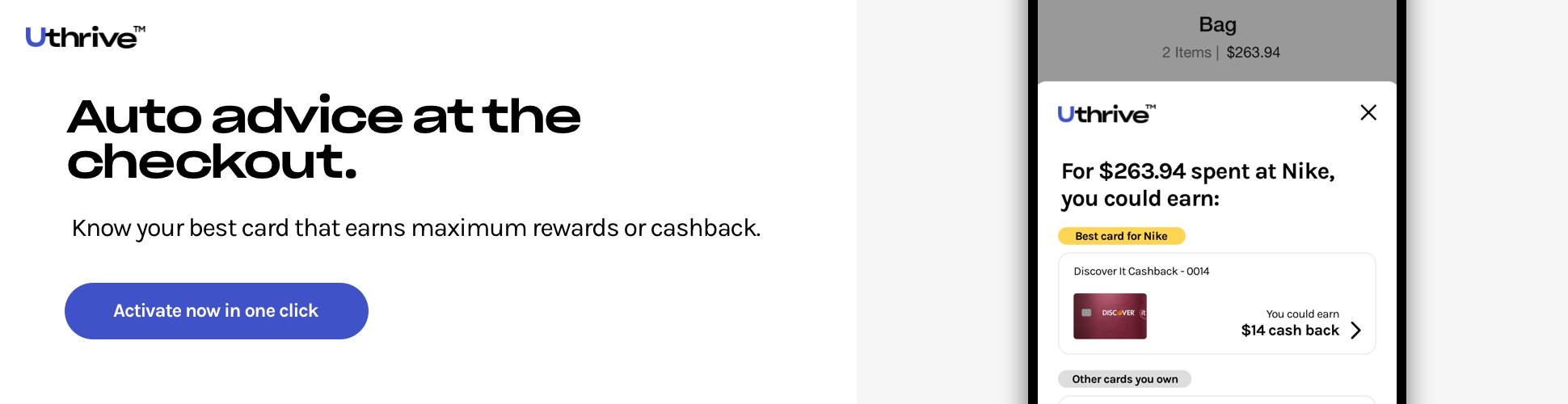

This is where things get interesting. The most convenient and cost-effective way for many people to get into the United Club is through a credit card with United Club access. This method offers more value and additional perks, making it an attractive option for frequent travelers.

Best Credit Cards for United Club Access

Not all credit cards are created equal. Some provide direct access to United Clubs, while others offer benefits that can be leveraged for lounge access. Let’s explore the best credit cards for United Club access and see what makes them stand out.

-

United Club℠ Infinite Card

- Annual Fee: annual_fees

- Key Benefits: Complimentary United Club membership, 4x miles on United purchases, 2x miles on dining and travel, two free checked bags, and priority boarding.

- Welcome Offer: bonus_miles_full

- APR: reg_apr,reg_apr_type

The United Club℠ Infinite Card is the only credit card that grants unlimited United Club lounge access for the cardholder and eligible travel companions.

If you fly with United frequently and appreciate the comfort and convenience of their lounges, this card pays for itself in the long run, especially when you consider the high cost of an annual membership.

The added perks like priority boarding and free checked bags make it an all-around great choice for frequent United flyers.

-

United℠ Explorer Card

- Annual Fee: annual_fees

- Key Benefits: Two United Club one-time passes each year, priority boarding, free first checked bag, and 2x miles on United purchases, dining, and hotel stays.

- Welcome Offer: bonus_miles_full

- APR: reg_apr,reg_apr_type

While the United℠ Explorer Card doesn’t offer unlimited access, it does provide two United Club passes annually. This is perfect for the occasional traveler who might not need constant lounge access but wants the option a couple of times a year.

With a reasonable annual fee after the first year, this card packs a punch with other perks like priority boarding and a free checked bag.

-

United℠ Business Card

- Annual Fee: annual_fees

- Key Benefits: Two United Club one-time passes annually, 2x miles on United purchases, dining, gas stations, and office supply stores, free first checked bag, and priority boarding.

- Welcome Offer: bonus_miles_full

- APR: reg_apr,reg_apr_type

The United℠ Business Card is geared toward business travelers who want some extra benefits when flying United. Similar to the Explorer Card, it provides two United Club passes each year, allowing access for occasional travelers.

The additional earning potential on business-related expenses like dining and gas stations adds more value.

-

Chase Sapphire Reserve®

- Annual Fee: annual_fees

- Key Benefits: 3x points on travel and dining, $300 annual travel credit, Priority Pass Select membership, and 50% more points value when booking through Chase Ultimate Rewards.

- Welcome Offer: bonus_miles_full

- APR: reg_apr,reg_apr_type

While the Chase Sapphire Reserve® does not directly provide United Club access with a credit card, it comes with a Priority Pass Select membership, which offers access to over 1,300 lounges worldwide.

This includes some affiliated lounges that may suffice when flying United, though not the actual United Clubs. With broad travel benefits and high reward-earning rates, this card is excellent for travelers who want flexibility beyond United-specific perks.

-

The Platinum Card® from American Express

- Annual Fee: annual_fees

- Key Benefits: Access to Centurion Lounges, Priority Pass Select membership, Delta Sky Clubs (when flying Delta), 5x points on flights booked directly with airlines or Amex Travel, up to $200 airline fee credit.

- Welcome Offer: bonus_miles_full

- APR: reg_apr,reg_apr_type

The Platinum Card® from American Express is a strong choice for frequent travelers who aren’t loyal to one airline. While it doesn’t offer United Club access, the Priority Pass Select membership and access to Amex’s luxurious Centurion Lounges provide a high level of flexibility. It’s ideal for those who might fly United occasionally but also want top-notch perks across multiple airlines.

Does Premier Access Get United Club Access?

A common point of confusion among travelers is the term “Premier Access.” While Premier Access provides benefits like priority check-in, boarding, and security lanes, it does not include United Club lounge access.

So, if you were hoping to snag a lounge seat with your Premier Access ticket, you’re out of luck. You’ll need one of the credit cards or access methods mentioned above.

United Club Access Cost: What to Expect

If you don’t want to commit to a credit card, here’s a quick breakdown of the United Club access cost:

-

Annual Membership

Ranges from $650 to $700 based on your MileagePlus status.

-

Day Passes

$59 per visit, available at select locations.

-

Credit Card Annual Fees

These vary from $95 (after the first year) for the United Explorer Card to $550 for the United Club Infinite Card.

When choosing between these options, it’s essential to consider how often you travel and whether the perks and benefits justify the cost.

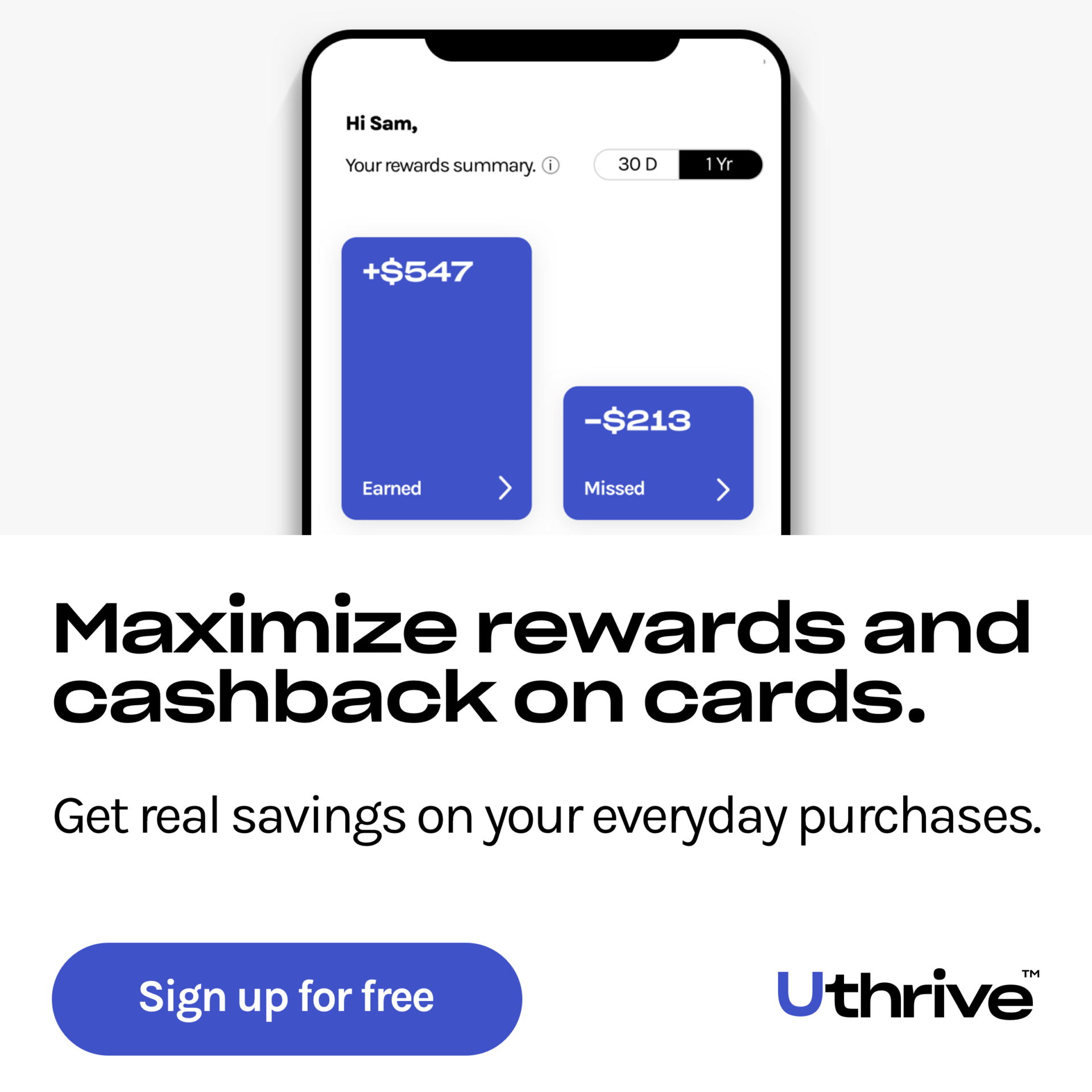

Credit Card United Club Access: Is It Worth It?

Absolutely! For frequent travelers, especially those who prefer United Airlines, having a credit card with United Club access is a game-changer.

The value of unlimited access to the lounges—along with other travel benefits like priority boarding, free checked bags, and mileage bonuses—adds up quickly. Even for occasional travelers, options like the United Explorer or Business cards offer significant benefits with lower fees.

How to Maximize Your Credit Card for United Club Access

-

Use the Welcome Offer

Many cards come with generous sign-up bonuses that can significantly offset travel costs. Use these bonuses for free flights or upgrades.

-

Leverage the Other Perks

Don’t forget about priority boarding, free checked bags, and other travel benefits that come with these cards. These can save you both time and money.

-

Plan Ahead for Lounge Visits

If your card comes with limited lounge passes, plan your trips and lounge visits carefully to maximize your benefits.

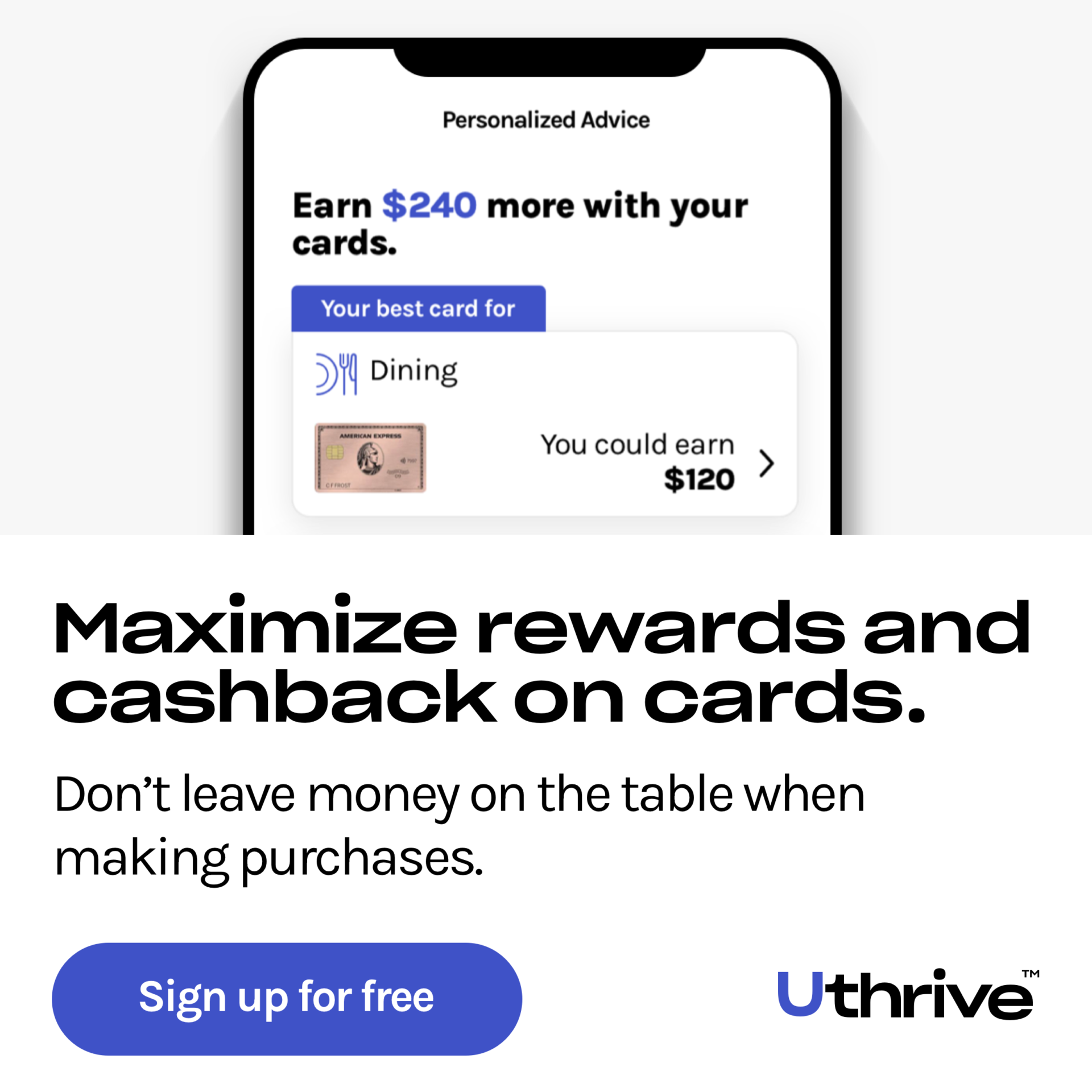

How To Choose the Best Credit Card for United Club Access

When it comes to choosing a united club access credit card, there’s no one-size-fits-all answer. If you’re a frequent flyer with United, the United Club℠ Infinite Card offers unbeatable value with unlimited access and other perks.

For those who travel less frequently or want broader flexibility across different airlines, options like the Chase Sapphire Reserve® or The Platinum Card® from American Express might be more suitable.

Ultimately, it comes down to how often you fly, how loyal you are to United, and how much you value premium airport lounge experiences. Happy travels!

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)