Capital One Miles is a versatile and rewarding loyalty program allowing cardholders to earn and redeem miles for several travel and non-travel benefits.

Whether you’re a frequent traveler looking to maximize your rewards or someone seeking flexible redemption options, understanding Capital One Miles can open up a world of possibilities.

What makes Capital One Rewards particularly appealing is its remarkable simplicity. With the right credit card, a customer can simplify their wallet by relying on a single card while still enjoying substantial rewards and a diverse array of redemption possibilities.

This flexibility makes it one of the best credit card programs.

If you’re eager to discover how to earn and redeem Capital One Miles to unlock remarkable travel experiences, this guide provides everything you need to kickstart your journey.

What are Capital One Miles Rewards?

Capital One Miles Rewards is a type of loyalty currency Capital One offers its users. The rewards program is branded as ‘miles,’ different from traditional airline miles acquired through flying. These miles are earned by using Capital One credit cards and are redeemable for a wide range of expenses.

Depending on your Capital One card, these miles can serve multiple purposes, and each credit card features its unique earning structure. It is known for its versatility, allowing cardholders to redeem miles with various partners or simply use them to offset everyday purchases.

Capital One Miles are valuable because they provide a gateway to affordable travel and other desirable perks, making them a popular choice among savvy consumers.

How do Capital One Miles Rewards Work?

The Capital One Miles Rewards program works on a pretty straightforward basis. For every dollar spent on eligible purchases with a Capital One credit card, cardholders earn a specific number of miles. These rewards accumulate in your account until you decide to utilize them.

Cardholders can use them for travel expenses, statement credits, gift cards, or even transfer them to partner airlines and hotels.

This enhances their value, as you’re not obligated to commit to a single type of reward in advance, granting you the freedom to choose your preferences at any given time. The ease of earning and redeeming makes Capital One Miles accessible and appealing to many consumers.

Who is the Capital One miles program best for?

The Capital One Rewards program is exceptionally well-suited for a broad spectrum of individuals. It caters to frequent travelers seeking flexibility and a wide range of redemption options. Moreover, it benefits everyday spenders, providing a consistent means of accumulating rewards on routine purchases.

Business owners can also reap the rewards through business-specific Capital One credit cards. Furthermore, the program’s simplicity and lack of foreign transaction fees make it ideal for international travelers.

Ultimately, Capital One Miles appeals to those who value versatility and the wish to maximize their rewards, regardless of their spending habits or travel preferences.

How to Earn Capital One Miles?

Earning Capital One Miles can be a rewarding experience, providing you with the means to unlock exciting travel adventures and more. Let’s explore the various methods to accumulate Capital One Miles.

Through Capital One Credit Cards

Capital One extends a diverse portfolio of credit cards, including both personal and business options.

Across the board, these cards feature a streamlined earning system with enhanced rates for travel bookings via Capital One Travel.

What sets these cards apart is their consistent ability to earn more than one mile for every dollar spent in non-bonus categories, placing them ahead of their competitive counterparts.

Whether you’re a frequent traveler, a business owner, or someone who enjoys versatile rewards, there’s likely a Capital One card that suits your needs. Here are some noteworthy options:

PERSONAL CREDIT CARDS

- Capital One Venture X Rewards Credit Card

It stands out as a premier travel credit card to earn Capital One Miles due to its generous rewards, versatile redemption options, and valuable perks. The Capital One Venture X Rewards Card offers a substantial welcome bonus of 75,000 miles and 2X miles per dollar spent on all purchases, making it easy to accumulate miles quickly.Sign-Up Offer Rewards Rate Annual Fee Earn 75,000 bonus miles after spending $4,000 on purchases within the first three months.

– 10X miles on hotels & rental cars booked through Capital One Travel

– 5X miles on flights booked through Capital One Travel

– 2X miles on all other purchases

$395

The perks include a $300 annual travel credit for bookings through Capital One and a $100 credit for Global Entry or TSA PreCheck application fees.

Cardholders also gain access to Capital One and Priority Pass Select lounges and receive an annual bonus of 10,000 miles on their account anniversary.

- Capital One VentureOne Rewards Credit Card

This is a valuable choice for travelers seeking robust rewards & travel benefits, offering a compelling rewards structure and a one-time bonus of 75,000 miles. The Capital One Venture Rewards Card includes two complimentary airport lounge visits, valid at Capital One lounges and partner lounges.Sign-Up Offer Rewards Rate Annual Fee Earn 75,000 bonus miles on spending $4,000 on purchases in the initial three months.

– Unlimited 2X miles per dollar on every purchase

– Earn 5X miles on hotels and rental cars booked through Capital One Travel

$95

Cardholders enjoy up to $100 credit towards Global Entry or TSA PreCheck application fees, access to Capital One Entertainment that offers exclusive events, a Lifestyle Collection with a $50 experience credit to indulge in various activities, and Capital One Dining for reservations at sought-after restaurants, enhancing your culinary adventures.

- Capital One VentureOne Rewards Credit Card

It serves as an introductory-level travel rewards card, allowing new users to earn 20,000 miles along with an unlimited 1.25 miles per dollar spent. The Capital One VentureOne Rewards Credit Card also boasts a 0% introductory period of 15 months for both new purchases and balance transfers.Sign-Up Offer Rewards Rate Annual Fee Earn 20,000 bonus miles after you spend $500 within the first three months.

– 5X miles on flights booked through Capital One Travel

– 1.25X miles on all other purchases

$0

Remarkably, this card carries no annual fee and offers an array of valuable perks and benefits, including Capital One Entertainment, Travel Insurance, extended warranty protection, and Capital One Dining.

The card shines with its ability to transfer miles to 15+ hotel and airline loyalty programs, amplifying the versatility of rewards.

BUSINESS CREDIT CARDS

- Capital One Spark Miles for Business

With this card, new applicants can earn a generous bonus of 50,000 miles (equivalent to $500 in travel) along with unlimited double miles for every dollar spent on all other purchases. The Capital One Spark Miles for Business card provides travel accident insurance and an auto rental collision damage waiver.Sign-Up Offer Rewards Rate Annual Fee Earn a bonus of 50,000 miles once you spend $4,500 in the first three months of account opening.

– 5X miles on flights booked through Capital One Travel

– 2X miles on all other purchases for your business

$95 (waived for first year)

The card enhances your travel experience with a $100 credit for Global Entry or TSA PreCheck, access to Capital One Lounge with two free annual visits, and flexibility to transfer miles to partners.

Furthermore, it boasts a $0 annual fee for the first year, no foreign transaction fees, and a $0 Fraud Liability policy, making it a well-rounded option for businesses on the go.

- Capital One Venture X Business

The Capital One Venture X Business Card is the ultimate companion for savvy travelers and business owners. It comes with a $300 annual credit for bookings made through the Capital One Travel portal, robust business management tools, and a generous 10,000 bonus miles every year after your account anniversary date.Sign-Up Offer Rewards Rate Annual Fee Earn 150,000 bonus miles once you spend $30,000 on purchases within the first three months

– 10X miles on each dollar spent on hotels and rental cars book through Capital One Travel

– 5X miles every dollar on flights book through Capital One Travel

– Unlimited 2X miles on every purchase

$395

The card also has no foreign transaction fees, Priority Pass membership, a $100 statement credit for Global Entry or TSA PreCheck, a $300 annual travel credit, and access to Capital One Lounges for free.

Redeem your miles without blackout dates on flights, hotels, and vacation rentals, or transfer them to over 15 travel loyalty programs for maximum value.

With eligible credit card spending

Earning Capital One Miles is as simple as using your Capital One credit card for everyday expenses.

Many cards offer a base earning rate of 2X or 1.5X miles on every dollar spent on all purchases, providing a consistent way to accumulate miles.

Some cards like Capital One Savor Cash Rewards Card come with bonus categories, such as dining, travel, or gas, where you can earn additional miles for every dollar spent.

This can significantly boost your rewards balance, especially if you frequently make purchases in these categories.

Credit Card Welcome Bonus

One of the fastest ways to accumulate a good number of Capital One Miles Rewards is by taking advantage of credit card welcome bonuses.

These bonuses typically require spending a certain amount within the first few months of card membership.

In return, you can earn significant bonus miles. These bonuses can range from 50,000 to 100,000 miles or more, depending on the card and the ongoing promotions.

Meeting the spending requirement for the welcome offer can provide a substantial head start on your miles total.

By adding an authorized user

Many Capital One credit cards present an excellent opportunity to earn additional miles by adding an authorized user to your account.

This feature helps meet spending thresholds and is particularly beneficial for those who share expenses with a spouse, family members, or employees needing company card access.

By adding an authorized user, you can earn capital one mile on their eligible purchases, contributing to a faster accumulation of rewards from everyday expenditures.

Earn Capital One Miles by Referring a Friend

Capital One often runs referral programs that enable cardholders to earn bonus miles by referring friends or family members.

You’ll receive a set number of bonus miles for each approved referral, and there’s often a cap on the number of miles you can earn through referrals.

Keep an eye out for referral promotions to maximize your earnings.

To determine your eligibility and referral rewards, log in to your account.

| Credit card |

Uthrive rating

|

Intro offer | Rewards rate | Annual fee | Learn more |

|---|---|---|---|---|---|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates 2- 5 Miles per dollar |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates 2- 5 Miles per dollar |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.6/5

|

Intro Offer bonus_miles |

Reward Rates 1.25 Miles per dollar on every purchase, every day |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates Earn a one-time bonus of 50,000 miles |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles |

Reward Rates 2 - 10 Miles per dollar |

Annual Fees annual_fees |

How much are Capital One Miles worth?

The value of Capital One Miles can vary depending on how you choose to redeem them. On average, each mile is typically worth around 1 cent when redeemed for travel expenses.

However, their value can increase significantly when transferred to partner airlines and hotels, especially when booking premium-class flights or luxury accommodations.

For example, when you convert your Capital One Miles into partner airlines such as Emirates or Singapore Airlines, you open the door to reserving first-class or business-class flights that might be excessively priced if purchased with cash. This flexibility in how you can redeem your miles helps maximize your rewards’ benefits.

How to use Capital One Miles?

The real fun begins when you start using your Capital One Miles! These versatile rewards can be redeemed in various ways, offering you flexibility and value. Here’s a breakdown of how to maximize your Capital One rewards.

-

Capital One Transfer Partners:

One of the most valuable ways to use your Capital One Miles is by transferring them to partner airlines and hotel loyalty programs.

Capital One has a growing list of transfer partners, including 14 major airlines like Emirates and Singapore Airlines & four hotels.

By doing so, you can unlock the potential to book flights, hotel stays, and even luxurious experiences that might otherwise be out of reach when using traditional mileage programs.

Several well-known hotel & airline loyalty programs provide numerous choices for redeeming your Capital One miles. Here are a few options to consider.

Partner Transfer ratio (Partner:Capital One Miles) Turkish Airlines

1:1

Flying Blue (Air France-KLM)

1:1

Avianca LifeMiles

1:1

Etihad

1:1

Accor Live Limitless

2:1

Wyndham Rewards

1:1

-

Book Travel through the Capital One Travel Portal

Capital One offers a user-friendly travel portal where you can redeem your miles to book flights, hotels, rental cars, and more. When you use your Capital One Miles to book travel through this platform, each mile is worth one cent.

It’s not tied to specific airlines or hotels, so you can flexibly choose from various options.

What makes this option more appealing is their lack of blackout dates, smooth process, and the wide range of airlines and hotels available. Your miles act as a currency to pay for your travel expenses, allowing you to plan your trips easily.

-

Redeem for Cash Back or Gift Cards

If you prefer cash back or gift cards, the Capital One rewards program allows you to redeem your miles for statement credits or gift cards for popular retailers & brands like Best Buy, DoorDash, and Starbucks.

This can be a convenient way to offset everyday expenses or treat yourself to some retail therapy while utilizing the rewards you’ve earned through your Capital One credit card.

-

Erase travel purchases from your credit card bill

With the “Purchase Eraser” feature, you can redeem your Capital One Miles to offset eligible travel purchases made on your Capital One card.

This means you can effectively eliminate travel-related expenses from your billing statement, saving money and making your trips even more affordable.

-

Redeem for PayPal or Amazon shopping

You can link your PayPal or Amazon account with a Capital One credit card and utilize your miles to cover purchases.

However, the value per mile redeemed will be 0.8 cents. Capital One’s reward program also allows you to apply points toward purchases at Amazon.com.

PayPal enables you to use rewards for payments when purchasing through various online retailers or service providers. This provides a seamless and convenient way to use your miles for everyday shopping needs, from electronics to household items.

-

Get Exclusive Event Tickets

Capital One provides cardholders access to exclusive events and entertainment experiences through the Capital One Entertainment portal.

You can use your miles to secure tickets to concerts, sports events, and other live performances.

This unique feature allows you to enjoy memorable experiences beyond travel and shopping, making your Capital One Miles more versatile.

Check entertainment.capitalone.com or your Capital One mobile app regularly for exciting event opportunities.

What you need to know about earning and redeeming Capital One Miles?

Earning and redeeming Capital One Miles offers cardholders an array of opportunities to maximize their rewards. It’s essential to stay informed about special promotions and partner offers that can help you accumulate miles faster.

You don’t have to juggle intricate category bonuses and won’t encounter any limitations on your earnings potential. An added convenience is that miles are posted to your account as soon as you earn them instead of waiting until the end of your billing cycle. This simplicity makes managing your rewards hassle-free.

Remember that the best strategy for earning and redeeming Capital One Miles depends on your goals and travel preferences. Whether you’re looking to save on flights, treat yourself to a luxury getaway, or offset everyday expenses!

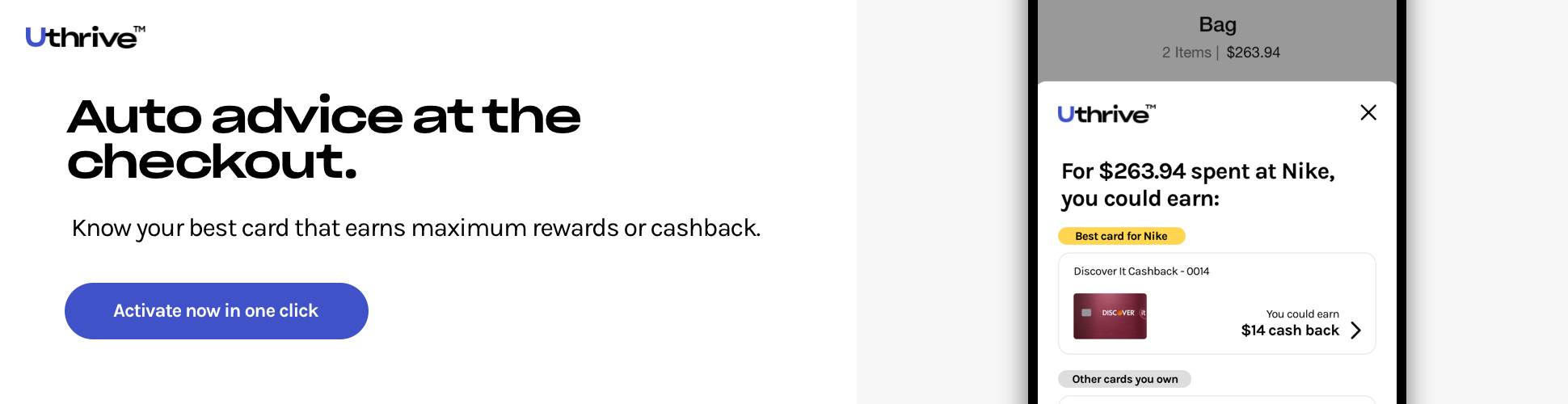

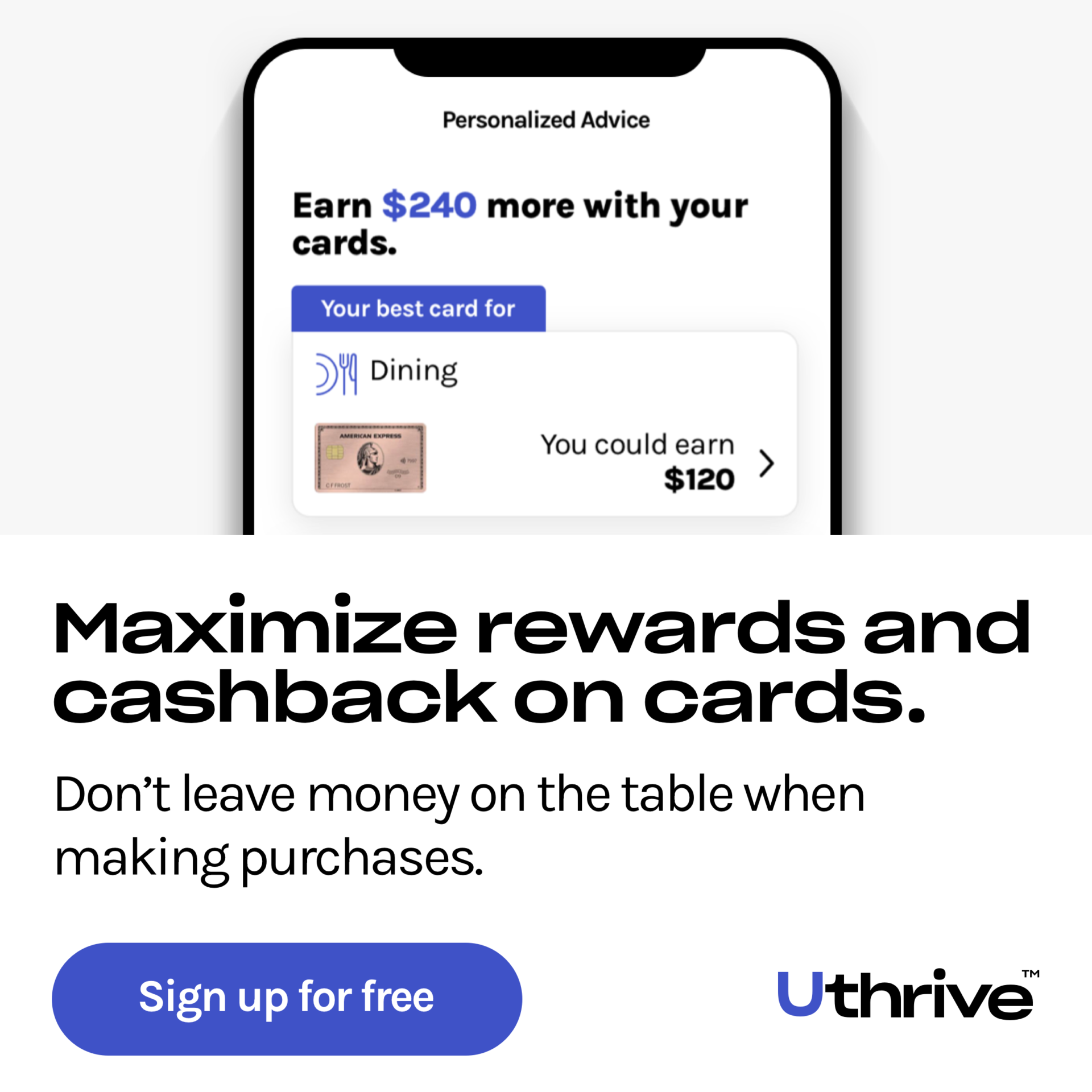

Why Track your Capital One Miles Rewards with Uthrive?

Tracking your Capital One Miles Rewards with Uthrive or Uthrive Premium offers several compelling benefits. First, it helps you maximize your rewards and savings potential by providing a user-friendly interface to track rewards and cashback.

Additionally, Uthrive assists you in identifying the best credit card to use for each purchase, whether you’re shopping in-store or online, ensuring you optimize your rewards at millions of merchants.

It even sends alerts when you’re missing out on potential rewards to ensure you always make informed decisions.

Overall, Uthrive empowers you to make the most of your credit card rewards, saving you hundreds of dollars and enhancing the value of your everyday purchases.

FAQ

Do Capital One miles expire?

No, Capital One miles do not expire as long as your Capital One credit card account remains open and in good standing.

How do I convert Capital One points to dollars?

Log In to your Capital One account and go to the rewards section. There, you can exchange your rewards for either a check or a statement credit. This redemption option offers a value of only 0.5 cents per mile redeemed.

How much are 50,000 Capital One points worth?

The value you get from your points depends on your redemption method. The 50,000 miles redeemed for cash will equal only $250, whereas the value increases to $400 – $500 when used for gift cards.

Redeeming the same points through Capital One Travel or paying for other travel reservations provides 1.0 cents per mile, equating to $500.

How should I redeem Capital One Rewards?

The most valuable ways to use your Capital One Miles is by transferring them to partner airlines and hotel loyalty programs

How do I use my Capital One shopping rewards?

To use your Capital One shopping rewards, log in to your Capital One account, navigate to the rewards section, and follow the instructions to redeem your rewards for various options, such as statement credits, gift cards, travel reservations, etc.

Where can I use my Capital One Rewards?

You can use your Capital One Rewards for various options, including travel bookings, gift cards, statement credits, transferring to partner loyalty programs, and more.

How do I get my Capital One Rewards miles?

You can earn Capital One Rewards miles by using your Capital One credit card for eligible purchases. Miles are typically credited to your account after a few days of transaction instead of each billing cycle.

How much is 20,000 reward miles for Capital One?

The value of 20,000 Capital One reward miles can vary depending on how you redeem them. In general, 20,000 Capital One miles are worth $200 when redeemed for travel purchases, such as flights or hotel bookings, through the Capital One Travel Center.

How can you receive cash back for Capital One Rewards?

To receive cash back for Capital One Rewards, log in to your Capital One account, go to the rewards section, and choose the option to redeem your rewards for a statement credit.

This will apply the cashback to your credit card account, reducing your outstanding balance.

What airlines can you use Capital One miles for?

Capital One miles can be used for a total of 14 airlines, including Air Canada Aeroplan, Air France-KLM, Avianca LifeMiles, Emirates, Singapore Airlines KrisFlyer, and Turkish Airlines Miles&Smiles.

Can you share miles with friends and family members?

Yes, you can share Capital One miles with friends and family members by transferring them to their accounts without any cost, provided they have a Capital One miles-earning account.

How many Capital One miles do you need for a flight?

You’ll require 100 Capital One miles for every dollar of flight cost, with each mile having a value of one cent when used for travel. Therefore, if your flight costs $200, you’ll need 20,000 miles for redemption.

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)