In modern finance, credit card rewards programs have become indispensable tools for consumers.

These programs offer an enticing array of benefits, from earning cash back on everyday purchases to accumulating miles for your next vacation.

Choosing the best rewards credit card can significantly impact your financial well-being.

However, with the number of options available, selecting the right rewards credit card can be a daunting task.

In this comprehensive guide, we will delve into credit card rewards programs, what credit card has the best rewards program, types of rewards, and provide tips on maximizing their benefits.

What is a credit card rewards program?

A credit card rewards program is an ingenious system that incentivizes cardholders to use their credit cards for purchases by offering them various benefits.

These incentives typically come in the form of cashback, reward points, miles, or other perks, depending on the specific program. It turns your day-to-day spending into a rewarding experience.

Rewards earned can be redeemed for travel, merchandise, gift cards, statement credits, or even charitable donations. Wondering how are credit card rewards programs defined? Well, they are defined by their structure and the types of rewards they offer.

These programs can vary significantly among credit card issuers and card types.

What is a rewards credit card?

A rewards credit card is your gateway to the world of rewards programs. This type of credit card is part of a rewards program.

Reward cards allow cardholders to earn rewards, such as cashback, points, or miles, based on their spending habits and other card-specific features.

These cards typically fall into two categories:

These cards provide a consistent rewards rate on all purchases, regardless of the purchase category. Some rewards cards offer higher earning rates on specific spending categories, like dining, groceries, or travel.

Apart from accumulating valuable rewards, you can even enjoy various credit card perks like access to airport lounges, extending warranty protection, travel insurance benefits, concierge service & more.

These perks can vary between cards, so it’s essential to review the details of the card.

Best Credit Cards Rewards Programs

Each credit card rewards program has its unique strengths and appeal.

To truly unlock the best rewards for your spending habits and financial goals, it’s essential to understand what each program excels at. Let’s explore the top 6 credit card rewards programs.

American Express Membership Rewards

The American Express Membership Rewards program is ideal for those who want to earn reward points.

With American Express, you can accumulate Membership Rewards points for various purchases and redeem them for travel bookings, shopping, gift cards, and even statement credits.

It stands out as the go-to choice for those seeking versatile & high-value reward points.

American Express Membership Rewards is renowned for its extensive lineup of cards, catering to a diverse range of preferences.

Whether you’re a frequent traveler, a foodie, or someone who prefers cashback, an Amex card will likely suit you.

Plus, American Express often runs lucrative promotions & partnerships that boost the value of your points, including transfer bonuses to airline and hotel partners.

The Amex rewards program has robust transfer partners, including major airlines and hotel chains.

Overall, the combination of flexibility, variety, promotions, and transfer options makes it one of the best rewards programs available to credit card users.

Best American Express Membership Rewards Credit Cards: American Express Gold Card, The Platinum Card from American Express, Blue Business Plus card

Chase Ultimate Rewards

The Chase Ultimate Rewards often considered one of the best rewards programs because it excels in versatility. Chase is perfect for those who want multiple earning and redeeming options.

You can earn points on a wide range of purchases. This flexibility allows cardholders to choose how they want to use their rewards.

Chase Ultimate Rewards Program has a robust list of transfer partners, including major airlines & hotel chains.

You can transfer your points to these loyalty programs at 1:1, potentially unlocking higher redemption values for flights and hotel stays.

When booking travel through the Chase Ultimate Rewards portal, points are worth 25% more.

It offers substantial sign-up bonuses for its credit cards, allowing cardholders to earn significant points upfront.

Chase cards often offer bonus categories, allowing cardholders to earn extra points on everyday spending, such as dining, travel, and more.

Best Chase Ultimate Rewards Reward Credit Cards: Chase Freedom Unlimited, Chase Sapphire Preferred Card, Chase Ink Business Preferred Card.

Capital One Miles

The Capital One Miles program is designed for frequent travelers. Capital One Miles is synonymous with flexibility and simplicity. You can earn miles on all purchases and there are no blackout dates.

Capital One has established partnerships with several airlines and hotel chains, enabling you to transfer your miles to these loyalty programs.

The Capital One Miles rewards program is user-friendly and earns miles quickly. Cardholders can redeem miles for various travel-related expenses, including flights, hotels, rental cars, and vacation packages.

The Capital One cards offer incredible value for those frequently on the move.

Capital One cards often provide a flat-rate earning structure, no foreign transaction fees, and additional travel benefits like travel insurance, rental car coverage, and concierge services.

It is a top choice for many who want hassle-free travel rewards.

Best Capital One Miles Credit Cards: Capital One Venture Rewards Credit Card, Capital One Venture X Rewards Credit Card, Capital One Spark Miles Business Card.

Bank of America Travel Rewards

The Bank of America Travel Rewards is the ultimate choice for travel enthusiasts. With the Bank of America Travel Rewards program, you can earn flexible points on everyday purchases and use them to offset several travel expenses.

Their cards make exploring the world more accessible and rewarding.

Cardholders can redeem their points for various travel expenses, including flights, hotels, car rentals, cruises, etc. This versatility allows you to use your rewards for the type of travel that suits your needs.

Unlike other travel rewards programs, Bank of America Travel Rewards doesn’t have blackout dates or restrictions on available flights or hotels.

For travelers who frequently go abroad, this card is particularly appealing. It doesn’t charge foreign transaction fees, which can help you save on international purchases.

You can earn a flat rate of rewards on all purchases with no rotating categories or complicated reward structures to keep track of.

Best Bank of America Travel Rewards Reward Credit Cards: Bank of America Travel Rewards Credit Card, Bank of America Premium Rewards Credit Card, Bank of America Customized Cash Rewards Credit Card.

Citi ThankYou Rewards

The Citi ThankYou Rewards program is excellent for individuals with multiple Citi rewards cards, as Citi ThankYou Rewards is the master of synergy.

You can pool your ThankYou points from various cards into one account, maximizing your rewards and flexibility when redeeming them.

Citi offers many credit cards that earn ThankYou Points. This diversity allows users to choose a card that caters to their lifestyle.

Citi ThankYou Points can be transferred to various airline loyalty programs, providing great value when redeeming for flights & hotel stays.

ThankYou Points can be redeemed for various options, including travel, gift cards, merchandise, statement credits, and charitable donations.

The Citi ThankYou Rewards program is admired for many reasons, like generous sign-up bonuses & valuable travel benefits, making it a preferred choice for many individuals.

Best Citi ThankYou Rewards Credit Cards: Citi Rewards+ Card, Citi Premier Card, Citi Double Cash Card.

Discover It Miles

With Discover It Miles program, you earn miles on every purchase. Discover even matches your miles at the end of your first year, making it a fantastic choice for those new to credit cards or looking to maximize their rewards in the first year.

The program complements the Discover It card’s features seamlessly.

Discover it Miles offers a straightforward rewards system. Cardholders earn 1.5 miles for every dollar spent on all purchases, making it easy to accumulate rewards without any complexity.

It offers a unique benefit to new cardholders where they will match all the miles at the end of the first year, doubling the rewards.

The Discover it Miles card comes with no annual fee and an introductory 0% APR period for purchases, making it a cost-effective choice for those looking to earn rewards without additional expenses.

Cardholders can redeem miles for various travel expenses and receive free access to their FICO Credit Score.

Best Discover It Miles Credit Cards: Discover it Miles, Discover it Cash Back, Discover it Secured Card.

Types of rewards credit card

Rewards credit cards for consumers mainly come in three types: cash back, points, and miles.

Cardholders can choose the one that aligns best with their spending habits and goals.

These cards offer a straightforward reward system. When you make purchases, you receive a percentage of your spending back in cash. You can pick between: flat-rate and rotating bonus cashback cards. It’s like getting a small refund every time you shop. With these cards, you earn points for every dollar spent, and you can redeem them for various rewards. The base rate is often one point per dollar. The value of these points can vary depending on the credit card issuer, the type of purchase, and how you choose to use your points. These cards are associated with airlines and offer miles for your spending. The more you spend, the more miles you accumulate. For instance, the Southwest rapid rewards plus card allows you to earn miles that can be used for free flights or seat upgrades.

![]()

![]()

![]()

How do rewards credit cards work?

They operate on a simple principle: the more you use the card, the more benefits you earn. Rewards credit cards give you a certain number of points, miles, or cash back for each eligible purchase you make using the card.

These rewards accumulate over time and can be redeemed based on the terms of your rewards program.

Issuers use rewards to encourage cardholder loyalty. Some cards offer bonus rewards in specific spending categories, allowing you to maximize your benefits in areas like dining, groceries, or travel.

It’s essential to understand the rewards structure of your card, earning limits & expiration dates on rewards, to make the most of your card.

How to choose the best rewards credit card?

You’re not alone if you’re overwhelmed by the number of credit card options available. Consider the following factors to navigate your way to the best rewards card:

Start by comparing the rewards programs offered by different credit cards. Look for a program that aligns with your spending habits & preferences. Understand the types of rewards—cash back, points, or miles. Identify which cards can maximize your rewards based on your lifestyle. Analyze your spending patterns to estimate how much you could earn with a particular card. Some cards offer flat-rate rewards while others give bonus category rewards, so make sure they match your regular expenses. Many rewards cards lure new users with attractive sign-up bonuses. It significantly boosts your rewards balance when you meet a spending requirement within the specified time frame. Track your expenditures to reach these thresholds. Evaluate the value of the card’s rewards currency (points/miles), as some programs may offer more flexibility or higher redemption values than others (like Chase Ultimate Rewards portal). Some cards also allow point transfers to partner programs, enhancing their versatility. Keep in mind that many rewards cards come with annual fees. While some cards offer valuable rewards that justify the fee, others may not be so cost-effective. Find out whether the benefits outweigh the cost based on your expected rewards or not! Look beyond rewards and consider additional cardholder perks. These include travel insurance, purchase protection, airport lounge access, and concierge services. Choose a card that offers benefits you’ll actually use.

How to redeem credit card rewards?

After making a purchase, everyone is excited to redeem their rewards. However, it’s essential to remember that rewards can take one to two billing cycles to appear in your account.

Most card issuers provide user-friendly rewards portals within your account to view & redeem your credit card rewards.

Just log in, go to the rewards section, and there you’ll find your rewards balance and various redemption options to explore. Depending on your preferences and goals, select the redemption method that suits you best.

If you value cash back, opt for statement credits or direct deposits to your bank account. Travel enthusiasts may find it advantageous to redeem for flights, hotel stays, or car rentals, with the added benefit of travel insurance.

Always calculate the value of your rewards before redeeming them. The worth of your rewards can vary depending on your redemption choices.

To maximize your rewards, strive for a 1:1 value conversion. Several credit cards even provide higher redemption values when used for travel bookings through the issuer’s portal.

Once you’ve decided on your preferred redemption method, follow the issuer’s instructions to initiate the redemption and carefully review everything to ensure accuracy.

The processing time for credit card reward redemptions depends on the issuer and the chosen method.

How to maximize credit card rewards?

It’s essential to use your credit card wisely to get the most value out of your rewards card. Here are some tips to make the most of your rewards:

Don’t miss out on the initial bonus offered by your credit card to elevate your rewards balance. Capitalize on lucrative sign-up bonuses by meeting the spending requirement within the specified time frame. Different cards offer rewards in specific categories, such as groceries, dining, or travel. Take note of which spending categories yield the highest points and plan your purchases accordingly. Credit card interest can quickly offset the value of your rewards. Pay your statement balance in full each month to avoid interest charges and maximize your rewards. Many rewards credit cards have valuable benefits like airport lounge access, travel insurance, purchase protection, and more. Take advantage of these perks to enhance your overall value. Consider having multiple rewards cards to earn more. Pair cards that complement each other, like use one card for everyday expenses and another for specific bonus categories to maximize rewards.

![]()

![]()

![]()

![]()

![]()

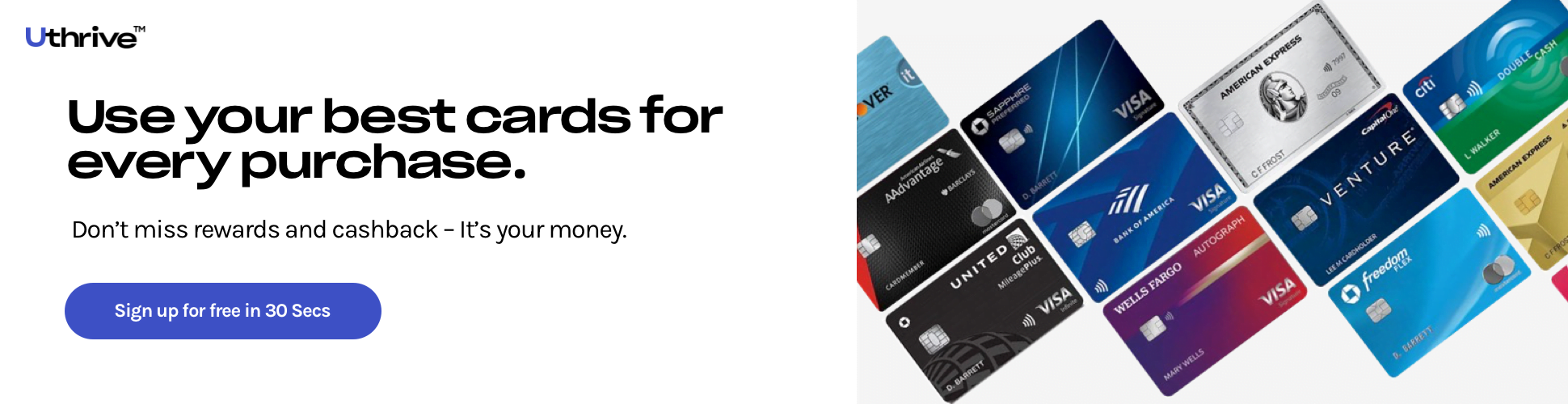

Why track your Credit Card Rewards with Uthrive?

If you want to maximize your cashback and savings, tracking your credit card rewards with Uthrive is a must! The app takes the guesswork out of credit card usage by suggesting the most suitable card for various transactions, be it shopping, dining, or travel.

It simplifies the process and offers alerts for the rewards you’re missing. With Uthrive, you can be confident about getting the most from your credit cards.

It’s a secure and efficient way to manage your finances, ensuring you never leave potential rewards on the table.

Conclusion

Credit card rewards programs have transformed how we manage our finances by converting everyday purchases into valuable rewards.

By understanding the types of rewards, choosing the right card, and using strategies to maximize your earnings, you can enjoy the perks of these programs.

Whether it’s cash back, travel rewards, or other incentives, a well-chosen rewards credit card can help you achieve your financial goals.

Credit Card Rewards FAQ’s

How do you earn credit card rewards?

They operate on a simple principle: the more you use the card, the more benefits you earn.

Rewards credit cards give you a certain number of points, miles, or cash back for each eligible purchase you make using the card.

What are the main types of credit card rewards?

Rewards credit cards for consumers mainly come in three types: cash back, points, and miles.

Cardholders can choose the one that aligns best with their spending habits and goals.

What rewards do credit cards offer?

Credit cards offer various rewards, including cash back, points, miles, and perks such as travel benefits, purchase protection, and access to airport lounges.

These rewards vary depending on the card.

Do credit cards have loyalty programs?

Yes, many credit cards offer loyalty programs that reward cardholders for their spending and loyalty.

Some of them include- American Express Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou Rewards.

What are the benefits of having a rewards credit card?

The benefits of having a rewards credit card are, from accumulating valuable rewards, you can even enjoy various credit card perks like access to airport lounges, extending warranty protection, travel insurance benefits, concierge service, and more.

Are rewards credit cards worth it?

A rewards credit card is totally worth it if you use it for everyday expenses and avoid carrying a balance.

The ideal credit card should not be a financial burden, so avoid high annual fees or having a balance solely for a sign-up bonus.

Are credit card rewards taxable?

No, your credit card rewards, be it points, miles, or cash back, are not taxable.

The IRS sees them as rebates, not income, as cardholders typically spend more to earn rewards than the rewards’ actual value.

This tax rule also applies to business credit cards.

Which credit card points are worth the most?

Chase Ultimate Rewards points are the most beneficial for its versatility, extensive transfer partner network, and the ability to maximize the value of points when booking through the Ultimate Rewards portal.

How do you redeem credit card rewards?

Just log in, go to the rewards section, and there you’ll find your rewards balance and various redemption options to explore.

Depending on your preferences and goals, select the redemption method that suits you best.

Is a rewards card right for you?

A rewards card is right for you if you use a credit card for everyday spending, can pay off the balance monthly, and want to earn rewards or cash back.

Managing credit responsibly and considering your spending habits when choosing a rewards credit card is essential.

How much are credit card rewards points worth?

The base rate is often one point per dollar. The value of these points can vary based on factors such as the credit card issuer, the type of purchase, and how you choose to use your points.

What credit score do I need to get a rewards credit card?

To qualify for most rewards credit cards, you generally need a good to excellent credit score, typically around 670-720 or higher.

However, some cards with less lucrative rewards may accept applicants with slightly lower scores.

Do credit card rewards expire?

Credit card rewards expiration policies differ by the card issuer and program.

Some rewards programs have no expiration date, while others have a set timeframe to use your rewards, often ranging from 12 to 24 months.

Is there a limit to the amount of rewards you can earn with a rewards card?

In general, most rewards cards do not have a limit on the amount of rewards you can earn.

However, specific card terms and conditions may apply.

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)