Most people have multiple credit cards, and sometimes managing them all can be a challenge. While a debit card makes it easy to track how much you have spent or how much money is left, one must stay on top of how much is spent on credit cards to avoid unnecessary stress afterward. At the same time, many credit cards offer a plethora of benefits and must-not-miss perks. It is where Credit Card Apps come into play. They help you keep your spending in order while realizing the most value by accessing the benefits.

These apps do the much-needed heavy lifting on your credit card use. You no longer have to sit down and analyze piles of bills and statements, nor end up paying for benefits that come built-in on your cards. They are your allies as they monitor and offer unique insights helping you stay in control.

What Credit Card Management Apps Can Do for You?

It is worth exploring these apps as they do not just remind you of your credit card balances and payment due dates to protect you from late fees but also help you earn reward points, keep your accounts and transactions in one place, manage unplanned expenditure, and so much more. While you rely on Tracking Apps for achieving your fitness goals, why not use apps for Credit Card Management. Here are a few to consider:

1. Credit Card Budgeting Apps

By providing a detailed view of your transactions across multiple credit cards, Credit Card Budgeting App helps you manage your overall finances. These apps ensure on-time payments by giving alerts. Mint is one of the most popular apps and assists the user in creating budgets and tracking card expenses. Using Mint will help you accomplish your financial goals as it is an effective personal finance management tool.

Image Credit- The Mint App

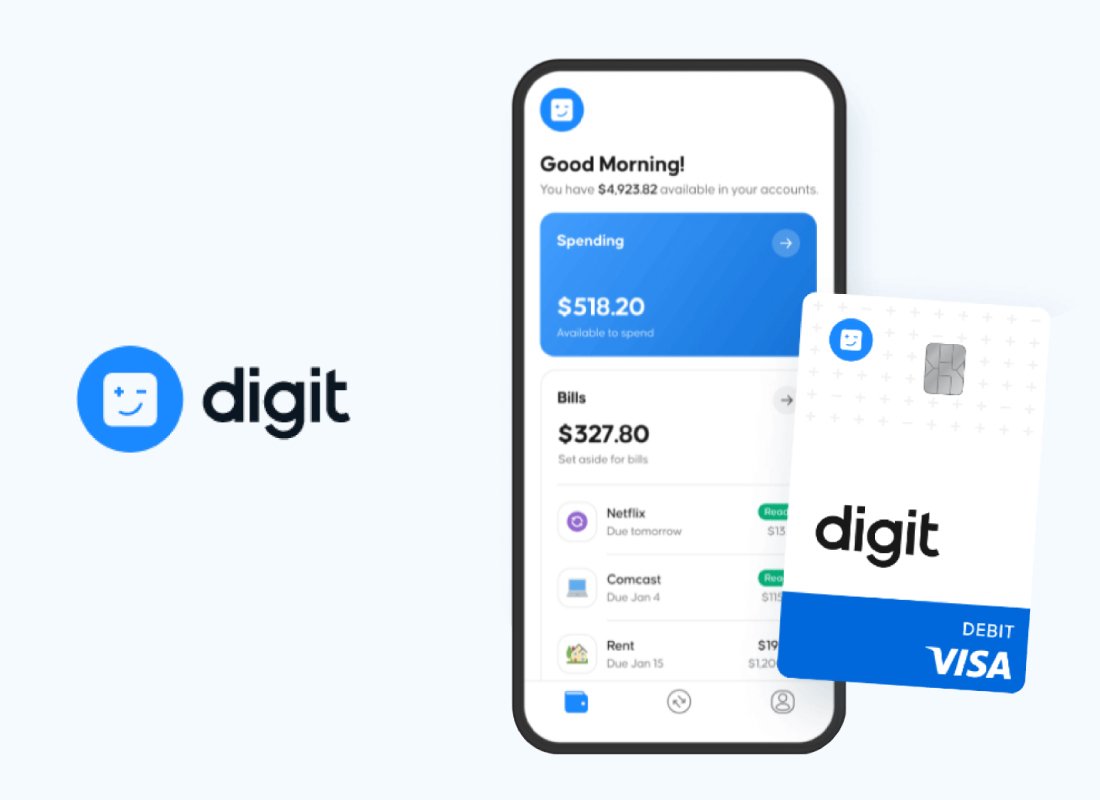

2. Credit Card Payment Apps

You must have a Credit Card Bill Payment app to seamlessly monitor what you owe and when it is due. It is an excellent choice to avoid late fees, increased interest rates, and potential impact on your credit score. A Credit Card Payment App creates a personalized calendar for your upcoming and paid bills. It even allows you to make same-day payments or even schedule them. Just sign up and add your card to give the app access to your current statement. The Digit App is the best choice for saving and investing money effectively and paying your bills on time without any hassle.

Image Credit- The Digit App

3. Monitor Credit Card Benefits

Most of the time, users are not fully aware of many Credit Card Offers and benefits like- Travel Protection, Extended Warranties, Price Protection, free checked bags, and more. Most banks offer easy access to information about these benefits via their mobile apps such as Chase, Amex, and Capital One. It is worth downloading the app as it monitors credit card benefits for travel. It includes statement credit for TSA Pre membership, car rental insurance protection, dining perks (Doordash pass, Uber pass, etc.), extra reward points for Lyft rides, and flight or hotel bookings. You can know the benefits of your American Express card with the Amex App.

Image Credit- The American Express App

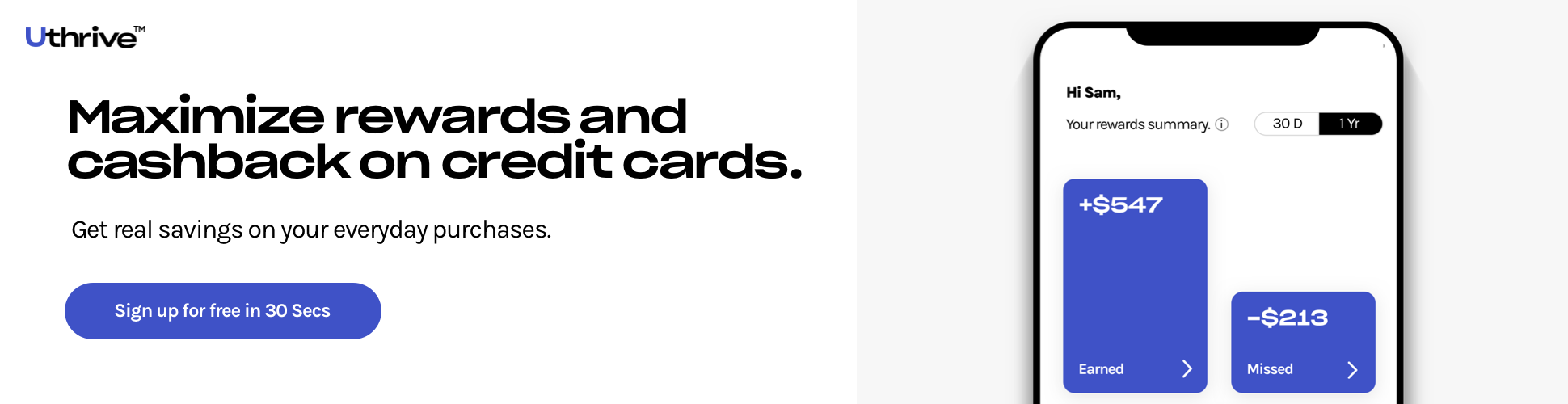

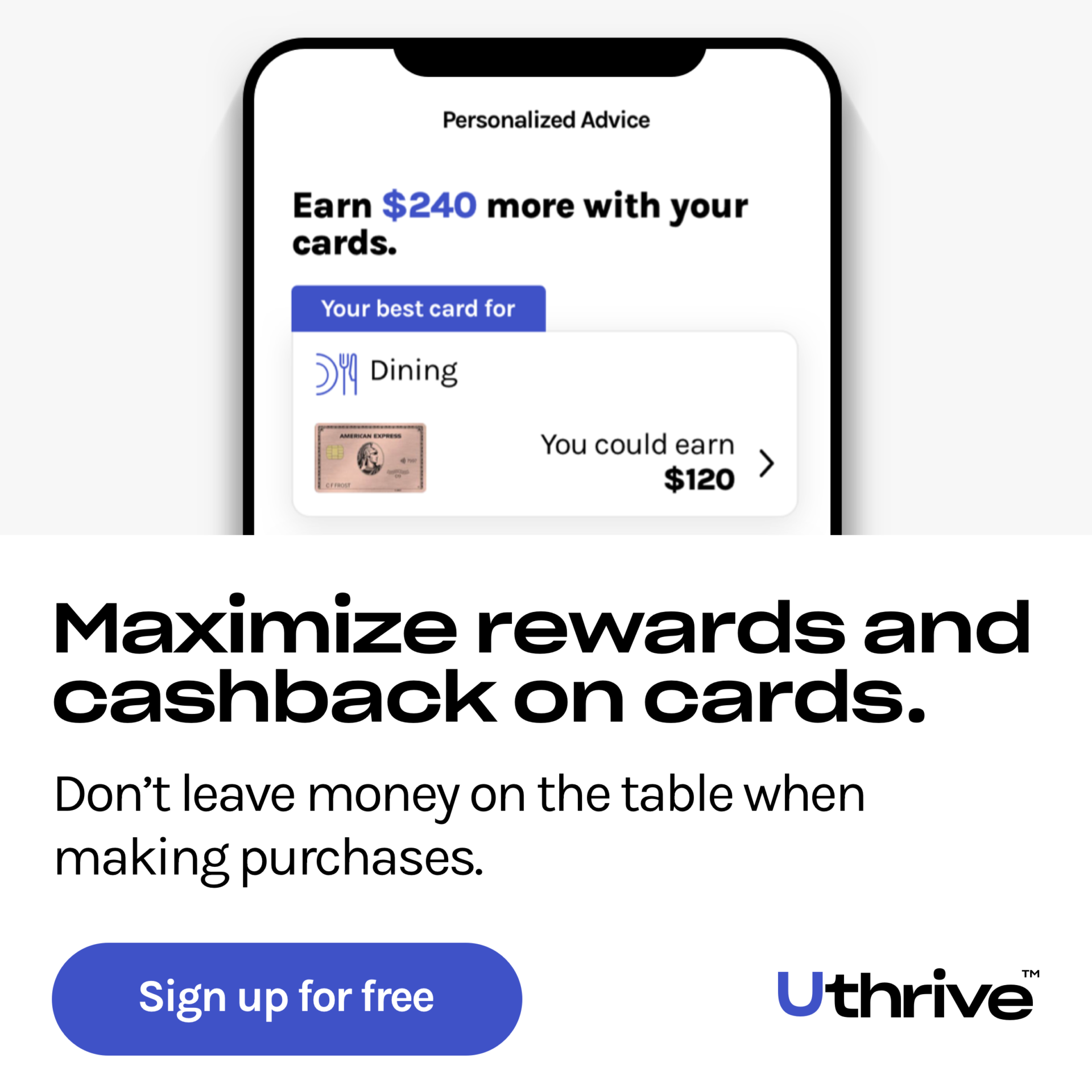

4. Credit Card Tracking Apps

While credit cards offer reward points and cashback, it’s nearly impossible to know which card to use to maximize the rewards and cashback from your spending. There are apps that not only consolidate your Credit Card Rewards in one place, including American Express Membership Rewards, Chase Ultimate Rewards, Citi ThankYou Points, and more. Such Credit Card Tracking Apps offer personalized advice for effectively utilizing credit cards for your purchases and accessing the benefits. It even accumulates enough rewards to travel by using the miles and points collected through the app.

If you are looking for an app to get the Best Credit Card Rewards, download the Uthrive App to maximize your rewards points. Link your credit and debit cards, and it lets you know which card to use for the transaction. Uthrive, with its innovative Al-based algorithms, also gives you an overall picture of rewards you may be missing and personalized recommendations on cards you should consider getting to not leave hundreds of dollars on the table.

Bottom Line

Whatever your credit card preferences are, you can easily find a Credit Card Management App to help accomplish them. Choose the right app to fulfill your goals, travel for less, maximize your experience, avoid extra charges, or earn more from your everyday spending.