The sky’s the limit when it comes to shopping. You can buy almost anything within a few simple clicks. For avid online shoppers, it’s wise to use a credit card that rewards you on purchases. They hold the key to exclusive rewards, cashback offers, and extra layers of protection.

Whether you prefer shopping at physical stores or online retailers, having a credit card with tailored shopping benefits can be a real game-changer!

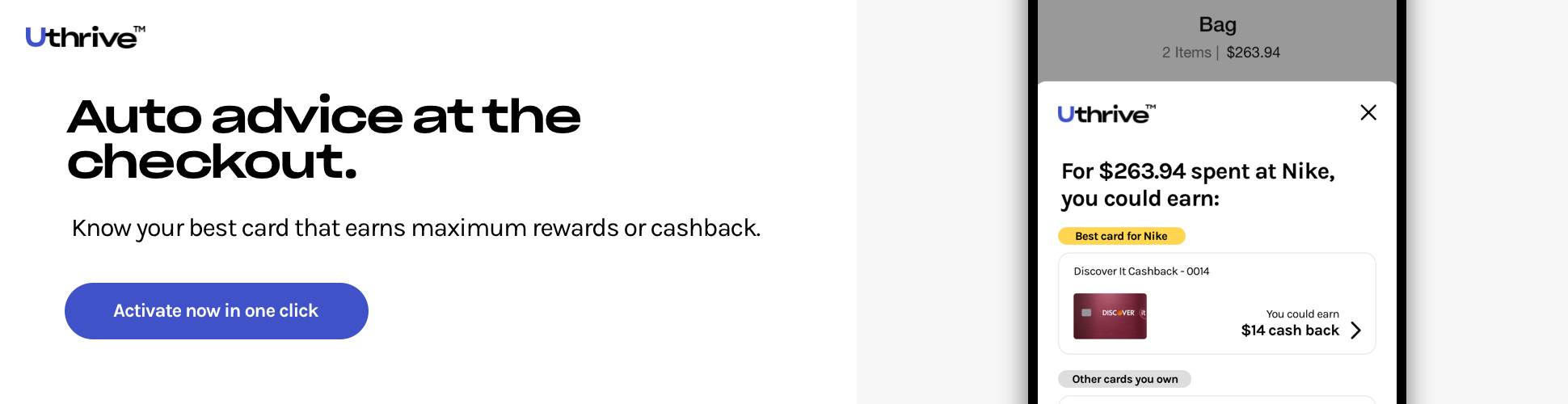

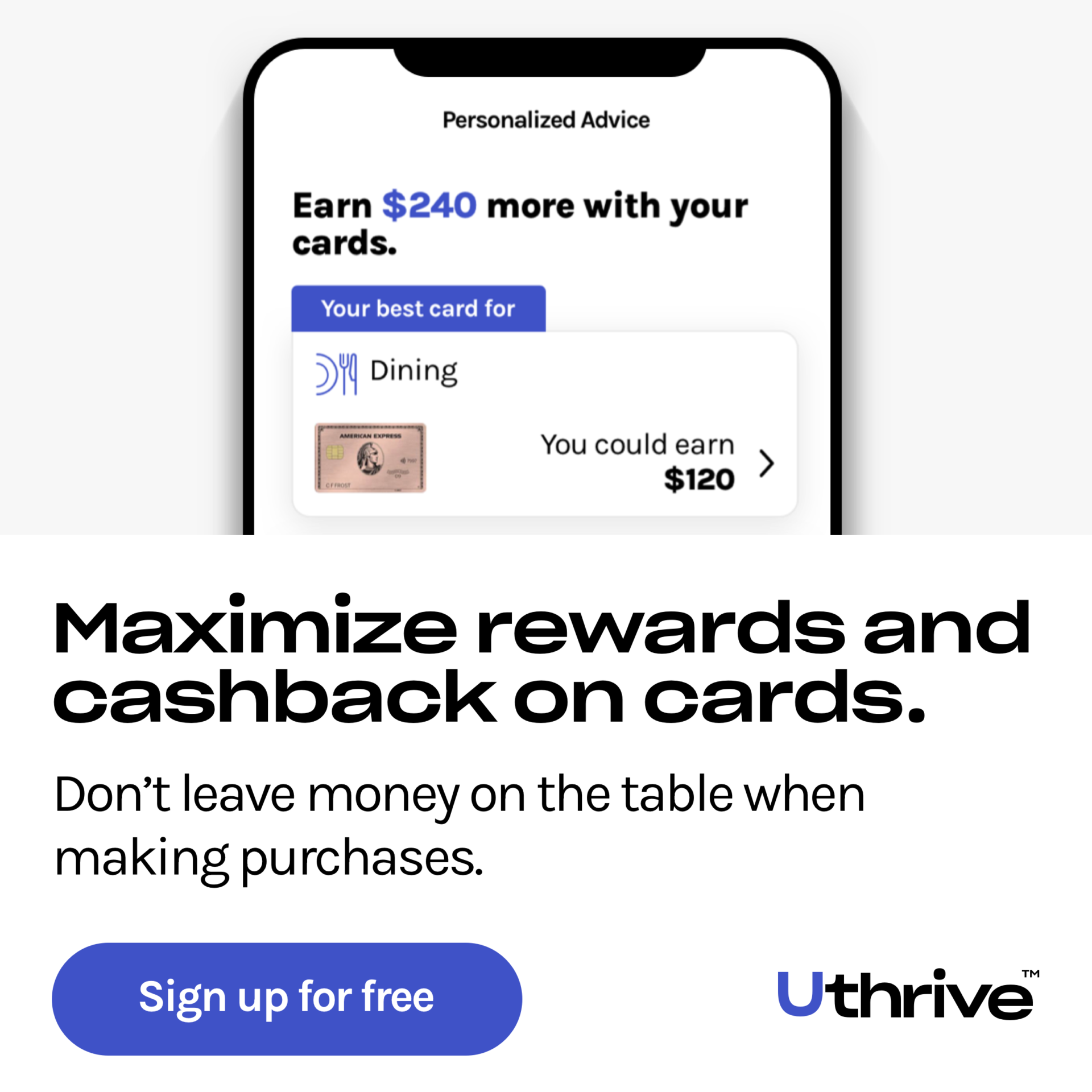

We’ll reveal the secret art of making the most of your credit cards by turning them into versatile tools for strategic shopping. From epic travel journeys to securing your purchases, each item on this list promises to be pivotal.

The average American online shopper annually spends approximately $5,300. That’s a substantial sum, and if you’re not using the right credit card for your purchases, you could be missing out on valuable rewards and perks.

While there’s no one-size-fits-all credit card for every scenario, some cards are tailored to specific online shopping categories. For example, one card might supercharge your rewards when you’re indulging in retail therapy on Amazon, while another could shower you with bonuses for ordering food delivery.

What are the top things you must buy with credit cards?

While it might seem like a good idea to use your debit card for everything to stick to a budget, there are some clever financial reasons to reach for your credit card instead. To help you figure out when it’s wise to use a credit card, below are the top 5 things to buy with a credit card.

But keep in mind you don’t want to overdo it. Using a credit card is a smart choice only if you can pay off the full amount every month or quickly. If you let the balance sit for too long and interest starts piling up, then the costs can outweigh the benefits. So, be careful and use your credit card wisely to make it work in your favor.

When it comes to paying for your travel expenses, using a credit card is often the best choice for several reasons. Travel is expensive, so you can earn loads of rewards here. Convenient Payment Option Many hotels and car rental companies prefer credit card payments, and some don’t even accept cash or debit cards. When you rent a car, using a credit card is especially wise because most cards provide free insurance coverage if the car gets damaged. Rewarding Travel Experience Credit cards offer excellent rewards when you spend on travel. The best travel cards bring an added delight – they shower you with bonus points for every dollar spent on your travel expenses. These bonus rewards typically amount to a rebate, effectively putting money back in your pocket. It’s common to get rewards worth $0.03 to $0.05 for every dollar spent on your travels. Travel Insurance & Other Perks If your trip gets canceled, delayed, or your luggage doesn’t arrive on time, your credit cards offer free trip protection and baggage delay insurance. This can be a real lifesaver as it is your safety net in case your trip goes sideways. Some other customer assistance during travel includes cancellation or trip interruption coverage, lost luggage insurance, emergency medical coverage, and free hotel stay or meal credit. You can even find many cards with free checked bags on the associated airline, zero foreign transaction fees for your shopping, and exclusive lounge access. Best Credit Card for Travel: Our top 3 travel credit card picks are Chase Sapphire Preferred Card, American Express Platinum Card, and Capital One Venture Rewards Credit Card. So, if you’re a traveler, you must use your credit card to buy tickets, hotel stays, and unlock other travel benefits. If you are committed to clearing your credit card balance monthly, then using a credit card for grocery shopping is a no-brainer. You can find a wide range of credit cards in the market that provide generous cash-back rewards for grocery purchases- with percentages as high as 2% or even 6%. Some of them include- Blue Cash Preferred Card from American Express, and American Express Gold Card, Chase Freedom Unlimited. As grocery shopping happens many times a month, opting for a grocery credit card while making frequent supermarket purchases can swiftly boost your credit card rewards or cashback. For Instance, Spending $100 every week with an Amex Blue Cash EveryDay card, offering a 3% cashback on U.S. supermarket purchases, you would earn $3 cashback per week. Over a year, this would amount to ($3×52) $156 in cashback earnings. On the other hand, Blue Cash Preferred card from American Express will earn a staggering $312 in cashback earnings. Excellent Rewards Using a credit card for streaming services can bring a host of benefits and perks. Many credit cards offer cashback or rewards points for streaming subscriptions, effectively saving you money on your entertainment expenses. Plus, some cards provide bonus rewards in categories like online streaming, making it a smart choice for those who enjoy binge-watching their favorite shows. For Building Credit Are you wondering what to buy to build credit? You need a simple & regular expense to put on your credit card. Just sign up for STREAMING SERVICES! These services are often affordable and have straightforward monthly payments, making it easier to build a positive credit history without getting overwhelmed. Best Streaming Credit Cards: Two top credit cards for streaming services include Capital One SavorOne Card or American Express Blue Cash Preferred Card with $84 Disney Bundle Credit can come in handy. They can offset your subscription costs while also giving you extra rewards when you use them to pay for popular streaming platforms. Plenty of cards like Costco Anywhere Visa Card by Citi and Amex Blue Cash EveryDay Credit Card give out substantial rewards when you use them to make a purchase at gas stations. However, there’s an extra incentive to use credit cards for your fuel expenses. Using your credit card for gas not only aids you in collecting rewards but also adds a layer of protection against fraudulent transactions. Credit cards provide more robust protection against fraud than debit cards, limiting a cardholder’s liability to a maximum of $50. Regardless of how often you find yourself at the gas pump, it’s always an intelligent move to save on fuel costs. Some of the best credit cards for gas purchases offer bonus points or cash back when you fill up your tank. These rewards serve as a valuable asset, allowing you to accumulate savings for numerous purposes, such as a vacation, making a substantial purchase, or for other financial objectives. Here’s another pricey thing to buy from your credit card. Big-ticket purchases such as refrigerators, laptops, washing machines, home appliances, and other large purchases are worth the swipe because of the rewards and additional perks. It is an excellent way to maximize credit card rewards. Chase Freedom Unlimited Card and Capital One Quicksilver Credit Card are the two best credit cards for large purchases. Protecting your Investments Your credit card can provide valuable purchase protections for such large purchases. This will make you eligible for reimbursement if your gadgets are stolen or broken within the first few months of buying them. Two well-known issuers, American Express and Chase, offer robust purchase protection policies on their several cards. Interest-Free Shopping Another great thing about using cards for big buys is the intro APR offers. If you can get a card with a 0% introductory APR offer, you won’t have to pay any interest for a year or more when you pay back what you bought. Extended Warranty Advantage Let’s not overlook the benefit of extended warranty protection. Many reward cards also come with this perk, which can add an extra year or even more to the warranty given by the manufacturer. Price Protection Perks: Some credit cards also provide price protection, which means they’ll give you back the extra money if the price of something you bought goes down within a certain time after you bought it. And this gets even better with new cards that offer big sign-up bonuses. Hence, it’s a wise decision to use a credit card to buy things.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()