Key Takeaways

-

The Sam’s Club Mastercard offers 5% cashback on gas, 3% on dining and travel, and 1% on other purchases, maximizing savings for frequent shoppers.

-

Cardholders enjoy no foreign transaction fees, purchase protection, and travel perks, including concierge services under the World Elite Mastercard.

-

The card has no annual fee for Sam’s Club members, making it a low-cost, high-reward option for those who frequently shop or travel.

When it comes to retail credit cards, the Sam’s Club Mastercard stands out as a robust option for both avid shoppers and casual visitors of Sam’s Club.

It’s more than just a store card; it offers rewards, benefits, and some surprising perks.

If you’ve ever wondered, “does Sam’s Club take Mastercard?” — not only do they take it, but they’ve also partnered with Synchrony Bank to offer their own card that provides excellent value.

In this comprehensive guide, we’ll dive deep into what makes the Sam’s Club Mastercard a notable contender in 2024, including its benefits, types, and a comparison with other credit options. Let’s swipe right on this card, shall we?

What is the Sam’s Club Mastercard?

The Sam’s Club Mastercard is a credit card offered by Sam’s Club in partnership with Synchrony Bank.

This isn’t your average store card; it’s a Sam’s Club Synchrony Mastercard that can be used anywhere Mastercard is accepted — which is practically everywhere!

It offers cashback rewards, travel benefits, and other perks that go beyond the regular Sam’s Club experience.

If you are a Sam’s Club member, this card can elevate your shopping game by offering solid cash-back options, especially on gas, dining, and travel purchases.

There are two types of cards: the Sam’s Club Consumer Mastercard and the Sam’s Club Business Mastercard.

Each caters to different needs, but both come with a range of benefits designed to save you money.

Key Benefits of the Sam’s Club Mastercard

Let’s break down the primary benefits of owning a Sam’s Club Mastercard:

-

Generous Cashback Rewards

Generous Cashback RewardsThe Sam’s Club Mastercard offers 5% cashback on gas (up to $6,000 per year, then 1% afterward), 3% cashback on dining and travel, and 1% cashback on all other purchases. This makes it particularly attractive for road warriors and foodies.

-

No Annual Fee

No Annual FeeUnlike some cards that charge you for the privilege of owning them, the Sam’s Club Mastercard benefits include no annual fee, as long as you maintain a Sam’s Club membership. This makes it a low-maintenance option for savings.

-

Sam's Club World Elite Mastercard

Sam's Club World Elite MastercardIf you qualify for the Sam’s Club World Elite Mastercard, you’ll enjoy additional perks like complimentary concierge services, enhanced security features, and access to exclusive offers through Mastercard.

-

Security and Convenience

Security and ConvenienceFeaturing contactless payment technology and zero fraud liability, the Sam’s Club Mastercard ensures that your transactions are secure and hassle-free.

-

Extended Warranty and Purchase Protection

Extended Warranty and Purchase ProtectionWhen you use your Sam’s Club Mastercard for purchases, you get an extended warranty on eligible items and purchase protection against damage or theft for up to 90 days.

Sam’s Club Mastercard vs. Other Credit Cards

So, how does the Sam’s Club Mastercard stack up against other credit cards, including its in-house competitor, the Sam’s Club Credit Card?

-

Sam's Club Credit Card vs. Mastercard

The key difference between the two is that the Sam’s Club Credit Card can only be used in Sam’s Club stores or at Walmart, while the Sam’s Club Mastercard is accepted everywhere Mastercard is. The Mastercard also offers better rewards, particularly for gas, dining, and travel.

-

Comparison with Other Cash Back Cards

In comparison to other cash-back cards, like the Costco Anywhere Visa® Card by Citi or the Target REDcard™, the Sam’s Club Mastercard shines in the gas rewards category. It’s also an excellent choice if you prefer Mastercard’s global acceptance over Visa or Amex.

Travel Benefits of the Sam’s Club Mastercard

The Sam’s Club Mastercard travel benefits are where the card really earns its stripes:

-

3% Cashback on Travel Purchases

This covers airfare, hotels, car rentals, and more. So, if you’re a frequent traveler, this card can help offset some of your travel costs.

-

World Elite Mastercard Perks

As a Sam’s Club World Elite Mastercard holder, you get access to the Mastercard Airport Concierge service, which provides a personal agent to assist with navigating airports. This perk alone can be a lifesaver when you’re sprinting through an unfamiliar airport!

-

Travel and Emergency Assistance

Another benefit under the World Elite Mastercard umbrella is the travel and emergency assistance services. Whether it’s medical referrals or emergency transportation arrangements, this feature provides peace of mind while on the road.

Is the Sam’s Club Mastercard Worth It?

With all these benefits, you might be wondering if the benefits of the Sam’s Club Mastercard justify applying for another credit card. The answer largely depends on your shopping habits and lifestyle.

If you regularly shop at Sam’s Club, buy gas frequently, or dine out often, the cashback rewards alone could make this card a no-brainer. Additionally, there are no foreign transaction fees, making it a solid choice for international travelers.

Applying for the Sam’s Club Mastercard

Applying for the Sam’s Club Synchrony Mastercard is straightforward. You can apply online or in-store, and you’ll need to be a Sam’s Club member to qualify.

Upon approval, you’ll receive a temporary shopping pass to use at Sam’s Club or Walmart until your physical card arrives.

For those who prefer doing business shopping, the Sam’s Club Business Mastercard offers a similar suite of benefits tailored to business owners.

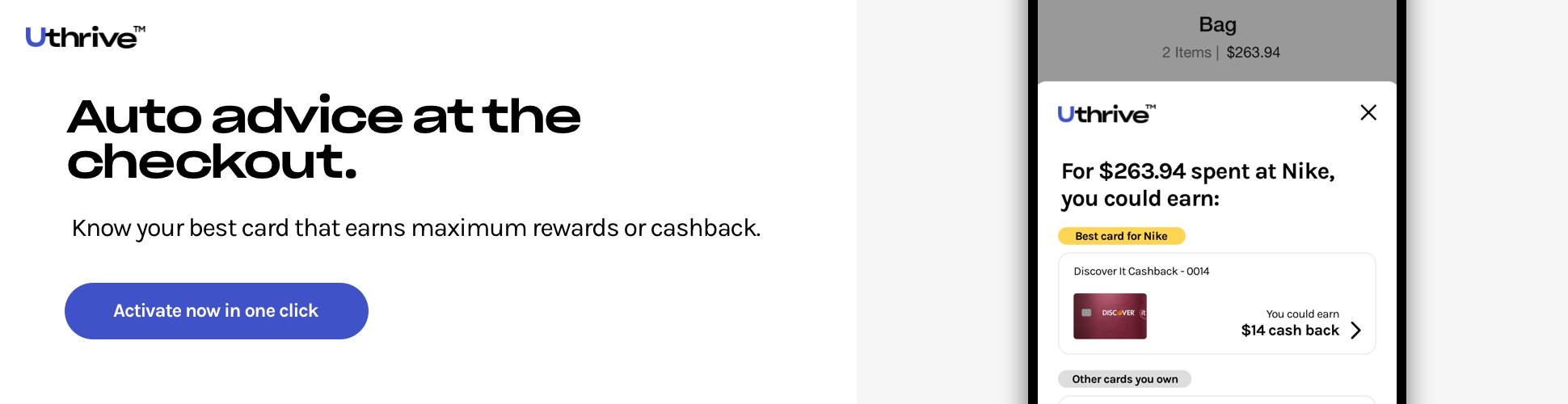

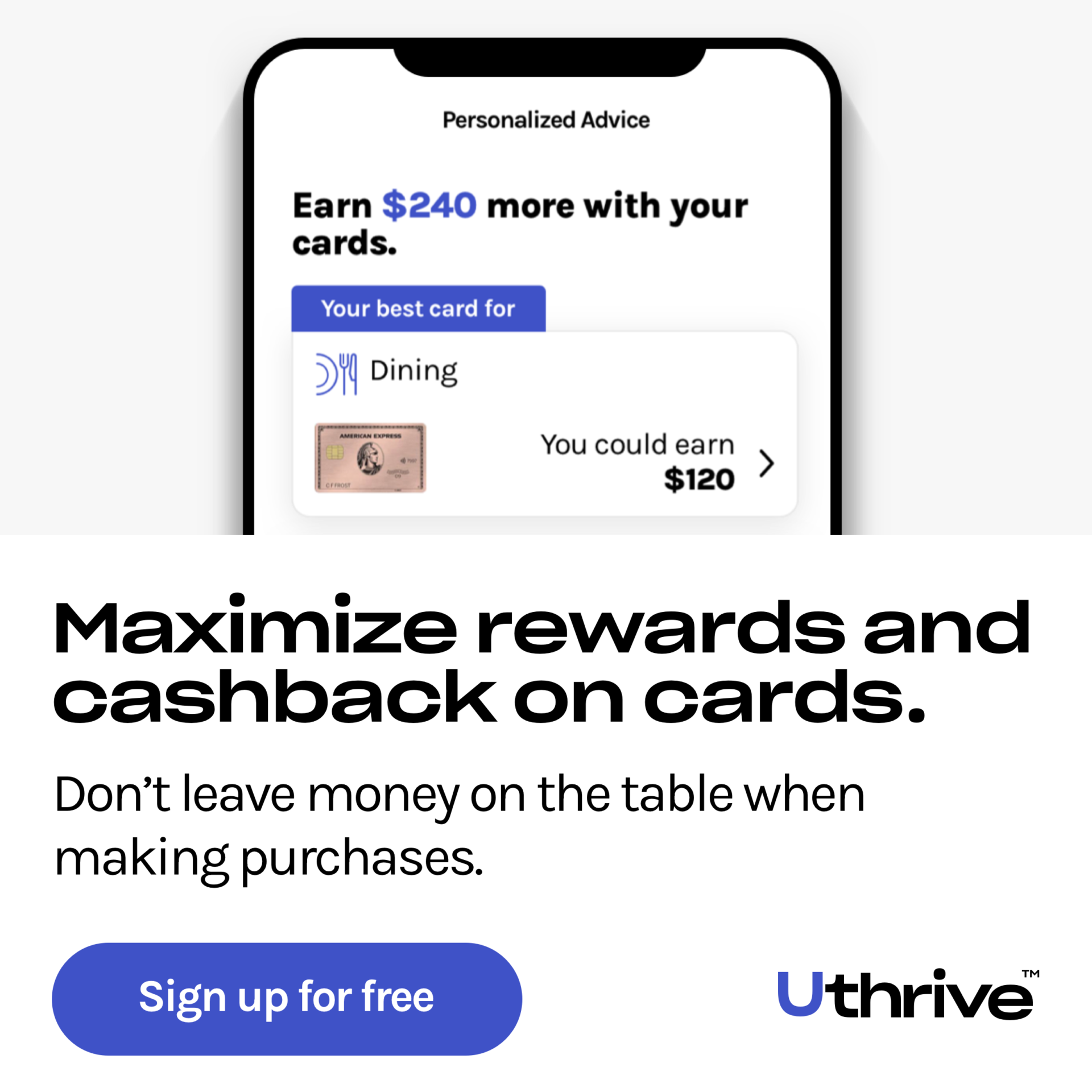

How to Maximize Rewards with the Sam’s Club Mastercard

To get the most out of your Sam’s Club Mastercard rewards, here are a few tips:

-

Fuel Up Often

Fuel Up OftenUse your card for gas purchases to earn the maximum 5% cashback.

-

Dine Out Regularly

Dine Out RegularlyUtilize the 3% cashback on dining to save more if you frequently eat out.

-

Plan Your Travel with the Card

Plan Your Travel with the CardBook flights, hotels, and car rentals using the card to benefit from the travel perks and cashback.

-

Use It for All Sam's Club Purchases

Use It for All Sam's Club PurchasesDon’t forget to use it for Sam’s Club purchases to earn the 1% cashback on everything else.

Other Credit Cards with Cashback on Everyday Purchases

-

Chase Freedom Unlimited®

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 5% cash back on travel purchased through Chase Ultimate Rewards®

- 3% cash back on dining and drugstores

- 1.5% cash back on all other purchases

Key Benefits:

- No Annual Fee: Maximizes net rewards without any yearly cost.

- Cash Back Rewards: Competitive flat-rate rewards on a variety of categories.

- Flexible Redemption Options: Redeem cash back as statement credits, direct deposits, gift cards, or travel.

- Purchase Protection: Covers eligible purchases against damage or theft for up to 120 days.

- Extended Warranty: Extends the manufacturer’s warranty by an additional year on eligible items.

- Zero Liability Protection: Protects you from unauthorized purchases.

Advantages:

- Versatile Rewards Structure: Suitable for everyday spending across multiple categories.

- Attractive Welcome Offer: Quickly earn a significant bonus with minimal spending.

- No Foreign Transaction Fees: Ideal for international purchases and travel.

Limitations:

- Lower Cash Back on General Purchases: Only 1.5% on non-bonus categories compared to some flat-rate cards.

-

Blue Cash Everyday® Card from American Express

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 3% cash back at U.S. supermarkets (up to $6,000 per year, then 1%)

- 2% cash back at U.S. gas stations and select U.S. department stores

- 1% cash back on other purchases

Key Benefits:

- No Annual Fee: Ideal for earning rewards without an annual cost.

- High Cash Back on Groceries and Gas: Aligns well with everyday spending needs.

- Additional Perks: Purchase Protection, Extended Warranty, Return Protection, and No Foreign Transaction Fees.

- Access to Amex Offers: Personalized deals and discounts for cardholders.

Advantages:

- Competitive Cash Back Rates: Especially on groceries and gas, which are common everyday expenses.

- Comprehensive Benefits Package: Offers valuable protections and no foreign transaction fees.

Limitations:

- Spending Caps: Higher cash back rates have annual limits.

- No Exclusive Perks: General rewards without specific benefits for particular memberships or stores.

-

Capital One Quicksilver Cash Rewards Credit Card

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 1.5% cash back on every purchase, including Sam’s Club

- Additional 5% on all purchases in the first 3 months (if eligible)

Key Benefits:

- No Annual Fee: Keeps your costs low while earning rewards.

- Simple Rewards Structure: Flat-rate cash back makes it easy to maximize rewards without tracking categories.

- Flexible Redemption: Redeem cash back as a statement credit, gift cards, or direct deposits.

- No Foreign Transaction Fees: Great for international use.

- Extended Warranty and Travel Accident Insurance: Provides added protection for your purchases and travel plans.

Advantages:

- Simplicity: Easy-to-understand rewards without category restrictions.

- High Introductory Bonus: Quickly earn significant cash back with the welcome offer.

Limitations:

- Flat Cash Back Rate: Lower rewards compared to category-specific cards like Sam’s Club Mastercard.

- No Enhanced Rewards for Sam’s Club: Same 1.5% cash back applies to all purchases.

-

Blue Cash Preferred® Card from American Express

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 6% cash back at U.S. supermarkets (up to $6,000 per year, then 1%)

- 6% on select U.S. streaming subscriptions

- 3% cash back at U.S. gas stations and on transit

- 1% cash back on other purchases

Key Benefits:

- High Cash Back Rates: Significant rewards on groceries, streaming, gas, and transit.

- Additional Perks: Purchase Protection, Extended Warranty, Return Protection, and No Foreign Transaction Fees.

- Flexible Redemption: Redeem cash back for statement credits, gift cards, or shopping.

- Access to Amex Offers: Personalized deals and discounts for cardholders.

Advantages:

- Generous Rewards Structure: Especially beneficial for heavy grocery shoppers and those who spend on streaming and transit.

- Comprehensive Benefits: Enhanced protections and no foreign transaction fees add value beyond rewards.

Limitations:

- Annual Fee: $95 fee may offset some rewards if not fully utilized.

- No Exclusive Perks: Similar to other general rewards cards without specific benefits for particular memberships or stores.

-

Capital One SavorOne Cash Rewards Credit Card

Annual Fee: annual_fees

APR:

- Purchase APR: reg_apr,reg_apr_type

- Balance Transfer APR: balance_transfer_rate

Welcome Offer: bonus_miles_full

Rewards:

- 6% cash back at U.S. supermarkets (up to $6,000 per year, then 1%)

- 6% on select U.S. streaming subscriptions

- 3% cash back at U.S. gas stations and on transit

- 1% cash back on other purchases

Key Benefits:

- High Cash Back Rates: Significant rewards on groceries, streaming, gas, and transit.

- Additional Perks: Purchase Protection, Extended Warranty, Return Protection, and No Foreign Transaction Fees.

- Flexible Redemption: Redeem cash back for statement credits, gift cards, or shopping.

- Access to Amex Offers: Personalized deals and discounts for cardholders.

Advantages:

- Generous Rewards Structure: Especially beneficial for heavy grocery shoppers and those who spend on streaming and transit.

- Comprehensive Benefits: Enhanced protections and no foreign transaction fees add value beyond rewards.

Limitations:

- Annual Fee: $95 fee may offset some rewards if not fully utilized.

- No Exclusive Perks: Similar to other general rewards cards without specific benefits for particular memberships or stores.

Comparison Summary

| Card | Annual Fee | Welcome Offer | Cash Back Rates | Key Benefits |

|---|---|---|---|---|

annual_fees |

bonus_miles |

5% on travel (Chase Ultimate Rewards), 3% on dining/drugstores, 1.5% on all else |

No annual fee, flexible redemption, purchase protection, extended warranty, no foreign fees |

|

annual_fees |

bonus_miles |

3% groceries, 2% gas/department stores, 1% all else |

No annual fee, purchase protections, extended warranty, return protection, no foreign fees |

|

annual_fees |

bonus_miles |

1.5% on all purchases |

Simple flat-rate rewards, no annual fee, flexible redemption, no foreign fees |

|

annual_fees |

bonus_miles |

6% groceries, 6% streaming, 3% gas/transit, 1% all else |

High rewards on key categories, purchase protections, extended warranty, no foreign fees |

|

annual_fees |

bonus_miles |

3% dining/entertainment, 2% groceries, 1% all else |

No annual fee, enhanced rewards on dining and entertainment, purchase protections, no foreign fees |

Which Card is Best for Everyday Purchases?

Choosing the right cashback credit card depends on your specific spending habits and preferences. Here’s a breakdown to help you decide:

-

Best for Versatile Spending

Chase Freedom Unlimited® – Why: Offers a mix of high rewards on travel, dining, and a solid flat rate on all other purchases. Ideal for those with diverse spending habits

-

Best for Grocery and Gas

Blue Cash Preferred® Card from American Express – Why: Provides 6% cash back at U.S. supermarkets and 3% on gas, making it excellent for households with significant grocery and fuel expenses.

-

Best for Simplicity

Capital One Quicksilver Cash Rewards Credit Card – Why: Flat-rate 1.5% cash back on all purchases simplifies earning rewards without tracking categories.

-

Best for Dining and Entertainment

Capital One SavorOne Cash Rewards Credit Card – Why: Enhanced 3% cash back on dining and entertainment, perfect for those who frequently dine out or enjoy entertainment activities.

-

Best No Annual Fee with High Rewards on Groceries

Blue Cash Everyday® Card from American Express – Why: Offers 3% cash back at U.S. supermarkets without an annual fee, balancing rewards and cost effectively.

Maximizing Rewards Strategy

To optimize your cashback earnings, consider the following strategies:

-

Match Spending to Rewards Categories

Use each card where it earns the highest cash back. For example, use the Blue Cash Preferred® Card from American Express for groceries and streaming, Chase Freedom Unlimited® for travel and dining, and Capital One Quicksilver Cash Rewards Credit Card for general purchases.

-

Leverage Welcome Offers

Meet the minimum spending requirements to earn your welcome bonus, boosting your initial cash back earnings.

-

Combine Cards for Maximum Benefits

Pair a category-specific card with a flat-rate card to cover all spending areas efficiently. For instance, use the Blue Cash Preferred® Card from American Express for groceries and the Capital One Quicksilver Cash Rewards Credit Card for everything else.

-

Redeem Strategically

Take advantage of the flexible redemption options to maximize the value of your cash back, whether through statement credits, direct deposits, or gift cards.

Customer Experience and Feedback

The feedback from customers using the Sam’s Club Mastercard is generally positive, especially regarding its straightforward rewards structure and the ability to earn substantial cashback on gas.

However, some users mention that rewards are capped, which might limit high spenders. But hey, getting 5% cashback on gas isn’t a bad deal at all!

Bottom Line

The Sam’s Club Mastercard is a solid choice for those who frequently shop at Sam’s Club or spend heavily on gas, dining, and travel.

With its low-maintenance costs, decent rewards, and travel benefits, this card certainly delivers value.

However, it’s always wise to compare it with other options to see which card best suits your spending habits and financial goals.

Ready to maximize your rewards and savings? The Sam’s Club Mastercard could be your next best move. Or, as they say, another swipe closer to your goals!

Frequently Asked Questions (FAQs)

Does Sam’s Club take Mastercard?

Yes, Sam’s Club accepts Mastercard, including their own branded Sam’s Club Mastercard.

How do I redeem Sam's Club Mastercard rewards?

You can redeem your cashback rewards once a year at any Sam’s Club location. Cashback is issued in the form of a check that can be cashed out or used for purchases.

What is the difference between the Sam's Club Credit Card and the Mastercard?

The primary difference is that the Sam’s Club Mastercard can be used anywhere that accepts Mastercard, while the Sam’s Club Credit Card is limited to Sam’s Club and Walmart.

Are there any fees with the Sam's Club Mastercard?

There is no annual fee, but you must be a Sam’s Club member. Foreign transaction fees are also waived.

Can I apply for the Sam's Club Mastercard without a Sam's Club membership?

No, you need to be a Sam’s Club member to qualify for the card.

What credit score is needed for the Sam's Club Mastercard?

Generally, a good to excellent credit score (670 or higher) is recommended for approval.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “Does Sam’s Club take Mastercard?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, Sam’s Club accepts Mastercard, including their own branded Sam’s Club Mastercard.”

}

},{

“@type”: “Question”,

“name”: “How do I redeem Sam’s Club Mastercard rewards?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “You can redeem your cashback rewards once a year at any Sam’s Club location. Cashback is issued in the form of a check that can be cashed out or used for purchases.”

}

},{

“@type”: “Question”,

“name”: “What is the difference between the Sam’s Club Credit Card and the Mastercard?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The primary difference is that the Sam’s Club Mastercard can be used anywhere that accepts Mastercard, while the Sam’s Club Credit Card is limited to Sam’s Club and Walmart.”

}

},{

“@type”: “Question”,

“name”: “Are there any fees with the Sam’s Club Mastercard?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “There is no annual fee, but you must be a Sam’s Club member. Foreign transaction fees are also waived.”

}

},{

“@type”: “Question”,

“name”: “Can I apply for the Sam’s Club Mastercard without a Sam’s Club membership?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “No, you need to be a Sam’s Club member to qualify for the card.”

}

},{

“@type”: “Question”,

“name”: “What credit score is needed for the Sam’s Club Mastercard?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Generally, a good to excellent credit score (670 or higher) is recommended for approval.”

}

}]

}

![Guide to Priority Pass Lounges at PDX – Top Things To Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-Lounges-at-PDX-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Las Vegas Priority Pass Lounges – Top Things to Know [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Las-Vegas-Priority-Pass-Lounges-Top-Things-To-Know-2024-1024x600.jpg)

![Guide to Priority Pass SFO – Lounges and Restaurant Options at San Francisco International Airport [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Guide-to-Priority-Pass-SFO-Lounges-Restaurants-at-SFO-1024x599.jpg)

![Chase Sapphire Lounge LGA: Review & Updates [2024]](https://stagingwp.uthrive.club/wp-content/uploads/2024/11/Chase-Sapphire-Lounge-LGA-Review-Updates-2024-1024x600.jpg)