Key Takeaways:

-

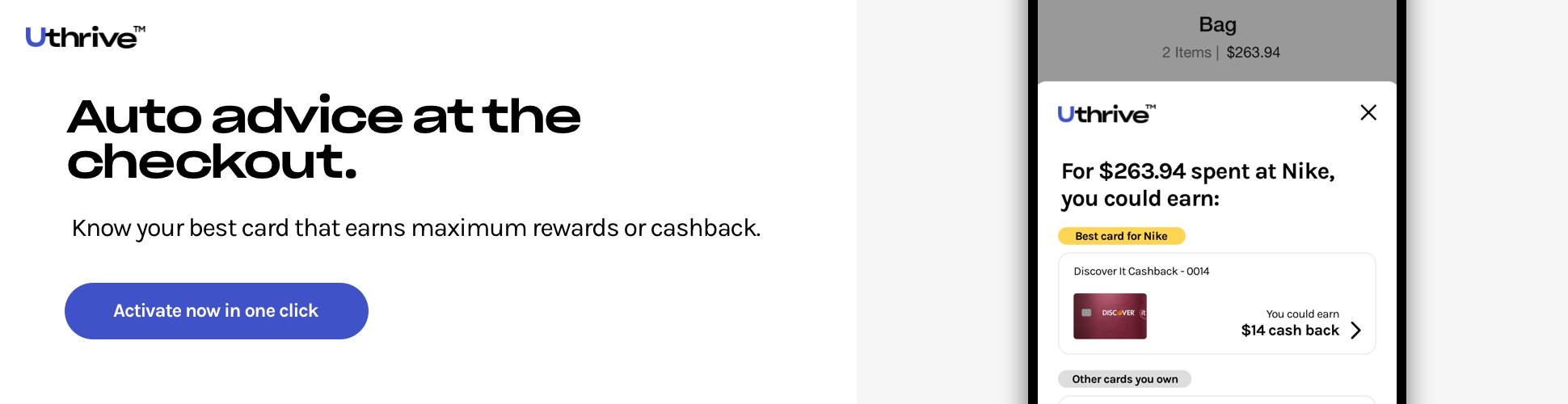

We are here to answer what is the best credit card for rewards, to help you maximize your benefits.

-

Get ready to embark on a journey of financial freedom as we uncover the magic of the best rewards credit cards!

-

Choosing the right rewards credit card depends on your spending habits and preferences.

Looking for the ultimate credit card to boost your rewards-earning power? Look no further! Whether you want to earn rewards for your everyday spending or next adventure, the best rewards credit card is the answer!

From cashback on groceries to free flights around the world, discover the best options to suit your lifestyle.

Rewards credit cards offer a fantastic opportunity to maximize your everyday spending by earning bonus miles, points, or cash back on purchases.

With so many reward cards and fee options in the market, there’s something for everyone.

Explore the top features and perks to find your perfect fit among the best rewards credit cards 2024.

What is a rewards credit card?

A rewards credit card is a type of card that offers users various incentives for using the card, including cash back, reward points, and miles, which are redeemable for various rewards like travel, gift cards, merchandise, or statement credits.

It effortlessly enhances the value of your spending by rewarding you for every purchase.ypes of credit card rewards program

You earn a set percentage of cash back or a fixed number of points/miles per dollar spent on qualifying purchases.

These cards also offer benefits like welcome bonuses, travel insurance perks, no annual fee, airport lounge access, and more.

Credit card rewards are ideal for consumers looking to maximize their spending and earn valuable rewards.

How do rewards credit cards work?

Rewards credit cards allow cardholders to earn rewards and enjoy several benefits by using their cards for purchases.

However, not all purchases qualify for rewards, such as cash advances or gift cards.

When you use a rewards card, a fee is charged to the vendor for processing the transaction.

Part of this fee is returned to you as rewards, such as cashback, points, or miles, depending on the card’s terms.

The redemption process and options depend on your type of credit card and your individual goals.

Note that the value of points or miles varies among travel brands, determined by various factors. Overall, credit cards with rewards incentivize spending while giving consumers valuable perks in return.

Types of Rewards credit cards

Reward credit cards come in various forms, each offering unique benefits tailored to different spending habits and preferences.

Understanding the different types can help consumers like you to maximize their reward potential.

By choosing the right type of rewards card based on your buying behavior and needs, you can effectively earn valuable rewards on your everyday purchases.

-

Cash back credit cards

Cash back credit cardsThey are popular for their simplicity and flexibility. Cash back credit cards offer a percentage of the amount spent on purchases back to the cardholder in the form of cash rewards – redeemable in various ways.

There are different types of cash back cards- flat-rate rewards offer consistent reward rates on all purchases, tiered category rewards offer higher percentages in specific spending categories like groceries or gas, and rotating category rewards change bonus categories quarterly or monthly.

Some well-known examples include the Citi Double Cash® Card, the Chase Freedom Unlimited®, and the Discover it Cash Back Card.

-

Travel rewards credit cards

Travel rewards credit cardsIt caters to frequent travelers by offering points/miles that can be redeemed for flights, hotel stays, rental cars, and other travel-related expenses. Travel rewards cards often come with solid welcome bonuses, travel insurance perks, the ability to transfer reward points to various airline and hotel partners, and airport lounge access.

There are two main types of travel rewards credit cards- co-branded cards that offer perks and elevated rewards with specific airlines or hotels and general-purpose cards whose rewards are not tied to a single brand, providing flexibility in earning and redeeming rewards.

Examples include Delta SkyMiles® Gold American Express Card, Marriott Bonvoy Brilliant® American Express® Card (co-branded), Capital One Venture Rewards Credit Card, and Chase Sapphire Preferred® Card (general-purpose).

-

Business rewards credit cards

Business rewards credit cardsThese are designed for small business owners and entrepreneurs looking to earn rewards on their business expenses. Business rewards cards typically offer bonus points on business-related purchases such as office supplies, advertising, telecommunication, and travel.

They may also provide valuable expense tracking and management tools, free employee cards, high spending limits, and annual credits.

The business credit cards help separate business and personal expenses, simplifying bookkeeping and tax preparation.

Businesses can effortlessly maximize their benefits by choosing the right card that suits their needs.

Examples include the Ink Business Preferred® Credit Card, the Capital One Spark Cash for Business, and the American Express® Business Gold Card.

Best Rewards Credit Cards

Today, finding the best rewards credit card can be a daunting task. But fear not, as we’ve got you covered! These financial gems offer a trove of perks, from cash back on everyday purchases to travel rewards for your dream vacations.

With a range of options to choose from, each card presents unique advantages tailored to different lifestyles and spending habits. So, whether you want free flights, highest reward credit cards, or luxurious hotel stays, there’s a rewards card for you!

We are here to answer what is the best credit card for rewards. Join us as we explore the top contender of 2024, helping you make the most of your spending and unlock a world of perks and benefits!

-

Chase Sapphire Preferred® Card - Ideal for Travelers

The Chase Sapphire Preferred® Card, being one of the best credit cards for rewards, boasts a versatile rewards program and valuable benefits. It comes with an impressive welcome bonus, allowing you to bonus_miles_full

With a annual_fees annual fee, you can earn up to $50 statement credits every account anniversary year for hotel stays purchased through Chase, 3x points on dining, online grocery purchases (excluding Target, Walmart, and wholesale clubs), and select streaming services, 5x total points on travel purchased through Chase Travel, and 1 point per dollar spent on other qualifying purchases.

Cardholders enjoy 25% more value when redeemed for travel, no foreign transaction fees for seamless international transactions, and extensive shopping and travel benefits. Additionally, points can be transferred to various airline and hotel partners at a 1:1 ratio, enhancing their value significantly.

-

Capital One Venture Rewards Credit Card - Perfect for Everyday Spending

The Capital One Venture Rewards Credit Card stands out as one of the top rewards credit cards for its simplicity and flexibility. It offers a substantial welcome bonus, where you can bonus_miles_full.

Cardholders earn unlimited 2x miles on every purchase and 5x miles on hotels & rental cars booked through Capital One Travel, making it easy to accumulate rewards quickly for future trips.

The card comes with valuable perks, such as up to $100 credit for Global Entry or TSA PreCheck application fee, no foreign transaction fees, Capital One Entertainment perks, and worthwhile travel and shopping benefits at just a annual_fees annual fee.

-

Chase Sapphire Reserve® - Top Choice for Luxury Travel

The Chase Sapphire Reserve® is renowned for its premium benefits and exceptional rewards structure, along with a lucrative welcome bonus to bonus_miles_full.

It offers 10x total points on hotels & rental cars and 5x total points on flights booked through Chase, 3x points on dining and other travel purchases worldwide, and more. Cardholders also receive a $300 annual travel credit each anniversary year and 50% more value when they redeem for travel through Chase.

With a annual_fees annual fee, this highest reward credit card comes with various perks like complimentary access to 1,300+ airport lounges worldwide with up to two guests, up to $100 for Global Entry, TSA PreCheck, or NEXUS fee credit, and 1:1 points transfer to leading airline and hotel loyalty programs.

Additionally, you enjoy no foreign transaction fees on your international expenses and comprehensive travel and shopping benefits, enhancing your overall travel experience!

-

American Express® Gold Card - Best Card for Dining and Grocery Rewards

The American Express® Gold Card is known for the best credit card rewards, thanks to its amazing membership benefits and extensive earning potential. New cardholders can bonus_miles_full As a welcome offer.

With a annual_fees annual fee, it offers 4x points at U.S. supermarkets (on up to $25,000 per year) and restaurants worldwide, 3x points on flights directly booked with the airlines or on amextravel.com, and 1x on other eligible purchases.

You also enjoy several perks, including valuable statement credits like up to $120 dining credit annually at select restaurants, no foreign transaction fees, travel benefits, and access to exclusive events through Amex Experiences.

-

Capital One Venture X Rewards Credit Card - Best Card for Travel Rewards

The Capital One Venture X Rewards Credit Card is recognized as the best rewards credit card 2024 due to its exceptional features and competitive rewards program. It comes with an excellent welcome bonus, allowing you to bonus_miles_full.

Cardholders earn 10x miles on hotels & rental cars and 5x miles on flights booked through Capital One Travel, along with unlimited 2x miles on all purchases. The card provides a $300 annual travel credit, offsetting the annual_fees annual fees.

You can also enjoy several perks, such as access to 1,300+ lounges worldwide with two guests through Priority Pass Select membership, the ability to transfer miles to 15+ travel loyalty programs, up to $100 credit for TSA PreCheck or Global Entry application fees, no foreign transaction fees, and lots more!

-

Chase Freedom Unlimited® - Top Choice for Flexible Rewards

The Chase Freedom Unlimited® is recognized as the best rewards credit card due to its simplicity and solid cashback rewards system, allowing you to bonus_miles_full

With no annual fee, cardholders earn 1.5% cash back on every purchase with no rotating categories or caps on earnings, 5% back on travel purchased through Chase Travel, and 3% on dining and drugstore purchases.

The card also provides additional benefits like flexible redemption options with ample opportunities and comprehensive shopping and travel benefits for peace of mind.

-

Ink Business Preferred® Credit Card - Excellent Rewards Card for Small Businesses

The Ink Business Preferred® Credit Card is perfect for business owners because of its robust rewards program tailored to business expenses. It comes with a generous welcome bonus, where you can bonus_miles_full

With a annual_fees annual fee, cardholders earn 3x on frequent business spending, including shipping purchases, internet, cable, and phone services, travel, and Advertising purchases made with social media sites and search engines on the first $150,000 spent in combined purchases each account anniversary year, along with 1x point per $1 spent on all other qualifying purchases.

This credit card with good rewards also provides various perks like 25% more value in travel redemption, the ability to transfer points to 14 airline and hotel loyalty programs, employee cards at no additional cost, extensive shopping and travel benefits, and no foreign transaction fees.

-

Citi Premier® Card - Ideal for Travel and Dining

The Citi Premier® Card is the best credit card for points, thanks to its diverse earning categories and valuable redemption options. New cardholders have an opportunity to bonus_miles_full, as an attractive welcome bonus.

You can earn 3x ThankYou points on air travel, restaurants, supermarkets, gas stations, etc., 10x points on hotels, car rentals, and attractions booked through the Citi Travel portal, and 1x on other eligible purchases.

With a annual_fees annual fee, it offers many perks, such as no foreign transaction fees for your international shopping, a $100 Annual Hotel Benefit, Citi Entertainment perks, and valuable travel benefits for peace of mind.

| Credit card |

Uthrive rating

|

Intro offer | Rewards rate | Annual fee | Learn more |

|---|---|---|---|---|---|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 5x Points |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 5x Miles |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.2/5

|

Intro Offer bonus_miles_full |

Reward Rates up to 10x Points |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 4x Membership Rewards® Points |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 10x Miles |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles_full |

Reward Rates 1.5%-5% Cashback |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 3x points per $1 |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.4/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 3x Points |

Annual Fees annual_fees |

What is a Rewards Program?

A credit card rewards program is a system offered by credit card companies that allow cardholders to earn points, miles, or cash back on their purchases. These rewards can be redeemed for various benefits such as travel, merchandise, gift cards, or statement credits.

The reward program serves as a guiding framework for cardholders, providing the rules and conditions.

Understanding these terms is essential for maximizing the benefits of your rewards credit card and ensuring a seamless experience while using accumulated rewards.

Pros and Cons of Rewards Credit Cards

Navigating the realm of credit card rewards involves a delicate balance of opportunity and risk. While these cards offer enticing benefits, they also present potential drawbacks.

Let’s delve into the pros and cons of reward cards to help you determine if they align with your financial goals and make well-informed financial decisions.

Pros

-

Earn Rewards: One of the main advantages of credit cards with rewards is the ability to earn rewards such as cashback, points, or miles on your everyday purchases while saving money on expenses.

-

Travel Benefits: Many rewards cards provide travel perks, such as airline miles, hotel discounts, rental car benefits, travel insurance benefits, no foreign transaction fees, and other travel amenities that can be valuable for frequent travelers and enhance their overall journey.

-

Helps in Building Credit: Responsible use of rewards credit cards can positively impact your credit score, enhancing your financial profile. It further helps build your credit history by reporting your payment activity to the major credit bureaus each month.

-

Universal Acceptance: Rewards credit cards are widely accepted around the world by merchants due to their convenience and versatility. This makes them an excellent choice for making large purchases or traveling abroad where debit cards may not be accepted as readily as credit cards.

-

Safety and Fraud Protection: Using a rewards credit card also offers enhanced safety features like zero liability for unauthorized purchases made with their credit cards.

-

Additional Features: Some cards provide extra perks like an Introductory 0% APR period, extended warranty, purchase protection, and concierge services, increasing the overall value.

Cons

-

High Annual Fees: Certain rewards credit cards come with expensive annual fees, which can offset the benefits of earning rewards, especially if the cardholder does not utilize the card's features frequently enough to justify the cost.

-

Complexity: Managing multiple reward programs, rotating categories, monthly bill payments, or redemption options can be difficult and time-consuming, negating all the benefits.

-

Reward Limitations: There are limitations on how you can earn or redeem your credit card rewards. These limitations may include caps on earning points or cash back, expiration dates on rewards, and restrictions on certain types of purchases that qualify for rewards.

-

High Interest Rates: If cardholders carry a balance on their rewards credit card, they may end up paying more in interest charges, potentially nullifying the value of the rewards earned.

-

Risk of Overspending: Aiming to earn high credit card rewards might tempt you to overspend, leading to debt accumulation if not managed properly.

Types of Credit Card Rewards Programs

Exploring the world of credit card rewards can be exciting and rewarding! There are broadly three types of credit card rewards programs- cash back rewards, points-based rewards, and miles rewards.

Whether you’re interested in earning cash back on your everyday purchases, collecting points for free flights or hotel stays, or enjoying other perks like discounts and bonuses, there’s a rewards program out there for you!

Each credit card provides different rewards programs tailored to suit your spending patterns and lifestyle. Let’s dive into cash back rewards cards and discover the types of credit cards to help you make the most of your spending!

Cash-Back Rewards

Cash back rewards are a popular feature of credit cards, allowing consumers to earn money back on their purchases. Depending on your card, you may earn cash back at a flat rate or a high amount for specific spending categories like groceries or dining out.

Most people choose a card with bonus categories that align with their spending habits to maximize their rewards effectively. However, it’s essential to keep track of these categories with higher reward rates to reach the full potential of earnings.

Overall, cash back rewards credit cards provide flexibility and tangible benefits to cardholders for their everyday expenses. Here are three types forms of cash-back cards:

-

Flat Rate Cash-Back Credit Cards

hey provide a consistent cash back percentage on all purchases, simplifying your rewards.

Flat-rate cash-back cards are very convenient and ideal for individuals seeking low-maintenance rewards programs with fixed cashback.

Examples include the Capital One Quicksilver Cash Rewards Credit Card with 1.5% cash back on all purchases, the Cash Magnet® Card from American Express with a flat 1.5% cash back rate, the Citi Double Cash® Card for 2% cash back, and the Wells Fargo Active Cash® Card with 2% cash back on purchases.

-

Tiered-Rate Cash-Back Credit Cards

These cards provide varying cash back rates based on different purchase categories, such as travel, dining, gas, groceries, select streaming services or drugstore items.

Tiered-rate cash-back cards often feature higher rewards for specific categories while offering a standard rate for all other spending.

You can opt for a credit card that fits your preferences, like the Blue Cash Preferred® Card from American Express for family spending, the Capital One SavorOne Cash Rewards Credit Card with excellent dining out and entertainment rewards, or the Chase Freedom Unlimited® for its versatile rewards structure.

-

Rotating Category Cash-Back Credit Cards

It is a type of credit card that offers higher cash-back rewards in certain purchase categories that often change quarterly.

Rotating category cash-back cards can provide elevated rewards, often up to 5%, requiring you to pay attention and actively manage your accounts by activating the bonus categories.

Top rewards card options that help you maximize benefits are the Discover it Cash Back, the Chase Freedom Flex℠, Citi Custom Cash® Card, and the U.S. Bank Cash+ Visa Signature Card – with a cap on quarterly spending.

What are the most popular credit card rewards programs?

Credit card rewards programs play a crucial role in an individual’s decisions when choosing a credit card. These rewarding programs provide various incentives such as cashback, travel rewards, miles or points for purchases, and other perks.

Among the most popular credit card rewards programs are Chase Ultimate Rewards, Citi ThankYou, American Express Membership Rewards, and Capital One.

Each of these programs has unique features and benefits that set them apart from the rest, making them highly sought after by consumers seeking to maximize their credit card benefits.

-

Chase Ultimate Rewards

Chase Ultimate Rewards is renowned for its flexibility and value. Cardholders can earn points on different purchases and redeem them for travel, gift cards, cash back, or transfer them to various airline and hotel partners at a 1:1 ratio.

One standout feature of the Chase Ultimate Rewards Program is the ability to combine points from multiple Chase cards into one account, maximizing earning potential.

You can enjoy substantial savings on flights and accommodations when you book travel seamlessly through the Chase travel portal.

Regardless of your travel preferences or card selection, it delivers unparalleled benefits and rewards, making it a preferred choice among savvy travelers seeking maximum value from their rewards.

Top Chase rewards cards include Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, and Chase Freedom Unlimited®.

-

Citi ThankYou

The Citi ThankYou rewards program offers a wide range of redemption options, including travel bookings, gift cards, merchandise, statement credits, and more.

Cardholders can earn points through everyday spending and special promotions.

What sets Citi ThankYou apart is its unique transfer partners like JetBlue TrueBlue and Singapore Airlines KrisFlyer, further adding to its appeal.

Additionally, the top-class American Airlines credit cards with excellent perks like a free checked bag and airport lounge access, are issued by CitiBank.

This expansive network opens doors to diverse redemption options, enhancing the program’s appeal for seasoned travelers seeking versatility.

Opt for the best Citi rewards cards like the Citi Custom Cash® Card, Costco Anywhere Visa® Card by Citi, and Citi Double Cash® Card to maximize rewards and elevate travel experiences.

-

American Express Membership Rewards

Amex Rewards program offers a wide array of redemption options, from travel to statement credits and gift cards to transfer partners.

You can earn reward points through everyday spending and welcome bonuses on credit cards.

What makes the American Express Rewards program shine is its extensive network of 22 airline and hotel transfer partners – the most among the best rewards programs.

Each Amex point equals 2 cents when used with travel partners, ensuring significant savings on flights and hotel stays.

With its unparalleled benefits, American Express Membership Rewards is a top choice for those seeking exceptional value and versatility.

The best credit card rewards are The Platinum Card® from American Express, Blue Cash Preferred® Card from American Express, and American Express® Gold Card.

-

Capital One

Capital One’s rewards program is known for its simplicity and straightforward redemption process.

Cardholders earn miles on every purchase without worrying about rotating categories or complicated reward structures.

The program often runs promotions that allow members to earn bonus miles for specific spending categories.

Capital One boasts over 15 esteemed airline and hotel partners, offering cardholders access to diverse redemption options.

This widespread network empowers Capital One cardholders to leverage their rewards for various travel experiences, from flights to accommodations, providing travelers to maximize their rewards.

Popular options include Capital One Venture Rewards Credit Card, Capital One SavorOne Cash Rewards Credit Card, and Capital One Venture X Rewards Credit Card.

How to Choose the Best Rewards Credit Card?

Choosing the best rewards credit card involves assessing your spending habits and personal goals.

Whether opting for cash back, points, or miles, rewards can accumulate over time, helping to cover your expenses or fund vacations.

It’s important to weigh the benefits against potential drawbacks, such as fees and associated risks. Beyond rewards rates, consider the following factors to select the rewards card that aligns best with your needs and preferences.

-

Identify Your Spending Habits

Identify Your Spending HabitsFigure out where you spend the most each month. Once you know your major monthly categories, match your frequent spending with the most fitting rewards credit card.

So, if your biggest expenses are groceries, opt for a grocery rewards card. And if you spend more on other everyday purchases, you will rack up more rewards with a flat-rate credit card or rewards card with bonus categories.

-

Annual Fee

Annual FeeIt is charged by credit card issuers for card ownership, which varies. Cards with higher fees often offer enhanced perks and rewards, potentially justifying the cost.

Consider your spending habits and desired benefits when evaluating the worth of an annual fee. Many premium rewards cards carry annual fees.

-

Welcome Bonus

Welcome BonusAlso known as a sign-up bonus, it serves as an incentive for new cardholders. With this, you can earn additional cash back, points, or miles by meeting a spending requirement within a specified timeframe.

These bonuses can range from hundreds of dollars of cash rewards to thousands of points/miles. It’s crucial to avoid overspending to meet the bonus threshold and focus on responsible budgeting aligned with your financial goals.

-

0% APR Period

0% APR PeriodMany reward cards come with a 0% Introductory APR period during which no interest is charged on purchases, balance transfers, or both. This promotional period typically lasts from six months to nearly two years.

However, if balances remain unpaid by the end of this period, interest will apply. Balance transfers usually incur a fee, typically $5 or 3% to 5% of the transferred amount.

Assess your needs and spending pattern to determine if a 0% APR period aligns with your financial strategy.

-

Foreign Transaction Fees

Foreign Transaction FeesForeign transaction fees, typically ranging from 1% to 3%, are imposed when making purchases abroad. Some cards provide no foreign transaction fees, making them ideal for international travel.

When travelers select a card for international use, they should prioritize those that waive these fees to optimize savings during overseas trips.

-

Perks

PerksThe additional benefits the rewards card offers further enhance the value. Travel cards are renowned for their excellent traveling perks, which can offset annual fees and elevate your overall journey.

Consider perks that align with your lifestyle and preferences when choosing a card. For instance, travel insurance, airport lounge access, and statement credits for travel expenses are coveted perks among travelers.

Should I Get a Rewards Credit Card?

YES! Getting a rewards credit card can be beneficial if you can manage your finances responsibly.

The top rewards cards come with various perks, such as cashback, welcome bonuses, travel rewards, points for purchases, and other incentives.

By using the best credit cards for rewards, you can earn versatile rewards for your everyday expenses, redeemable for travel, gift cards, merchandise, statement credits, or even cash back.

However, it is crucial to choose a card that aligns with your spending habits and preferences to maximize the benefits.

If you frequently make purchases using a credit card and pay off the balance in full each month, a rewards credit card can help you save a lot of money while earning valuable benefits.

For example, if you frequently travel, a travel rewards card can provide you with points or miles that can be redeemed for flights or hotel stays.

With numerous options available in the market and no card being ideal for all, it’s essential to consider factors like fees, rewards structure, APR, additional perks, and redemption options.

Note that rewards credit cards often come with higher interest rates and annual fees compared to standard credit cards.

If you tend to carry a balance on your credit card, the interest charges may outweigh the benefits of the rewards.

Examples include Chase Freedom Unlimited for 1.5% cash back on every purchase, Capital One Venture Rewards Card to get miles for travel expenses, and joining the American Express Membership Rewards program to earn points for various purchases.

Ultimately, deciding whether to get a rewards credit card requires weighing the potential benefits against your needs and financial circumstances.

The best rewards cards can provide significant savings – to extend your budget or for future vacations.

How to Maximize Rewards for the Best Rewards Credit Card?

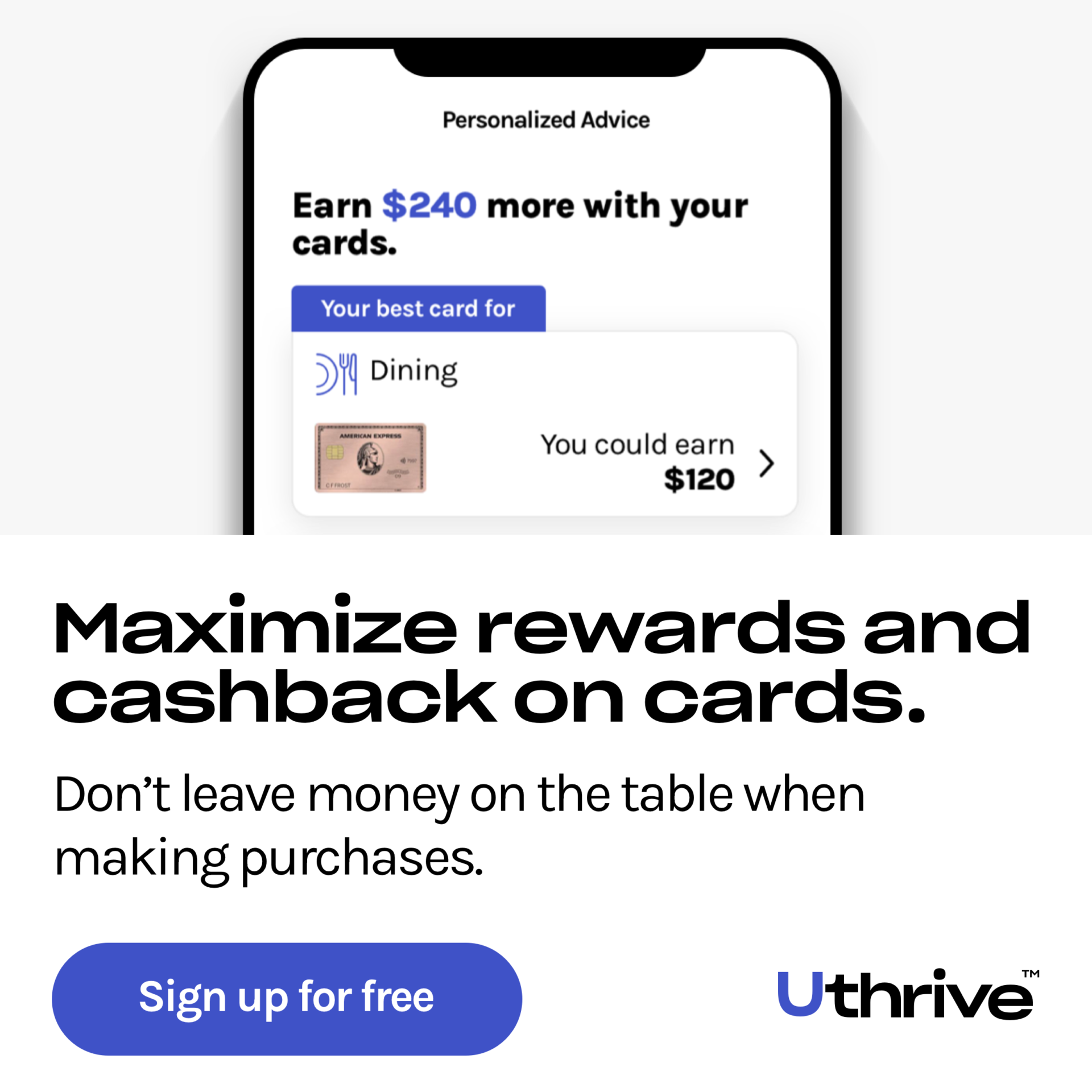

To maximize credit card rewards, you must explore your options and choose the one that best matches your spending habits.

Tailor your choice based on your lifestyle; for instance, if you often dine out, prioritize cards offering rewards on dining.

Pick a reward type that aligns with your goals, such as cashback, airline miles, or hotel points, especially if you travel frequently. Here are some tips and tricks on how you can make the most of your best rewards credit cards:

-

Use the card for the bulk of your spending

You can earn maximum rewards by charging all regular expenses to your credit card. However, avoid overspending and ensure to use it responsibly.

Track your everyday spending can help you identify areas where you can increase your rewards-earning potential.

-

Pair cards to earn even more

Combine cards strategically to boost your rewards. Utilize one with higher reward rates for specific spending categories like dining and gas and another flat-rate card for general expenses.

Evaluate your spending habits to determine which cards complement each other best and offer the highest rewards for your purchases.

-

Take advantage of welcome bonuses

New cardholders should aim to capitalize on lucrative sign-up bonuses by meeting the required spending threshold within the specified timeframe to boost their rewards balance.

-

Redeem rewards thoughtfully

Ensure to use your rewards wisely for optimal redemption by choosing methods that offer maximum value, such as travel expenses for travel cards or statement credit for cash back cards.

Transferring points to travel partners can also boost value. Keep track of expiration dates and blackout dates to make the most of your rewards.

-

Make use of the free perks

Leverage your reward card’s benefits, such as free checked bags and complimentary access to airport lounges to maximize value, particularly for cards with annual fees.

Take advantage of all available perks to offset costs effectively. Consider whether the benefits offered by a card justify its annual fee.

-

Understand your spending habits

It’s best to align your credit card for rewards with your lifestyle and spending patterns. Select a card that rewards you where you spend the most frequently, whether it’s groceries, dining, gas, or travel.

Review your budget regularly to ensure your card selection matches your evolving financial goals and lifestyle changes.

-

Don't carry a balance

Make sure to pay your statement balance in full each month to avoid unnecessary interest charges. Carrying a balance can nullify your rewards earned, diminishing the value of your card.

Use autopay to ensure timely payments and avoid fees. Closely monitor your spending to stay within your budget and avoid accumulating debt.

FAQs

What is the best credit card for rewards?

The best credit card for rewards depends on individual preferences and spending habits. Some popular options include the Chase Sapphire Preferred, American Express Gold Card, and Capital One Venture Rewards Credit Card.

How do you redeem credit card rewards?

You can redeem your credit card rewards through the card issuer’s online portal or mobile app.

Redemption options vary with each credit card program but often include statement credits, gift cards, travel bookings, merchandise purchases, or even direct deposits into a bank account.

What is the best credit card for travel rewards?

The best credit card for travel rewards depends on your travel habits and preferences.

Popular choices include the Chase Sapphire Reserve Credit Card, American Express Platinum Card, and Capital One Venture X Rewards Card.

These cards offer benefits like travel credits, airport lounge access, and flexible redemption options for travel-related expenses.

What are the best rewards programs?

Some of the best rewards programs include Chase Ultimate Rewards, American Express Membership Rewards, and Citi ThankYou Points.

These programs offer flexibility in earning points across various categories and provide valuable redemption options such as travel bookings, statement credits, gift cards, and more.

How do I take advantage of credit card rewards?

To maximize credit card rewards, it’s essential to understand your card’s features and earning structure.

- Use your card for everyday purchases to accumulate points or cash back quickly.

- Take advantage of generous welcome bonuses and high-earning bonus categories.

- Watch out for special promotions offered by the credit card issuer.

- Ensure to pay off your balance in full each month to avoid interest charges that could negate your rewards earnings.

What credit score do I need to get a rewards credit card?

Generally, you need a good to excellent credit score of 670 or higher to qualify for most rewards credit cards with attractive benefits and features.

Some entry-level rewards cards may just need a fair credit score above 580, providing fewer perks and lower reward rates.

How much are credit card rewards points worth?

The value of credit card reward points varies depending on the specific program and how they are redeemed. On average, one point is worth around 1 cent, but this value can fluctuate based on how you decide to redeem them.

Is there a limit to the amount of rewards you can earn with a rewards card?

Most rewards cards do not have a preset limit on the amount of rewards you can earn. However, some cards may impose caps on high rates of bonus category spending or during promotional periods.

It is important to carefully review the terms of your rewards credit card to understand any limitations on earning rewards.

Are credit card rewards taxable?

In most cases, credit card rewards earned from purchases are not considered taxable income by the IRS since they are treated as discounts rather than income.

However, you can consult with a tax professional for personalized advice regarding your specific situation.

Do credit card rewards expire?

Credit card reward expiration policies vary among card issuers and programs. Most card programs have no expiration dates for earned rewards, as long as the account remains open and in good standing.

It’s crucial to review your credit card’s terms on reward expiry to avoid losing valuable points.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What is the best credit card for rewards?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The best credit card for rewards depends on individual preferences and spending habits. Some popular options include the Chase Sapphire Preferred, American Express Gold Card, and Capital One Venture Rewards Credit Card.”

}

},{

“@type”: “Question”,

“name”: “How do you redeem credit card rewards?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “You can redeem your credit card rewards through the card issuer’s online portal or mobile app.

Redemption options vary with each credit card program but often include statement credits, gift cards, travel bookings, merchandise purchases, or even direct deposits into a bank account.”

}

},{

“@type”: “Question”,

“name”: “What is the best credit card for travel rewards?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The best credit card for travel rewards depends on your travel habits and preferences. Popular choices include the Chase Sapphire Reserve Credit Card, American Express Platinum Card, and Capital One Venture X Rewards Card.

These cards offer benefits like travel credits, airport lounge access, and flexible redemption options for travel-related expenses.”

}

},{

“@type”: “Question”,

“name”: “What are the best rewards programs?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Some of the best rewards programs include Chase Ultimate Rewards, American Express Membership Rewards, and Citi ThankYou Points.

These programs offer flexibility in earning points across various categories and provide valuable redemption options such as travel bookings, statement credits, gift cards, and more.”

}

},{

“@type”: “Question”,

“name”: “How do I take advantage of credit card rewards?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “To maximize credit card rewards, it’s essential to understand your card’s features and earning structure.

Use your card for everyday purchases to accumulate points or cash back quickly.

Take advantage of generous welcome bonuses and high-earning bonus categories.

Watch out for special promotions offered by the credit card issuer.

Ensure to pay off your balance in full each month to avoid interest charges that could negate your rewards earnings.”

}

},{

“@type”: “Question”,

“name”: “What credit score do I need to get a rewards credit card?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Generally, you need a good to excellent credit score of 670 or higher to qualify for most rewards credit cards with attractive benefits and features.

Some entry-level rewards cards may just need a fair credit score above 580, providing fewer perks and lower reward rates.”

}

},{

“@type”: “Question”,

“name”: “How much are credit card rewards points worth?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The value of credit card reward points varies depending on the specific program and how they are redeemed. On average, one point is worth around 1 cent, but this value can fluctuate based on how you decide to redeem them.

Is there a limit to the amount of rewards you can earn with a rewards card?

Most rewards cards do not have a preset limit on the amount of rewards you can earn. However, some cards may impose caps on high rates of bonus category spending or during promotional periods.

It is important to carefully review the terms of your rewards credit card to understand any limitations on earning rewards.”

}

},{

“@type”: “Question”,

“name”: “Are credit card rewards taxable?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “In most cases, credit card rewards earned from purchases are not considered taxable income by the IRS since they are treated as discounts rather than income.

However, you can consult with a tax professional for personalized advice regarding your specific situation.”

}

},{

“@type”: “Question”,

“name”: “Do credit card rewards expire?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Credit card reward expiration policies vary among card issuers and programs. Most card programs have no expiration dates for earned rewards, as long as the account remains open and in good standing.

It’s crucial to review your credit card’s terms on reward expiry to avoid losing valuable points.”

}

}]

}

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)