Key Takeaways:

-

No annual fee credit cards are a cost-effective solution, eliminating the burden of annual fee and providing strong value without additional costs.

-

You can maximize the benefits of no annual fee cards by making full monthly payments, pairing them with premium cards, utilizing welcome bonuses, leveraging intro APR periods, and strategically using the card’s perks.

-

Credit cards with no annual fee are suitable for credit newcomers, individuals with financial constraints, those building or rebuilding credit, and those seeking 0% introductory APR benefits.

A credit card without an annual fee opens the door for cardholders to enjoy rewards and perks without an annual fee. Opting for the best credit card with no annual fee can be enticing, but remember, all these cards are not identical.

When used wisely, credit cards transform into outstanding financial instruments, offering not just essential consumer protections but also opportunities to earn rewards for every dollar spent.

Today, we’ll explore the eight top no-annual-fee credit cards that eliminate the burden of annual fees and offer valuable perks and rewards.

By opting for these, you can save significant amounts annually and make informed choices that contribute to your overall financial well-being.

What is an Annual Fee?

An annual fee is a recurring charge imposed by credit card issuers for maintaining and utilizing a credit card.

While many credit cards, especially those offering premium rewards or those targeting consumers with lower credit scores, come with annual fees, not all cards have this cost.

The best no-annual-fee cards eliminate this yearly expense, offering a wide selection with various perks.

Some cards may waive the annual fee in the first year or provide incentives, creating options for potential cardholders.

Understanding the implications of an annual fee is crucial when selecting a credit card, as it directly impacts the overall cost and benefits associated with card ownership.

Best No Annual Fee Credit Card

Choosing the best credit card with no annual fee means the cardholder is exempt from a yearly charge imposed by the issuer.

However, a no-annual-fee card doesn’t necessarily translate to a fee-free experience, as additional charges like late fees, balance transfer fees, and foreign transaction fees may apply, along with interest on carried balances.

It’s crucial to review the fine print to comprehend the comprehensive fee structure of any chosen credit card.

Navigate through the financial possibilities with the finest credit cards that align with your lifestyle, providing unparalleled benefits without the burden of annual fees.

From travel enthusiasts to those craving cash-back rewards, find the perfect match for your wallet among the best credit cards with no annual fees.

-

Capital One Quicksilver Cash Rewards Credit Card

The Capital One Quicksilver Cash Rewards Credit Card stands out as one of the best no annual fee credit cards due to its straightforward and unlimited 1.5% cash back on all purchases.

Ideal for those who prefer simplicity, it offers a flat-rate reward structure without any rotating categories.

Welcome Offer: One-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

Rewards Rate: 1.5% – 5% Cashback

APR: 0% intro on purchases 15 months

Annual Fee: $0

Additionally, the card provides a bonus_miles_full for new cardholders and 5% back on hotels & rental cars booked through Capital One Travel.

With no foreign transaction fees, it’s suitable for both domestic and international use.

The simplicity of earning and redeeming cash back, coupled with other travel perks makes it a great choice for everyday spending.

-

Capital One SavorOne Cash Rewards Credit Card

The Capital One SavorOne Cash Rewards Credit Card is an excellent credit card for entertainment and food with zero annual fees.

Boasting 3% cash back on dining, entertainment, popular streaming services, and grocery stores, it’s an ideal choice for those who frequently spend on these categories.

Welcome Offer: $200 Cash Back after you spend $500 on purchases within 3 months from account opening

Rewards Rate: 1% – 5% Cashback

APR: 0% intro on purchases 15 months, then 19.99% – 29.99% (Variable)

Annual Fee: $0

The card also offers 5% cash back on hotels & rental cars booked through Capital One Travel and 8% back on eligible Capital One Entertainment purchases.

With no annual fee, an appealing welcome offer of bonus_miles_full, Complimentary Concierge Service, and more, the SavorOne Card caters to individuals seeking rewards in their lifestyle spending. Enrollment Required.

-

Chase Freedom Flex℠

The Chase Freedom Flex℠ is best for flexible rewards with an exciting earning structure that covers a wide range of expenses, along with 5% cashback on rotating quarterly bonus categories, such as grocery and gas stations.

This card allows cardholders to maximize their rewards

Welcome Offer: Earn a good $200 Welcome Bonus after spending $500 in the first three months of getting this card.

Rewards Rate: 1% – 5% Cashback

APR: 0% Intro. APR for 15 months, then 20.49% – 29.24% variable

Annual Fee: $0

It is among the best no annual fee credit cards due to its versatility and robust rewards program.

The card also features 5% cash back on Chase travel and 3% cash back on eligible dining and drugstore purchases.

With a generous welcome bonus of Earn a good $200 Welcome Bonus after spending $500 in the first three months of getting this card and several valuable perks, the card is well-suited for individuals seeking dynamic rewards.

-

Blue Cash Everyday® Card from American Express

The Blue Cash Everyday® Card from American Express is the finest no annual fee credit card to earn solid rewards, particularly for families and individuals focused on everyday spending.

It is the best card for U.S. supermarkets with 3% cash back at U.S. supermarkets (on up to $6,000 spend per year, then 1%).

Welcome Offer: Earn a $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months.

Rewards Rate: 3% Cashback under different categories

APR: 0% on purchases 15 months, then 19.24% – 29.99% Variable

Annual Fee: $0

Cardholders also get 3% back at U.S. gas stations and U.S. Online Retail Purchases (On up to $6,000 spend per year, then 1%), 1% on all other eligible purchases, and a welcome bonus of bonus_miles_full

With Amex’s reputation for excellent customer service, the card provides useful statement credits and a intro_apr_rate,intro_apr_duration, then reg_apr,reg_apr_type on purchases and balance transfers. Terms Apply*.

-

Chase Freedom Unlimited®

The Chase Freedom Unlimited® secures its position as one of the best no annual fee credit cards with its simple yet lucrative cash back structure.

Offering a flat-rate 1.5% cash back on all eligible purchases, it’s an excellent choice for individuals who prefer a consistent and uncomplicated rewards program.

Welcome Offer: Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That’s 6.5% on travel purchased through Chase Travel, 4.5% on dining and drugstores, and 3% on all other purchases.

Rewards Rate: 1.5% – 5% cashback

APR: 0% Intro APR on Purchases 15 months, then 20.49% – 29.24% Variable

Annual Fee: $0

The card also features a compelling welcome bonus of bonus_miles_full. It also lets you earn 5% on eligible travel purchased through Chase travel and 3% on eligible restaurants and drugstore purchases.

With no earning caps and valuable protections, the card is ideal for those seeking a hassle-free approach to earning cash back on every purchase.

-

Citi Custom Cash® Card

The Citi Custom Cash® Card earns its recognition among the best credit cards with no annual fee for its unique and customizable cash-back structure.

Ideal for those who want to maximize rewards in their top spending category each billing cycle with a competitive 5% cash back rate, the card automatically adapts to cardholders’ changing spending patterns.

Welcome Offer: Earn $200 in cash back after you spend $1500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® points, which can be redeemed for $200 cash back.

Rewards Rate: 1% – 5% cashback

APR: 0% 15 months, then 19.24% – 29.24% (Variable)

Annual Fee: $0

The top eligible category include restaurants, gas stations, grocery stores, select travel, select streaming services, etc. – up to the first $500 spent.

It offers 1% back on other eligible purchases and a generous welcome bonus of bonus_miles_full

The card’s versatility, flexible redemption, $0 liability on unauthorized charges, and Citi Entertainment perks make it an attractive option for individuals seeking tailored rewards without the commitment of annual charges. Enrollment Required.

-

card_name

The card_name is considered one of the top no annual fee credit cards for travelers who frequently fly with Delta Airlines.

Ideal for those seeking travel rewards without the burden of an annual fee, this card offers an array of benefits like 20% back on in-flight purchases. Enrollment Required.

Welcome Offer: Earn 10,000 bonus miles after you spend $1,000 in purchases on your new Card in your first 6 months.

Rewards Rate: 1X – 2X Miles

APR: reg_apr,reg_apr_type

Annual Fee: annual_fees

Cardholders earn 2x Delta SkyMiles at restaurants and eligible Delta purchases and a welcome bonus of bonus_miles_full, allowing them to accumulate miles for future flights.

Additionally, the card provides 1x miles on other eligible purchases and no foreign transaction fees.

It is an excellent choice for those who value Delta’s extensive flight network and want to enjoy travel perks without additional costs. Terms Apply*.

-

Hilton Honors American Express Card

The Hilton Honors American Express Card stands out as one of the best no annual fee credit cards, particularly for individuals who often stay at Hilton hotels.

Tailored for hotel enthusiasts, this card offers robust rewards and benefits without an annual fee, such as complimentary Hilton

Welcome Offer: Earn 100,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership. Offer ends 4/17/24.

Rewards Rate: 3x – 7x Hilton Honors Bonus Points

APR: reg_apr,reg_apr_type

Annual Fee: annual_fees

Cardholders earn 7x points at hotels and resorts in the Hilton portfolio, 5x at U.S. restaurants, U.S. gas stations, and U.S. supermarkets, and 3x points on all other eligible purchases.

The card also provides a welcome bonus of bonus_miles_full, making it an attractive option for those seeking to enhance their hotel experience and earn valuable rewards within the Hilton Honors program. Terms Apply*.

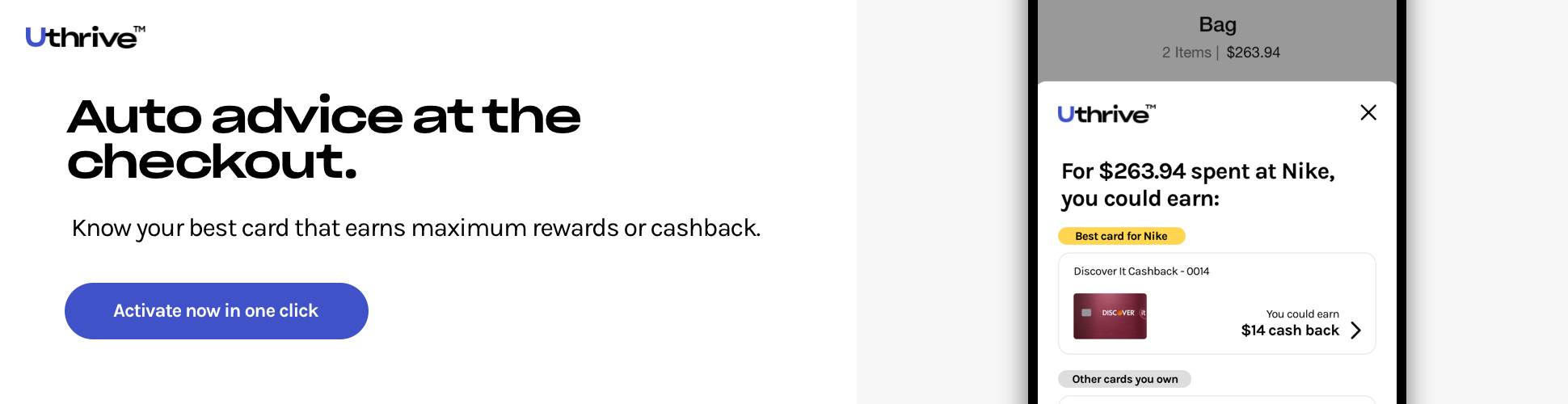

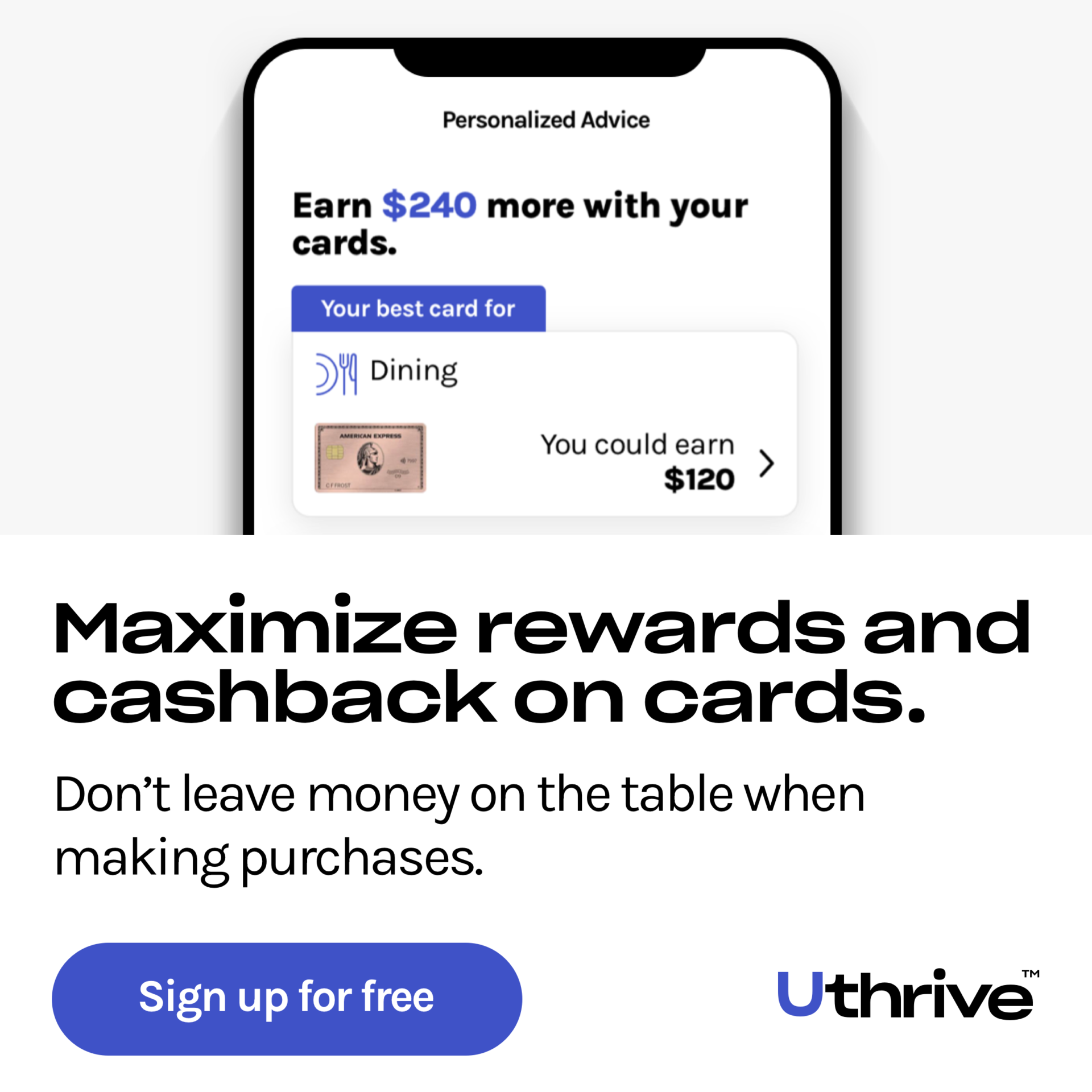

To identify the best credit cards of 2024, our experts compare the rewards, interest rates, and fees. We assure the tailored services of the Uthrive App outshine the rest.

| Credit card |

Uthrive rating

|

Intro offer | Rewards rate | Annual fee | Learn more |

|---|---|---|---|---|---|

|

Terms Apply |

Rating

4.6/5

|

Intro Offer bonus_miles_full |

Reward Rates 1.5% - 5% Cashback |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.6/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 8% Cashback |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.7/5

|

Intro Offer Earn a good $200 Sign-up Bonus after spending $500 in the first three months of getting this card. |

Reward Rates Up to 5% Cashback |

Annual Fees $0 |

|

|

Terms Apply |

Rating

4.6/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 3% Cashback |

Annual Fees annual_fees* |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles_full |

Reward Rates 1.5%-5% Cashback |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.5/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 5% Cash back |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.8/5

|

Intro Offer bonus_miles_full |

Reward Rates 1x - 2x Miles per dollar |

Annual Fees annual_fees |

|

|

Terms Apply |

Rating

4.6/5

|

Intro Offer bonus_miles_full |

Reward Rates Up to 7x Hilton Honors Bonus Points |

Annual Fees annual_fees |

Pros and cons of no-annual-fee credit cards

Pros

-

Cost-Efficiency: No annual fee credit cards offer a cost-effective solution for cardholders, eliminating the burden of a yearly charge.

-

Accessible for All: With no annual fee, these cards are more accessible to a wide range of individuals, including those with varying income levels and credit histories.

-

Introduction to Credit Building: For individuals new to credit, the best no annual fee credit cards offer an introductory platform for building a positive credit history without the immediate financial strain of an annual charge.

-

Financial Flexibility: Credit cards without an annual fee provide users with financial flexibility, allowing them to enjoy the benefits of credit without committing to a recurring annual cost.

Cons

-

Limited Sign-Up Bonuses: These credit cards often come with smaller sign-up bonuses, making them less attractive for individuals seeking substantial initial rewards.

-

Reduced Luxury and Additional Perks: No annual fee cards are less likely to offer premium travel perks such as airport lounge access, travel insurance, or elite status.

-

Less Valuable Rewards: The rewards offered by cards with no annual fees tend to be less valuable than those associated with annual fee counterparts.

When should you get a No-Annual-Fee Card?

Deciding when to opt for a no annual fee card depends on your unique financial circumstances and preferences.

It involves a thoughtful assessment of your usage patterns, spending habits, and financial objectives.

These cards are a cost-effective credit solution without the burden of yearly charges. Consider acquiring the best credit card without an annual fee under the following scenarios:

-

Ideal for Credit Newcomer

Ideal for Credit NewcomerIf you’re entering the realm of credit cards for the first time, a no annual fee card provides a straightforward option without the complexity of offsetting an annual fee.

This allows you to gain experience without added financial pressure.

-

Financial Constraints

Financial ConstraintsWhen the additional cost of an annual fee is not feasible for you, the best reward no annual fee credit card becomes a sensible choice.

However, bear in mind that while the annual fee is absent, other fees like late fees, balance transfer fees, and foreign transaction fees may still apply.

-

Moderate Spending Habits

Moderate Spending HabitsNo annual fee credit cards suit individuals who aren’t heavy spenders. While cards with annual fees often come with enhanced perks, it’s essential to evaluate whether the benefits outweigh the costs.

-

Building or Rebuilding Credit

Building or Rebuilding CreditThose building or rebuilding their credit can benefit from the absence of an annual fee, hence simplifying budgeting efforts.

This streamlined approach can be very helpful, especially for individuals with limited credit history or those recovering from past financial challenges.

-

0% Introductory APR Benefits

0% Introductory APR BenefitsSome of the best no annual fee credit cards offer enticing 0 percent introductory APR on purchases, balance transfers, or both.

This feature is advantageous for those managing debt, providing a temporary interest-free period for substantial purchases or balance transfers from other credit accounts.

-

Diversifying your Credit Portfolio

Diversifying your Credit PortfolioExperienced cardholders with premium cards may want to diversify their wallets and find value in adding a carefully chosen no-annual-fee card to their portfolio.

Combining a premier travel card with an everyday cash-back card, for instance, can enhance the diversity and utility of your credit options.

Annual Fee Credit Cards vs. No Annual Fee

The foremost advantage of the best no annual fee credit card is evident in its name—it doesn’t impose an annual fee, offering a cost-free option that doesn’t burden your finances even if left unused.

In contrast, a card with an annual fee requires sufficient usage to recoup the fee’s value through rewards or perks; otherwise, it becomes a financial drain.

Not only must a fee-based card justify its cost, but it also needs to outshine fee-free alternatives in overall value.

| Annual Fee Credit Cards | No Annual Fee Credit Cards | |

|---|---|---|

Cost |

Typically higher, with an annual charge |

No annual fee, providing cost savings |

Rewards |

Enhanced rewards programs, travel perks |

Modest rewards, but no cost for entry |

Perks |

Exclusive benefits like airport lounge access |

Limited perks, but no additional fees |

Flexibility |

May have more flexible redemption options |

Straightforward with fewer complexities |

Target Audience |

Ideal for frequent travelers or heavy spenders |

Suitable for budget-conscious individuals or new card users |

Credit Score |

May require a higher credit score for approval |

Generally more accessible, suitable for various credit profiles |

Choosing between credit cards with an annual fee and those without involves weighing the benefits against potential costs.

Annual fee cards often offer premium perks, rewards, and exclusive features, while no annual fee cards provide simplicity and cost-effectiveness.

When deciding between the two, personal spending habits, financial goals, and preferences play a crucial role. Analyzing the table above can guide you toward choosing the credit card type that aligns best with your needs and life!

Can I get the annual fee waived on a credit card?

Yes, it is possible to get the annual fee waived on a credit card. If you’re considered a valuable customer, credit card issuers may be willing to waive the fee to retain your business.

Simply call and negotiate with the issuer to waive the fee. Requesting a fee waiver carries no risk, and demonstrating regular card usage increases the likelihood of a positive response.

Alternatively, you might receive a retention offer, providing a bonus that offsets the fee. If a card’s annual fee doesn’t align with your utilization, consider a product change—downgrading to a no-fee card from the same issuer by contacting them for alternatives.

How to Pick a Credit Card with No Annual Fee?

Choosing a credit card with no annual fee is a smart move, given the plethora of options offering noteworthy perks. Thoughtful consideration is key to ensuring it aligns with your financial goals. Here’s a refined guide on selecting the best no-annual-fee credit card for your specific needs:

-

Know your Credit Score and Available Options

Be aware of your credit score, as it significantly influences your credit card options. Some of the finest no annual fee cards are tailored for individuals with good to excellent credit.

For instance, Capital One SavorOne Cash Rewards Credit Card and Capital One VentureOne Rewards Credit Card cards require an excellent credit history, defined by factors like timely bill payments and at least three years of credit history.

-

Analyze Spending Habits

Understanding your spending patterns is pivotal in identifying the ideal no-annual fee card. Some cards provide flat rewards rates on all purchases, while others offer higher rates in specific categories.

Pick a card that maximizes your rewards by complementing your spending, such as earning more at supermarkets or gas stations based on your needs.

-

Determine Preferred Rewards

Decide whether you prefer cash back, travel points, or miles as rewards. Redemption values can differ, so aligning your reward preferences with your typical redemption style aids in selecting the most suitable card.

For frequent travelers, especially those loyal to specific brands, a card with an annual fee might provide valuable perks like checked bags or elite status.

Explore flexible currency cards like Chase Ultimate Rewards or Amex Membership Rewards for diverse travel rewards.

-

Consider Balance Carrying

If you anticipate carrying a balance, opt for the best balance transfer fee credit card with no annual fee, like the Citi Double Cash® Card, which offers a 0% APR on purchases or balance transfers for an extended period.

Be mindful of the ongoing variable APR, as it will revert to this rate post the introductory period.

What to consider before switching to a Credit Card with No Annual Fee?

If you’re contemplating the shift from a card with an annual fee to one without, the process is usually straightforward, involving a simple contact with your credit card issuer.

However, one must evaluate the following before transitioning to a no annual fee credit card as they have their merits, but there are instances where they may not be the optimal choice.

-

Luxury Perks and Benefits

Luxury Perks and BenefitsIf you seek premium perks such as elite status, concierge service, travel insurance, or airport lounge access, no annual fee cards might not meet your expectations.

Cards with annual fees typically offer enhanced features and luxury benefits that are often absent in their fee-free counterparts.

-

Rewards Maximization

Rewards MaximizationFor individuals aiming to maximize rewards, cards with annual fees may provide higher reward rates and more diverse spending categories in comparison to the no annual fee credit cards.

-

Points Handling

Points HandlingUnderstand the impact on your hard-earned reward points. Downgrading to a no-fee card within the same issuer may leave your points unaffected.

Conversely, closing the account and opting for a card from a different issuer might result in forfeiting earned points.

To mitigate this, utilize your points before making any moves, though be aware that closing an account may have a marginal impact on your credit score.

-

Eligibility Timing

Eligibility TimingYou likely won’t be able to downgrade your card within the initial year of account opening. Verify with your issuer for precise eligibility details.

Why should you consider downgrading to a No-Annual-Fee Credit Card?

To embrace evolving financial goals, you must reevaluate your credit card choices. Rather than outright cancellation, consider downgrading to some of the best no annual fee cards to preserve your credit score.

This strategic move maintains your credit utilization and account age, preventing any negative impacts.

It’s crucial to note that while this transition safeguards your credit history, potential limitations may include forfeiting sign-up bonuses on the new card and using accrued rewards before making the switch, as certain issuers may not facilitate seamless points transfer.

-

Cost Justification

Cost JustificationIf a credit card with a hefty annual fee remains underutilized and doesn’t justify its cost, downgrading to a more fitting no annual fee card aligning with your spending habits is the right choice.

-

Financial Changes

Financial ChangesLife events like job loss or family additions may necessitate reduced spending, making a no annual fee credit card more financially prudent.

-

Adapting to Lifestyle Changes

Adapting to Lifestyle ChangesLifestyle shifts, such as reduced travel frequency or the discovery of more fitting card options can diminish the long-term utility of high-fee travel cards.

In a scenario like this, transitioning from Chase Sapphire Reserve® to Chase Freedom Unlimited®, downgrading eliminates an unnecessary $550 annual fee when travel perks are underutilized.

-

Preserving Credit Score

Preserving Credit ScoreInstead of canceling a card and risking credit score damage, downgrading a card with no annual fees within the same issuer allows you to keep your account active without accumulating excessive annual fees.

How to pair no annual fee and annual fee cards?

Commencing your credit journey with a no annual fee credit card is a prudent first step in fostering financial management skills.

As you become well-versed with rewards, consider enhancing your earning potential by complementing your no-annual-fee card with a premium annual fee card.

For instance, if you possess the Chase Freedom Unlimited®, ideal for everyday purchases, pair it strategically with a travel rewards card like the Chase Sapphire Reserve®. Use the no-fee card for everyday expenses, ensuring a consistent credit history.

Simultaneously, leverage the annual fee card for specialized spending, capitalizing on premium rewards and perks. This strategy allows you to enjoy a broad range of benefits without overcommitting to unnecessary fees.

Ensure the combined rewards and benefits outweigh the annual fee, enhancing overall credit card value. Regularly reassess spending habits to adjust the card pairing, adapt to evolving financial needs, and optimize rewards.

How can you maximize your no-annual-fee credit card?

The best no annual fee credit cards often offer substantial perks without breaking the bank. It’s crucial to use them strategically to make the most of these cost-effective choices. Harness the full potential of your no-annual-fee credit card by incorporating these tips:

-

Commit to Full Payments

Uphold a golden rule for all credit cards, regardless of fees – pay your entire balance on time each month to avoid interest charges, ensuring a cost-free card experience.

-

Pair with Rewards

Elevate your rewards game by pairing your no annual fee card with a rewards card charging an annual fee.

For instance, combining the Delta SkyMiles® Blue American Express Card for additional rewards on Restaurants with the Delta SkyMiles® Platinum American Express Card from American Express for points transfer to Delta for Delta points enhances your earning potential.

-

Welcome Bonus Boost

Capitalize on welcome bonuses by meeting spending thresholds, often providing a $200 welcome bonus after spending $500 in the initial three months.

-

Introductory APR Utilization

Take advantage of any offered 0% APR introductory periods to handle significant purchases or balance transfers without accruing interest charges. Execute balance transfers with a clear strategy for effective debt reduction.

-

Strategic Usage

Optimize spending by understanding your card’s perks. If your credit card with no annual fee offers enhanced cash back at specific outlets like drug stores or grocery stores, prioritize its use for increased value.

Or simply, make sure you get a card that aligns with your spending habits to optimize your earning potential and redeem it wisely.

Are no-annual-fee credit cards worth it?

Yes, no annual fee credit cards are worth it for many individuals, especially those who prefer simplicity and want to avoid yearly charges.

These cards provide a cost-effective way to build credit, access essential financial tools, and enjoy various perks without the burden of annual fees.

While they may not offer as many premium benefits as cards with fees, their affordability makes them an excellent choice for those starting their credit journey, maintaining multiple cards, or seeking a low-maintenance financial option.

FAQs

What is the best credit card with no annual fee?

The best no annual fee credit card varies based on individual preferences and needs. Popular choices include Chase Freedom Unlimited®, Blue Cash Everyday® Card from American Express, Capital One SavorOne Cash Rewards Credit Card, and Citi Double Cash® Card, each offering unique benefits and rewards without an annual charge.

What Does No Annual Fee Mean?

No annual fee means that the credit card issuer does not impose a yearly charge for maintaining and using the card.

Cardholders can enjoy the card’s benefits without the burden of an additional annual expense, making it a cost-effective choice.

Why do credit cards have annual fees?

Credit cards have annual fees to cover the costs of providing perks, rewards, and additional features.

Premium cards with extensive benefits, travel rewards, or exclusive services often come with annual fees to offset the added value provided to cardholders.

What are the elite credit cards with no annual fee?

Some elite credit cards with no annual fees include the Blue Cash Everyday® Card from American Express, Capital One VentureOne Rewards Credit Card, and the Chase Freedom Unlimited®. These cards offer premium features without the typical annual charge.

What is the best no-annual-fee card for pairing?

The best no annual fee card for pairing depends on your spending habits and goals. Consider the Chase Freedom Flex℠ for its rotating categories and the Citi Double Cash® Card for consistent cash back on all purchases, enhancing your overall rewards strategy.

Can you get a no-annual-fee credit card with bad credit?

While obtaining a credit card with no annual fee and bad credit can be challenging, some secured credit cards may have minimal or no annual fees.

You can opt for the Capital One Platinum Secured Card. Secured cards require a deposit, making them more accessible for individuals with less-than-perfect credit.

Is a lower APR better than a lower annual fee?

The choice between a lower APR and a lower annual fee depends on individual priorities. If you carry a balance, a lower APR can save on interest.

However, if you pay in full each month, a lower annual fee may be more appealing, especially if the card offers valuable rewards.

What happens if you cancel a card with an annual fee?

If you cancel a card with an annual fee, it’s essential to consider the timing. Canceling shortly after paying the fee may not result in a refund. Closing the card may impact your credit score, so weigh the benefits and drawbacks before making a decision.

Can issuers waive the annual fee?

In some cases, credit card issuers may waive the annual fee, especially if you have a good payment history or meet certain requirements. It’s worth contacting the issuer, negotiating, and exploring potential alternatives or card retention offers to retain your business.