Key Takeaways

-

The Good Sam Credit Card offers 5x points at Good Sam stores, 3x on gas and campgrounds, making it ideal for RV enthusiasts.

-

The card comes with no annual fee and offers fuel discounts and special financing for RV purchases at affiliated stores.

-

It can be used anywhere Mastercard is accepted, with convenient online and phone payment options for managing your account.

If you’re an outdoor enthusiast or a frequent RVer, you might have heard of the Good Sam Credit Card. It’s a popular choice for those who love hitting the road, exploring the great outdoors, and staying at campgrounds across the country.

With rewards tailored to the RV lifestyle and various perks at affiliated locations, the Good Sam Club Credit Card could be the perfect travel companion for you.

But before you start dreaming of those gas savings and camping discounts, let’s take a closer look at everything you need to know about this card. Grab a cup of coffee (or a marshmallow if you’re already by the campfire), and let’s dive in!

What is the Good Sam Credit Card?

The Good Sam Credit Card, also known as the Good Sam Rewards Credit Card, is a store-branded credit card offered by the Good Sam Club in partnership with Comenity Bank.

It’s designed specifically for RVers and outdoor lovers, providing them with exclusive rewards and discounts that align with their lifestyle.

Whether you’re spending money on gas, buying camping supplies, or booking a night at a Good Sam-affiliated RV park, this card offers rewards that make the whole experience more affordable.

It’s like having a trusty co-pilot that gives you cashback!

Good Sam Credit Card Benefits

So, why should you consider the Good Sam Credit Card? Here are some of the most compelling benefits:

-

Rewards Program

Rewards ProgramCardholders earn 5 points per $1 spent at Good Sam, Camping World, Gander Outdoors, and Overton’s. You also get 3 points per $1 on purchases made at private campgrounds and gas stations, and 1 point per $1 on everything else. These points can be redeemed for merchandise and services at Good Sam and its affiliated brands.

-

Special Financing Offers

Special Financing OffersFor those planning a big RV purchase or some hefty camping gear, the Good Sam Rewards Credit Card occasionally offers special financing options on large purchases at their stores. This could be a great way to spread out the cost of those must-have items.

-

No Annual Fee

No Annual FeeUnlike many travel credit cards that charge an annual fee, the Good Sam Club Credit Card doesn’t have one. That means more money for your road trip snacks and fewer fees weighing you down.

-

Fuel Savings

Fuel SavingsYou get additional fuel discounts at participating Pilot Flying J locations. Given how much RVers can spend on fuel, this is a fantastic perk!

-

Exclusive Member Discounts

Exclusive Member DiscountsCardholders often enjoy additional discounts and promotions at Camping World and affiliated stores, helping you save on everything from RV accessories to outdoor apparel.

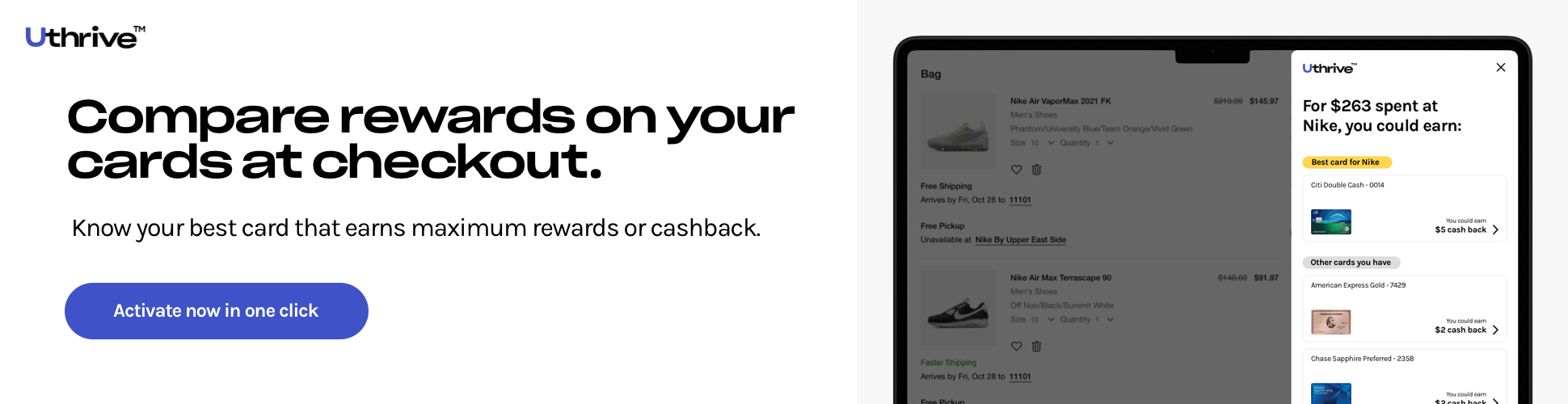

Other Credit Cards with Cashback on Good Sam

-

Chase Freedom Unlimited®

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 5% cash back on travel purchased through Chase Ultimate Rewards®

- 3% cash back on dining and drugstores

- 1.5% cash back on all other purchases, including Good Sam-related expenses

Key Benefits:

- No Annual Fee: Maximizes net rewards without any yearly cost.

- Cash Back Rewards: Competitive flat-rate rewards across various categories.

- Flexible Redemption Options: Redeem cash back as statement credits, direct deposits, gift cards, or travel.

- Purchase Protection: Covers eligible purchases against damage or theft for up to 120 days.

- Extended Warranty: Extends the manufacturer’s warranty by an additional year on eligible items.

- Zero Liability Protection: Protects you from unauthorized purchases.

Advantages:

- Versatile Rewards Structure: Suitable for everyday spending across multiple categories, including travel and dining.

- Attractive Welcome Offer: Quickly earn a significant bonus with minimal spending.

- No Foreign Transaction Fees: Ideal for international purchases and travel.

Limitations:

- Lower Cash Back on General Purchases: Only 1.5% on non-bonus categories compared to some flat-rate cards.

-

Blue Cash Everyday® Card from American Express

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 3% cash back at U.S. supermarkets (up to $6,000 per year, then 1%)

- 2% cash back at U.S. gas stations and select U.S. department stores

- 1% cash back on other purchases, including Good Sam-related expenses

Key Benefits:

- No Annual Fee: Ideal for earning rewards without an annual cost.

- High Cash Back on Groceries and Gas: Aligns well with everyday spending needs, such as fuel and camping supplies.

- Additional Perks: Purchase Protection, Extended Warranty, Return Protection, and No Foreign Transaction Fees.

- Access to Amex Offers: Personalized deals and discounts for cardholders.

Advantages:

- Competitive Cash Back Rates: Especially on groceries and gas, which are common everyday expenses for Good Sam members.

- Comprehensive Benefits Package: Offers valuable protections and no foreign transaction fees.

Limitations:

- Spending Caps: Higher cash back rates have annual limits.

- No Exclusive Perks: General rewards without specific benefits for particular memberships or stores.

-

Capital One Quicksilver Cash Rewards Credit Card

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 1.5% cash back on every purchase, including Good Sam-related expenses

- Additional 5% on all purchases in the first 3 months (if eligible)

Key Benefits:

- No Annual Fee: Keeps your costs low while earning rewards.

- Simple Rewards Structure: Flat-rate cash back makes it easy to maximize rewards without tracking categories.

- Flexible Redemption: Redeem cash back as statement credits, gift cards, or direct deposits.

- No Foreign Transaction Fees: Great for international use.

- Extended Warranty and Travel Accident Insurance: Provides added protection for your purchases and travel plans.

- Access to Capital One Offers: Exclusive deals and discounts for cardholders.

Advantages:

- Simplicity: Easy-to-understand rewards without category restrictions.

- High Introductory Bonus: Quickly earn significant cash back with the welcome offer.

- Versatile Redemption Options: Multiple ways to use your cash back.

Limitations:

- Flat Cash Back Rate: Lower rewards compared to category-specific cards like the Chase Freedom Unlimited®.

- No Enhanced Rewards for Specific Categories: Same 1.5% cash back applies to all purchases.

-

Blue Cash Preferred® Card from American Express

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 6% cash back at U.S. supermarkets (up to $6,000 per year, then 1%)

- 6% on select U.S. streaming subscriptions

- 3% cash back at U.S. gas stations and on transit

- 1% cash back on other purchases, including Good Sam-related expenses

Key Benefits:

- High Cash Back Rates: Significant rewards on groceries, streaming, gas, and transit.

- Additional Perks: Purchase Protection, Extended Warranty, Return Protection, and No Foreign Transaction Fees.

- Flexible Redemption: Redeem cash back for statement credits, gift cards, or shopping.

- Access to Amex Offers: Personalized deals and discounts for cardholders.

Advantages:

- Generous Rewards Structure: Especially beneficial for heavy grocery shoppers and those who spend on streaming and transit.

- Comprehensive Benefits: Enhanced protections and no foreign transaction fees add value beyond rewards.

Limitations:

- Annual Fee: $95 fee may offset some rewards if not fully utilized.

- No Exclusive Perks: Similar to other general rewards cards without specific benefits for particular memberships or stores.

-

Capital One SavorOne Cash Rewards Credit Card

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 3% cash back on dining and entertainment

- 2% cash back at grocery stores

- 1% cash back on all other purchases, including Good Sam-related expenses

Key Benefits:

- No Annual Fee: Earn rewards without any yearly cost.

- Cash Back Categories: High rewards on dining, entertainment, and groceries.

- Additional Perks: Purchase Protection, Extended Warranty, Travel Accident Insurance, and No Foreign Transaction Fees.

- Flexible Redemption: Options to redeem cash back as statement credits, gift cards, or direct deposits.

- Access to Capital One Offers: Exclusive deals and discounts for cardholders.

Advantages:

- Enhanced Rewards on Dining and Entertainment: Ideal for those who frequently dine out or engage in entertainment activities.

- Comprehensive Benefits Package: Offers valuable protections and no foreign transaction fees.

Limitations:

- Lower Cash Back on General Purchases: Only 1% on non-category purchases.

- No Exclusive Perks: General rewards without specific benefits for particular memberships or stores.

Comparison Summary

| Card | Annual Fee | Welcome Offer | Cash Back Rates | Key Benefits |

|---|---|---|---|---|

annual_fees |

bonus_miles |

5% on travel (Chase Ultimate Rewards), 3% on dining/drugstores, 1.5% on all else |

No annual fee, flexible redemption, purchase protection, extended warranty, no foreign fees |

|

annual_fees |

bonus_miles |

3% groceries, 2% gas/department stores, 1% all else |

No annual fee, purchase protections, extended warranty, return protection, no foreign fees |

|

annual_fees |

bonus_miles |

1.5% on all purchases |

Simple flat-rate rewards, no annual fee, flexible redemption, no foreign fees |

|

annual_fees |

bonus_miles |

6% groceries, 6% streaming, 3% gas/transit, 1% all else |

High rewards on key categories, purchase protections, extended warranty, no foreign fees |

|

annual_fees |

bonus_miles |

3% dining/entertainment, 2% groceries, 1% all else |

No annual fee, enhanced rewards on dining and entertainment, purchase protections, no foreign fees |

Which Card is Best for Good Sam Purchases?

While none of these cards offer exclusive cashback specifically for Good Sam purchases, they provide competitive rewards that can benefit Good Sam members by aligning with common spending categories such as gas, travel, dining, and groceries.

-

Best for Versatile Spending

Chase Freedom Unlimited® – Why: Offers a mix of high rewards on travel, dining, and a solid flat rate on all other purchases. Ideal for diverse spending habits, including those related to Good Sam activities like travel and dining.

-

Best for Grocery and Gas

Blue Cash Preferred® Card from American Express – Why: Provides 6% cash back at U.S. supermarkets and 3% on gas, making it excellent for households with significant grocery and fuel expenses often associated with Good Sam membership.

-

Best for Simplicity

Capital One Quicksilver Cash Rewards Credit Card – Why: Flat-rate 1.5% cash back on all purchases simplifies earning rewards without tracking categories, suitable for consistent Good Sam-related spending.

-

Best for Dining and Entertainment

Capital One SavorOne Cash Rewards Credit Card – Why: Enhanced 3% cash back on dining and entertainment, perfect for Good Sam members who frequently dine out or enjoy entertainment activities during their travels.

-

Best No Annual Fee with High Rewards on Groceries

Blue Cash Everyday® Card from American Express – Why: Offers 3% cash back at U.S. supermarkets without an annual fee, balancing rewards and cost effectively for Good Sam members who spend heavily on groceries.

Recommendation

-

Primary Choice

Chase Freedom Unlimited® for its versatile rewards and attractive welcome offer, benefiting a wide range of Good Sam-related expenses.

-

Secondary Option

Blue Cash Preferred® Card from American Express for higher cash back on groceries and gas, aligning well with typical Good Sam expenses.

-

Complementary Card

Consider pairing with a specialized card like the Good Sam Credit Card (if available) to maximize rewards specifically related to your Good Sam membership alongside another versatile cashback card.

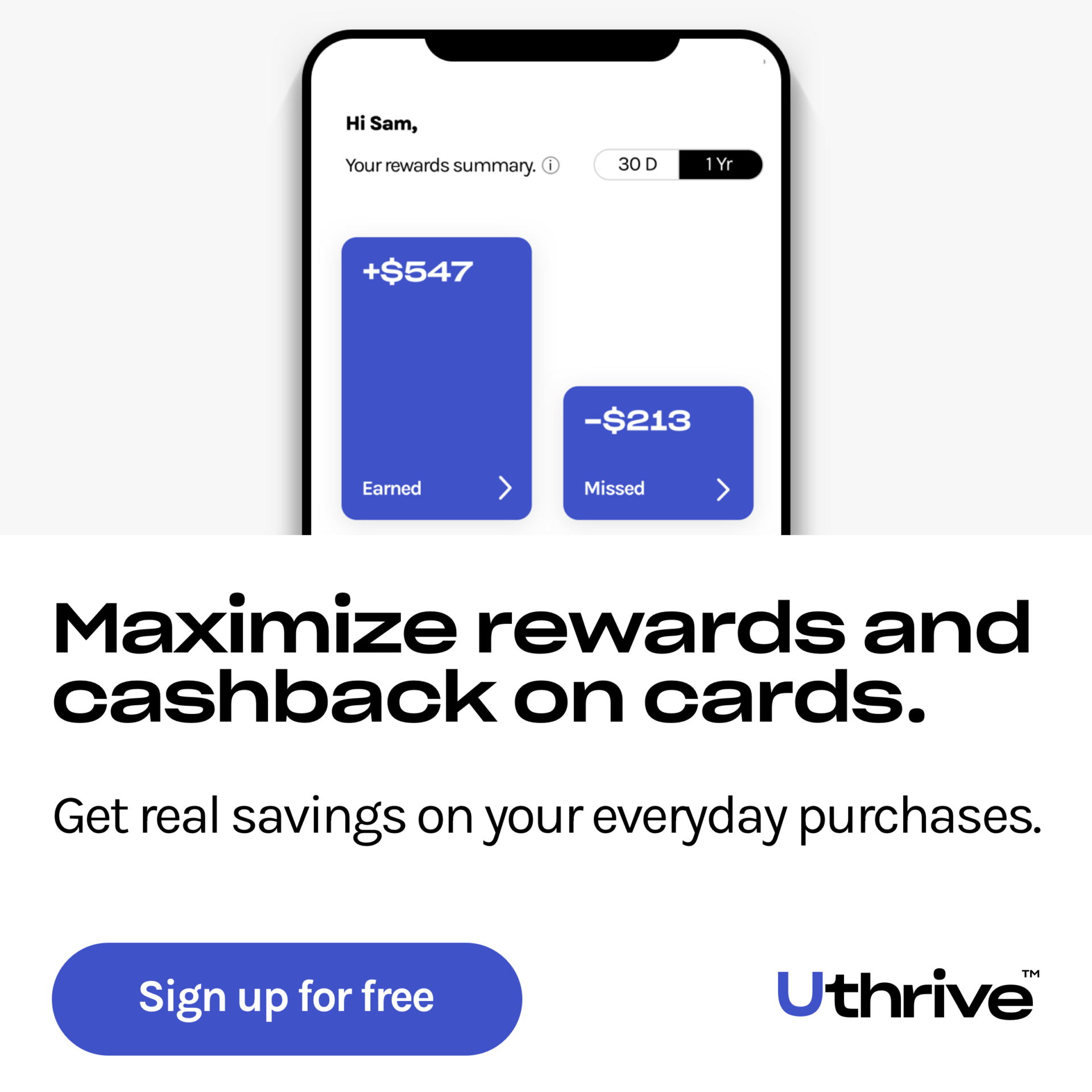

Maximizing Rewards Strategy

To optimize your cashback earnings as a Good Sam member, consider the following strategies:

-

Match Spending to Rewards Categories

Use each card where it earns the highest cash back. For example, use the Blue Cash Preferred® Card from American Express for groceries and gas, Chase Freedom Unlimited® for travel and dining, and Capital One Quicksilver Cash Rewards Credit Card for general purchases.

-

Leverage Welcome Offers

Meet the minimum spending requirements to earn your welcome bonus, boosting your initial cash back earnings.

-

Combine Cards for Maximum Benefits

Pair a category-specific card with a flat-rate card to cover all spending areas efficiently. For instance, use the Blue Cash Preferred® Card from American Express for groceries and gas, and the Capital One Quicksilver Cash Rewards Credit Card for everything else.

-

Redeem Strategically

Take advantage of the flexible redemption options to maximize the value of your cash back, whether through statement credits, direct deposits, or gift cards.

Where Can You Use the Good Sam Credit Card?

You might be asking, “Where can I use my Good Sam Credit Card?” Well, the card is pretty versatile.

While it’s branded for Good Sam Club, it’s actually a Mastercard, which means it can be used almost anywhere Mastercard is accepted.

Whether you’re buying groceries, dining out, or stocking up on marshmallows for those campfire nights, you can earn points and rewards on your everyday spending.

However, to maximize the card’s benefits, you’ll want to use it at Good Sam, Camping World, and other affiliated locations.

Making Good Sam Credit Card Payments

If you’ve already got your hands on a Good Sam’s Credit Card (lucky you!), managing payments is a breeze. There are a few ways to handle your Good Sam Credit Card payment:

-

Online Payments

The most convenient way to handle your Good Sam Credit Card pay my bill online is through Comenity Bank’s website. After logging in, you can check your balance, review your statements, and make payments without leaving your couch—or camp chair, if you’re out in the wild.

-

By Phone

If you prefer to pay by phone, that’s an option too. Just call the customer service number on the back of your card and follow the prompts to make a Good Sam Credit Card payment. Pro tip: Be prepared for potential hold times, especially around billing deadlines!

-

Mail-In Payments

For those who like doing things the old-fashioned way, you can mail in your payment. Just make sure it arrives on time, or you might end up using that stamp money to pay a late fee instead.

How to Apply for the Good Sam Credit Card

Interested in applying for the Good Sam Credit Card? The process is straightforward:

-

Apply Online

Head over to the Good Sam website or the Comenity Bank website. Fill out the Good Sam Credit Card application, and you could receive an instant decision. They’ll ask for the usual information—name, address, income, etc.—so make sure you have it handy.

-

Apply In-Store

If you’re visiting a Camping World or Good Sam store, you can also apply in person. This gives you a chance to ask any questions you might have about the card’s benefits or perks.

-

Credit Score Requirements

It’s generally a good idea to have a decent credit score (in the fair to good range, around 620 or higher) to increase your chances of approval. A higher score might also help you secure a lower interest rate, which is always a good thing.

Good Sam Credit Card vs. Other Travel Cards

How does the Good Sam Rewards Credit Card stack up against other travel and rewards cards? Let’s see:

Pros

-

No annual fee.

-

High rewards rate on Good Sam purchases and at affiliated stores.

-

Discounts on fuel and special financing offers.

Cons

-

Rewards are primarily redeemable at Good Sam-affiliated locations, which could limit their usefulness for some cardholders.

-

High APR if you carry a balance.

In comparison to general travel rewards cards like the Chase Sapphire Preferred® or the Capital One Venture Rewards Credit Card, the Good Sam’s Credit Card might not offer as much flexibility.

However, for loyal Good Sam Club members and frequent RV travelers, the tailored rewards and discounts could make this card a great choice.

Managing Your Good Sam Credit Card

Once you’ve got your Good Sam Credit Card in hand, managing it responsibly is key. Here are a few tips to make sure you’re getting the most out of your card:

-

Stay On Top of Payments

Stay On Top of PaymentsMake sure to pay your bill on time each month to avoid late fees and interest charges. You can set up autopay to make sure you never miss a due date.

-

Monitor Your Statements

Monitor Your StatementsKeep an eye on your transactions to ensure there are no unauthorized charges. It’s always better to catch these early.

-

Redeem Rewards Strategically

Redeem Rewards StrategicallyMake sure you redeem your points for things you really need or want. While the card offers plenty of rewards, they’re most valuable when used wisely.

Is the Good Sam Credit Card Right for You?

The Good Sam Credit Card is an excellent choice for loyal Good Sam Club members, frequent campers, and RV enthusiasts who regularly shop at affiliated stores or need those precious fuel discounts.

With no annual fee, solid rewards, and some sweet discounts at the pump, it’s a card that can make your adventures a little bit cheaper and a lot more fun.

However, if you’re looking for a card with more general travel rewards or flexible redemption options, you might want to consider other alternatives.

But for the die-hard RVer, the Good Sam Rewards Credit Card is like that extra tank of gas—it just makes the journey better.

Frequently Asked Questions About the Good Sam Credit Card

What is the APR for the Good Sam Credit Card?

The APR for purchases with the Good Sam Credit Card generally ranges from 16.99% to 29.99% based on your creditworthiness. As with all credit cards, it’s best to pay off your balance in full each month to avoid these charges.

Can I use my Good Sam Credit Card for everyday purchases?

Yes! As a Mastercard, you can use it anywhere Mastercard is accepted. However, you’ll earn more rewards when you use it at Good Sam, Camping World, and other affiliated stores.

How do I check my Good Sam Credit Card balance?

You can check your balance by logging into your account on Comenity Bank’s website or by calling the customer service number on the back of your card.

What happens if I lose my Good Sam Credit Card?

If your card is lost or stolen, contact Comenity Bank customer service immediately. They will help you freeze the account and issue a replacement card.

How do I redeem my Good Sam Rewards?

Rewards points can be redeemed at Good Sam, Camping World, Gander Outdoors, and Overton’s. You can check your rewards balance and redeem points through the Comenity Bank website or by contacting customer service.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What is the APR for the Good Sam Credit Card?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The APR for purchases with the Good Sam Credit Card generally ranges from 16.99% to 29.99% based on your creditworthiness. As with all credit cards, it’s best to pay off your balance in full each month to avoid these charges.”

}

},{

“@type”: “Question”,

“name”: “Can I use my Good Sam Credit Card for everyday purchases?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes! As a Mastercard, you can use it anywhere Mastercard is accepted. However, you’ll earn more rewards when you use it at Good Sam, Camping World, and other affiliated stores.”

}

},{

“@type”: “Question”,

“name”: “How do I check my Good Sam Credit Card balance?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “You can check your balance by logging into your account on Comenity Bank’s website or by calling the customer service number on the back of your card.”

}

},{

“@type”: “Question”,

“name”: “What happens if I lose my Good Sam Credit Card?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “If your card is lost or stolen, contact Comenity Bank customer service immediately. They will help you freeze the account and issue a replacement card.”

}

},{

“@type”: “Question”,

“name”: “How do I redeem my Good Sam Rewards?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Rewards points can be redeemed at Good Sam, Camping World, Gander Outdoors, and Overton’s. You can check your rewards balance and redeem points through the Comenity Bank website or by contacting customer service.”

}

}]

}

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)