Key Takeaways:

-

Amex Offers is a rewards program exclusive to American Express cardholders, offering personalized discounts and cashback rewards of hundreds of dollars tailored to individual spending habits and preferences.

-

Cardholders can easily enroll in offers through their online account or mobile app and then make qualifying purchases at participating merchants to enjoy statement credits or bonus rewards.

-

They cover a range of categories, including dining, entertainment, travel, retail, and services, adding an extra layer of savings to your credit card experience.

-

Almost all American Express cards are eligible for Amex Offers, including personal, business, and co-branded cards, providing opportunities for savings across different card types.

Want to maximize your credit card rewards beyond just welcome bonuses and everyday spending?

Enter the world of Amex Offers, a savings program exclusively for American Express card members, where exclusive discounts and cashback rewards await!

It empowers Amex cardholders to earn rewards on purchases made within designated timeframes, covering categories such as dining, entertainment, and retail.

American Express Credit Card Offers are personalized perks tailored just for you.

Join us as we unravel the process of enrollment, how to redeem these best buy Amex Offers, and show you how to make the most out of these hidden treasures.

If you are curious about those tempting Amex deals that magically appear on your American Express cards, this is for you!

What are Amex Offers?

Amex Offers are tailored deals available after enrolling in Amex credit cards for a limited time. It is a rewards program offered by American Express, allowing cardholders to earn additional benefits and savings on eligible purchases.

With Offers from American Express, you can earn statement credits and bonus rewards when shopping with participating merchants.

These offers cater to almost every type of card you possess, whether it’s a travel rewards card or a small business card.

Cardholders can access Amex Offers through their online account or mobile app and add them to their card.

They provide excellent opportunities for savings, covering a wide range of categories, including dining, travel, entertainment, retail, and more.

These American Express Deals vary for each credit card account, so you may see different offers across your Amex cards.

Remember, only a limited number of card members can enroll in a particular offer. Therefore, it’s best to enroll promptly in offers you like.

How do Amex Offers work?

Amex Credit Card Offers function by providing targeted deals for individual American Express cardholders.

It allows them to earn statement credits, cashbacks, or other bonus rewards when they make qualifying purchases with select merchants.

For Example- A cardholder might have an offer to spend $100 at a specific retailer and receive a $20 statement credit.

You just need to enroll in and add the offer to your credit, make a qualifying purchase from the selected retailer, and then enjoy the reward.

Which cards are eligible for Amex Offers?

Almost all American Express cards are eligible for current Amex Offers, spanning from personal and business credit cards to co-branded airline and hotel cards, like the Delta SkyMiles® Gold American Express Card.

It also includes no-annual-fee credit cards and debit cards, except gift cards, prepaid cards, and corporate cards, except for Serve and Bluebird prepaid cards.

Cardholders can access a wide range of offers tailored to their spending habits and preferences.

Diversifying your Amex portfolio can increase access to these deals, making it a significant money-saving tool.

One can easily view and enroll in available offers through their online account portals or the Amex mobile app, maximizing their savings and rewards.

-

The Platinum Card® from American Express

Annual Fee: $695

Welcome Bonus: Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership.

Rewards:

- 5x points on flights booked directly through airlines or amextravel.com, on up to $500,000 per calendar year

- 5x points on prepaid hotels booked on amextravel.com

- 1x on other eligible purchases

Other Benefits:

- Access to over 1,400 airport lounges with the Global Lounge Collection

- Global Entry or TSA PreCheck Fee Credit

- $200 Hotel Credit and $200 Airline Fee Credit every year

- Complimentary Hilton Honors Gold Elite Status, after enrollment

- No Foreign Transaction Fees

- Up to $100 fee credit for Global Entry or TSA PreCheck

Terms and Limitations Apply*

-

American Express® Gold Card

Annual Fee: $250

Welcome Bonus: Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

Rewards:

- 4x points on restaurants worldwide (including takeout & delivery in the U.S.)

- 4x points at U.S supermarkets on up to $25,000 per calendar

- 3x points on flights directly booked with airlines or amextravel.com

- 1x on other eligible purchases

Other Benefits:

- $120 Dining Credit, enrollment required*

- No foreign transaction fees

Terms and Limitations Apply*

-

American Express® Business Gold Card

Annual Fee: $375

Welcome Bonus: Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

Rewards:

- 4x points on your top 2 eligible business categories, such as U.S. media providers for advertising, transit, U.S. gas stations, and U.S. restaurants

- 3x points on flights and prepaid hotels booked on amextravel.com

- 1x points on other eligible purchases

Other Benefits:

- $240 Flexible Business Credit ($20 statement credit each month), enrollment required

- No Foreign Transaction Fees

- Expense Management Tools to assist business owners

Terms and Limitations Apply*

-

The Business Platinum Card® from American Express

Annual Fee: $695

Welcome Bonus: Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of Card Membership.

Rewards:

- 5x points on flights and prepaid hotels booked on amextravel.com

- 1.5x points on all eligible key business spending, such as U.S shipping providers and U.S. construction material & hardware suppliers, and on eligible purchases of $5,000 (on up to $2 million per year)

- 1x on other eligible purchases

Other Benefits:

- Access to 1,400+ airport lounges

- Up to $100 Fee Credit for Global Entry or TSA PreCheck

- Marriott Bonvoy Gold Elite Status

- Hilton Honors Gold Status, enrollment required

- $1,000 Business Credit for Dell Technologies, Adobe, etc. (enrollment required)

- Expense Management Tools

Terms and Limitations Apply*

To learn more about selecting the ideal American Express credit card tailored to your needs and spending habits, explore our comprehensive guide to Amex Membership Rewards, highlighting the top American Express cards and the best American Express Business Credit Cards for the growth of your business.

| Credit card |

Uthrive rating

|

Intro offer | Rewards rate | Annual fee | Learn more |

|---|---|---|---|---|---|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 5X Membership Rewards® Points |

Annual Fees annual_fees |

|

|

American Express® Gold Card

American Express® Gold Card

Terms Apply |

Rating

4.7/5

|

Intro Offer bonus_miles_full |

Reward Rates 3x - 4x Membership Rewards® Points |

Annual Fees $250 |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles_full |

Reward Rates 1 - 2 Miles on every dollar |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles_full |

Reward Rates 1x - 5x Membership Rewards® points |

Annual Fees annual_fees |

Different Types of Amex Offers

The list of Amex Card Offers stretches around 100 deals at a time! They are a fantastic way for American Express cardholders to unlock additional savings and rewards on their everyday purchases.

Amex has money-saving offers in various categories, including dining, entertainment, beauty, etc. You can earn rewards, ranging from statement credits to discounts, helping to increase your spending power.

Explore the different types of Amex Offers available to cardmembers.

-

Featured Offers

Featured OffersThese are generally directly from American Express, such as giving reminders to add an authorized user, utilizing a promoted card perk, and more.

-

Dining Offers

Dining OffersYou receive statement credits for dining purchases at participating restaurants, cafes, or food delivery services, including local restaurants, national chains, and bakeries.

-

Services

ServicesAmex Offers also covers various services like- phone and internet service, spa treatments, car rentals, and home services with exclusive discounts or rewards.

-

Travel Offers

Travel OffersEnjoy cashback or discounts on travel-related expenses – varying from card to card, including flights, hotels, car rentals, and vacation packages.

-

Entertainment Offers

Entertainment OffersThese Amex Offers are mostly focused on streaming services, where you get rewards for purchases related to entertainment, such as movie tickets, concert tickets, or streaming subscriptions.

-

Retail Offers

Retail OffersGet amazing rewards with Amex Offers for shopping at selected merchants, both online and in-store, covering a wide range of products from clothing and electronics to beauty and home goods.

Such online shopping offers help you earn your money back in the form of statement credit from popular e-commerce platforms.

-

Local Offers

Local OffersDiscover deals and rewards for supporting local businesses in your community, encouraging cardholders to shop locally and enjoy savings on everyday purchases.

How to get Targeted Amex Offers?

To get targeted Amex Offers, make sure your American Express account has opted for marketing communications to receive recent updates and deals via email.

Keep an eye on promotional emails from American Express, as they often include personalized offers.

Regularly check your account online or through the mobile app for current offers tailored to your spending habits.

Additionally, make purchases with your Amex card at participating merchants, as this may trigger targeted offers based on your transaction history.

Use your American Express credit card, especially premium ones like The Platinum Card® from American Express to access Amex Platinum Offers like the Amex Platinum 150k Offer and Amazon Amex Offers.

Finally, engage with American Express’ social media channels and follow relevant hashtags for potential exclusive Amex deals.

How to enroll in Amex Offers?

It is very simple to enroll in Amex Offers. Just log in to your American Express online account or open the Amex mobile app.

Go to the “Offers” section, where you’ll find a list of available deals personalized to your spending patterns.

Browse through the offers and click “Add to Card” on the ones you like. Once the offer is enrolled in your eligible Amex credit card, use it to make purchases at the participating retailers.

Note that enrollment may be limited, so it’s advisable to act quickly.

You’ll automatically receive statement credits or rewards based on the offer terms. Keep an eye out for new offers regularly to maximize your savings!

Ensure to carefully review the terms and conditions specific to each offer, as some may require a minimum spending threshold or specific merchants.

How to add Amex Offers to your card?

If you want to make the most of your Amex Offers, you must manually add them to your credit card. Follow these easy and quick steps to ensure you don’t miss out on valuable savings:

-

Access Your Account

Log in to your American Express account through the official American Express website or AMEX mobile app.

-

Navigate to Offers

Now go to the Amex Offers tab and click on it.

-

Browse Available Offers

Explore the list of all current Amex Offers tailored to your card account.

-

Add Offers to Your Card

Simply scroll through the available offers to find the one that interests you. Then, click on ‘Add to Card’ to activate the Offer on your chosen Amex card.

-

Enjoy Rewards

After adding the offer, use your card for making a qualifying purchase, and Amex will automatically apply the rewards as a statement credit, typically within five business days.

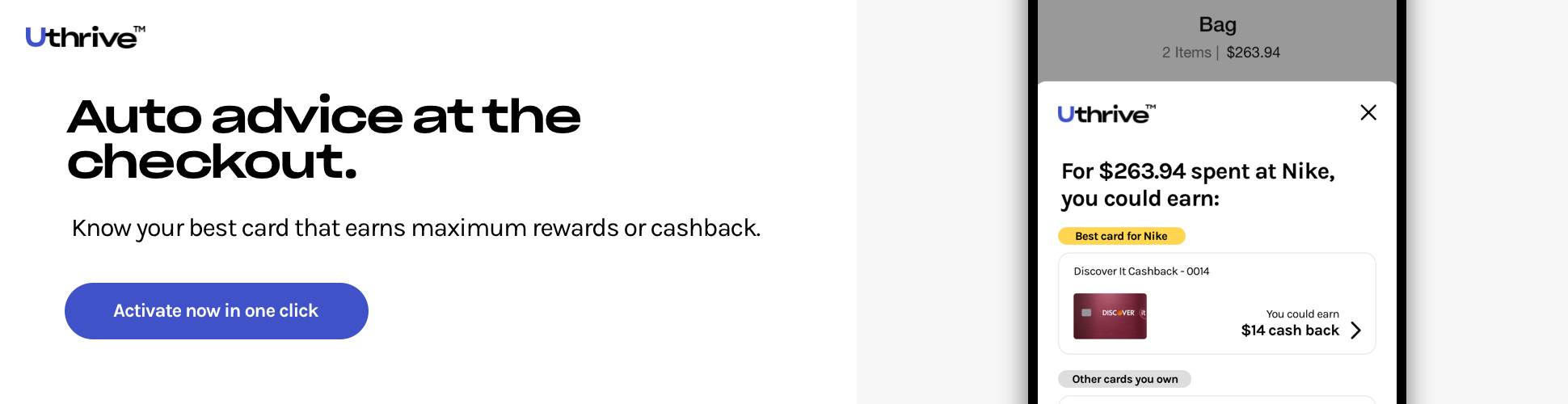

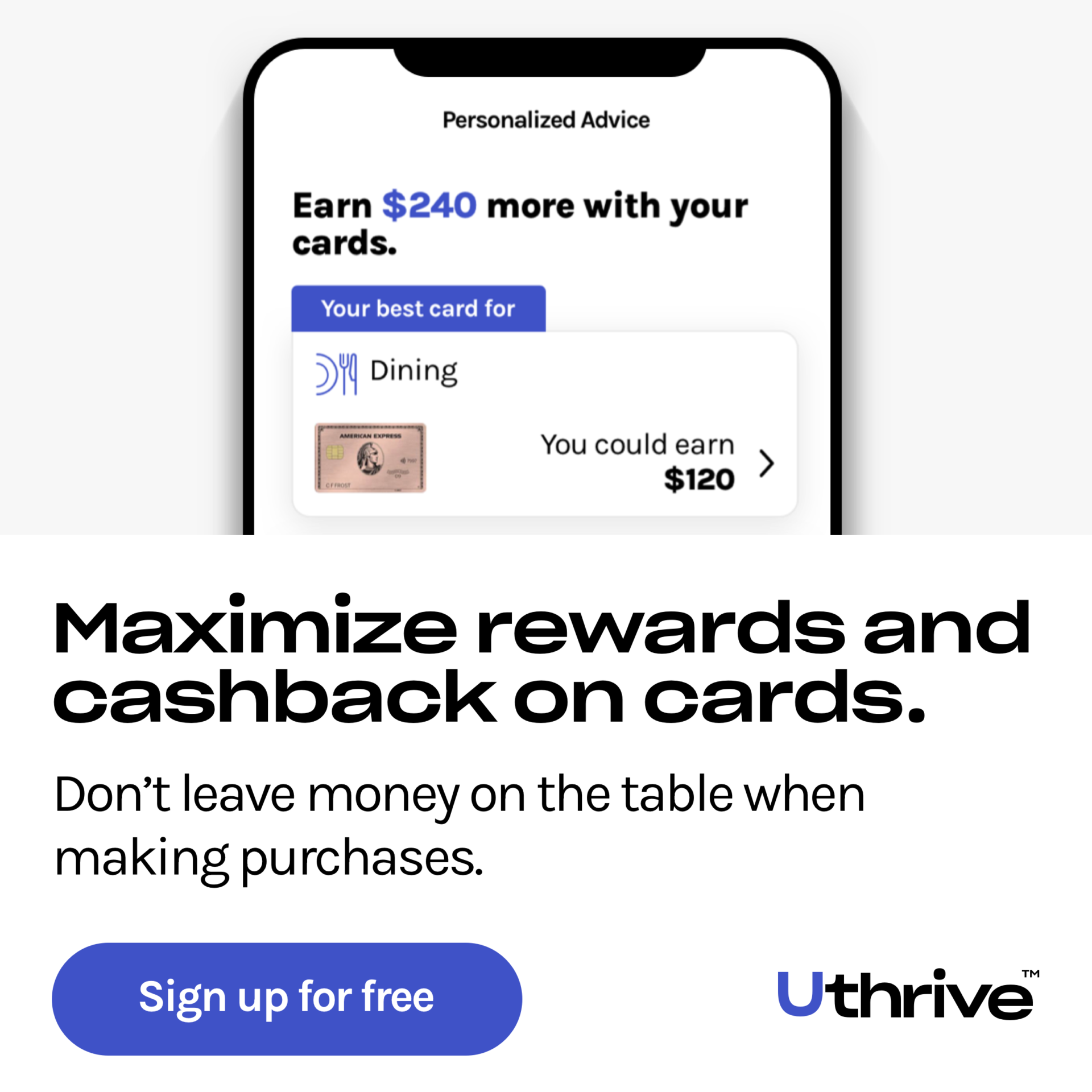

Don’t want to add Amex Offers manually every time? Opt for the Uthrive App Premium benefits to add your available Amex Offers to your card automatically. This saves you the time and hassle of doing it on your own every month.

What to do if you have multiple Amex cards?

If you have multiple American Express cards, you must keep track of which offers you add to each credit card.

Each of your Amex card accounts may have different Offers, so it’s essential to review them individually.

Additionally, you can move Amex Offers from one card to another by contacting Amex customer service.

This helps you optimize your rewards using the credit card with the best offer for each purchase while maximizing your perks.

You should select the appropriate card for enrolling in Amex Offers with strategic thinking when you have more than one Amex card.

Some credit cards may offer bonus points, while others provide cash-back incentives.

Always be smart about adding deals to each card and prioritize enrolling on cards with targeted Offers.

Carefully select the credit card for each Amex Offer to enjoy benefits across your Amex portfolio.

How to Use Amex Offers?

Redeeming Amex Offers is a pretty straightforward way to earn rewards and savings on your everyday purchases.

Simply enroll your American Express credit card in eligible deals and make qualifying purchases at participating merchants.

Ensure to add each offer through your Amex online account on the website or mobile app.

Just browse through and click on ‘Add to Card’ next to the offers that align with your spending preferences.

Use your enrolled credit card to make purchases at the specified retailers while meeting any requirements, such as minimum spending thresholds or location restrictions.

You can then enjoy statement credits automatically within a few days after completing qualifying purchases.

Remember, each Offer from American Express can only be added to one card, so choose wisely about how to use them based on your intended card usage.

You can also combine Amex Offers with promo codes and shopping portals to maximize benefits.

Visit the Offers tab frequently and continue adding offers to your eligible Card, as Amex constantly adds new ones when old ones expire.

They are easy to add, earn, and redeem!

Best Tips for Amex Offers

Cardholders can unlock the full potential of their American Express Credit Card Offers by following some tips discussed below.

They enhance your savings and rewards on purchases you already intend to make.

Remember to stay informed, plan strategically, and utilize offers that align with your financial goals and preferences.

Here is how you can make the most of this program while earning substantial savings.

-

Make the Right Selection to Enroll Your Card

Make the Right Selection to Enroll Your CardOne should always explore the list of deals and choose the Amex Offers that align with their usual spending habits to maximize rewards effortlessly.

-

Optimal Timing is the Key

Optimal Timing is the KeyKeep an eye on your Offers’ expiration dates and other requirements and terms by the merchants to ensure you don’t miss out on substantial savings.

-

Stack your Amex Rewards

Stack your Amex RewardsWhen you combine Amex Card Offers with other promotions, such as promo codes or shopping portals, you earn more rewards and additional savings on your shopping.

-

Always Review the Offers Terms & Conditions Carefully

Always Review the Offers Terms & Conditions CarefullyCardholders must understand their added Offers’ terms and requirements, including minimum spending thresholds, eligible merchants, and specific locations, to ensure they qualify for rewards.

-

Plan your Purchases for More Rewards

Plan your Purchases for More RewardsIf you strategically time your American Express shopping to coincide with the lucrative Amex Offers program, especially for large purchases or upcoming travel plans, you can boost your rewards-earning potential.

-

Track your Credit Card Spending

Track your Credit Card SpendingMonitor your enrolled Amex card transactions regularly to confirm that your purchases qualify for the Amex Offers.

How to Maximize Amex Offers?

American Express Offers can be a great way to save money on purchases you were planning to make beforehand.

You can get maximum value from these offers with strategic planning and attention to detail.

They are excellent on their own, but you can double- or even triple-dip to get a much better return.

Here are some tips to ensure you get the most out of these valuable savings opportunities:

-

Stack Offers with Online Shopping Portals

Combine your Amex Card Offers with online shopping portals to earn extra cash back or bonus miles on your purchases.

Just add the Amex Offers promotion and then access the merchant’s website through a shopping portal to earn double rewards – both the Amex Offer reward and portal reward.

-

Take Advantage of Credit Card Bonus Categories

Make sure you leverage your card’s bonus categories to earn cashbacks, bonus points, or miles in addition to Offers’ cashback.

Look for opportunities to use your credit card for purchase categories that align with Amex Offers to maximize your rewards.

-

Read the Terms Carefully

Pay close attention to the terms and conditions of each Amex Credit Card Offer to ensure your eligibility and easy redemption.

Some deals might have restrictions on additional stacking, so be sure to understand the requirements before making a purchase.

-

Combine with Other Amex Perks

You can boost your savings by stacking your Amex Offers with other perks provided by American Express cards, such as annual statement credits.

Find ways to use your credit card at participating retailers to unlock additional benefits and savings.

-

Ensure to Register Early

Whenever you spot an Amex Offer you may use, always register right away!

All these offers come with registration caps, so securing your spot ensures you do not miss out on potential savings, even if you don’t make a purchase immediately.

-

Keep Added Offers Below 100

Aim to keep your total Amex Offers below 100, as it consistently gives you access to new offers.

If you enroll in new deals under this threshold, you increase your likelihood of getting fresh offers regularly.

-

Choose Your Credit Card Wisely

Opt for the card that offers the best rewards and benefits, meeting your needs and preferences- beyond the Amex Offer deals.

Select a credit card with robust bonus categories or rewards rates that align with the specific offer to maximize savings

Keep in mind that just because something is on sale doesn’t automatically make it a good deal, so you must avoid unnecessary expenses.

For example, everyone would love to enjoy a 20% cashback on a fancy hotel stay at Hyatt or Hilton, but that does not mean you have to book a stay without any travel plans.

Best Amex Offers for 2024

American Express continues to provide enticing deals with a limited timeframe through its excellent Amex Offers program, rewarding cardholders with opportunities to save on many different purchases.

From travel and dining to retail and entertainment, Amex Credit Card Offers cater to several spending preferences, allowing users to earn statement credits or discounts on eligible transactions.

Let’s explore some of the currently available Best Buy Amex Offers 2024 that deliver exceptional value and benefits to American Express members (be sure to act promptly to seize these opportunities!).

-

Hilton (Las Vegas and Nevada Locations)

Spend $500 or more and get $100 back.

-

Expedia

Get 10% back on your purchases, up to a total of $100.

-

Adobe

Spend $20 or more to get $10 back every month, up to 3 months.

-

Sixt+

Receive $199 back when you spend $1,000 or more.

-

Reebok

Get 3% cashback on your purchases for up to a total of $250.

-

Cruise America

Spend $500 or more to get $100 cashback.

-

Hyatt Hotels and Resorts (Canada)

Earn a $100 back after spending $500 or more.

-

Fig and Olive

Get $20 cashback when you spend $100 or more.

-

The Motley Fool

You can earn $50 back on spending $99 or more.

-

Marley Spoon

Spend $65 or more and get $20 back, up to 2 times i.e. total of $40.

-

The Langham Hotels & Resorts

Enjoy a $150 cashback when you spend $750 or more.

-

Blue Bottle Coffee

Receive $3 back after spending $15 or more.

-

Paramount Plus

Get $11 back for up to 3 times i.e. total of $33, when you spend $11 or more.

-

Margaritas Mexican Restaurant

Earn a $12 cashback if you spend $60 or more, up to 2 times.

-

Wahoo’s Tacos and More

Spend $25 or more to get $5 back for up to 3 times i.e. total of $15.

-

Stitch Fix

Earn a $25 cashback when you spend $50 or more.

-

Harry’s Table

Get $8 back after spending $40 or more.

-

Crunchyroll

Receive $4 back when you spend $7.99 or more for up to 3 times.

-

Just Salad

Enjoy $5 cashback if you spend $15 or more, up to 2 times i.e. total of $10.

-

Clinique

Get 6% back on all your purchases for up to a total of $250.

-

TurboTax

Spend $50 or more and get $10 back.

-

Bose

Get 15% cashback on your purchases for up to a total of $50.

-

Jane Restaurant and Bar

Earn a $15 cashback on spending $75 or more.

-

History Vault

Receive a $15 cashback after spending $40 or more in a single purchase for an annual subscription.

-

Fanatics

Spend $100 or more and get $25 back, up to 2 times for a total of $50.

-

SkinCeuticals

Enjoy a $40 cash back when you spend $200 or more in purchases.

-

Clutter

Get $50 back if you spend $150 or more.

-

Skims

Earn +5 Membership Rewards points per eligible dollar spent for up to 5,000 points.

-

iRobot Vacuum and Mop

Spend $400 or more to get $75 back.

-

Sunday Citizen

Receive $50 back after spending $200 or more.

Remember not all offers will be accessible to every Amex cardholder, as certain offers may be exclusive to specific cards or targeted toward selected members.

With new offers regularly added and existing ones refreshed, you can maximize your savings and rewards throughout the year.

Are Amex Offers worth it?

YES! Amex Offers are worth it as they provide rewards and savings on purchases you already planned to make, along with being a smart strategy to offset hefty annual card fees.

These rewards can add up quickly, especially when combined with other promotions or your existing credit card cashbacks.

By enrolling in American Express Card Offers tailored to your spending habits, you can earn statement credits or discounts, effectively reducing the cost of your purchases.

Moreover, these Amex deals are free to use and easily accessible through your American Express account, making them a convenient way to maximize the benefits of your credit card membership.

It presents an appealing opportunity to earn rewards on your regular purchases, though it’s important to avoid overspending just to get rewards.

Despite increasing competition from other providers like Chase, Capital One, and Citi, Offers from American Express stay at the top with the most value!

FAQs

How do you add Amex Offers manually?

To add Amex Offers manually, just log in to your Amex account online, go to the Amex Offers tab, and click on add when you see an Offer that you would like to use.

With Uthrive Premium, you can skip adding the Amex Offers by yourself, as the app automatically adds the Offers to your card.

How often do Amex Offers change?

Amex Offers change regularly, with new offers appearing frequently and old ones expiring. It’s best to check the Offers section regularly for updates, as they depend on merchant partnerships and seasonal promotions.

What benefits does Amex offer?

Amex offers a wide range of benefits for its customers, including robust rewards programs, purchase protection, cell phone protection, travel perks like airport lounge access, statement credits, and access to Amex Offers.

Can I use different Amex Offers on all of my American Express cards?

Yes, you can use different Amex Offers on all your American Express credit cards as long as the offers are available on each card individually – because you cannot add an Amex Offer to another card.

Also, remember Amex Offers are different for every card and cardholder as well.

Does Amex offer travel insurance?

Yes, some American Express credit cards offer travel insurance like American Express® Gold Card and The Platinum Card® from American Express, including coverage for trip cancellation/interruption, baggage delay, and rental car insurance. Coverage limitations and other Terms and Conditions apply*,

How to get Amex Platinum 150k Offer?

Some applicants can get the Amex Platinum 150k Offer with a targeted offer or by pre-qualifying after meeting the threshold of spending $8,000 on purchases within the first six months of card membership.

Why am I not eligible for Amex welcome offer?

You may not be eligible for an Amex welcome offer if you’ve already had the card or a previous version of the same card earlier or exceeded your welcome offer limits.

Does Amex offer balance transfers?

Yes, Amex offers balance transfers on some cards, like the Blue Cash Everyday® Card from American Express, allowing you to move existing debt from one credit card to another with a 0% APR period.

Does Amex offer rental car insurance?

Yes, Amex offers car rental insurance on some cards, like The Platinum Card® from American Express, providing coverage for damage or theft when you rent a car using your American Express credit card.

What happens if I don’t use my Amex Offers?

If you don’t use your Amex Offers before they expire, you will end up missing out on the potential savings or rewards associated with those offers.

How can you check for Amex upgrade Offers?

To check for Amex upgrade Offers, simply log in to your Amex account, navigate to the Account Services section and select Card Management to see if there are any targeted upgrade Offers available for your account.

You are only eligible for Amex Upgrade Offers if your account is in good standing for at least a year.