Are you a business owner looking to improve financial management while maximizing your rewards? Capital One Business Credit Cards offer a range of options designed to cater to your specific business needs.

Whether you want cashback, rewards, or building business credit, Capital One provides credit card solutions tailored to various businesses and their unique requirements.

This guide will walk you through the best Capital One business cards available and the process of applying for a Capital One Business Credit Card, helping you take that essential step towards streamlining your business expenses and unlocking valuable rewards.

Best Capital One Business Credit Cards

The Capital One Spark Miles for Business for Business is the best choice for travel lovers as it allows you to earn unlimited premium travel rewards. It also comes with a generous sign-up bonus wherein you get 50,000 miles on spending $4,500 in three months. It also has a $0 Intro APR for the first year. Speaking of rewards, the card offers 5x miles on hotels and rental cars that you book via Capital One Travel and 2x miles on all other purchases. It also lets you transfer those miles to 15-plus travel partners and doesn’t have a foreign transaction fee. Additional perks include a $100 credit for Global Entry or TSA PreCheck, ® no balance transfer fee, and two free visits per year to Capital One Lounge. The Capital One Venture X Business Card is the best choice for small businesses because it is an exceptional charge card that offers elevated travel rewards. It offers unlimited 2X miles on every purchase. There are no caps or limitations. You also earn an extra 10X on hotels and rental cars. The card also lets you earn 5X on flights booked through Capital One Travel. You also earn a whopping 150,000 bonus miles if you spend $30,000 within the first three months of getting the card. It also offers free employee cards and virtual cards and a free accounts payable solution. You also get unlimited complimentary access to Capital One Lounges and over 1300 airport lounges globally in the Partner Lounge Network of Capital One. You can also benefit from complimentary entry for two guests per visit and up to a $100 credit for TSA PreCheck® or Global Entry every four years. The Capital One Spark Cash Select Good Credit is a great option if you want to earn a fixed rate cashback and avoid the hassle of calculating the cashback every month. It is offered to business owners with fair credit scores and has an annual fee of $0. It also offers 5% cashback on hotels and rental cars that you book via Capital One Travel and 1% cashback on other purchases. It also has no foreign transaction fee or balance transfer fee! The Capital One Spark® Cash Select Excellent Credit is meant for business owners who want decent cashback with zero annual fees. It offers a welcome bonus of $500 cash if you spend $4,500 within three months. You also get 5% cashback on hotels and rental cars that you book via Capital One Travel and 1.5% cashback on all other purchases. It doesn’t have a foreign transaction fee or balance transfer fee either. The Capital One CLUB Business Mastercard® card offers a high reward rate and helps you to maximize your savings. It is ideal for Frequent Bass Pro shops and Cabela’s store shoppers and has a $0 annual fee. It helps you get $75 in CLUB Points if you manage to spend $1,000 within 60 days of card acquisition. It also lets you enjoy 5% back in CLUB Points at Bass Pro Shops & Cabela’s, 2.5% back in CLUB Points at participating Cenex® convenience stores, and 1.5% back in CLUB Points on other purchases. You also get to enjoy a price match with 5% less at Bass Pro Shops and Cabela’s and get access to exclusive signature events. It doesn’t have a balance transfer fee or foreign transaction fee either. The Capital One Spark, 1% Classic, is the right choice for business owners who want to build their credit. It allows you to get approved even with a fair credit score, which ranges between 580 and 669. You also get unlimited 1 percent cashback on all purchases. There is no annual fee, and you get an unlimited 5 percent cashback on hotels and rental cars that you book via Capital One Travel.

| Credit card |

Uthrive rating

|

Intro offer | Rewards rate | Annual fee | Learn more |

|---|---|---|---|---|---|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates 2x - 5x Miles |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates 2x-10x Miles |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.5/5

|

Intro Offer bonus_miles |

Reward Rates 1% - 5% cashback |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.5/5

|

Intro Offer bonus_miles |

Reward Rates 2% Cash back |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.3/5

|

Intro Offer - |

Reward Rates 1% - 5% Cash back |

Annual Fees $0 |

|

|

Terms Apply |

Rating

4.2/5

|

Intro Offer - |

Reward Rates 1% cash back |

Annual Fees $0 |

Capital One Business Credit Card Requirements

When seeking a Capital One Business Credit Card, you need to know that there are some limits you need to remember. First is that you will only be approved for a Capital One issued card once every six months. All the Capital One business cards you own will appear on your personal credit report. So, they will add to the Chase 5/24 count. Though there is a limit to having two personal credit cards at a time, this doesn’t apply to Capital One business cards or co-branded cards. You may need to share business details and your personal details for verification purposes when you apply. You might need to provide your personal or business credit score details as well.

Capital One Business Credit Card Rewards

When you sign up with Capital One Business Credit cards, you can be eligible for various cashback, travel rewards and perks.

They make travel easy, efficient, and very cost-effective.

Capital One Business Credit Cards offer a diverse array of rewards programs designed to cater to the specific needs of businesses.

These credit cards are renowned for their generous rewards, making them a prime choice for businesses looking to maximize their benefits.

For example, the Capital One Spark Cash Plus Credit Card provides unlimited 2% cash back on all purchases, an excellent option for businesses seeking straightforward cash rewards.

Additionally, Capital One business cards often come with impressive introductory bonuses that further enhance their reward potential.

Whether it’s cash back, travel miles, or other perks, Capital One business credit cards are a valuable tool for businesses to earn rewards on their spending while managing their finances effectively.

Capital One Business Credit Card Offers

Each card comes with different capital one business credit card offers like a Welcome Bonus, Intro APR offer, and many others.

These offers further help you to maximize your savings. Some cards also have annual, or anniversary offers.

They also vary from one card to the other. So, read about them thoroughly before applying for a card so that you get the maximum benefit.

Benefits of Capital One Business Credit Cards

There are numerous benefits of Capital One Business Credit Cards. Some of them are:

-

Account and Business Management

Account and Business ManagementAs a Capital One business credit card holder, you will get access to different business tools that can help you manage a business well.

Examples include automatic payments, setting up recurring transactions, paying vendors by card, getting year-end financial summaries, etc.

-

Travel Benefits & Bonus Travel Rewards

Travel Benefits & Bonus Travel RewardsWhen you own Capital One Business Credit Cards, you will get a higher cash back rate when booking hotels and rental cars through Capital One Travel.

Other benefits you can get as the owner of Capital One Business Credit Cards include miles transfers to more than 15 travel partners, redeeming your miles for travel, Capital One lounge access, Statement credit for Global Entry or TSA PreCheck, and zero foreign exchange fees.

-

QuickBooks Integration

QuickBooks IntegrationWhen you own Capital One Business Credit Cards, you can integrate the same seamlessly with business management software programs like QuickBooks, Quicken, and Excel.

-

Flexible Bill Payments

Flexible Bill PaymentsWith Capital One Business Credit Cards, you can pick your own monthly due date and have more control over your finances.

How to Apply for a Capital One Business Credit Card?

When you are applying for Capital One Business Credit Cards, you need to follow these steps:

-

Share your email address and business information like business name (or your name if you are the sole proprietor), and provide your business tax identification number (or your Social Security Number)

-

You also need to select the “Business ownership type,” which is usually privately owned.

Then, you have to select the “Industry type” and specify the business activities by “Category” and “Specialty.” After that, you need to share the Annual business revenue.

-

The next step is to choose your own role or title in the business (like partner or owner). Then, you need to specify your total annual income. The final step is to specify whether you want blank checks for cash advances or not.

-

That’s it! You are done with the process. It will hardly take more than ten minutes if you have everything handy beforehand and you can expect the approval within 60 seconds

How to Choose the Right Capital One Business Credit Card for You?

If you want to get one or more Capital One Business Credit Cards, you need to decide which one is the right one for you, as there are plenty of options.

Use the following to decide.

-

Credit Score

Credit ScoreYour credit history matters when picking a credit score. If you have a good credit score, pick a card that’s available to people with a good credit score.

If you have an excellent credit score, pick one that’s offered only to people/businesses with an excellent credit score.

-

Travel Vs. Cashback

Travel Vs. CashbackMost Capital One Business Credit Cards offer travel-related benefits, and many offer cashback offers.

You need to pick which one is essential for you based on how much you spend or travel in a month or year.

-

Annual Fee

Annual FeeYou need to look at the annual fee of the credit cards you like and ensure that you can offset the fees with the benefits/perks/rewards.

A credit card should not cost more than the benefits it offers.

-

Welcome Bonus

Welcome BonusMany Capital One Business Credit Cards offer a generous welcome offer with simple terms like you need to spend a few thousand dollars within the first few months.

So, sign up for a card wherein you can meet that requirement and avail the generous offer.

-

Rewards

RewardsYou need to look at the rewards being offered and decide how you can use them in the future when picking the best one among Capital One Business Credit Cards.

-

Introductory APR

Introductory APRCredit cards with an intro APR of 0% are a good choice and should be considered as they allow you to transfer a balance or finance a purchase over time using the credit card easily.

So, don’t forget it when getting a business credit card.

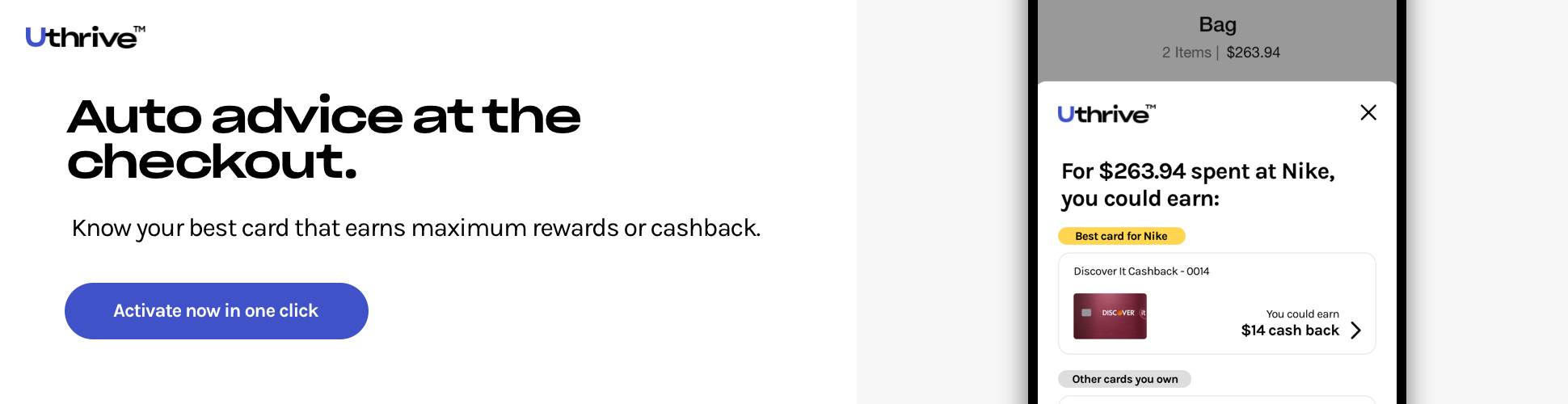

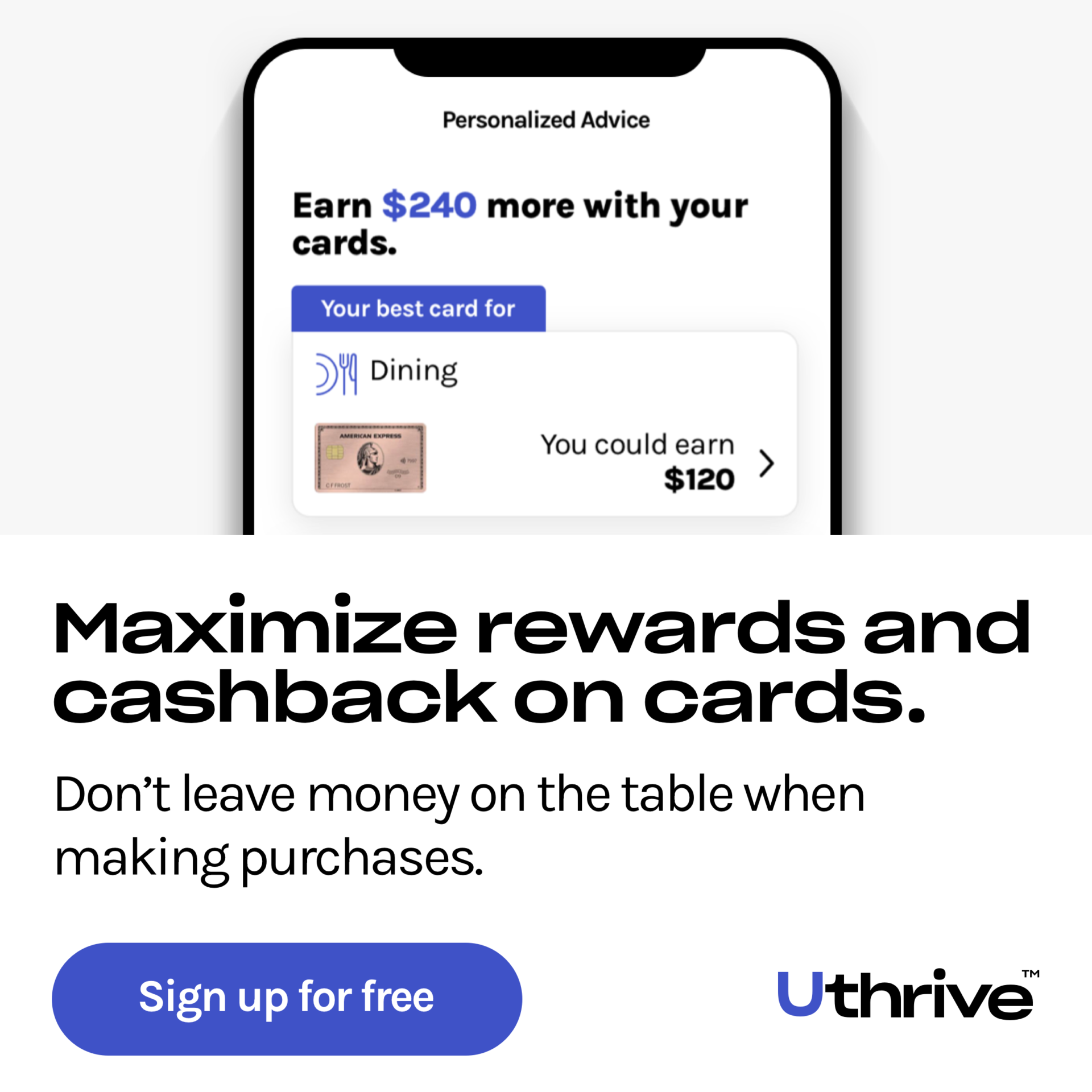

Why track your Capital One Rewards with Uthrive?

Tracking your Capital One Rewards with Uthrive is an intelligent move for anyone looking to make the most of their credit card benefits.

Uthrive acts as a personal credit card manager, guiding you on which card to use for specific purchases, ensuring you maximize your savings and cash back effortlessly!

With its user-friendly interface, you can easily track rewards and cash back without the need to keep tabs on individual credit card benefits.

Uthrive also provides alerts for missed rewards, safeguarding your hard-earned perks.

It will unlock a seamless way to enhance your credit card experience and maximize your financial benefits- with a secure and safe platform with bank-level encryption.

Moreover, Uthrive’s wide coverage extends to all major credit cards and ensures savings across leading airlines and hotels.

Conclusion

All in all, it can be said that Capital One Business Credit Cards are a good option for small business owners.

Applying for them and getting approved is easy if you have a decent credit score.

The rewards, benefits, and perks are also attractive and usually offset the annual fee.

So, you can easily pick a Capital One Business Credit Card and use it to manage your finances better. Good luck!

Capital One Business Credit Cards FAQs

What benefits do all Capital One business credit cards share?

All Capital One Business credit cards come with $0 foreign transaction fees, online account management services, various business benefits like expense tracking and purchase records, $0 fraud liability, and 24/7 customer service.

What are the application requirements for Capital One business credit cards?

To apply for a Capital One Business Credit card, you need to provide the personal information of the business owner, like name, address, SS number, etc., and business information, like name, address, and tax identification number.

How long does it take to apply for a Capital One business credit card?

In most cases, the Capital One small business credit card application process will take about 10 minutes, and the decision will be made in a few seconds.

Does Capital One have a secured business credit card?

Not yet. The Capital One Platinum Secured Credit Card is a secure personal credit card.

Does Capital One offer virtual cards?

Yes! Capital One offers virtual cards for better payment security, ease of use, and smooth management of your purchases.

Do I need to provide a personal guarantee for a Capital One business credit card?

Yes, it is mandatory. You need to be personally liable for the debts of your business in case your business cannot pay them.

What credit score do I need to apply for a Capital One business card?

You need to have an excellent credit score to get most Capital One business credit cards.

Your FICO score must be higher than 740.

Only Spark Cash Select for Good Credit is available to those with good credit, and the Spark 1% Classic is available to those with fair credit.

Which Capital One business credit card is the best for my business?

The answer depends on your business, its spending patterns, and the rewards, benefits, and APR you need.

The Capital One Spark Cash Plus is Best for Cashback Rewards, and the Capital One Spark Classic for Business – is Best for High Reward Rate.

Do I need good personal credit to get a business credit card?

Yes, you need good personal credit if you have a small business.

Once your business has sufficient income and assets, you might get a business credit card without the need to offer your personal credit details.

How is a business credit card different from a personal credit card?

Business credit cards are distinct from personal credit cards as they cater to business expenses designed for business owners and employees.

They offer business-related benefits like- expense tracking, customizable employee spending limits, and tailored rewards programs.

Personal credit cards, in contrast, target individual needs, offering benefits like cashback and travel rewards, primarily for personal expenses.

Do Capital One business credit cards charge an annual fee?

Yes, many Capital One business cards charge an annual fee. The Capital One Spark Cash Plus, for instance, has an annual fee of $150.

Does Capital One business card report to personal credit?

Yes, Capital One reports your business credit card activity to both personal and business credit bureaus.

This means that the way you manage your business credit card can have an impact on both your personal and business credit profiles.

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)