Key Takeaways

-

CVS offers cash back with a debit card, but the cash back limit is $35 per transaction, available both at cashier and self-checkout.

-

No cash back with mobile payments: CVS does not provide cash back when using Apple Pay or Google Pay.

-

CVS ExtraCare card is not a credit card, but a rewards program offering discounts and ExtraBucks on qualifying purchases.

If you’re a frequent CVS shopper, you may have wondered, “Does CVS do cash back?” Whether you’re picking up prescriptions or stocking up on household essentials, knowing if you can get cash back at CVS can save you an extra trip to the ATM.

In this article, we’ll explore whether CVS offers cash back, what payment methods are accepted, and other important details for 2024.

We’ll also answer some common questions about the CVS credit card, cash back limits, and the role of mobile payment systems like Apple Pay and Google Pay at CVS.

Does CVS Do Cash Back in 2024?

Yes, CVS offers cash back at its stores in 2024, but only under specific conditions.

To get cash back at CVS, you need to make a purchase and pay with a debit card. Credit cards and most other payment methods don’t qualify for cash back.

However, the convenience of cash back at CVS can save you from hunting down the nearest ATM, especially when you’re running low on cash while shopping for essentials.

Does CVS Do Cash Back with Debit Cards?

Absolutely! CVS does cash back with debit cards.

This is the most straightforward and common way to receive cash back at CVS. You simply need to make a purchase, and during the transaction, you’ll be prompted to select whether you want cash back.

CVS offers cash back in various denominations, making it convenient for shoppers who need a little extra cash on hand.

Key points to remember:

-

You must use a debit card to get cash back at CVS.

-

Cash back is only available in-store and not for online purchases.

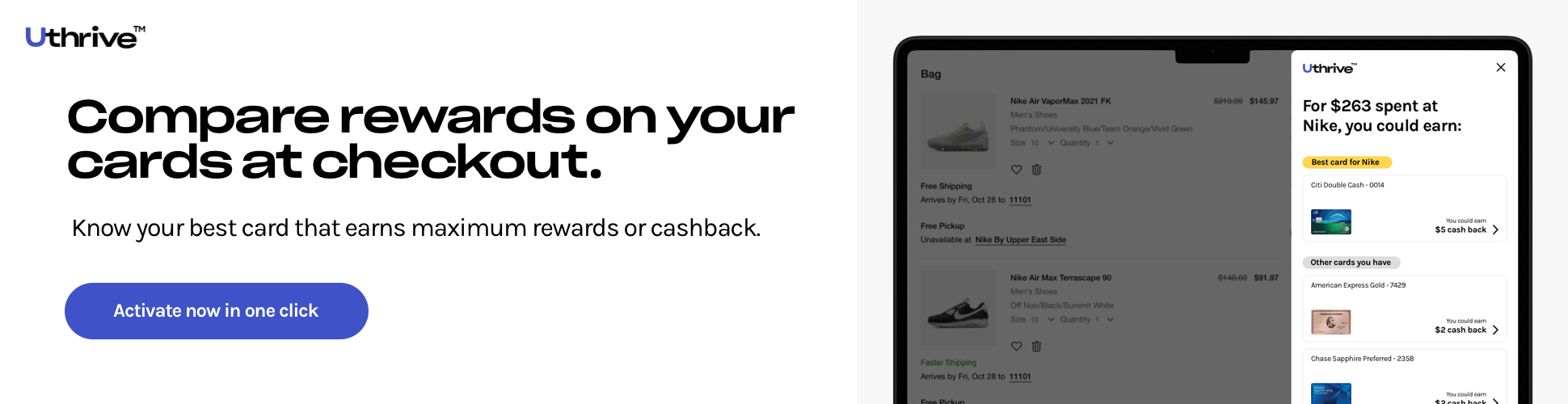

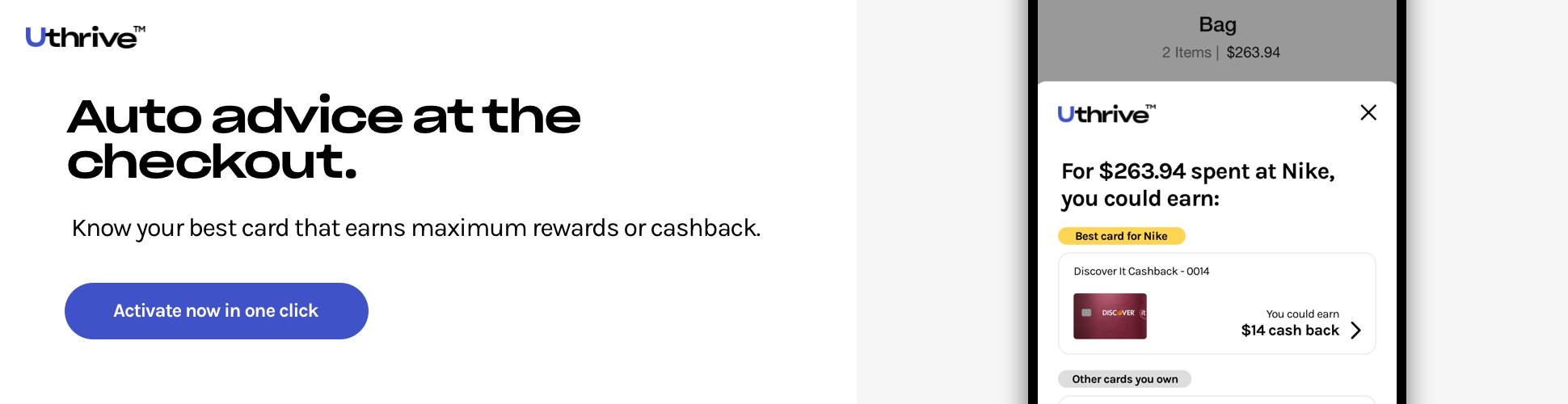

Best Credit Cards For CVS

-

Chase Freedom Unlimited®

🔹 Rewards:

- 1.5% Cash Back on all purchases, including CVS.

- 5% Cash Back on travel purchased through Chase Ultimate Rewards.

- 3% Cash Back on dining and drugstores (including CVS).

💳 Annual Fee: annual_fees

📈 APR: reg_apr,reg_apr_type

✨ Advantages:

- No Annual Fee: Keep more of your rewards.

- Sign-Up Bonus: Earn a substantial cash bonus after spending a certain amount within the first few months.

- Flexible Redemption: Redeem cash back as statement credits, direct deposits, or gift cards.

-

Citi® Custom Cash℠ Card

🔹 Rewards:

- 5% Cash Back on your top eligible spending category each billing cycle (up to $500), including drugstores.

- 1% Cash Back on all other purchases.

💳 Annual Fee: annual_fees

📈 APR: reg_apr,reg_apr_type

✨ Advantages:

- Automatically earns 5% cash back at CVS, making it a reliable choice if CVS is your top spending category.

- No need to track rotating categories—cash back adjusts based on your spending.

- Intro 0% APR for 15 months on purchases and balance transfers.

-

American Express® Gold Card

🔹 Rewards:

- 4x Membership Rewards® points at restaurants and supermarkets;

- 3x points at drugstores, including CVS.

💳 Annual Fee: annual_fees

📈 APR: reg_apr,reg_apr_type

✨ Advantages:

- Earns 3x points on drugstore purchases like CVS, making it a high-reward option for frequent shoppers.

- Includes valuable travel and dining perks, adding flexibility beyond just CVS purchases.

- Points are part of the Amex Membership Rewards program, which can be transferred to airlines and hotels.

-

Discover it® Cash Back

🔹 Rewards:

- 5% cash back on rotating categories (up to $1,500 in purchases each quarter), including drugstores during certain periods;

- 1% on all other purchases.

💳 Annual Fee: annual_fees

📈 APR: reg_apr,reg_apr_type

✨ Advantages:

- Drugstores like CVS frequently appear as 5% cash back categories, allowing high returns on those purchases.

- First-year cashback match: Discover matches all the cash back earned in the first year.

- No annual fee, making it a great option for casual shoppers.

-

Blue Cash Everyday® Card from American Express

🔹 Rewards:

- 3% cash back at U.S. supermarkets (up to $6,000 annually);

- 3% cash back at U.S. gas stations and online retail;

- 1% cash back at drugstores.

💳 Annual Fee: annual_fees

📈 APR: reg_apr,reg_apr_type

✨ Advantages:

- Earns 1% cash back at CVS, plus strong rewards on everyday spending like groceries and gas.

- No annual fee, which is ideal for light users who still want to maximize everyday cash back.

- Introductory 0% APR on purchases for 15 months.

These cards offer a mix of high rewards for CVS purchases, introductory APRs, and additional perks, making them excellent choices for regular CVS shoppers.

CVS Cash Back Limit

While CVS does provide cash back, there is a limit. As of 2024, the cash back limit at CVS is $35 per transaction. If you need more cash, you’ll have to make multiple purchases, which could become inconvenient if you’re not buying a lot of items.

How it works:

-

You can request cash back amounts such as $5, $10, $15, $20, or $35.

-

Keep in mind that this service is free, meaning CVS does not charge any extra fees for providing cash back.

That said, if you’re shopping for smaller items like toothpaste or snacks, you can still take advantage of CVS’s cash back feature—just don’t expect to withdraw more than $35 at once.

Does CVS Do Cash Back with Apple Pay or Google Pay?

No, CVS does not currently offer cash back when you use mobile payment systems like Apple Pay or Google Pay. While these payment options are convenient for contactless transactions, they don’t support cash back withdrawals at CVS.

Why this matters: If you’re planning on using Apple Pay or Google Pay at CVS, you’ll need to use a separate method, like a debit card, if you want to get cash back. So, if you’re low on cash and planning to shop at CVS, it’s better to use your debit card rather than your mobile wallet.

Does CVS Do Cash Back at Self-Checkout?

Yes! CVS has self-checkout kiosks that allow customers to complete their purchases independently. The good news is that CVS does offer cash back at self-checkout, provided you are paying with a debit card. The same cash back limit of $35 applies, and the process is just as easy as with a traditional cashier.

To receive cash back at CVS self-checkout:

-

Scan your items as usual.

-

Choose to pay with your debit card.

-

When prompted, select the cash back option and enter the amount.

Self-checkout makes the cash back process even faster, especially for those who want to avoid lines.

CVS Credit Card: Does CVS Have One?

Now, let’s shift gears and address some of the other questions customers often ask about CVS, particularly about credit cards.

First off, CVS does not have a traditional store credit card like some other major retailers do. However, the company offers the CVS ExtraCare card, which is a rewards program that provides discounts, personalized offers, and ExtraBucks rewards on qualifying purchases. But let’s clear up some confusion:

Is the CVS ExtraCare Card a Credit Card?

No, the CVS ExtraCare card is not a credit card. It’s a free loyalty program that allows customers to earn rewards and discounts on their purchases. While it may look similar to a credit card, it functions solely as a rewards card.

When you scan your ExtraCare card at checkout, you earn 2% back in ExtraBucks on most purchases, along with access to other exclusive deals. But you cannot charge purchases to the card as you would with a credit card.

Does CVS Accept Care Credit Card?

Yes, CVS does accept CareCredit cards, which is a healthcare credit card designed for medical expenses, including prescriptions. However, the acceptance of CareCredit can vary based on the type of CVS store you’re in and what you’re buying.

Key details:

-

CareCredit cards are accepted at most CVS locations for purchasing prescriptions and other eligible healthcare-related products.

-

CareCredit is not accepted for non-healthcare items, such as food, household products, or beauty items.

If you’re unsure whether your local CVS accepts CareCredit for a specific purchase, it’s always a good idea to ask a cashier or check online before heading to the store.

How to Maximize Your CVS Experience in 2024

Now that you know the answer to “Does CVS do cash back?,” let’s talk about how to make the most of your shopping experience at CVS in 2024.

-

Use the CVS ExtraCare Card for Extra Savings

While it’s not a credit card, the CVS ExtraCare card can still help you save money. The rewards card lets you earn 2% back in ExtraBucks on qualifying purchases.

ExtraBucks can be used just like cash on your next purchase, so even though you can’t earn cash back directly from the ExtraCare card, you can get future savings.

Tip: Sign up for CVS’s email newsletters or mobile app to get personalized deals and discounts based on your shopping history. This can stretch your savings even further!

-

Use a Debit Card for Cash Back

If you need cash back, make sure to use a debit card. CVS’s cash back limit of $35 may not be high, but it’s still a handy feature when you need cash and don’t want to make a separate trip to the ATM.

-

Combine Discounts and Cash Back

If you’re paying with a debit card, take advantage of ExtraCare rewards to maximize your savings. Scan your ExtraCare card before paying to ensure you’re getting the best deal on your items, and then request cash back at checkout.

By combining these features, you can shop smart at CVS and save money in more ways than one.

-

Plan Ahead for Larger Cash Needs

Because CVS limits cash back to $35 per transaction, it’s best for small cash needs. If you require more cash, you’ll either have to make multiple purchases or find an ATM. It’s a convenient feature for quick cash, but don’t count on it for larger withdrawals.

CVS Cash Back and Payment Options in 2024

To sum it all up: CVS does offer cash back, but only when using a debit card, and the cash back limit is $35 per transaction.

Unfortunately, mobile payment options like Apple Pay and Google Pay don’t allow for cash back, and the CVS ExtraCare card is a rewards program, not a credit card.

Whether you’re looking to save money through rewards or need quick access to cash, CVS offers a variety of options to meet your needs.

Just remember to have your debit card handy for cash back, and make the most of your ExtraCare rewards to stretch your savings even further.

FAQ’s CVS and Cash Back

Does CVS Do Cash Back with Debit Cards?

Yes, CVS does offer cash back with debit cards. You can request cash back when making a purchase, with a limit of $35 per transaction.

Does CVS Do Cash Back with Apple Pay?

No, CVS does not offer cash back if you use Apple Pay for your purchase. If you need cash back, you’ll need to use a debit card.

Does CVS Do Cash Back with Google Pay?

Similar to Apple Pay, Google Pay transactions at CVS do not qualify for cash back. Stick to using a debit card if you need cash back.

Does CVS Do Cash Back at Self-Checkout?

Yes, you can get cash back at CVS self-checkout, as long as you’re using a debit card. The cash back limit remains $35 per transaction.

What Is the CVS Cash Back Limit?

The cash back limit at CVS is $35 per transaction. There are no additional fees for requesting cash back, but the maximum amount you can get in one transaction is $35.

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)