Key Takeaways:

-

This comprehensive guide will help you find out what is the best credit card for travel rewards.

-

With a plethora of options available, it’s essential to choose the right credit card for travel points wisely.

-

Discover how to maximize your travel rewards to take your trip to the next level!

Ready to jet set with the best travel credit card in hand? Whether you’re planning a dream vacation or a quick getaway, finding the perfect travel credit card can make all the difference!

Whether you’re loyal to a specific airline or hotel chain or prefer flexibility in your travel rewards, there’s a card tailored to your needs.

The best card for travel rewards not only earns you rewards but also brings your next adventure closer with every swipe.

What is a Travel Credit Card?

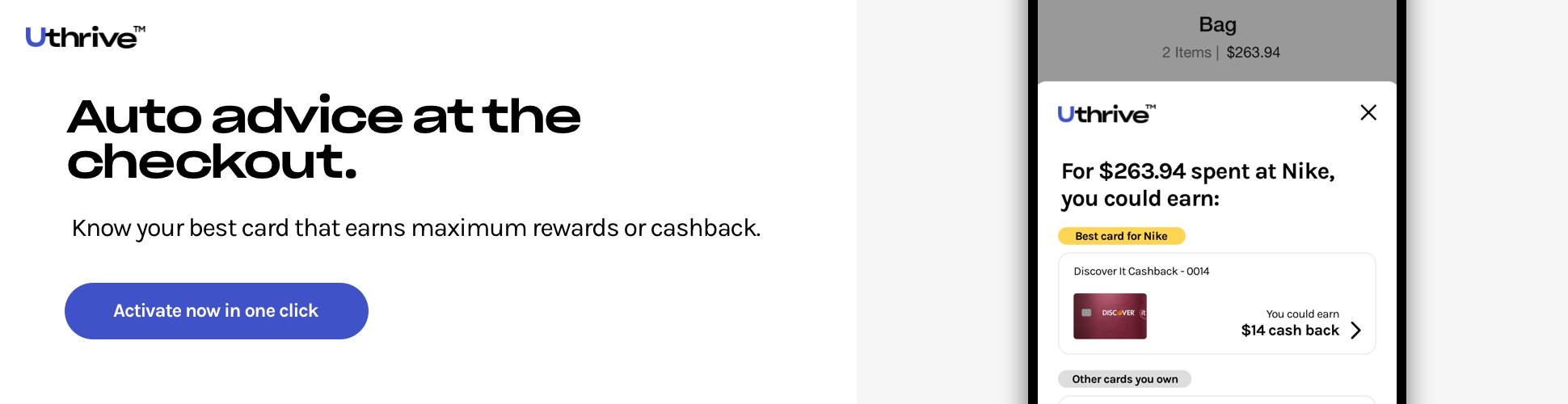

A travel rewards credit card is a card that earns points, miles, or cash back specifically designed for travel expenses. These versatile tools offer perks and rewards tailored for booking flights, hotels, and more.

They provide benefits like Global Entry application fee credits, airport lounge access, trip insurance, and free checked bags, enhancing the overall travel experience.

With no foreign transaction fees, they’re ideal for international travelers looking to earn rewards easily while on the go.

Some co-branded travel cards with airlines and hotels provide specific discounts and perks for loyal members.

You can unlock limitless travel possibilities with the right card!

How do Travel Credit Cards work?

Travel credit cards work by allowing cardholders to earn rewards points or miles for eligible travel purchases, which can then be redeemed for various travel-related expenses such as flights, hotel stays, vacation packages, and rental cars.

You can also use these rewards for non-travel purchases in some cases, with different conversion rates.

The value of these rewards can vary depending on the card and spending categories.

Some travel cards are tied to specific airlines or hotel chains, while others offer more flexibility with their rewards programs.

For instance, the Chase Sapphire Preferred® Card provides bonus points for travel, while the Marriott Bonvoy Boundless® credit card rewards purchases at Marriott hotels, grocery stores, restaurants, and gas stations.

Airline credit cards allow cardholders to earn miles that can be redeemed exclusively for flights and upgrades on that airline. Hotel credit cards focus on earning points for hotel stays and offer benefits like free nights and elite status within the hotel’s loyalty program.

Best Travel Credit Cards

Discover the gateway to extraordinary journeys with the best travel credit cards! These cards are designed to elevate your journey while offering exceptional perks, from earning points on flights and hotel stays to enjoying exclusive travel benefits.

Whether you’re looking for luxurious getaways or a budget-friendly explorer trip, we’ll help you find the perfect companion.

In this guide, we unveil the top contenders for the best credit cards for travel rewards, each promising unparalleled rewards and flexibility.

-

The Platinum Card® from American Express - Perfect for Luxury Travelers

The Platinum Card® from American Express is renowned for its premium travel benefits, making it one of the best credit cards for travel perks. It offers an excellent welcome bonus, where you can bonus_miles_full.

You can get 5X points on flights booked directly with airlines or through amextravel.com (up to $500,000 per year), 5X on prepaid hotels booked on Amex Travel, and 1X on other eligible purchases.

Cardholders enjoy exclusive perks like access to over 1,400 airport lounges worldwide, automatic Hilton Honors and Marriott Bonvoy Gold Elite Status (after enrollment), up to $100 credit for Global Entry or TSA PreCheck, valuable statement credit for hotel and airline fees, and more, offsetting the competitive annual_fees annual fee.

It is a top choice for frequent travelers seeking luxury and comfort. The card also comes with no foreign transaction fees, up to $189 CLEAR Plus credit, the ability to transfer points to various hotel and airline partners, and comprehensive shopping and travel benefits.

-

The World of Hyatt Credit Card - Tailored for Hotel Rewards and Perks

The World of Hyatt Credit Card is known as one of the best credit cards for travel rewards due to its exceptional value for Hyatt loyalists and travelers alike. New cardholders have the opportunity to bonus_miles_full as a solid welcome bonus.

It offers up to 9X points at all Hyatt hotels, 2X points at restaurants, flights purchased directly from the airline, local transit & commuting, and fitness club and gym memberships, and 1X on all other eligible purchases.

With a annual_fees annual fee, the card also comes with a free night award on every account anniversary, automatic World of Hyatt Discoverist status with perks like room upgrades and late checkout, five qualifying night credits for next-tier status each year, various travel protection benefits, and no foreign transaction fees.

-

United℠ Explorer Card - Top Choice for United Flyers

The United℠ Explorer Card stands out amongst the best credit cards for international travel, especially for United Airlines enthusiasts. It has a generous welcome bonus, allowing you to bonus_miles_full

With a annual_fees, you can earn 2X miles per $1 spent on United purchases, dining, and direct hotel purchases, and 1X mile on other qualifying purchases.

Cardholders enjoy priority boarding, the first free checked bag for themselves and their companion, two United Club one-time passes annually, up to $100 for Global Entry, TSA PreCheck, or NEXUS fee credit, and 25% savings on United Airlines in-flight purchases.

The card also offers no foreign transaction fees to save money on your overseas travel, no blackout dates on miles earned, and extensive shopping and travel benefits, catering to individuals who prefer flying with United Airlines.

-

Delta SkyMiles® Platinum American Express Card - Best Card for Delta SkyMiles Lovers

The Delta SkyMiles® Platinum American Express Card is a top choice for Delta Air Lines passengers seeking valuable travel benefits. It features a solid welcome bonus, where you can bonus_miles_full.

With a annual_fees annual fee, cardholders can get 3X miles on Delta purchases and hotel purchases made directly with hotels, 2X miles at U.S. supermarkets and restaurants worldwide, and 1X mile per $1 spent on other eligible purchases.

You can benefit from various perks, such as a free checked bag, an annual companion certificate, up to $100 credit for Global Entry or TSA PreCheck, and MQD Headstart and MQD Boost for achieving Delta Medallion Status, making it one of the best travel rewards credit card.

Additionally, the card provides various travel protections, 20% back on in-flight purchases, valuable statement credits like $150 Delta Stays Credit, no foreign transaction fees, and shopping benefits, enhancing the overall Delta flying experience.

-

Hilton Honors American Express Card - Best No Annual Fee Hotel Card

Your search for the best credit card for travel with no annual fee ends at the Hilton Honors American Express Card! Beyond rewarding hotel stays, new cardholders bonus_miles_full as an excellent welcome bonus.

You can earn 7X points on purchases made directly with hotels and resorts in the Hilton portfolio, 5X points at U.S. restaurants, U.S. gas stations, and U.S. supermarkets, and 3X points on all other eligible spending.

It comes with perks like- complimentary Hilton Honors Silver status (with an opportunity to upgrade), no foreign transaction fees for seamless international transactions, and various shopping benefits for peace of mind. With no annual fee, the card is ideal for those who frequently stay at Hilton properties.

-

Marriott Bonvoy Brilliant® American Express® Card - Best Premium Hotel Credit Card

The Marriott Bonvoy Brilliant® American Express® Card is your answer to what is the best travel credit card. It is well-known for its exceptional blend of benefits catering to Marriott Bonvoy members and luxury travelers.

New cardholders can bonus_miles_full as a fantastic welcome bonus. You receive 6x points on purchases at hotels participating in the Marriott Bonvoy program, 3x points at restaurants worldwide and flights booked directly with the airlines, and 2x on other eligible purchases.

The card provides a complimentary Marriott Bonvoy Platinum Elite Status (with various benefits like 50% Bonus Points on stays), one free night award every year, access to over 1,200 airport lounges around the world with up to 2 guests, and up to $100 credit for Global Entry or TSA PreCheck application fee, justifying the annual_fees annual fee.

Additionally, you enjoy perks like no foreign transaction fees, valuable statement credits for dining and stays, 25 elite night credits, various travel protections, and shopping benefits, adding to the appeal of the card.

-

Southwest Rapid Rewards® Plus Credit Card- Perfect Choice for Southwest Flyers

The Southwest Rapid Rewards® Plus Credit Card is one of the best business credit cards for travel due to its appeal to Southwest passengers seeking valuable rewards and perks when flying with the airline.

It features a significant welcome bonus, where you can bonus_miles_full. Cardholders get 2x points on Southwest purchases, local transit & commuting, internet, cable, and phone services, hotels & car rental partners, and select streaming services.

You can also earn 1x point for each dollar spent on other eligible purchases, with an opportunity to redeem all your accumulated reward points for flights without blackout dates, seat restrictions, or change fees.

With a annual_fees annual fee and extensive route network, the card provides various perks, such as 2 EarlyBird Check-in, free checked bags, 3,000 bonus points on every anniversary, no earning caps, 25% back on in-flight purchases, flexible redemption options, and shopping benefits.

-

Hilton Honors American Express Aspire Card - Ideal for Luxury Hilton Stays

The Hilton Honors American Express Aspire Card offers the best travel credit card bonus. It is considered one of the most premium travel cards for avid Hilton guests looking for luxury experiences during their stays.

New cardholders can receive an outstanding welcome bonus, where they can Earn 150,000 Hilton Honors Bonus Points with the Hilton Honors American Express Aspire Card after you spend $6,000 in purchases on the Card within your first 6 months of Card Membership.

You can earn 14X points on purchases at hotels and resorts in the Hilton portfolio, 7X points at U.S. restaurants, flights booked directly with airlines or AmexTravel.com, and car rentals booked directly with select rental companies, and 3X points on all other eligible spending.

With a $550 annual fee, the card provides several perks, including complimentary Hilton Honors Diamond Status, annual free night rewards, significant statement credits like up to $200 flight credits and up to $400 for Hilton Resort Credit, no foreign transaction fees, comprehensive shopping and travel protection benefits, and lots more – enhancing your travel experience!

-

Delta SkyMiles® Reserve American Express Card - Perfect for Elite Delta Airline Benefits

The Delta SkyMiles® Reserve American Express Card, being one of the best credit cards for traveling, caters to frequent travelers seeking elite travel privileges and exclusive benefits when flying with Delta Air Lines or its partners worldwide.

It comes with a generous welcome bonus, allowing you to bonus_miles_full Cardholders earn 3x miles per $1 spent on Delta purchases and 1x miles on all other eligible purchases.

You can enjoy various perks, such as complimentary access to the Delta Sky Club lounges with four One-Time Guest Passes every year and access to The Centurion Lounge, an enhanced annual companion certificate, a free checked bag, and up to $100 credit for Global Entry or TSA PreCheck – making up for the annual_fees high annual fee.

The card also offers no foreign transaction fees, essential statement credits for dining, hotel stays, and rideshare, 20% savings on Delta in-flight purchases, MQD Headstart and MQD Boost for Medallion status, and comprehensive travel and shopping benefits for added convenience.

Types of travel credit cards

Travel credit cards cater specifically to travel-related expenses and come in various types, each offering unique benefits tailored to different travel preferences and spending habits.

Understanding the difference between these types can help travelers maximize their rewards and savings. Continue reading to find out the best travel credit cards that match your needs and lifestyle!

-

Transferable-rewards credit cards

Transferable-rewards credit cardsThese cards provide points and miles that offer the utmost flexibility in redemption. Transferable rewards credit card points can be utilized directly through the card’s rewards program or transferred to various airline or hotel partners.

This versatility makes them highly coveted, allowing you to redeem them in a way that best suits your preferences and travel goals.

Examples include the Chase Sapphire Reserve®, The Platinum Card® from American Express, and Chase Sapphire Preferred® Card.

-

Airline credit cards

Airline credit cardsThey specialize in earning specific airline miles and often include tailored perks for that particular airline. Airline co-branded cards come with several benefits for travelers, such as complimentary checked bags, in-flight discounts, and priority boarding.

These cards accumulate miles that can be redeemed flexibly for flights with the airline, as well as its partners, or within the same alliance.

Popular examples include Delta SkyMiles® Platinum American Express Card, United℠ Explorer Card, and Southwest Rapid Rewards® Plus Credit Card.

-

Hotel credit cards

Hotel credit cardsIt functions similarly to airline cards, offering rewards redeemable within a specific hotel program like Hilton, Marriott, or Hyatt. Hotel co-branded cards provide exclusive benefits, such as complimentary elite status and free award-night stays, enhancing your hotel experience.

Ideal for frequent travelers who stay at the hotel, especially those committed to a single brand, these credit cards earn rewards in the hotel’s currency, valid across their respective properties.

Notable options include the Marriott Bonvoy Brilliant® American Express® Card, The World of Hyatt Credit Card, and IHG One Rewards Premier Credit Card

-

Travel cards for beginners

Travel cards for beginnersWith so many travel credit card options available, it can be overwhelming for beginners. While transferable rewards cards can be complex, fixed-rate and cash-back cards are simpler alternatives.

Travel credit cards for beginners are designed for those new to travel rewards programs, offering a straightforward earning structure and easy-to-understand redemption options.

Examples include Capital One VentureOne Rewards Credit Card, Chase Sapphire Preferred® Card, and Hilton Honors American Express Card.

-

Fixed-value credit cards

Fixed-value credit cardsThey earn rewards at a set rate on all your purchases, providing consistent value without the complexity of award charts or redemption tiers. Fixed-value credit cards serve as an excellent entry point into the world of travel credit cards.

You can easily calculate the worth of your rewards and redeem them towards any travel expense at a fixed rate per point or dollar.

Opt for credit cards like Capital One Venture Rewards Credit Card, Bank of America® Travel Rewards credit card, or Wells Fargo Active Cash® Card.

-

Cash-back credit cards

Cash-back credit cardsThese cards offer straightforward rewards in the form of cash rebates on purchases, including those related to travel expenses. Cash-back credit cards provide flexible redemption options – statement credits, gift cards, direct deposits, etc.

With this, you earn a percentage of cash back on your purchases with no need to navigate points systems or transfer partners.

Examples include Capital One Quicksilver Cash Rewards Credit Card, Citi Double Cash® Card, and Chase Freedom Unlimited®.

Travel credit card benefits

Embarking on a journey is not just about reaching your destination—it’s about the experiences along the way.

The best travel reward credit cards open doors to a world of benefits that elevate your trip.

From earning rewards on everyday purchases to enjoying exclusive perks like airport lounge access and travel insurance, these cards are tailored to take your journey to the next level!

-

Elite Status with Travel Credit Cards

Certain travel rewards cards provide automatic elite status upon enrollment, streamlining your path to elite airline or hotel status. It is a valuable benefit that can be easily achieved through credit card spending.

For instance, American Express Platinum Card offers Membership Rewards points that can be used to earn elite status with various loyalty programs like Hilton Honors or Marriott Bonvoy. Achieving an elite status with leading airlines and hotels often comes with exclusive perks to elevate your travel.

Loyalty to a specific hotel brand yields valuable perks such as room upgrades, hotel credits, and flexible check-in/out times. Similarly, airline elite status grants privileges like lounge access and baggage allowances.

The best travel rewards credit cards for elite status include Marriott Bonvoy Boundless® Credit Card with automatic Marriott Bonvoy Silver Elite status, the Hilton Honors American Express Aspire Card for instant Hilton Honors Diamond status, and the IHG Rewards Club Premier Credit Card with complimentary Platinum Elite status.

-

Airport Lounge Access

This is the most popular benefit of travel cards, thanks to their comfort and value. Premium travel credit cards often include a coveted perk: complimentary access to airport lounges, often with Priority Pass membership.

These lounges save you from the hustle and bustle of crowded airports by providing a haven for travelers to relax or grab a bite before flights with amenities like Wi-Fi, comfortable seating, and food & beverages.

While the lounges available vary based on the card, airline co-branded options typically grant access to lounges affiliated with the card’s airline. You can use renowned credit cards like The Platinum Card® from American Express, Chase Sapphire Reserve®, and the Delta SkyMiles® Reserve American Express Card.

-

TSA PreCheck & Global Entry

TSA PreCheck and Global Entry are both expedited screening programs designed to streamline your travel experience at airports and international borders. Travel credit cards often cover the application fees for these programs as a benefit.

The perk of TSA PreCheck expedites domestic flight security screening, while Global Entry facilitates faster customs clearance for international travelers entering the United States. The application fees for these programs are up to $85 for TSA PreCheck and $100 for Global Entry, with memberships valid for 5 years.

The best credit card for travel perks provides statement credits to cover these fees, allowing members to bypass long lines at security checkpoints and immigration counters, saving time and reducing stress during travel.

You can choose from cards like- Chase Sapphire Reserve®, United℠ Explorer Card, Capital One Venture X Rewards Credit Card, and The Platinum Card® from American Express.

Travel vs. Cash Back Credit Cards

When comparing travel credit cards to cash back credit cards, you must consider the key differences based on your financial goals and spending habits.

Travel rewards credit cards offer points or miles that can be redeemed for travel-related expenses such as flights, hotels, and car rentals.

They often come with additional perks like airport lounge access, priority boarding, and travel insurance.

On the other hand, cash back credit cards provide a percentage of your purchases back in cash rewards, which can be easily redeemed or deposited into your bank account.

These cards are straightforward and perfect for those who prefer simplicity and flexibility in their rewards.

| Criteria | Travel Credit Cards | Cash Back Credit Cards |

|---|---|---|

Rewards Earned |

Points or miles for travel expenses |

Cash back on purchases |

Redemption Options |

Redeem for flights, hotels, and other travel expenses |

Redeem for statement credits, gift cards, or direct deposits |

Examples |

Chase Sapphire Reserve® and The Platinum Card® from American Express |

Chase Freedom Unlimited® and Blue Cash Preferred® Card from American Express |

Foreign Transaction Fees |

Some waive foreign transaction fees |

May have foreign transaction fees |

Travel Benefits |

Offer travel insurance, lounge access, etc. |

Focus more on cash back rewards |

In summary, travel rewards cards are ideal for frequent travelers who can maximize the value of travel perks and redemption options, while cash back cards are great for individuals looking for easy-to-redeem rewards with no hassle.

Co-branded Travel Cards vs. General Travel Cards

When deciding between co-branded travel cards and general travel cards, your loyalty to specific brands and your preference for flexibility play a crucial role.

Co-branded credit cards are ideal if you like or often end up using a particular airline or hotel chain.

They provide accelerated rewards tailored to their travel partner brand and often include exclusive perks like free award nights, free checked bags, or airline elite status.

On the other hand, general travel credit cards offer greater flexibility by allowing you to earn points redeemable for varied travel expenses.

They come with broader benefits like travel credits, ability to transfer points, and airport lounge access and versatile rewards on various travel categories.

| Criteria | Co-branded Travel Cards | General Travel Cards |

|---|---|---|

Issuer |

In partnership with a specific airline or hotel chain |

Issued by banks or financial institutions |

Rewards |

Typically offer higher rewards for purchases with partner brands |

Generally offer more flexibility in earning and redeeming points |

Perks |

Provide exclusive perks like priority boarding, free checked bags, or room upgrades at partners |

Offer a broader range of travel-related benefits |

Annual Fees |

May have higher annual fees due to premium perks and benefits |

Annual fees vary depending on the card issuer and benefits offered |

Examples |

United℠ Explorer Card and Marriott Bonvoy Boundless® credit card |

Capital One Venture Rewards Credit Card and Chase Sapphire Preferred® Card |

Co-branded cards excel when you want to maximize benefits with a particular brand, whereas general travel cards are perfect for those seeking flexible redemption and no specific brand partnership.

Ultimately, your choice should align with your travel habits and preferences for rewards and perks.

How to Choose and Compare Travel Credit Cards?

There’s no single travel rewards credit card that ticks every box. Each card has its own unique features.

It’s essential to compare cards based on what they offer and prioritize what matters most to you to select the best travel credit card tailored to your needs and preferences.

Whether you’re seeking a high rewards rate, a generous sign-up bonus, top-notch perks, or no annual fee at all, there’s something for everyone!

With a plethora of options available, choosing the right travel card can be a game-changer for your adventures.

-

Annual Fee

Annual FeeIt is common among premium and top-tier travel cards, boasting amazing perks. Always assess the value of rewards and benefits offered to ensure they offset the annual fee.

The no annual fee travel cards provide lower reward rates and fewer perks. Consider your spending habits and preferences when selecting a card with or without an annual fee.

-

Foreign Transaction Fee

Foreign Transaction FeeIf you frequently travel abroad, it’s crucial to pick a credit card that doesn’t charge foreign transaction fees. These fees, typically around 3%, are added to purchases made outside the U.S. and can significantly diminish any rewards you might earn.

-

Welcome Bonus

Welcome BonusWhen it comes to credit cards, the welcome bonuses often serve as a great incentive, especially with travel cards offering thousands of points upon reaching a certain spending threshold.

You must factor in the required spending to unlock the bonus. It’s essential never to overspend just to chase a sign-up bonus. These offers fluctuate, and a generous one can help mitigate the impact of the annual fee or future travel expenses.

-

Rewards Rate

Rewards RateWhen evaluating rewards, it’s essential to consider both the earning rate and the burning rate.

The earn rate reflects how many reward points/miles you earn per dollar spent, whereas the burn rate represents the value you receive when redeeming them.

Some general travel cards provide flat-rate rewards across all purchases, while co-branded cards offer higher rewards in specific categories such as travel or dining.

One must also consider the spending categories to which these reward rates apply, ensuring the card aligns with your spending patterns.

-

International acceptance

International acceptanceNot all travel credit cards are accepted around the world. Visa and Mastercard are widely accepted worldwide, compared to American Express and other cards when traveling outside the United States.

-

Travel Protections

Travel ProtectionsWhile comparing travel rewards credit cards, take into account the travel protections they offer, such as car rental insurance, trip cancellation coverage, and lost baggage protection.

This in-built travel coverage can provide savings and convenience during your trip compared to standalone policies. Review your card’s travel protections to understand the specifics.

-

Perks

PerksThese are additional benefits you receive just for having the card. Cards with no annual fees typically focus on rewards and offer minimal perks, and premium cards with high annual fees come packed with perks, though sometimes their rewards may not be as enticing.

A few such perks are free access to airport lounges, extended warranty, complimentary checked bags, free night stay, valuable statement credits, etc. Utilizing the card’s perks often offsets the annual fee.

Should you get a travel reward card? : Pros and Cons

Considering a travel rewards card to complement your lifestyle? The best credit cards for traveling offer enticing benefits like points for travel, airport lounge access, travel insurance, and lots more!

However, it is essential to weigh the advantages and drawbacks of travel rewards cards to make a well-informed decision.

Pros

-

Excellent Welcome Bonus: The best travel credit cards often come with large sign-up bonuses, worth hundreds or even thousands of dollars in travel rewards, giving a head start to your adventures. These bonuses can help offset the high annual fees that come with many premium travel cards.

-

Premium Perks: The cost-effective travel perks offered by cards not only make your trip more affordable but also enhance the overall travel experience with added comfort and convenience. Some of these perks include complimentary checked bags, access to airport lounges to escape from the hustle and bustle of crowded terminals, primary rental car insurance for peace of mind, and priority boarding.

-

Rewards Every Purchase: One of the remarkable features of travel credit cards is their ability to turn everyday spending into valuable rewards. These ongoing rewards can be earned in the form of cashback rewards, points, or miles, bringing travelers one step closer to their next trip.

-

Savings with No Foreign Transaction Fees: Foreign transaction fees can quickly add up and dent the excitement of an international trip. However, with travel credit cards that waive these fees, you can enjoy seamless transactions abroad while avoiding unnecessary fees.

-

Flexible Redemption Options: Some travel credit cards offer multiple options for redeeming rewards, allowing you to use your points or miles to book travel through the card issuer’s travel portal or transfer them to airline or hotel loyalty programs for maximum value.

Cons

-

High Annual Fees: Many top travel credit cards with elite benefits come with high annual fees. While these fees may be justified by the rewards and perks offered by the card, they can still be a significant expense for some consumers, hence limiting their options.

-

Credit Score Requirements: The best credit cards for travel have stern credit score requirements that can make it difficult for some individuals to qualify for the card. You typically need a good credit score to apply and be approved for these cards.

-

High Interest Rates: Travel credit cards usually have higher interest rates, making them less suitable for individuals who carry balances from month to month. The interest accrued on outstanding balances offsets the value of rewards earned.

How to Maximize Credit Card Points for Travel?

Unlocking the full potential of your credit card with the best travel rewards points can be a game-changer!

By strategically using your credit card rewards, you can enjoy upgraded flights, luxurious accommodations, and unforgettable experiences.

Here are the top expert strategies and tips to help you navigate the world of travel credit card points effectively, ensuring every swipe brings you closer to your dream destinations.

-

Optimize Rewards by Combine Cards

Maximizing rewards involves understanding your spending patterns across various categories and identifying credit cards that align with those merchants.

Start with a flat-rate card to earn a consistent rate on all purchases and then stack cards featuring bonus categories to boost your reward earnings in the highest spending areas.

For instance, use the Chase Sapphire Reserve® for travel and dining purchases and the Chase Freedom Unlimited® for everyday expenses and bills. This can efficiently maximize your credit card points for travel.

-

Maximize your Rewards Value with Transfer Partners and Issuer Travel

Make sure to select the most beneficial redemption options for optimal value. Using travel points and miles for travel through the card issuer’s portal provides excellent value.

Plus, if you make an extra effort to transfer your rewards to select airline or hotel partner programs, you can enjoy even greater returns!

By transferring points to an airline’s loyalty program such as United Airlines MileagePlus, you can leverage them for flight bookings, often valued at 2 cents per point.

-

Plan for the Welcome Bonus

To maximize the benefits of your travel credit card, aim to earn the sign-up bonus. These bonuses grant cardholders a substantial amount of points or miles, boosting their rewards balance.

Before applying for a new travel card, strategize how to meet the spending threshold required to earn this valuable bonus. Assess whether the requirement aligns with your spending patterns and, if necessary, plan purchases accordingly.

-

Make the Most of Your Travel Perks

Different cards offer varied benefits, so it’s crucial to understand the specifics to fully capitalize on them. Look for the best travel credit cards with recurring benefits, such as annual award nights, waived baggage fees, elite status privileges, etc.

Ensure these perks align with your needs to offset the annual fee, leading to substantial savings and enhancing your overall travel experiences.

-

Look Out for Limited-time Offers, Partner Perks, and Other Benefits

To maximize your travel points, watch out for special promotions available for a limited time, such as lucrative sign-up bonuses, partner perks like those with DoorDash or Instacart, and other avenues to earn extra rewards.

Keep an eye on email notifications and rewards portals for limited-time offers provided by issuers, such as Amex Offers for American Express cards such as American Express® Gold Card or occasional promotional offers like credits for VRBO rentals with the Capital One Venture X Rewards Credit Card.

-

Track your Spending and Rewards

Tracking your credit card spending and rewards is crucial to get the ultimate value. By monitoring your expenses, you can strategically use cards that offer bonus points on specific categories like dining, groceries, or travel.

This allows you to earn more points efficiently. Additionally, regularly reviewing your rewards balance ensures you are aware of how close you are to reaching your travel goals and can plan accordingly.

Are Travel Credit Cards Worth It?

Yes, travel credit cards can be worth it for individuals who frequently travel and can maximize the benefits the card offers.

They can be a valuable addition to your wallet, thanks to their attractive benefits like airline miles, hotel discounts, airport lounge access, and travel insurance.

These cards cater to various traveler types. Beginners may find value in cards with simple earning and redemption processes, whereas those loyal to specific brands can maximize benefits with co-branded cards, enjoying perks like lounge access and elite status.

Similarly, business travelers can leverage business travel cards for high rewards on everyday purchases.

For example, a frequent traveler who uses a travel credit card that offers bonus points for travel-related purchases can accumulate points quickly and redeem them for free flights or hotel stays.

The best credit cards for traveling waive foreign transaction fees, making them ideal for international travelers.

Travel cards can offer significant savings while providing added comfort and convenience.

However, it’s essential to consider factors like annual fees, interest rates, and spending habits to determine if it is the right card for your needs and travel patterns.

FAQs

What is the best travel credit card?

The best travel credit card can vary depending on individual preferences and spending habits. Some popular options include the Chase Sapphire Preferred® Card, the Capital One Venture X Rewards Credit Card, and The Platinum Card® from American Express.

What is considered travel for credit cards?

Travel expenses typically include flights, hotel stays, rental cars, cruises, trains, taxis, and other transportation-related costs.

Additionally, expenses like dining at restaurants while traveling or purchasing tickets for tours or attractions may also qualify as travel expenses on credit cards. It’s crucial to check your card’s terms and conditions for specific details.

What credit score do you need for a travel credit card?

You typically need a good to excellent credit score of around 670 or higher to qualify for a travel credit card. Some premium travel cards may require an excellent credit score of 740 or more.

What is the easiest travel credit card to get?

Credit cards like the Capital One QuickSilver Rewards Credit Card or entry-level travel cards from issuers like Capital One or Discover are often the easiest travel credit cards to get for individuals with limited or fair credit histories.

Do travel miles or points expire?

The expiration policies for travel miles and points vary among different credit card issuers. Most credit cards have no expiry dates for earned miles or points as long as the account remains open and in good standing.

However, it’s crucial to review the terms of your specific rewards program to understand how and when your rewards may expire.

What is the best credit card with travel insurance?

The best credit cards with travel insurance include the Chase Sapphire Preferred® Card, Capital One Venture X Rewards Credit Card, and The Platinum Card® from American Express.

They are known for offering comprehensive travel insurance coverage, such as trip cancellation/interruption insurance, baggage delay insurance, and rental car insurance.

Are travel cards with annual fees worth it?

YES! Travel cards with annual fees can be worth it if you maximize their benefits and rewards to offset the fee. They often offer lucrative rewards, travel perks like lounge access, travel credits, and insurance protections.

However, it’s essential to assess your spending habits and travel frequency to determine if the benefits outweigh the annual fee.

Do I have to tell my credit card company when I travel?

No, you don’t have to tell your credit card company when you travel. But it’s advisable to inform them about your travel plans to prevent your card from being flagged for suspicious activity when used in unfamiliar locations, reducing the risk of it being declined.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What is the best travel credit card?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The best travel credit card can vary depending on individual preferences and spending habits. Some popular options include the Chase Sapphire Preferred Card, the Capital One Venture X Rewards Credit Card, and the American Express Platinum Card.”

}

},{

“@type”: “Question”,

“name”: “What is considered travel for credit cards?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Travel expenses typically include flights, hotel stays, rental cars, cruises, trains, taxis, and other transportation-related costs.

Additionally, expenses like dining at restaurants while traveling or purchasing tickets for tours or attractions may also qualify as travel expenses on credit cards. It’s crucial to check your card’s terms and conditions for specific details.”

}

},{

“@type”: “Question”,

“name”: “What credit score do you need for a travel credit card?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “You typically need a good to excellent credit score of around 670 or higher to qualify for a travel credit card. Some premium travel cards may require an excellent credit score of 740 or more.”

}

},{

“@type”: “Question”,

“name”: “What is the easiest travel credit card to get?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “In most cases, cash back rewards from credit cards are not considered taxable income by the IRS as they are treated as rebates or discounts rather than income.

Credit cards like the Capital One QuickSilver Rewards Credit Card or entry-level travel cards from issuers like Capital One or Discover are often the easiest travel credit cards to get for individuals with limited or fair credit histories.”

}

},{

“@type”: “Question”,

“name”: “Do travel miles or points expire?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The expiration policies for travel miles and points vary among different credit card issuers. Most credit cards have no expiry dates for earned miles or points as long as the account remains open and in good standing.

However, it’s crucial to review the terms of your specific rewards program to understand how and when your rewards may expire.”

}

},{

“@type”: “Question”,

“name”: “What is the best credit card with travel insurance?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The best credit cards with travel insurance include the Chase Sapphire Preferred Credit Card, Capital One Venture X Rewards Card, and the Platinum Card from American Express.

They are known for offering comprehensive travel insurance coverage, such as trip cancellation/interruption insurance, baggage delay insurance, and rental car insurance.”

}

},{

“@type”: “Question”,

“name”: “Are travel cards with annual fees worth it?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “YES! Travel cards with annual fees can be worth it if you maximize their benefits and rewards to offset the fee. They often offer lucrative rewards, travel perks like lounge access, travel credits, and insurance protections.

However, it’s essential to assess your spending habits and travel frequency to determine if the benefits outweigh the annual fee.”

}

},{

“@type”: “Question”,

“name”: “Do I have to tell my credit card company when I travel?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “No, you don’t have to tell your credit card company when you travel. But it’s advisable to inform them about your travel plans to prevent your card from being flagged for suspicious activity when used in unfamiliar locations, reducing the risk of it being declined.”

}

}]

}

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)