Key Takeaways

-

Sam’s Club offers both store-only and Mastercard credit cards, each with different rewards and benefits tailored to frequent shoppers and business owners.

-

The Sam’s Club Mastercard offers up to 5% cashback on gas, 3% on dining and travel, with no annual fee besides membership costs.

-

Cardholders can manage their Sam’s Club credit card accounts and payments online or through the mobile app, ensuring convenient and secure access.

Sam’s Club, known for its bulk deals and competitive prices, also offers credit cards that provide significant benefits to its members.

If you’re already a Sam’s Club shopper or thinking of becoming one, you might be wondering if a Sam’s Club credit card is worth it.

With multiple card options, various cashback rewards, and additional perks, Sam’s Club credit cards can be a valuable addition to your wallet.

But before you rush to fill out that Sam’s Club credit card application, let’s break down everything you need to know about these cards in 2024.

Types of Sam’s Club Credit Cards

Sam’s Club offers two main types of credit cards: the Sam’s Club Consumer Credit Card and the Sam’s Club Mastercard. Both cards offer rewards and benefits, but they cater to different kinds of shoppers.

-

Sam's Club Consumer Credit Card

This card is only accepted at Sam’s Club and Walmart stores. It’s a store-only card that does not have the capability of being used outside these locations. If you’re a frequent Sam’s Club shopper, this might be a simple

-

Sam's Club Mastercard

This is where things get a bit more exciting. The Sam’s Club Mastercard is a general-use credit card that can be used anywhere Mastercard is accepted. It offers better cash back rewards than the store-only card, including 5% cashback on gas (up to $6,000 per year, then 1%), 3% cashback on dining and travel, and 1% on all other purchases. Not too shabby, right?

-

Sam's Club Business Credit Card

If you run a business, Sam’s Club also offers a business credit card option that allows for flexible spending. It operates similarly to the consumer versions but is geared towards business expenses. It can also offer employee cards to help manage and track spending.

Sam’s Club Credit Card Benefits

Now that we know the types of cards available, let’s talk about the perks. Why bother applying for a Sam’s Club credit card? Here are some standout benefits:

-

Cashback Rewards

Both the consumer and Mastercard versions offer cashback rewards, but the Sam’s Club Mastercard has the upper hand with better cashback on gas, dining, and travel.

-

No Annual Fee

Unlike some other credit cards, neither the Sam’s Club Consumer Credit Card nor the Sam’s Club Mastercard has an annual fee. However, you must maintain an active Sam’s Club membership to keep the card, which has its own annual cost.

-

Special Financing Options

Sometimes, there are promotional financing deals available for large purchases. This can be particularly beneficial if you’re making big buys like electronics or furniture.

-

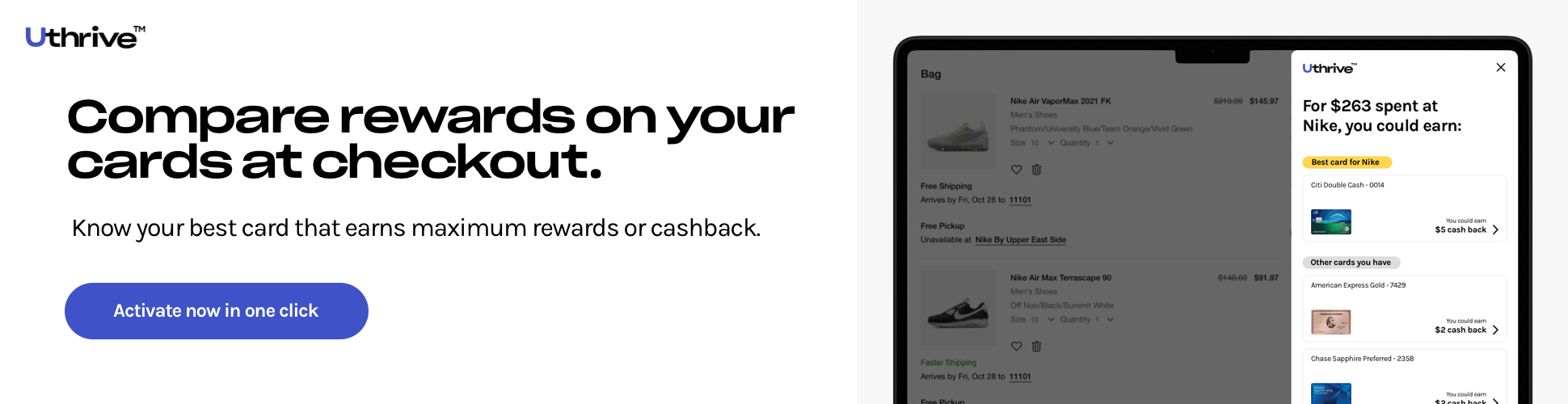

Easy Card Management

You can manage your Sam’s Club credit card online with ease. With the Sam’s Club credit card payments online feature, paying your bills, checking your balance, and monitoring your spending can all be done from your phone or computer.

-

Access to Sam's Club Exclusives

Occasionally, there are exclusive sales or offers for cardholders, making it worth having the card just to unlock these extra savings.

Sam’s Club Credit Card Payment and Management

One of the most important things to consider before getting any credit card is how you will manage your payments. With Sam’s Club credit cards, you have multiple options:

-

Sam's Club Credit Card Payment Online

Paying your bill has never been easier. The Sam’s Club login credit card payment option on their website allows you to make payments quickly and securely. Simply log in, go to the payment section, and choose your payment method. You can also set up automatic payments to avoid late fees—because no one wants those!

-

Sam's Club Credit Card Payment In-Store

If you’re more of an old-school type who likes to handle payments in person, you can also pay your bill at any Sam’s Club location. Just head to the customer service desk, and they’ll guide you through it.

-

Mobile App Management

The My Sam’s Club Credit Card app (part of the Synchrony Bank suite of apps) is a convenient way to manage your account. You can check balances, make payments, and view statements on the go.

Applying for a Sam’s Club Credit Card

Applying for a Sam’s Club credit card is a straightforward process, whether you want the consumer card or the Mastercard. Here’s how you can do it:

-

Apply Online

Visit the Sam’s Club credit card application page on their website. Fill in your details, select the card type you prefer, and submit your application. Approval is often instant, and you’ll receive your card in the mail if approved.

-

Apply In-Store

If you prefer doing things face-to-face, you can also apply for a Sam’s Club credit card at any Sam’s Club location. This option allows you to ask any questions directly to the staff before committing.

-

Credit Requirements

For both the consumer card and the Sam’s Club Mastercard, having a fair to good credit score (around 670 or higher) is typically recommended for approval. Lower credit scores may still qualify, but the terms might not be as favorable.

What Credit Cards Does Sam’s Club Take?

If you’re not convinced about getting a Sam’s Club credit card and are just wondering, “What credit cards does Sam’s Club take?” Here’s a quick rundown.

Sam’s Club accepts Visa, Mastercard, Discover, and American Express, both in-store and online.

If you’re already loyal to another card’s reward program, you won’t have any trouble using it at Sam’s Club.

Other Credit Cards with Cashback on Sam’s Club Purchases

-

Chase Freedom Unlimited®

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 5% on travel purchased through Chase Ultimate Rewards®

- 3% on dining and drugstores

- 1.5% on all other purchases, including Sam’s Club

Key Benefits:

- No Annual Fee: Maximizes net rewards without any yearly cost.

- Cash Back Rewards: Competitive flat-rate rewards on a variety of categories.

- Flexible Redemption Options: Redeem cash back as statement credits, direct deposits, or gift cards.

- Purchase Protection: Covers eligible purchases against damage or theft for up to 120 days.

- Extended Warranty: Extends the manufacturer’s warranty by an additional year on eligible items.

Advantages:

- Versatile Rewards Structure: Suitable for everyday spending across multiple categories.

- Introductory Bonus: Attractive welcome offer to kickstart your rewards.

Limitations:

- Lower Cash Back on Sam’s Club: Only 1.5% cash back on Sam’s Club purchases, which is modest compared to other specialized cards.

-

Blue Cash Everyday® Card from American Express

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 3% cash back at U.S. supermarkets (up to $6,000 per year, then 1%)

- 2% cash back at U.S. gas stations and select U.S. department stores, including Sam’s Club

- 1% cash back on other purchases

Key Benefits:

- No Annual Fee: Ideal for earning rewards without an annual cost.

- Cash Back Categories: High rewards on groceries and gas, aligning well with Sam’s Club shopping.

- Additional Perks: Purchase Protection, Extended Warranty, Return Protection, and No Foreign Transaction Fees.

Advantages:

- Competitive Cash Back Rates: Especially on groceries and gas, which are common Sam’s Club expenses.

- Comprehensive Benefits Package: Offers valuable protections and no foreign transaction fees.

Limitations:

- Spending Caps: Higher cash back rates have annual limits.

No Exclusive Sam’s Club Perks: General rewards without specific benefits for Sam’s Club members.

-

Capital One Quicksilver Cash Rewards Credit Card

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 1.5% cash back on every purchase, including Sam’s Club

- Additional 5% on all purchases in the first 3 months (if eligible)

Key Benefits:

- No Annual Fee: Keeps your costs low while earning rewards.

- Simple Rewards Structure: Flat-rate cash back makes it easy to maximize rewards without tracking categories.

- Flexible Redemption: Redeem cash back as a statement credit, gift cards, or direct deposits.

- No Foreign Transaction Fees: Great for international use.

- Extended Warranty and Travel Accident Insurance: Provides added protection for your purchases and travel plans.

Advantages:

- Simplicity: Easy-to-understand rewards without category restrictions.

- High Introductory Bonus: Quickly earn significant cash back with the welcome offer.

Limitations:

- Flat Cash Back Rate: Lower rewards compared to category-specific cards like Sam’s Club Mastercard.

- No Enhanced Rewards for Sam’s Club: Same 1.5% cash back applies to all purchases.

-

Blue Cash Preferred® Card from American Express

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 6% cash back at U.S. supermarkets (up to $6,000 per year, then 1%)

- 6% on select U.S. streaming subscriptions

- 3% cash back at U.S. gas stations and on transit

- 1% cash back on other purchases, including Sam’s Club

Key Benefits:

- High Cash Back Rates: Significant rewards on groceries, streaming, gas, and transit.

- Additional Perks: Purchase Protection, Extended Warranty, Return Protection, and No Foreign Transaction Fees.

- Flexible Redemption: Redeem cash back for statement credits, gift cards, or shopping.

Advantages:

- Generous Rewards Structure: Especially beneficial for heavy grocery shoppers and those who spend on streaming and transit.

- Comprehensive Benefits: Enhanced protections and no foreign transaction fees add value beyond rewards.

Limitations:

- Annual Fee: $95 fee may offset some rewards if not fully utilized.

- No Exclusive Sam’s Club Perks: Similar to other general rewards cards without specific Sam’s Club benefits.

-

Capital One SavorOne Cash Rewards Credit Card

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 3% cash back on dining and entertainment

- 2% cash back at grocery stores

- 1% cash back on all other purchases, including Sam’s Club

Key Benefits:

- No Annual Fee: Earn rewards without any yearly cost.

- Cash Back Categories: High rewards on dining, entertainment, and groceries.

- Additional Perks: Purchase Protection, Extended Warranty, Travel Accident Insurance, and No Foreign Transaction Fees.

- Flexible Redemption: Options to redeem cash back as statement credits, gift cards, or direct deposits.

Advantages:

- Enhanced Rewards on Dining and Entertainment: Ideal for those who spend heavily in these categories.

- Comprehensive Benefits Package: Offers valuable protections and no foreign transaction fees.

Limitations:

- Lower Cash Back on Sam’s Club: Only 1% cash back on Sam’s Club purchases, which is lower compared to specialized cards.

- No Exclusive Sam’s Club Benefits: General rewards without specific perks for Sam’s Club members.

Comparison Summary

| Card | Annual Fee | Welcome Offer | Cash Back Rates | Key Benefits |

|---|---|---|---|---|

annual_fees |

bonus_miles |

5% on travel (Chase Ultimate Rewards), 3% on dining/drugstores, 1.5% on all else |

No annual fee, flexible redemption, purchase protection, extended warranty |

|

annual_fees |

bonus_miles |

3% groceries, 2% gas/department stores, 1% all else |

No annual fee, purchase protections, extended warranty, return protection, no foreign fees |

|

annual_fees |

bonus_miles |

1.5% on all purchases |

Simple flat-rate rewards, no annual fee, flexible redemption, no foreign fees |

|

annual_fees |

bonus_miles |

6% groceries, 6% streaming, 3% gas/transit, 1% all else |

High rewards on key categories, purchase protections, extended warranty, no foreign fees |

|

annual_fees |

bonus_miles |

3% dining/entertainment, 2% groceries, 1% all else |

No annual fee, enhanced rewards on dining and entertainment, purchase protections, no foreign fees |

Which Card is Best for Sam’s Club Purchases?

While none of these cards offer exclusive cashback on Sam’s Club purchases like the Sam’s Club® Mastercard®, some provide competitive rewards that can still benefit Sam’s Club members:

-

Chase Freedom Unlimited® and Capital One Quicksilver Cash Rewards Credit Card offer flat-rate rewards that include Sam’s Club purchases, providing simplicity and consistent earnings.

-

Blue Cash Everyday® Card from American Express and Blue Cash Preferred® Card from American Express offer higher rewards on groceries and gas, which can complement Sam’s Club spending, especially if you use the cards for other grocery stores and fuel.

-

Capital One Quicksilver Cash Rewards Credit Card is ideal if you also spend significantly on dining and entertainment, adding versatility to your rewards portfolio.

Recommendation:

-

Primary Choice

Chase Freedom Unlimited® for its versatile rewards and attractive welcome offer.

-

Secondary Option

Blue Cash Everyday® Card from American Express for higher cash back on groceries and gas, aligning well with typical Sam’s Club expenses.

-

Complementary Card

Consider pairing with the Sam’s Club® Mastercard® to maximize rewards specifically at Sam’s Club alongside another versatile cash back card.

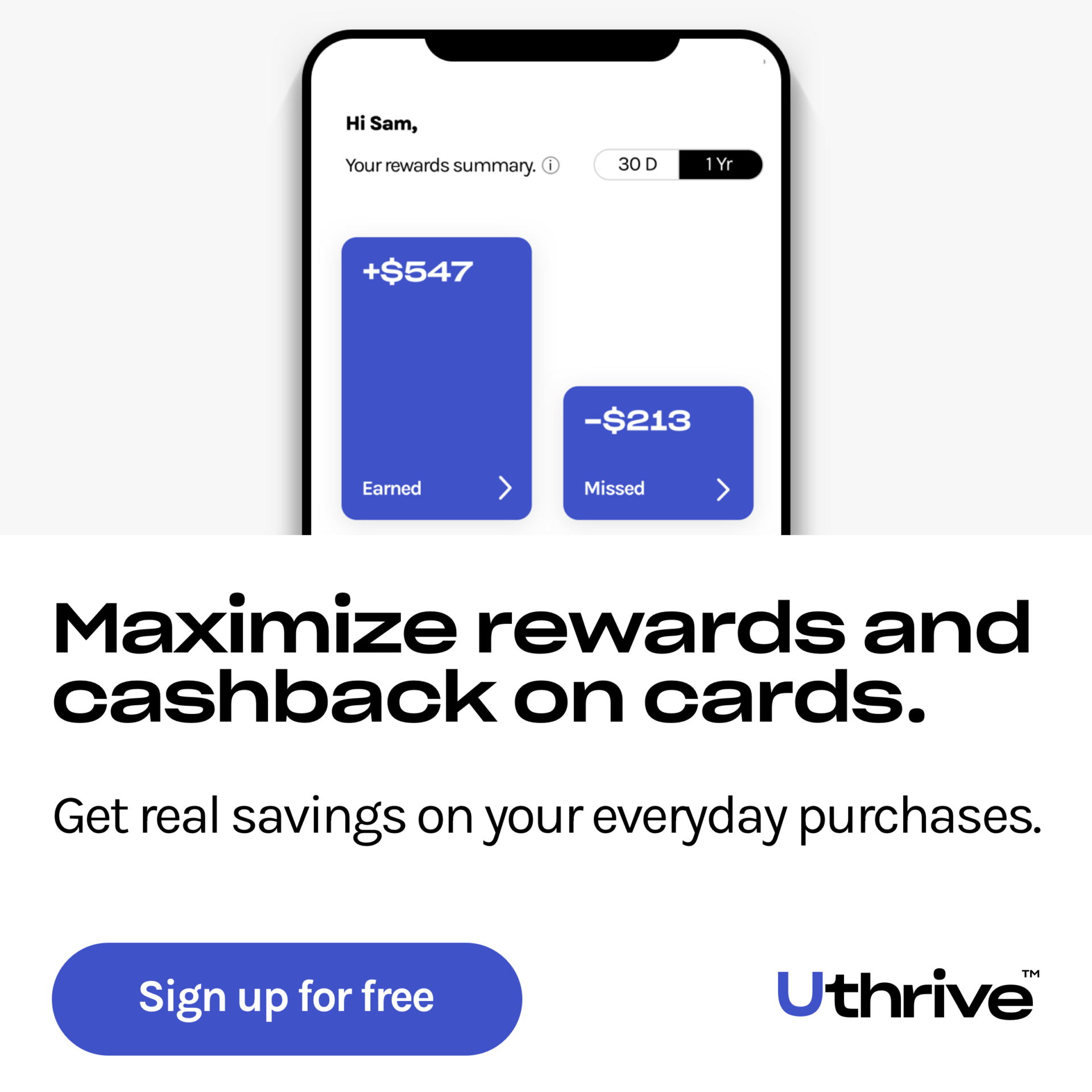

Maximizing Rewards Strategy

To optimize your cashback earnings:

-

Use the Sam’s Club® Mastercard® for all Sam’s Club purchases, gas, dining, and travel to take advantage of its higher cash back rates in these areas.

-

**Use the Chase Freedom Unlimited® or Blue Cash Everyday® Card from American Express for other everyday spending categories such as general groceries, dining, and travel.

-

Redeem cash back strategically to maximize value, whether through statement credits, direct deposits, or gift cards.

By strategically using multiple cards tailored to different spending categories, you can maximize your rewards without incurring multiple annual fees.

Sam’s Wholesale Club Credit Card: Is It the Same Thing?

The term Sam’s Wholesale Club Credit Card is just another way of referring to the Sam’s Club credit card options we’ve discussed.

Sam’s Club was originally known as Sam’s Wholesale Club, so sometimes the old name still sneaks into conversations. Don’t be confused—they’re the same cards!

Managing Your Sam’s Club Credit Card

When it comes to credit card management, organization is key. Manage Sam’s Club credit card options are plentiful, whether online, through the app, or via customer service. Here’s what you need to keep in mind:

-

Stay On Top of Payments

Stay On Top of PaymentsEnsure you make timely Sam’s Club credit card payments to avoid interest charges and maintain a good credit score.

-

Check Your Statements Regularly

Check Your Statements RegularlyWhether you prefer digital or paper statements, make sure to review them regularly for any suspicious charges or errors.

-

Understand Your Limits

Understand Your LimitsKnowing your credit limit can help you manage your spending and avoid maxing out your card.

Is the Sam’s Club Credit Card Worth It?

Now for the big question: Should you apply for a Sam’s Club credit card? The answer depends on your shopping habits and financial goals.

-

Frequent Sam's Club Shoppers

Frequent Sam's Club ShoppersIf you find yourself constantly shopping at Sam’s Club or Walmart, the Sam’s Club Consumer Credit Card can be a simple way to manage expenses without an annual fee.

-

Gas and Travel Enthusiasts

Gas and Travel EnthusiastsFor those who drive a lot or travel frequently, the Sam’s Club Mastercard offers a great way to earn back on everyday expenses with up to 5% cashback on gas and 3% on dining and travel.

-

Business Owners

Business OwnersIf you run a small business, the Sam’s Club Business Credit Card provides a flexible way to manage expenses, especially with options to add employee cards and track spending.

Pros and Cons of Sam’s Club Credit Cards

Here are some quick pros and cons to consider before applying:

Pros

-

No annual fee with active membership.

-

Competitive cashback rewards.

-

Easy online and mobile management.

-

Special financing offers available.

Cons

-

Requires an active Sam's Club membership.

-

Limited acceptance for the consumer card.

-

Rewards are capped annually.

Should You Get a Sam’s Club Credit Card?

If you’re a Sam’s Club fan looking to make the most out of your shopping, the Sam’s Club credit card options could be a valuable addition to your wallet.

With generous cashback rewards, easy management options, and no annual fees (outside of membership), these cards offer practical benefits.

However, it’s always wise to consider your spending habits and financial goals before adding another card to your wallet.

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)